PRIN.OF CORPORATE FINANCE

13th Edition

ISBN: 9781260013900

Author: BREALEY

Publisher: RENT MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 7, Problem 8PS

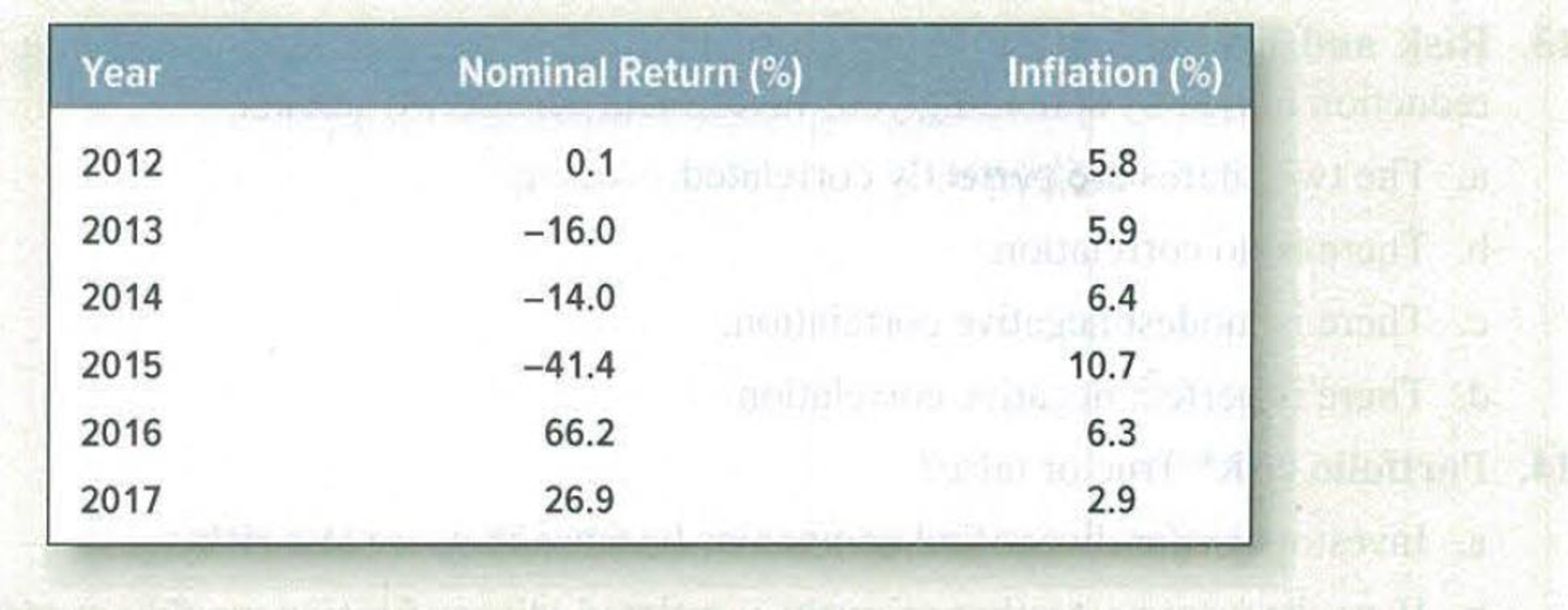

Standard deviation of returns The following table shows the nominal returns on Brazilian stocks and the rate of inflation.

- a. What was the standard deviation of the market returns? (Do not make the adjustment for degrees of freedom described in footnote 15.)

- b. Calculate the average real return.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

The following table shows the nominal returns on

Brazilian stocks and the rate of inflation. a. What was

the standard deviation of the market returns? (Use

decimals, not percents, in your calculations. Do not

round intermediate calculations. Enter your answer as a

percent rounded to 2 decimal places.) Answer is

complete but not entirely correct. b. Calculate the

average real return. (A negative answer should be

indicated by a minus sign. Do not round intermediate

calculations. Enter your answer as a percent rounded to

2 decimal places) Answer is complete but not entirely

correct.

The following table shows the nominal returns on Brazilian stocks and the rate of inflation.

Year

Nominal Return (%)

Inflation (%)

2012

0.1

7.3

2013

-18.0

7.4

2014

-16.0

7.9

2015

-42.9

12.2

2016

2017

67.7

28.4

7.8

4.4

a. What was the standard deviation of the market returns? (Use decimals, not percents, in your calculations. Do not round

intermediate calculations. Enter your answer as a percent rounded to 2…

Use the following information on states of the economy and stock returns to calculate the standard deviation of returns. (Do not round intermediate calculations. Enter your answer as a percent rounded to 2 decimal places.)

