PRIN.OF CORPORATE FINANCE

13th Edition

ISBN: 9781260013900

Author: BREALEY

Publisher: RENT MCG

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 7, Problem 25PS

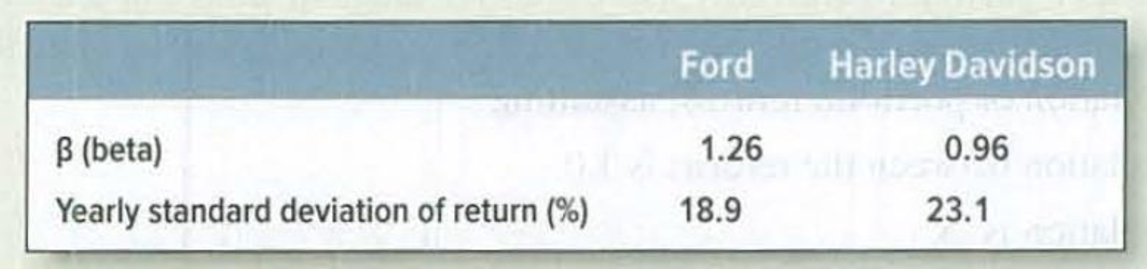

Portfolio risk Here are some historical data on the risk characteristics of Ford and Harley Davidson:

Assume the standard deviation of the return on the market was 9.5%.

- a. The correlation coefficient of Ford’s return versus Harley Davidson is 0.30. What is the standard deviation of a portfolio invested half in each share?

- b. What is the standard deviation of a portfolio invested one-third in Ford, one-third in Harley Davidson, and one-third in risk-free Treasury bills?

- c. What is the standard deviation if the portfolio is split evenly between Ford and Harley Davidson and is financed at 50% margin, that is, the investor puts up only 50% of the total amount and borrows the balance from the broker?

- d. What is the approximate standard deviation of a portfolio composed of 100 stocks with betas of 1.26 like Ford? How about 100 stocks like Harley Davidson? [Hint: Part (d) should not require anything but the simplest arithmetic to answer.]

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Here are some historical data on the risk characteristics of Ford and Harley Davidson.

Harley

Davidson

Ford

B (beta)

Yearly standard deviation of return (%)

1.26

0.67

30.6

15.8

Assume the standard deviation of the return on the market was 13.0%

a. The correlation coefficient of Ford's return versus Harley Davidson is 0.39. What is the standard deviation of a portfolio invested half

in each share?

b. What is the standard deviation of a portfolio invested one-third in Ford, one-third in Harley Davidson, and one-third in risk-free

Treasury bills?

c. What is the standard deviation if the portfolio is split evenly between Ford and Harley Davidson and is financed at 50% margin, that

is, the investor puts up only 50% of the total amount and borrows the balance from the broker?

d-1. What is the approximate standard deviation of a portfolio composed of 100 stocks with betas of 1.26 like Ford?

d-2. What is the approximate standard deviation of a portfolio composed of 100 stocks with betas of…

Here are some historical data on the risk characteristics of Ford and Harley Davidson.

Ford

Harley Davidson

β (beta)

1.43

0.75

Yearly standard deviation of return (%)

33.3

16.9

Assume the standard deviation of the return on the market was 12.0%.

a. The correlation coefficient of Ford’s return versus Harley Davidson is 0.38. What is the standard deviation of a portfolio invested half in each share?

b. What is the standard deviation of a portfolio invested one-third in Ford, one-third in Harley Davidson, and one-third in risk-free Treasury bills?

c. What is the standard deviation if the portfolio is split evenly between Ford and Harley Davidson and is financed at 50% margin, that is, the investor puts up only 50% of the total amount and borrows the balance from the broker?

d-1. What is the approximate standard deviation of a portfolio composed of 100 stocks with betas of 1.43 like Ford?

d-2. What is the approximate standard deviation of a portfolio composed of…

Based on the following information, calculate the expected return and standard deviation for

each of the following stocks. What are the covariance and correlation between the returns of

the two stocks? Calculate the portfolio return and portfolio standard deviation if

you invest

equally in each asset.

