Concept explainers

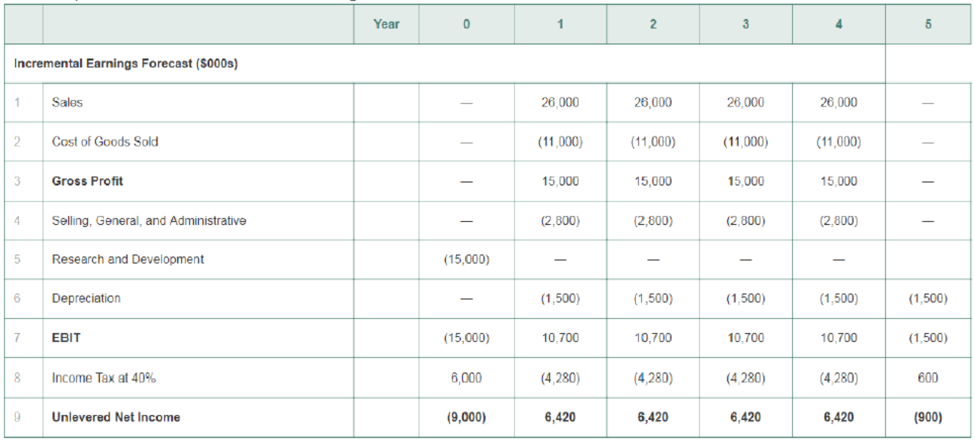

Table 8.1 Spreadsheet HomeNet’s Incremental Earnings

5. After looking at the projections of the HomeNet project, you decide that they are not realistic. It is unlikely that sales will be constant over the four-year life of the project. Furthermore, other companies are likely to offer competing products, so the assumption that the sales price will remain constant is also likely to be optimistic. Finally, as production ramps up, you anticipate lower per unit production costs resulting from economies of scale. Therefore, you decide to redo the projections under the following assumptions: Sales of 50,000 units in year 1 Increasing by 50,000 units per year over the life of the project, a year 1 sales price of $260/unit, decreasing by 10% annually and a year 1 cost of $120/ unit decreasing by 20% annually. In addition, new tax laws allow you to depreciate the equipment over three rather than five years using straight-line depreciation.

- a. Keeping the other assumptions that underlie Table 8.1 the same, recalculate unlevered net income (that is, reproduce Table 8.1 under the new assumptions, and note that we are ignoring cannibalization and lost rent).

- b. Recalculate unlevered net income assuming, in addition, that each year 20% of sales comes from customers who would have purchased an existing Cisco router for $100/unit and that this router costs $60/unit to manufacture.

Want to see the full answer?

Check out a sample textbook solution

Chapter 8 Solutions

Corporate Finance (4th Edition) (Pearson Series in Finance) - Standalone book

- Scenario Analysis Shao Industries is considering a proposed project for its capital budget. The company estimates the projects NPV is 12 million. This estimate assumes that the economy and market conditions will be average over the next few years. The companys CFO, however, forecasts there is only a 50% chance that the economy will be average. Recognizing this uncertainty, she has also performed the following scenario analysis: What are the projects expected NPV, standard deviation, and coefficient of variation?arrow_forwardQuestion 1 A firm is assessing a project's BTCF for year 3. It has developed three estimates for BTCF in today's dollars, the likely amount, a high amount and a low amount, each with an associated probability. Annual inflation could be low at 3% or high at 8%. The firm estimates low inflation to have a 80% likelihood. BTCF (today's $) Probability Low 150,000 0.3 Most Likely 180,000 0.6 High 200,000 0.1 What is the expected BTCF for year 3 of the project tn actual dollars? O $179,920 O $187,117 O $194,819 $202.843 A firm is assessing a projects BTCF for year 3. It has developed three estimates for BTCF in todays dollars, the likely amount, a high amount, and a low amount, each with an associated probability. Annual inflation could be low at 3% or high at 8%. The firm estimates low inflation to have a 80% likelihood. What is the expected BTCF for year 3 of the project in actual dollars?arrow_forwardYou estimate that a planned project for your company has a 0.3 chance of tripling the investment in a year and a 0.7 chance of halving the investment in a year. What is the standard deviation of the return on this project? A.1.5625 B.1.3126 C.1.2247 D.1.1457arrow_forward