State of Economy

Probability ofState of Economy

Security Returnif State Occurs

Recession

0.40

−4.50

%

Normal

0.50

13.00

Boom

0.10

25.00

Use the following information on states of the economy and stock returns to calculate the standard deviation of returns.

Note: Do not round intermediate calculations. Enter your answer as a percent rounded to 2 decimal places.

State of Economy

Recession

Normal

Boom

Standard deviation

Probability of

State of Economy

0.60

0.25

0.15

4.42%

Security Return if

State Occurs

-5.00%

13.00

17.00

Chapter 7 Solutions

PRIN.OF CORPORATE FINANCE

Ch. 7 - Rate of return The level of the Syldavia market...Ch. 7 - Real versus nominal returns The Costaguana stock...Ch. 7 - Arithmetic average and compound returns Integrated...Ch. 7 - Risk premiums Here are inflation rates and U.S....Ch. 7 - Risk Premium Suppose that in year 2030, investors...Ch. 7 - Stocks vs. bonds Each of the following statements...Ch. 7 - Expected return and standard deviation A game of...Ch. 7 - Standard deviation of returns The following table...Ch. 7 - Average returns and standard deviation During the...Ch. 7 - Prob. 10PS

Ch. 7 - Prob. 11PSCh. 7 - Diversification Here are the percentage returns on...Ch. 7 - Risk and diversification In which of the following...Ch. 7 - Prob. 14PSCh. 7 - Portfolio risk To calculate the variance of a...Ch. 7 - Portfolio risk a) How many variance terms and how...Ch. 7 - Portfolio risk Table 7.8 shows standard deviations...Ch. 7 - Portfolio risk Hyacinth Macaw invests 60% of her...Ch. 7 - Stock betas What is the beta of each of the stocks...Ch. 7 - Stock betas There are few, if any, real companies...Ch. 7 - Portfolio betas A portfolio contains equal...Ch. 7 - Portfolio betas Suppose the standard deviation of...Ch. 7 - Portfolio risk Here are some historical data on...Ch. 7 - Portfolio risk Suppose that Treasury bills offer a...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- The following table shows the nominal returns on Brazilian stocks and the rate of inflation. Year Nominal Return (%) 2015 0.3 2016 -16.0 2017 -14.0 2018 -41.9 2019 66.7 27.4 2020 Inflation (%) 6.3 6.4 6.9 11.2 6.8 3.4 a. What was the standard deviation of the market returns? Note: Use decimals, not percents, in your calculations. Do not round intermediate calculations. Enter your answer as a percent rounded to 2 decimal places. b. Calculate the average real return. Note: A negative answer should be indicated by a minus sign. Do not round intermediate calculations. Enter your answer as a percent rounded to 2 decimal places. a. Standard deviation b. Average real return % %arrow_forwardThe following table shows the nominal returns on Brazilian stocks and the rate of inflation. Nominal Return (%) Inflation (%) Year 2012 0.3 7.1 2013 -13.0 7.2 2014 -11.0 7.7 2015 -42.7 12.0 2016 67.5 7.6 2017 4.2 28.2 a. What was the standard deviation of the market returns? (Use decimals, not percents, in your calculations. Do not round intermediate calculations. Enter your answer as a percent rounded to 2 decimal places.) Standard deviation b. Calculate the average real return. (A negative answer should be indicated by a minus sign. Do not round intermediate calculations. Enter your answer as a percent rounded to 2 decimal places) Average real returnarrow_forwardThe following table shows the nominal returns on Brazilian stocks and the rate of inflation. Year Nominal Return (%) Inflation (%) 2012 0.3 7.1 2013 -13.0 7.2 2014 -11.0 7.7 2015 -42.7 12.0 2016 67.5 7.6 2017 28.2 4.2 Calculate the average real return. (A negative answer should be indicated by a minus sign. Do not round intermediate calculations. Enter your answer as a percent rounded to 2 decimal places)arrow_forward

