Concept explainers

a)

To determine: The decision table for the decision.

Introduction: Decision table is formats or visual representations were data is expressed arranged, determined and calculated to make a effective decision making. A decision table is a tabular representation that is used to analyze decision alternatives and states of nature.

b.

To determine: Maximax decision

Introduction:

Maximax is the decision making method which come decision making under uncertainty. This method finds an alternative that maximizes the maximum outcome of each alternative or we can say that calculating the maximum outcome within every alternatives.

c.

To determine: The minimax decision.

Introduction

Maximin is the decision making method which makes decision making under uncertainty. This method will find an alternative that maximizes the minimum outcome of every alternative or we can say that calculating the minimum outcome within the each alternative.

d.

To determine: Equally likely decision

Introduction

Equally likely is the decision method which come decision making under uncertainty. Under this condition, equal probability is assigned under each uncertainty state of nature.

e.

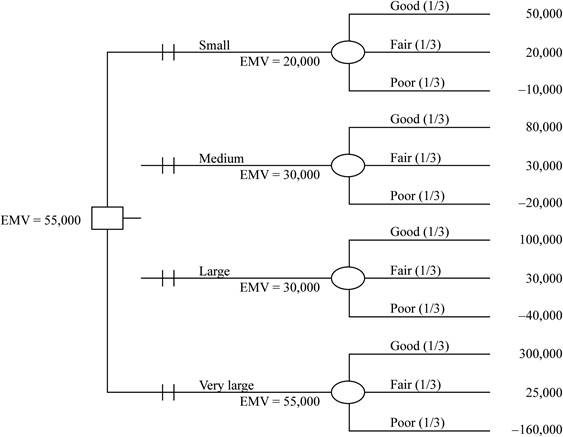

To draw: Decision tree. Assume each outcome is equally likely, and find the highest EMV.

Introduction:

Decision tree is graphical representation of decision making process which has state of nature, alternative, payoffs and their probabilities of outcomes.

EMV: It is expected value or payout that has different possible state of nature, each with their associated possibilities.

Formula:

Here probabilities are equal likely in each case. So probabilities of the be 1/3= 0.3333

Want to see the full answer?

Check out a sample textbook solution

Chapter A Solutions

Mylab Operations Management With Pearson Etext -- Access Card -- For Operations Management: Sustainability And Supply Chain Management (13th Edition)

