Corporate Finance (4th Edition) (Pearson Series in Finance) - Standalone book

4th Edition

ISBN: 9780134083278

Author: Jonathan Berk, Peter DeMarzo

Publisher: PEARSON

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 8, Problem 7P

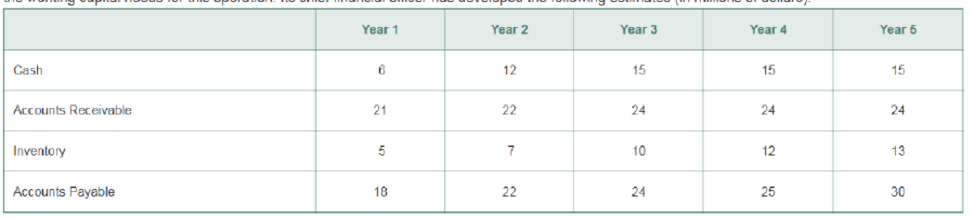

Castle View Games would like to invest in a division to develop software for video games. To evaluate this decision, the firm first attempts to project the working capital needs for this operation. Its chief financial officer has developed the following estimates (in millions of dollars):

Assuming that Castle View currently does not have any working capital invested in this division, calculate the cash flows associated with changes in working capital for the first five years of this investment.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Gamestop wants to invest in a new division to develop software for video games. The company is

evaluating this decision by projecting the working capital needs for the operation. The CFO has developed

the following estimates (in millions of dollars). Assume that Gamestop does not currently have any working

capital invested in this division. Calculate the cash flows associated with the net working capital and

changes in net working capital for the first five years of this investment.

Year 0

Year 1

Year 2

Year 3

Year 4

Year 5

Cash

6.

12

16

15

14

Accounts

21

26

24

25

24

Receivable

Inventory

Accounts

5

10

12

15

17

19

25

25

32

Payable

NWC

ANWC

Castle View Games would like to invest in a division to develop software for a soon to-be-released video game console. To evaluate this decision, the firm first attempts to project the working capital needs for this operation. Its chief financial officer has developed estimates (in millions of dollars).

If Castle View currently does not have any initial working capital invested in this division, calculate the cash flows associated with changes in working capital for the first five years of this investment.

A sports nutrition company is examining whether a new high-performance sports drink should be added to its product line. A preliminary feasibility analysis indicated that the company would need to invest $1 7.5 million in a new manufacturing facility to produce and package the product. A financial analysis using sales and cost data supplied by marketing and production personnel indicated that the net cash flow (cash inflows minus cash outflows) would be $6.1 million in the first year of commercialization, $7.4 million in year 2, $7 .0 million in year 3, and $ 5. 5 million in year 4. Senior company executives were undecided whether to move forward with the development of the new product. They requested that a discounted cash flow analysis be performed using two different discount rates: 20 percent and 15 percent. a. Should the company proceed with development of the product if the discount rate is 20 percent? Why? b. Does the decision to proceed with development of the product change if…

Chapter 8 Solutions

Corporate Finance (4th Edition) (Pearson Series in Finance) - Standalone book

Ch. 8.1 - How do we forecast unlevered net income?Ch. 8.1 - Prob. 2CCCh. 8.1 - Prob. 3CCCh. 8.2 - Prob. 1CCCh. 8.2 - What is the depreciation tax shield?Ch. 8.3 - Prob. 1CCCh. 8.3 - Prob. 2CCCh. 8.4 - Prob. 1CCCh. 8.4 - What is the continuation or terminal value of a...Ch. 8.5 - Prob. 1CC

Ch. 8.5 - How does scenario analysis differ from sensitivity...Ch. 8 - Pisa Pizza, a seller of frozen pizza is...Ch. 8 - Kokomochi is considering the launch of an...Ch. 8 - Home Builder Supply, a retailer in the home...Ch. 8 - Hyperion, Inc. currently sells its latest...Ch. 8 - Table 8.1 Spreadsheet HomeNets Incremental...Ch. 8 - Prob. 6PCh. 8 - Castle View Games would like to invest in a...Ch. 8 - Prob. 9PCh. 8 - Prob. 10PCh. 8 - Prob. 11PCh. 8 - A bicycle manufacturer currently produces 300,000...Ch. 8 - One year ago, your company purchased a machine...Ch. 8 - Prob. 15PCh. 8 - Markov Manufacturing recently spent 15 million to...Ch. 8 - Prob. 17PCh. 8 - Arnold Inc. is considering a proposal to...Ch. 8 - Bay Properties is considering starting a...Ch. 8 - Prob. 21PCh. 8 - Prob. 22P

