Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

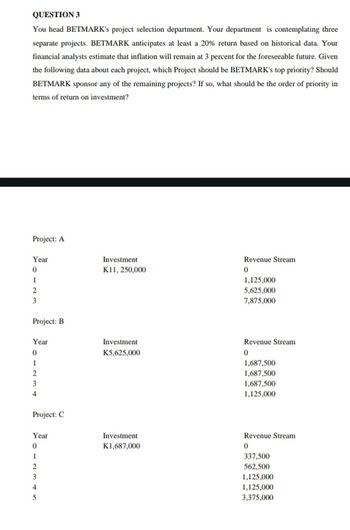

Transcribed Image Text:QUESTION 3

You head BETMARK's project selection department. Your department is contemplating three

separate projects. BETMARK anticipates at least a 20% return based on historical data. Your

financial analysts estimate that inflation will remain at 3 percent for the foreseeable future. Given

the following data about each project, which Project should be BETMARK's top priority? Should

BETMARK sponsor any of the remaining projects? If so, what should be the order of priority in

terms of return on investment?

Project: A

Year

0

1

2

3

Project: B

Year

0

1

2

3

4

Project: C

Year

0

1

2

345

Investment

K11, 250,000

Investment

K5,625,000

Investment

K1,687,000

Revenue Stream

0

1,125,000

5,625,000

7,875,000

Revenue Stream

0

1,687,500

1,687,500

1,687,500

1,125,000

Revenue Stream

0

337,500

562,500

1,125,000

1,125,000

3,375,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 1 steps

Knowledge Booster

Similar questions

- Suppose your firm is considering investing in a project with the cash flows shown below, that the required rate of return on projects of this risk class is 12 percent, and that the maximum allowable payback and discounted payback statistic for the project are 2 and 3 years, respectively. Time 0 1 2 3 4 5 6 Cash Flow -1,150 30 570 770 770 370 770 Use the NPV decision rule to evaluate this project; should it be accepted or rejected? Multiple Choice A. $968.66, accept B. $2,118.66, accept C. $-495.13, reject D. $864.87, acceptarrow_forwardPlease solve and provide the steps for the problem provided belowarrow_forwardYou are evaluating the following four projects: Project Beta Projected (or Expected) Return A 1.80 19.5% B 1.20 14.0% C 0.80 11.5% D 0.50 7.0% Your company’s current practice is to apply its WACC of 12% as a single hurdle rate to all projects. Under your company’s current practice, which project(s) of the four projects above would be incorrectly accepted? Currently, the 3-month Treasury bill rate is 3%, and the market risk premium is 10%. (Hint: Measure the RADRs using the CAPM.) Group of answer choices C A D B At least two of the projects are incorrectly accepted.arrow_forward

- 1.Assuming you are facing with making a decision on a large capital investment proposal. the capital investment amount is $ Estimated the study period is years .The annual revenue at the end of each year is $ and the estimated annual year-end expense is $ starting in year Assuming a market value at the end year is $ and the benchmark rate is 10%, please answer the following questions: 1.Please design this investment project to fill the proper number in blank space to let the project is feasible in economics( 2.To give the cash flow chart of the project(arrow_forwardI need to know the Cash payback period for each project, the Net present value, the annual rate of return for each project and finally I need the projects ranked best to worse (1, 2, 3) on their cashpayback, net present value, and annual return. Finally I need to know which is the best project. Question 1 of 1 > E Pharoah Company is considering three long-term capital investment proposals. Each investment has a useful life of 5 years. Relevant data on each project are as follows. Project Bono Project Edge Project Clayton Capital investment $172,000 $182,000 $202,000 Annual net income: Year 1 14,700 18,900 28,350 2 14,700 17,850 24,150 3 14,700 16,800 22,050 4 14,700 12.600 13,650 5 14,700 9,450 12,600 5 14,700 9,450 12,600 Total $73,500 $75,600 $100,800 Depreciation is computed by the straight-line method with no salvage value. The company's cost of capital is 15%. (Assume that cash flows occur evenly throughout the year.)arrow_forwardAssuming monetary benefits of a construction project at $50,000 per year, one-time costs (initial investment) of $15,000, recurring costs of $35,000 per year, a discount rate of 10 per cent, and a 4-year time horizon, calculate the net present value (NPV) of an information system's costs and benefits. Calculate the overall return on investment (ROI) of the project. During which year does break-even occur? Use the NPV template provided (modify to suit your answer) and clearly display the NPV, ROI, and year in which payback occurs. Write a paragraph explaining whether you would recommend investing in this project based on your financial analysis. Explain your answer referring to the NPV, ROI and payback for this project. Discount Rate (10%) Year 0 - 1.0000 Year 1 - .9091 Year 2 - .8264 Year 3 - .7513 Year 4 - .6830arrow_forward

- Please correct answer thes questionarrow_forward1. Calvulate the internal rate of return(IRR) of each project and based on this criterion. Indicate which project you would recommend or acceptance.arrow_forwardProfitability index. Given the discount rate and the future cash flow of each project listed in the following table, , use the PI to determine which projects the company should accept. ..... What is the Pl of project A? (Round to two decimal places.)arrow_forward

- Suppose your firm is considering investing in a project with the cash flows shown below, that the required rate of return on projects of this risk class is 13 percent, and that the maximum allowable payback and discounted payback statistic for the project are 2 and 3 years, respectively. Time 0 1 2 3 4 5 6 Cash Flow -1,110 70 530 730 730 330 730 Use the payback decision rule to evaluate this project; should it be accepted or rejected? Multiple Choice A. 1.10 years, accept B. 4.00 years, reject C. 2.70 years, reject D. 0 years, acceptarrow_forwardA firm wants to select one new research and development project. The following table summarizes six possibilities. Considering expected return and risk, which projects are good candidates? The firm believes it can earn 5.5% on a risk-free investment in government securities (labeled as Project F).arrow_forwardSuppose your firm is considering investing in a project with the cash flows shown below, that the required rate of return on projects of this risk class is 11 percent, and that the maximum allowable payback and discounted payback statistic for the project are 2 and 3 years, respectively. Time 0 1 2 3 4 5 6 Cash Flow -1,040 140 460 660 660 260 660 Use the NPV decision rule to evaluate this project; should it be accepted or rejected?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education