- Scenario 3 Ben Gibson, the purchasing manager at Coastal Products, was reviewing purchasing expenditures for packaging materials with Jeff Joyner. Ben was particularly disturbed about the amount spent on corrugated boxes purchased from Southeastern Corrugated. Ben said, I dont like the salesman from that company. He comes around here acting like he owns the place. He loves to tell us about his fancy car, house, and vacations. It seems to me he must be making too much money off of us! Jeff responded that he heard Southeastern Corrugated was going to ask for a price increase to cover the rising costs of raw material paper stock. Jeff further stated that Southeastern would probably ask for more than what was justified simply from rising paper stock costs. After the meeting, Ben decided he had heard enough. After all, he prided himself on being a results-oriented manager. There was no way he was going to allow that salesman to keep taking advantage of Coastal Products. Ben called Jeff and told him it was time to rebid the corrugated contract before Southeastern came in with a price increase request. Who did Jeff know that might be interested in the business? Jeff replied he had several companies in mind to include in the bidding process. These companies would surely come in at a lower price, partly because they used lower-grade boxes that would probably work well enough in Coastal Products process. Jeff also explained that these suppliers were not serious contenders for the business. Their purpose was to create competition with the bids. Ben told Jeff to make sure that Southeastern was well aware that these new suppliers were bidding on the contract. He also said to make sure the suppliers knew that price was going to be the determining factor in this quote, because he considered corrugated boxes to be a standard industry item. Is Ben Gibson acting legally? Is he acting ethically? Why or why not?arrow_forwardThe Tinkan Company produces one-pound cans for the Canadian salmon industry. Each year the salmon spawn during a 24-hour period and must be canned immediately. Tinkan has the following agreement with the salmon industry. The company can deliver as many cans as it chooses. Then the salmon are caught. For each can by which Tinkan falls short of the salmon industrys needs, the company pays the industry a 2 penalty. Cans cost Tinkan 1 to produce and are sold by Tinkan for 2 per can. If any cans are left over, they are returned to Tinkan and the company reimburses the industry 2 for each extra can. These extra cans are put in storage for next year. Each year a can is held in storage, a carrying cost equal to 20% of the cans production cost is incurred. It is well known that the number of salmon harvested during a year is strongly related to the number of salmon harvested the previous year. In fact, using past data, Tinkan estimates that the harvest size in year t, Ht (measured in the number of cans required), is related to the harvest size in the previous year, Ht1, by the equation Ht = Ht1et where et is normally distributed with mean 1.02 and standard deviation 0.10. Tinkan plans to use the following production strategy. For some value of x, it produces enough cans at the beginning of year t to bring its inventory up to x+Ht, where Ht is the predicted harvest size in year t. Then it delivers these cans to the salmon industry. For example, if it uses x = 100,000, the predicted harvest size is 500,000 cans, and 80,000 cans are already in inventory, then Tinkan produces and delivers 520,000 cans. Given that the harvest size for the previous year was 550,000 cans, use simulation to help Tinkan develop a production strategy that maximizes its expected profit over the next 20 years. Assume that the company begins year 1 with an initial inventory of 300,000 cans.arrow_forwardScenario 3 Ben Gibson, the purchasing manager at Coastal Products, was reviewing purchasing expenditures for packaging materials with Jeff Joyner. Ben was particularly disturbed about the amount spent on corrugated boxes purchased from Southeastern Corrugated. Ben said, I dont like the salesman from that company. He comes around here acting like he owns the place. He loves to tell us about his fancy car, house, and vacations. It seems to me he must be making too much money off of us! Jeff responded that he heard Southeastern Corrugated was going to ask for a price increase to cover the rising costs of raw material paper stock. Jeff further stated that Southeastern would probably ask for more than what was justified simply from rising paper stock costs. After the meeting, Ben decided he had heard enough. After all, he prided himself on being a results-oriented manager. There was no way he was going to allow that salesman to keep taking advantage of Coastal Products. Ben called Jeff and told him it was time to rebid the corrugated contract before Southeastern came in with a price increase request. Who did Jeff know that might be interested in the business? Jeff replied he had several companies in mind to include in the bidding process. These companies would surely come in at a lower price, partly because they used lower-grade boxes that would probably work well enough in Coastal Products process. Jeff also explained that these suppliers were not serious contenders for the business. Their purpose was to create competition with the bids. Ben told Jeff to make sure that Southeastern was well aware that these new suppliers were bidding on the contract. He also said to make sure the suppliers knew that price was going to be the determining factor in this quote, because he considered corrugated boxes to be a standard industry item. As the Marketing Manager for Southeastern Corrugated, what would you do upon receiving the request for quotation from Coastal Products?arrow_forward

- A logistics provider plans to have a new warehouse built to handle increasing demands for its services. Although the company is unsure of how much demand there will be, it must decide now on the size (large or small) of the warehouse. Preliminary estimates are that if a small warehouse is built and demand is low, the monthly income will be $700,000. If demand is high, it will have to either expand the facility or lease additional space. Leasing will result in a monthly income of $100,000 while expanding will result in a monthly income of $500,000. If a large warehouse is built and demand is low, monthly income will only be $40,000, while if demand is high, monthly income will be $2 million.a. Construct a tree diagram for this decision.b. Using your tree diagram, identify the choice that would be made using each of the four approaches for decision making under uncertaintyarrow_forwardA builder has located a piece of property that she would like to buy and eventually build on. The land is currently zoned for four homes per acre, but she is planning to request new zoning. What she builds depends on the approval of zoning requests and your analysis of this problem to advise her. With her input and your help, the decision process has been reduced to the following costs, alternatives, and probabilities:Cost of land: $2 millionProbability of rezoning: .60If the land is rezoned, there will be additional costs for new roads, lighting, and so on, of $1 million. If the land is rezoned, the contractor must decide whether to build a shopping center or 1,500 apartments that the tentative plan shows would be possible. If she builds a shopping center, there is a 70 percent chance that she can sell the shopping center to a large department store chain for $4 million over her construction cost, which excludes the land; and there is a 30 percent chance that she can sell it to an…arrow_forwardABC Inc is considering the possibility of building an additional factory that would produce a new addition to its product line. The company is currently considering 2 options. The first is a small facility that could build be built at a cost of $6million. If demand for the new product is low, the company expects to receive $10million in discounted revenues(present value of future revenues) with the small building. On the other hand, if demand is high, it expects $12million in discounted revenues using the small building.The second option is to build a large facility at a cost of $9million. If the demand were to low, the company would expect $10million in discounted revenues with the large building. If demand is high, the company estimates that the discounted revenues would be $14million. In either case, the probability of demand being high is 0.40, and the probability of it being low is 0.60. Not constructing a new facility would result in no additional revenue being generated…arrow_forward