- The following table shows the nominal returns on Brazilian stocks and the rate of inflation. Year Nominal Return (%) Inflation (%) 2012 0.3 6.3 2013 -16.0 6.4 2014 -14.0 6.9 2015 -41.9 11.2 2016 66.7 6.8 2017 27.4 3.4 a. What was the standard deviation of the market returns? (Use decimals, not percents, in your calculations. Do not round intermediate calculations. Enter your answer as a percent rounded to 2 decimal places.) b. Calculate the average real return. (A negative answer should be indicated by a minus sign. Do not round intermediate calculations. Enter your answer as a percent rounded to 2 decimal places)arrow_forwardThe following table shows the nominal returns on Brazilian stocks and the rate of inflation. Nominal Return (%) Year Inflation (%) 2012 0.3 7.1 2013 -13.0 7.2 2014 -11.0 7.7 2015 -42.7 12.0 2016 67.5 7.6 2017 28.2 4.2 a. What was the standard deviation of the market retuns? (Use decimals, not percents, in your calculations. Do not ro intermediate calculations. Enter your answer as a percent rounded to 2 decimal places.) Standard deviation b. Calculate the average real return. (A negative answer should be indicated by a minus sign. Do not round intermediat calculations. Enter your answer as a percent rounded to 2 decimal places) Average real returnarrow_forwardName the econometric term used for estimating the correlation between today’s stock price and the price of previous days (lag prices).arrow_forward

- The following table shows the nominal returns on Brazilian stocks and the rate of inflation. Year Nominal Return (%) 2012 0.1 -15.0 -13.0 2013 2014 2015 2016 2017 -43.4 68.2 28.9 Standard deviation a. What was the standard deviation of the market returns? (Use decimals, not percents, in your calculations. Do not round intermediate calculations. Enter your answer as a percent rounded to 2 decimal places.) Inflation (%) 7.8 7.9 8.4 12.7 8.3 4.9 Averano real return % b. Calculate the average real return. (A negative answer should be indicated by a minus sign. Do not round intermediate calculations. Enter your answer as a percent rounded to 2 decimal places) %arrow_forwardConsider the following information: State of Economy Probability of State of Economy Rate of Return if State Occurs Stock A Stock B Recession .17 .08 −.12 Normal .58 .11 .17 Boom .25 .16 .34 a. Calculate the expected return for Stocks A and B. (Do not round intermediate calculations and enter your answers as a percent rounded to 2 decimal places, e.g., 32.16.) b. Calculate the standard deviation for Stocks A and B. (Do not round intermediate calculations and enter your answers as a percent rounded to 2 decimal places, e.g., 32.16.)arrow_forwardConsider the following information about Stocks I and ll: Rate of Return If State Occurs Probability of State of- Economy .15 State of Economy Stock I Stock II Recession .05 -.21 Normal .70 .18 .10 Irrational exuberance .15 .07 .39 The market risk premium is 7 percent, and the risk-free rate is 3.5 percent. (Do not round intermediate calculations. Enter your standard deviation answers as a percent rounded to 2 decimal places, e.g., 32.16. Round your beta answers to 2 decimal places, e.g., 32.16.) The standard deviation on Stock l's return is percent, and the Stock I beta is The standard deviation on Stock Il's return is percent, and the Stock II beta is Therefore, based on the stock's systematic risk/beta, Stock is riskier.arrow_forward

- You have $100,000 to invest in a portfolio containing Stock X and Stock Y. Your goal is to create a portfolio that has an expected return of 12.1 percent. Stock X has an expected return of 10.28 percent and a beta of 1.20, and Stock Y has an expected return of 7.52 percent and a beta of .80. a.How much money will you invest in Stock Y? (A negative answer should be indicated by a minus sign. Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) b.What is the beta of your portfolio? (Do not round intermediate calculations and round your answer to 3 decimal places, e.g., 32.161.) a. Investment in Stock Y b. Portfolio betaarrow_forwardConsider the following information: Rate of Return If State Occurs State of Probability of State of Economy Stock A Economy Stock B Recession .15 .06 - 10 Normal .56 .09 .19 Вoom .29 .14 .36 . Calculate the expected return for Stocks A and B. (Do not round intermediate calculations and enter your answers as a percent rounded to 2 decimal places, e.g., 32.16.) . Calculate the standard deviation for Stocks A and B. (Do not round intermediate calculations and enter your answers as a percent rounded to 2 decimal places, e.g., 32.16.) Stock A expected return % Stock B expected return % Stock A standard deviation % Stock B standard deviation %arrow_forwardWhat is the standard deviation of the returns on a stock given the following information? State of Economy Probability of State of Economy Rate of Return if State Occurs Boom .08 .171 Normal .70 .076 Recession .22 .017arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education

Foreign Exchange Risks; Author: Kaplan UK;https://www.youtube.com/watch?v=ne1dYl3WifM;License: Standard Youtube License