Returns

State of Economy

Prob

J

K

Recession

0.25

-0.02

0.034

Normal

0.6

0.138

0.062

Boom

0.15

0.218

0.092

Chapter 7 Solutions

PRIN.OF CORPORATE FINANCE

Ch. 7 - Rate of return The level of the Syldavia market...Ch. 7 - Real versus nominal returns The Costaguana stock...Ch. 7 - Arithmetic average and compound returns Integrated...Ch. 7 - Risk premiums Here are inflation rates and U.S....Ch. 7 - Risk Premium Suppose that in year 2030, investors...Ch. 7 - Stocks vs. bonds Each of the following statements...Ch. 7 - Expected return and standard deviation A game of...Ch. 7 - Standard deviation of returns The following table...Ch. 7 - Average returns and standard deviation During the...Ch. 7 - Prob. 10PS

Ch. 7 - Prob. 11PSCh. 7 - Diversification Here are the percentage returns on...Ch. 7 - Risk and diversification In which of the following...Ch. 7 - Prob. 14PSCh. 7 - Portfolio risk To calculate the variance of a...Ch. 7 - Portfolio risk a) How many variance terms and how...Ch. 7 - Portfolio risk Table 7.8 shows standard deviations...Ch. 7 - Portfolio risk Hyacinth Macaw invests 60% of her...Ch. 7 - Stock betas What is the beta of each of the stocks...Ch. 7 - Stock betas There are few, if any, real companies...Ch. 7 - Portfolio betas A portfolio contains equal...Ch. 7 - Portfolio betas Suppose the standard deviation of...Ch. 7 - Portfolio risk Here are some historical data on...Ch. 7 - Portfolio risk Suppose that Treasury bills offer a...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Table attached shows the historical returns for Companies A, B and C If one investor has a portfolio consisting of 50% Company A and 50% Company B, what are the average portfolio return and standard deviation? What is Sharpe ratio if the risk-free rate is 3.8%? If another investor has a portfolio consisting of 1/3 Company A, 1/3 Company B and 1/3 Company C, what are the average portfolio return and standard deviation? What is Sharpe ratio if the risk-free rate is 3.8%?arrow_forwarda. Based on the following information, calculate the expected return and standard deviation for each of the following stocks. What are the covariance and correlation between the returns of the two stocks? Calculate the portfolio returm and portfolio standard deviation if you invest equally in each asset. Returns State of Economy Prob J K Recession 0.25 -0.02 0.034 Normal 0.6 0.138 0.062 Boom 0.15 0.218 0.092 b. A portfolio that combines the risk-free asset and the market portfolio has an expected return of percent and a standard deviation of 10 percent. The risk-free rate is 4 percent, and the Page 7 of 33 expected return on the market portfolio is 12 percent. Assume the capital asset pricing model holds. What expected rate of return would a security earn if it had a 45 corelation with the market portfolio and a standard deviation of 55 percent? C. Suppose the risk-free rate is 4.2 percent and the market portfolıo has an expected return of 10.9 mercent Tibemadkat normfeliobasiabiamance…arrow_forwarda. Based on the following information, calculate the expected return and standard deviation for each of the following stocks. What are the covariance and correlation between the returns of the two stocks? Calculate the portfolio return and portfolio standard deviation if you invest equally in each asset. Returns State of Economy Prob K Recession 0.25 -0.02 0.034 Normal 0.6 0.138 0.062 Boom 0.15 0.218 0.092 b. A portfolio that combines the risk-free asset and the market portfolio has an expected return of 7 percent and a standard deviation of 10 percent. The risk-free rate is 4 percent, and the expected return on the market portfolio is 12 percent. Assume the capital asset pricing model holds. What expected rate of return would a security earn if it had a .45 correlation with the market portfolio and a standard deviation of 55 percent? c. Suppose the risk-free rate is 4.2 percent and the market portfolio has an expected return of 10.9 percent. The market portfolio has a variance of…arrow_forward