- Consider the following information for the next year's return on IBM. probability return 10% 20% 0.8 0.2 Find the expected return. ⒸA. 2% B. 5% OC. 8% OD. 12% E. 11%arrow_forwardQuestion It is expected that a 2-year term project will generate revenues of $5 million at the end of the second year. Costs and expenses are fixed at $3 million at thc end of the first year. You are also given that the risk-free rate is 3% and the market risk premium is 5.5%. Determine the project's beta if the revenues have a beta of 1.15. Possible Answers A Less than I At least 1 but less than 2 C At least 2 but less than 3 D At least 3 but less than 4 At least 4arrow_forwardQUESTION 3 You head BETMARK's project selection department. Your department is contemplating three separate projects. BETMARK anticipates at least a 20% return based on historical data. Your financial analysts estimate that inflation will remain at 3 percent for the foreseeable future. Given the following data about each project, which Project should be BETMARK's top priority? Should BETMARK sponsor any of the remaining projects? If so, what should be the order of priority in terms of return on investment? Project: A Year 0 1 2 3 Project: B Year 0 1 2 3 4 Project: C Year 0 1 2 345 Investment K11, 250,000 Investment K5,625,000 Investment K1,687,000 Revenue Stream 0 1,125,000 5,625,000 7,875,000 Revenue Stream 0 1,687,500 1,687,500 1,687,500 1,125,000 Revenue Stream 0 337,500 562,500 1,125,000 1,125,000 3,375,000arrow_forward

- Pronto Email service has a beta of 0.95 and a cost of equity of 11.9 percent. The risk-free rate of return is 2.8 percent. The firm is currently considering a project that has a beta of 1.03 and a project life of 6 years. What discount rate should be assigned to this project? a. 13.33% b. 13.84% c. 12.67% d. 13.62%arrow_forwardBuchanan Corporation forecasts the following payoffs from a project. Outcome Probability of Outcome 15% 45% 40% $ 1,000 $ 3,300 $ 5,500 What is the expected value of the outcomes? Assumptions pessimistic moderately successful optimisticarrow_forwardQUESTION 7 A project has a 0.8 chance of quintupling your investment in a year and a 0.2 chance of halving your investment in a year. What is the standard deviation of the rate of return on this investment? O 100.00% O 140.00% 180.00% O 220.00% 260.00% None of the abovearrow_forward

- Please do not give solution in image formate thanku An investment generates the following monthly returns: 10.25%, -8.90%, 7.48%, 8.90%, 7.30%, 5.80%. Comparing with a risk-free benchmark rate of 5% for the time period, the investment is successful (i.e., investment return > 5%).arrow_forwardhorizon value question the forecast period for a project is from year 0 thru year 15. You think there is a 10% chance each year from 15 on will be the last. The real net benefit in year 15 was 225 and grows at 2% per year. The discount rate is 3%. a) Find the horizon value? b) Suppose that when the program ends, there will be a clean-up cost of $1000 that must be subtracted to calculate the horizon value. What is the horizon value now?arrow_forwardCash Flow estimation Question Shultz Business Systems is analyzing an average-risk project, and the following data have been developed. Unit sales will be constant, but the sales price should increase with inflation. Fixed costs will also be constant, but variable costs should rise with inflation. The project should last for 3 years, it will be depreciated on a straight-line basis, and there will be no salvage value. This is just one of many projects for the firm, so any losses can be used to offset gains on other firm projects. What is the project's expected NPV? Project cost of capital (r) 10.0% Net investment cost (depreciable basis) $200,000 Units sold 50,000 Average price per unit, Year 1 $25.00 Fixed op. cost excl. deprec. (constant) $150,000 Variable op. cost/unit, Year 1 $20.20 Annual depreciation rate 33.333% Expected inflation rate per year 5.00% Tax rate 40.0% a. $15,925 b. $16,764 c.…arrow_forward

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning