Corporate Finance (4th Edition) (Pearson Series in Finance) - Standalone book

4th Edition

ISBN: 9780134083278

Author: Jonathan Berk, Peter DeMarzo

Publisher: PEARSON

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 8, Problem 19P

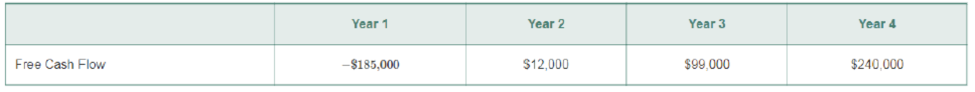

Bay Properties is considering starting a commercial real estate division. It has prepared the following four-year

Assume cash flows after year 4 will grow at 3% per year, forever. If the cost of capital for this division is 14%, what is the continuation value in year 4 for cash flows after year 4? What is the value today of this division?

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

GTO Inc. is considering an investment costing $214,170 that results in net cash flows of $30,000 annually for 11 years. (a) What is the internal rate of return of this investment? (b) The hurdle rate is 9.5%. Should the company invest in this project on the basis of internal rate of return?

Fijisawa Inc. is considering a major expansion of its product line and has estimated the following cash flows associated with such an expansion. The initial outlay would be $10,100,000 and the project would generate incremental free cash flows of $1,270,000 per year for 20 years. The appropriate required rate of return is 9.5 percent.

a. Calculate the NPV.

b. Calculate the PI.

c. Calculate the IRR.

d. Should this project be accepted?

You are evaluating a project that will cost $508,000, but is expected to produce cash flows of $126,000 per year for

10 years, with the first cash flow in one year. Your cost of capital is 11.3% and your company's preferred payback

period is three years or less.

a. What is the payback period of this project?

b. Should you take the project if you want to increase the value of the company?

a. What is the payback period of this project?

The payback period is years. (Round to two decimal places.)

Chapter 8 Solutions

Corporate Finance (4th Edition) (Pearson Series in Finance) - Standalone book

Ch. 8.1 - How do we forecast unlevered net income?Ch. 8.1 - Prob. 2CCCh. 8.1 - Prob. 3CCCh. 8.2 - Prob. 1CCCh. 8.2 - What is the depreciation tax shield?Ch. 8.3 - Prob. 1CCCh. 8.3 - Prob. 2CCCh. 8.4 - Prob. 1CCCh. 8.4 - What is the continuation or terminal value of a...Ch. 8.5 - Prob. 1CC

Ch. 8.5 - How does scenario analysis differ from sensitivity...Ch. 8 - Pisa Pizza, a seller of frozen pizza is...Ch. 8 - Kokomochi is considering the launch of an...Ch. 8 - Home Builder Supply, a retailer in the home...Ch. 8 - Hyperion, Inc. currently sells its latest...Ch. 8 - Table 8.1 Spreadsheet HomeNets Incremental...Ch. 8 - Prob. 6PCh. 8 - Castle View Games would like to invest in a...Ch. 8 - Prob. 9PCh. 8 - Prob. 10PCh. 8 - Prob. 11PCh. 8 - A bicycle manufacturer currently produces 300,000...Ch. 8 - One year ago, your company purchased a machine...Ch. 8 - Prob. 15PCh. 8 - Markov Manufacturing recently spent 15 million to...Ch. 8 - Prob. 17PCh. 8 - Arnold Inc. is considering a proposal to...Ch. 8 - Bay Properties is considering starting a...Ch. 8 - Prob. 21PCh. 8 - Prob. 22P

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- You are evaluating a project that will cost $502,000, but is expected to produce cash flows of $127,000 per year for 10 years, with the first cash flow in one year. Your cost of capital is 10.7% and your company's preferred payback period is three years or less. a. What is the payback period of this project? b. Should you take the project if you want to increase the value of the company? a. What is the payback period of this project? The payback period is years. (Round to two decimal places.) b. Should you take the project if you want to increase the value of the company? (Select from the drop-down menus.) If you want to increase the value of the company you take the project since the NPV is will not willarrow_forwardYou are evaluating a project that will cost $474,000, but is expected to produce cash flows of $130,000 per year for 10 years, with the first cash flow in one year. Your cost of capital is 11.5% and your company's preferred payback period is three years or less. a. What is the payback period of this project? b. Should you take the project if you want to increase the value of the company?arrow_forwardK Bay Properties is considering starting a commercial real estate division. It has prepared the following four-year forecast of free cash flows for this division: (Click on the following icon in order to copy its contents into a spreadsheet.) Free Cash Flow Year 1 - $151,000 Year 2 $14,000 Year 3 Year 4 $79,000 $192,000 Assume cash flows after year 4 will grow at 5% per year, forever. If the cost of capital for this division is 13%, what is the continuation value in year 4 for cash flows after year 4? What is the value today of this division? What is the continuation value in year 4 for cash flows after year 4? The continuation value is $ (Round to the nearest dollar.)arrow_forward