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Nakamichi Bancorp has made an investment in banking software at a cost of $1,430,438. Management expects productivity gains and cost savings over the next several years. If, as a result of this investment, the firm is expected to generate additional cash flows of $667,344, $725,331, $475,138, and $343,237 over the next four years, what is the investment’s payback period? (Round answer to 2 decimal places, e.g. 15.25.) Payback period is yearsarrow_forwardRoyal Mount Games would like to invest in a division to develop software for video games. To evaluate this decision, the firm first attempts to project the working capital needs for this operation. Its chief financial officer has developed the following estimates (in millions of dollars): (To copy the table below and use in Excel, click on icon in the upper right corner of table.) 1 Cash 2 Accounts receivable 3 Inventory 4 Accounts payable Year 1 6 19 6 17 Year 2 11 23 8 22 Year 3 14 26 11 23 The cash flow associated with the change in working capital for year 1 is $ million. (Round to the nearest integer.) Year 4 5242 15 14 27 Year 5 16 24 14 ९ 34 Assuming that Royal Mount currently does not have any working capital invested in this division, calculate the cash flows associated with changes in working capital for the first five years of this investment. (Enter increases as negative numbers since they are uses of cash.)arrow_forwardAlfredo Auto Parts is considering investing in a new forming line for grille assemblies. For a five-year study period, the cash flows for two separate designs are shown below. Create a spreadsheet that will calculate the present worths for each project for a variable ALARR. Through trial and error, establish the ALARR at which the present worths of the two projects are exactly the same. Cash Flows for Grille Assembly Project Automated Line Manual Line Disburse- Net Cash | Disburse- Net Cash Year | ments | Receipts | Flow ments | Receipts Flow 0 [e1 500000 [€ 0 [-€1 500 000 [€1 000 000 | € o[ -€1 000 000 1 50 000 | 300 000 250000 [ 20000 [ 200 000 180 000 2 60 000 | 300 000 240000 [ 25000 [ 200 000 175 000 3 70 000 | 300 000 230 000 30 000 | 200 000 170 000 4 80000 [ 300 000 220 000 35000 | 200 000 165 000 5 90 000 [ 800 000 710000 40000 [ 200 000 160 000arrow_forward

- K Innovation Company is thinking about marketing a new software product. Upfront costs to market and develop the product are $4.98 million. The product is expected to generate profits of $1.09 million per year for 10 years. The company will have to provide product support expected to cost $98,000 per year in perpetuity. Assume all profits and expenses occur at the end of the year. a. What is the NPV of this investment if the cost of capital is 5.6%? Should the firm undertake the project? Repeat the analysis for discount rates of 1.6% and 14.5%, respectively. b. What is the IRR of this investment opportunity? c. What does the IRR rule indicate about this investment? a. What is the NPV of this investment if the cost of capital is 5.6%? Should the firm undertake the project? Repeat the analysis for discount rates of 1.6% and 14.5%, respectively. If the cost of capital is 5.6%, the NPV will be $ (Round to the nearest dollar.) Should the firm undertake the project? (Select the best choice…arrow_forwardGina Ripley, president of Dearing Company, is considering the purchase of a computer-aided manufacturing system. The annual net cash benefits and savings associated with the system are described as follows: The system will cost 9,000,000 and last 10 years. The companys cost of capital is 12 percent. Required: 1. Calculate the payback period for the system. Assume that the company has a policy of only accepting projects with a payback of five years or less. Would the system be acquired? 2. Calculate the NPV and IRR for the project. Should the system be purchasedeven if it does not meet the payback criterion? 3. The project manager reviewed the projected cash flows and pointed out that two items had been missed. First, the system would have a salvage value, net of any tax effects, of 1,000,000 at the end of 10 years. Second, the increased quality and delivery performance would allow the company to increase its market share by 20 percent. This would produce an additional annual net benefit of 300,000. Recalculate the payback period, NPV, and IRR given this new information. (For the IRR computation, initially ignore salvage value.) Does the decision change? Suppose that the salvage value is only half what is projected. Does this make a difference in the outcome? Does salvage value have any real bearing on the companys decision?arrow_forwardThe management of Kawneer North America is considering investing in a new facility and the following cash flows are expected to result from the investment: A. What is the payback period of this uneven cash flow? B. Does your answer change if year 10s cash inflow changes to $500,000?arrow_forward