- Assume that using the Security Market Line (SML) the required rate of return (RA) on stock A is foundto be half of the required return (RB) on stock B. The risk-free rate (Rf) is one-fourth of the requiredreturn on A. Return on market portfolio is denoted by RM. Find the ratio of beta of A (A) to beta of B(B). d) Assume that the short-term risk-free rate is 3%, the market index S&P500 is expected to payreturns of 15% with the standard deviation equal to 20%. Asset A pays on average 5%, has standarddeviation equal to 20% and is NOT correlated with the S&P500. Asset B pays on average 8%, also hasstandard deviation equal to 20% and has correlation of 0.5 with the S&P500. Determine whetherasset A and B are overvalued or undervalued, and explain why. (Hint: Beta of asset i (??) = ???????, where ??,?? are standard deviations of asset i and marketportfolio, ??? is the correlation between asset i and the market portfolio)arrow_forwardAssume that using the Security Market Line (SML) the required rate of return (RA) on stock A is foundto be half of the required return (RB) on stock B. The risk-free rate (Rf) is one-fourth of the requiredreturn on A. Return on market portfolio is denoted by RM. Find the ratio of beta of A (A) to beta of B(B). d) Assume that the short-term risk-free rate is 3%, the market index S&P500 is expected to payreturns of 15% with the standard deviation equal to 20%. Asset A pays on average 5%, has standarddeviation equal to 20% and is NOT correlated with the S&P500. Asset B pays on average 8%, also hasstandard deviation equal to 20% and has correlation of 0.5 with the S&P500. Determine whetherasset A and B are overvalued or undervalued, and explain why. (Hint: Beta of asset i (??) =???????, where ??,?? are standard deviations of asset i and marketportfolio, ??? is the correlation between asset i and the market portfolio)Question 2. Foreign exchange marketsStatoil, the national…arrow_forward(Expected Rate of Return and Risk) Syntex, Inc. is considering an investment in one of two common stocks. Given the information that follows, which investment is better, based on risk (as measured by the standard deviation) and return? Common Stock A Common Stock B Probability Return Probability Return .30 11% .20 25% .40 15% .30 6% .30 19% .30 14% .20 22%arrow_forward

- (Expected rate of return and risk) Syntex, Inc. is considering an investment in one of two common stocks. Given the information that follows, which investment is better, based on the risk (as measured by the standard deviation) and return? Common Stock A Probability 0.35 0.30 0.35 Return 13% 14% 18% Common Stock B Return - 6% 7% 16% 20% Probability 0.15 0.35 0.35 0.15 (Click on the icon in order to copy its contents into a spreadsheet.)arrow_forwardQuestion: Assume that using the Security Market Line (SML) the required rate of return (RA) on stock A is found to be half of the required return (RB) on stock B. The risk-free rate (Rf) is one-fourth of the required return on A. Return on market portfolio is denoted by RM. Find the ratio of beta of A to beta of B.arrow_forwardSuppose the risk-free return is 3.5% and the market portfolio has an expected return of 11.9% and a volatility of 12.9% Merck & Co. (Ticker: MRK) stock has a 20.8% volatility and a correlation with the market of 0.065. a. What is Merck's beta with respect to the market? b. Under the CAPM assumptions, what is its expected return?arrow_forward

- a. Determine Stock X's beta coefficient. b. Determine the arithmetic average rates of return for Stock X and the NYSE over the period given. Calculate the standard deviations of returns for both Stock X and the NYSE. c. Assume that the required return on equity, re, for Stock X is equal to its average return. Likewise, assume that the market return is equal to the NYSE's average return. Using the information calculated, what is the assumed risk-free rate in the CAPM equation? Hint: Solve algebraically for rf in, re = r¡ + B(rm – r;)arrow_forwardb) You are given the following information about Stock X and the market: The annual effective risk-frec rate is 5%. The expected return and volatility for Stock X and the market are shown in the table below: Expected Return Volatility Stock X 5% 40% Market 8% 25% The correlation between the returns of stock X and the market is -0.25. Assume the Capital Asset Pricing Model holds. Calculate the required return for Stock X and determine if the investor should invest in Stock X.arrow_forwardassume that expected return of the stock A in Rachel's portfolio is 13.6% this year.The risk premium on the stock of the same industry are 4.8%.beta of the stock is 1.5 and the inflation rate was 2.7. a)Calculate the risk-free rate of return using capital market asset pricing model please provide the workings for finding risk free rate finding adjusted rate of return(inflation adjusted) finding Risk free rate of return using CAPM modelarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education

Chapter 8 Risk and Return; Author: Michael Nugent;https://www.youtube.com/watch?v=7n0ciQ54VAI;License: Standard Youtube License