EBK CFIN

6th Edition

ISBN: 9781337671743

Author: BESLEY

Publisher: CENGAGE LEARNING - CONSIGNMENT

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

Chapter 8, Problem 5PROB

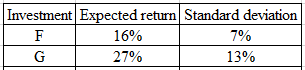

Summary Introduction

Expected

Standard deviation is the financial measure of risk and stability on the

Coefficient of variance is a measure used to calculate the total risk per unit of return of an investment.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Supposing the return from an investment has the following probability distribution

Return Probability

R (%)

8 0.2

10 0.2

12 0.5

14 0.1

Required:

What is the expected return of the investment?

What is the risk as measured by the standard deviation of expected returns?

On the basis of the utility formula below, which investment would you select if you were risk averse with A = 4?

Investment

Expected return E(r)

Standard deviation

σ

1

0.12

0.30

2

0.15

0.50

3

0.21

0.16

4

0.24

0.21

The expected rate of return of an investment ________.

a. equals one of the possible rates of return for that investment

b. equals the required rate of return for the investment

c. is the mean value of the probability distribution of possible returns

d. is the median value of the probability distribution of possible returns

e. is the mode value of the probability distribution of possible returns

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- What is the expected return of a portfolio of two risky assets if the expected return E(Ri), standard deviation (SDi), covariance (COVij), and asset weight (Wi) are as shown below? Asset (A) E(R₂) = 10% SDA = 8% WA = 0.25 COVAB = 0.006 Select one: A. 13.75% B. 7.72% C. 12.5% D. 8.79% Asset (B) E(RB) = 15% SDB = 9.5% WB = 0.75arrow_forwardCalculate the (a) expected return, (b) standard deviation, and (c) coefficient of variation for an investment with the following probability distribution: Probability Payoff 0.45 32.0% 0.35 -4.0% 0.20 -20.0%arrow_forwardAssuming that the rates of return associated with a given asset investment are normally distributed; that the expected return, r, is 18.7%; and that the coefficient of variation, CV, is 1.88, answer the following questions: a. Find the standard deviation of returns, sigma Subscript rσr. b. Calculate the range of expected return outcomes associated with the following probabilities of occurrence: (1) 68%, (2) 95%, (3) 99%.arrow_forward

- An investment has probabilities 0.15, 0.34, 0.44, 0.67, 0.2 and 0.15 of giving returns equal to 50%, 39%, -4%, 20%, -25%, and 42%. What are the expected returns and the standard deviations of returns?arrow_forwardCompute the (a) expected return, (b) standard deviation, and (c) coefficient of variation for investments with the following probability distributions: Probability r/A r/B 0.3 30.0% 5.0% 0.2 10.0 15.0 0.5 -2.0 25.0arrow_forwardThe standard deviation of return on investment a is 0.10, while the standard deviation of return on investment b is 0.04. If the correlation coefficient between the returns on A and B is_____________. A. -0.0447 B. -0.0020 C. 0.0020 D. 0.0447arrow_forward

- Calculate the expected return for an investment with the following probability distribution. Return (%) Probability (%) -10 20 5 20 10 20 17 30 26 10arrow_forwardWhat is the expected return of a portfolio of two risky assets if the expected return E(Ri), standard deviation (SDi), covariance (COVij), and asset weight (Wi) are as shown below? Asset (A) E(R₁) = 10% SDA = 8% WA = 0.25 COVAB = 0.006 Asset (B) E(R₂) = 15% SDB = 9.5% WB = 0.75arrow_forwardAssuming the following returns and corresponding probabilities for Asset D: Rate of Return Probability 10% 30% 15% 40% 20% 30% Compute for: a. Expected rate of return b. The standard deviation c. The coefficient of variationarrow_forward

- What is the expected return of a portfolio of two risky assets if the expected return E(Ri), standard deviation (SDi), covariance (COVij), and asset weight (Wi) are as shown below? Asset (A) E(R₂) = 25% SDA = 18% WA = 0.75 COVA, B = -0.0009 Select one: A. 13.65% B. 20 U ODN 20.0% C. 18.64% D. 22.5% Asset (B) E(R₂) = 15% SDB = 11% WB = 0.25arrow_forward1. Calculate the Expected Return and Risk measured in terms of standard deviation and Variance relating to the following information of a Investment avenue: Return in Percentage: -15-10-5+5+10+15 Probability:.10.15.20.20.25.10arrow_forwardWhat is the expected return of a portfolio of two risky assets if the expected return E(Ri), standard deviation (SDi), covariance (COVij), and asset weight (Wi) are as shown below? Asset (A) E(RA) = 25% SDA = 18% WA = 0.75 COVAB= -0.0009 Asset (B) E(R₂) = 15% SDB = 11% W₁ = 0.25arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Portfolio return, variance, standard deviation; Author: MyFinanceTeacher;https://www.youtube.com/watch?v=RWT0kx36vZE;License: Standard YouTube License, CC-BY