- Fijisawa, Inc. is considering a major expansion of its product line and has estimated the following cash flows associated with such an expansion. the initial outlay would be $11,700,000, and the project would generate cash flows of $1,200,000 per year for 20 years. the appropriate discount rate is 6.7%. A. Calculate the NPV b. Calculate the PI C. Calculate the IRR D. should this project be accepted? why or why not?arrow_forwardYou are evaluating a project that will cost $543,000, but is expected to produce cash flows of $127,000 per year for 10 years, with the first cash flow in one year. Your cost of capital is 10.9% and your company's preferred payback period is three years or less. a. What is the payback period of this project? b. Should you take the project if you want to increase the value of the company?arrow_forwardA project’s initial cost is 13 million. The company expects a net cashflow of 10 million in year one, but the net cashflow is expected to decrease 1 million each year for the next years. If the company’s MARR is 12%, using NPW/NFW analysis is the project profitable in the first 5 years?arrow_forward

- Consider a project with an initial investment (today, t = 0) of $225,000. This project will generate cash flows of $68,750 per year for the next 6 years. The company will pay $50,000 to another for clean-up and disposal in Year 6. What is the Profitability Index (PI) of the project if shareholders demand 8.25% return? Answer in whole numbers, rounded to three decimal places.arrow_forwardYou are considering opening a new plant. The plant will cost $98.6 million upfront. After that, it is expected to produce profits of $29.9 million at the end of every year. The cash flows are expected to last forever. Calculate the NPV of this investment opportunity if your cost of capital is 8.1%. Should you make the investment? Calculate the IRR and use it to determine the maximum deviation allowable in the cost of capital estimate to leave the decision unchanged.arrow_forwardYou are considering opening a new plant. The plant will cost $98.2 million upfront. After that, it is expected to produce profits of $30.2 million at the end of every year. The cash flows are expected to last forever. Calculate the NPV of this investment opportunity if your cost of capital is 6.6%. Should you make the investment? Calculate the IRR and use it to determine the maximum deviation allowable in the cost of capital estimate to leave the decision unchanged. Calculate the NPV of this investment opportunity if your cost of capital is 6.6%. The NPV of this investment opportunity is $ million. (Round to one decimal place.)arrow_forward

- JFINEX Corporation is considering a new project that will cost 110,000. The project is expected to generate cash flows over the next four years in the amounts of +200,000 in year one, -30,000 in year two, -25,000 in year three, and +50,000 in year four. The required rate of return is 12%. What is the profitability index of this project?arrow_forwardYou are considering opening a new plant. The plant will cost $103.2 million upfront. After that, it is expected to produce profits of $30.9 million at the end of every year. The cash flows are expected to last forever. Calculate the NPV of this investment opportunity if your cost of capital is 8.6%. Should you make the investment? Calculate the IRR and use it to determine the maximum deviation allowable in the cost of capital estimate to leave the decision unchanged. If your cost of capital is 8.6%, the NPV of this investment opportunity is S Should you make the investment? (Select the best choice below.) O A. Yes, because the project will generate cash flows forever. O B. No, because the NPV is not greater than the initial costs. O C. Yes, because the NPV is positive. O D. No, because the NPV is less than zero. million. (Round to one decimal place.) The IRR of the investment is %. (Round to two decimal places.) The maximum deviation allowable in the cost of capital is %. (Round to two…arrow_forwardAce Investment Company is considering the purchase of the Apartment Arms project. Next year's NOI and cash flow is expected to be $2,080,000, and based on Ace's economic forecast, market supply and demand and vacancy levels appear to be in balance. As a result, NOI should increase at 4 percent each year for the foreseeable future. Ace believes that it should earn at least a 13 percent return on its investment. Required: a. Assuming the above facts, what would the estimated value for the property be now? b. What going-in cap rates should be indicated from recently sold properties that are comparable to Apartment Arms? c. What would the estimated value for the property, if the required return changes to 12 percent?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Working capital explained; Author: The Finance Storyteller;https://www.youtube.com/watch?v=XvHAlui-Bno;License: Standard Youtube License