- Even though independent gasoline stations have been having a difficult time, lan Langella has been thinking about starting his own independent gasoline station. lan's problem is to decide how large his station should be. The annual returns will depend on both the size of his station and a number of marketing factors related to the oil industry and demand for gasoline. After a careful analysis, lan developed the following table: States of Nature Size of First Station Good Market Fair Market Poor Market $40,000 $90,000 $18,000 $27,000 - $8,000 - $22,000 Small Medium $105,000 $27,500 Large Very Large - $36,000 - $180,000 $320,000 $26,000 For example, if lan constructs a small station and the market is good, he will realize a profit of $40,000. This exercise contains only parts b, c, and d. b) Using the decision making under uncertainty with the criterion of Maximax The appropriate decision will bearrow_forwardEven though independent gasoline stations have been having a difficult time. Murad has been thinking about starting her own independent gasoline station. Murad's problem is to decide how large his station would be. The annual returns will depend on both the size of his station and a number of marketing factors related to the oil industry and demand for gasoline. After a careful analysis, Murad developed the following table: Size of the first station Small Medium Large Very large Probability Good market,$ 50 000 80 000 100 000 300 000 20% Fair market,$ 20 000 30 000 30 000 25 000 30% a) what is the maximax decision? b) what is the maximin decision c) what is the equally likely decision (Laplace) d) What is the Expected Monetary Value Criterion (EMV Criterion) Poor market, $ -10 000 -20 000 -40 000 -160 000 50%arrow_forwardThe lease of Theme Park, Inc., is about to expire. Management must decide whether to renew the lease for another 10 years or to relocate near the site of a proposed motel. The town planning board is currently debating the merits of granting approval to the motel. A consultant has estimated the net present value of Theme Park's two alternatives under each state of nature as shown below. Suppose that the management of Theme Park, Inc., has decided that there is a 0.40 probability that the motel's application will be approved. Motel Motel Options Rejected $4,500,000 300,000 Approved Renew $ 600,000 Relocate 2,500,000 а-1. If management uses maximum expected monetary value as the decision criterion, calculate expected monetary value for the alternatives "Renew" and "Relocate". Alternative Expected Value Renew Relocatearrow_forward

- The net annual operating cost for a water treatment filtration plant for a semiconductor fabrication line was estimated to be $1,900,000 per year. The estimate was based on the $200,000 per year cost of a 1-MGD plant. The exponent in the cost-capacity equation is 0.75. The size of the larger plant is nearest to: 41,009,300 32,052,560 20,600,020 20,120,162arrow_forwardExpando, Inc. is considering the possibility of building an additional factory that would produce a new addition to its product line. The company is currently considering two options. The first is a small facility that it could build at a cost of $9 million. If demand for new products is low, the company expects to receive $11 million in discounted revenues (present value of future revenues) with the small facility. On the other hand, if demand is high, it expects $12 million in discounted revenues using the small facility. The second option is to build a large factory at a cost of $12 million. Were demand to be low, the company would expect $13 million in discounted revenues with the large plant. If demand is high, the company estimates that the discounted revenues would be $18 million. In either case, the probability of demand being high is 0.50, and the probability of it being low is 0.50. Not constructing a new factory would result in no additional revenue being generated because…arrow_forwardExpando, Inc. is considering the possibility of building an additional factory that would produce a new addition to its product line. The company is currently considering two options. The first is a small facility that it could build at a cost of $6 million. If the demand for new products is low, the company expects to receive $10 million in discounted revenues (present value of future revenues) with the small facility. On the other hand, if demand is high, it expects $12 million in discounted revenues using the small facility. The second option is to build a large factory at a cost of $9 million. Were demand to below, the company would expect $10 million in discounted revenues with the large plant. If demand is high, the company estimates that the discounted revenues would be $14 million. In eithercase, the probability of demand being high is .40, and the probability of it being low is .60. Not constructing a new factory would result in no additional revenue being generated because…arrow_forward

Practical Management ScienceOperations ManagementISBN:9781337406659Author:WINSTON, Wayne L.Publisher:Cengage,

Practical Management ScienceOperations ManagementISBN:9781337406659Author:WINSTON, Wayne L.Publisher:Cengage, Purchasing and Supply Chain ManagementOperations ManagementISBN:9781285869681Author:Robert M. Monczka, Robert B. Handfield, Larry C. Giunipero, James L. PattersonPublisher:Cengage Learning

Purchasing and Supply Chain ManagementOperations ManagementISBN:9781285869681Author:Robert M. Monczka, Robert B. Handfield, Larry C. Giunipero, James L. PattersonPublisher:Cengage Learning