- Manzer Enterprises is considering two independent investments: A new automated materials handling system that costs 900,000 and will produce net cash inflows of 300,000 at the end of each year for the next four years. A computer-aided manufacturing system that costs 775,000 and will produce labor savings of 400,000 and 500,000 at the end of the first year and second year, respectively. Manzer has a cost of capital of 8 percent. Required: 1. Calculate the IRR for the first investment and determine if it is acceptable or not. 2. Calculate the IRR of the second investment and comment on its acceptability. Use 12 percent as the first guess. 3. What if the cash flows for the first investment are 250,000 instead of 300,000?arrow_forwardOakmont Company has an opportunity to manufacture and sell a new product for a four-year period. After careful study, Oakmont estimated the following costs and revenues for the new product: When the project concludes in four years the working capital will be released for investment elsewhere within the company. Required: Using Excel (this will save you time and effort) answer the following: Oakmont’s cost of capital is 15%, and management does not feel it should have any adjustment for risk, compute the NPV. Same situation as (a), but management does feel this project does possess a greater than average risk, so 19% should be the required rate of return. Compute the NPV. Management is concerned that Sales Revenues and Expenses could be rising due to inflationary factors. So the projection for year 1 is as shown, but that sales revenues will grow by 2% per year for years 2-4; and that variable expenses will grow by 4% per year for years 2-4, and that fixed out-of-pocket operating…arrow_forwardDuring the last few years, Jana Industries has been too constrained by the high cost of capital to make many capital investments. Recently, though, capital costs have been declining, and the company has decided to look seriously at a major expansion program proposed by the marketing department. Assume that you are an assistant to Leigh Jones, the financial vice president. Your first task is to estimate Jana’s cost of capital. Jones has provided you with the following data, which she believes may be relevant to your task: The firm’s tax rate is 40%. The current price of Jana’s 12% coupon, semiannual payment, noncallable bonds with 15 years remaining to maturity is $1,153.72. Jana does not use short-term interest-bearing debt on a permanent basis. New bonds would be privately placed with no flotation cost. The current price of the firm’s 10%, $100 par value, quarterly dividend, perpetual preferred stock is $116.95. Jana would incur flotation costs equal to 5% of the proceeds on a new…arrow_forward

- During the last few years, Helney Industries has been too constrained by the high cost of capital to make many capital investments. Recently, though, capital costs have been declining, and the company has decided to look seriously at a major expansion program proposed by the marketing department. Assume that you are an assistant to Leigh Jones, the financial vice president. Your first task is to estimate Helney’s cost of capital. Jones has provided you with the following data, which she believes may be relevant to your task:(1) The firm’s tax rate is 40%.(2) The current price of Harry Davis’s 12% coupon, semi-annual payment, noncallable bonds with 15 years remaining to maturity is $1,225.72. Helney does not use short-term interest-bearing debt on a permanent basis.(3) The current price of the firm’s 10%, $100 par value, quarterly dividend, perpetual preferred stock is $117.(4) Helney’s common stock is currently selling at $50 per share. Its last dividend (D0) was $3.12, and dividends…arrow_forwardDuring the last few years, Jana Industries has been too constrained by the high cost of capital to make many capital investments. Recently, though, capital costs have been declining, and the company has decided to look seriously at a major expansion program proposed by the marketing department. Assume that you are an assistant to Leigh Jones, the financial vice president. Your first task is to estimate Jana's cost of capital. Jones has provided you with the following data, which she believes may be relevant to your task: ● The firm's tax rate is 25%. ●The current price of Jana's 12% coupon, semiannual payment, noncallable bonds with 15 years remaining to maturity is $1,153.72. There are 70,000 bonds. Jana does not use short-term interest-bearing debt on a permanent basis. New bonds would be privately placed with no flotation cost. ● The current price of the firm's 10%, $100 par value, quarterly dividend, perpetual pre-ferred stock is $116.95. There are 200,000 outstanding shares.…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENTPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENTPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

Capital Budgeting Introduction & Calculations Step-by-Step -PV, FV, NPV, IRR, Payback, Simple R of R; Author: Accounting Step by Step;https://www.youtube.com/watch?v=hyBw-NnAkHY;License: Standard Youtube License