Concept explainers

Segment Reporting and Decision-Making L07—4

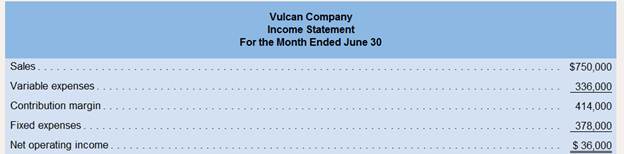

Vulcan Company’s contribution format income statement for June is as follows:

Management is disappointed with the company’s performance and is wondering what can be done to improve profits. By examining sales and cost records, you have determined the following:

a. The company is divided into two sales territories—Northern and Southern. The Northern territory recorded $300.000 in salesand $156,000 in variable expenses during June; the remaining sales and variable expenses were recorded in the Southernterritory. Fixed expenses of $120,000 and $108,000 are traceable to the Northern and Southern territories, respectively. Therest of the fixed expenses are common to the two territories.

b. The company is the exclusive distributor for two products—Paks and Tibs. Sales of Paks and Tibs totaled $50,000 and$250,000, respectively, in the Northern territory during June. Variable expenses are 22% of the selling price for Paks and 58%for Tibs. Cost records show that $30,000 of the Northern territory’s fixed expenses are traceable to Paks and $40,000 toTibs, with the remainder common to the two products.

Required:

1. Prepare contribution format segmented income statements first showing the total company broken down between sales territories andthen showing the Northern territory broken down by product line. In addition, for the company as a whole and for each segment, showeach item on the segmented income statements as a percent of sales.

2. Look at the statement you have prepared showing the total company segmented by sales territory. What insights revealed by thisstatement should be mentioned to management?

3. Look at the statement you have prepared showing the Northern territory segmented by product lines. What insights revealed by thisstatement should be mentioned to management?

Want to see the full answer?

Check out a sample textbook solution

Chapter 7 Solutions

Introduction To Managerial Accounting

- Vulcan Company's contribution format income statement for June is as follows: Vulcan Company Income Statement For the Month Ended June 30 Sales Variable expenses Contribution margin Fixed expenses Net operating income $ 800,000 300,000 500,000 475,000 $ 25,000 Management is disappointed with the company's performance and is wondering what can be done to improve profits. By examining sales and cost records, you have determined the following: a. The company is divided into two sales territories-Northern and Southern. The Northern Territory recorded $400,000 in sales and $220,000 in variable expenses during June; the remaining sales and variable expenses were recorded in the Southern Territory. Fixed expenses of $156,000 and $100,000 are traceable to the Northern and Southern Territories, respectively. The rest of the fixed expenses are common to the two territories. b. The company is the exclusive distributor for two products-Paks and Tibs. Sales of Paks and Tibs totaled $100,000 and…arrow_forwardVulcan Company's contribution format income statement for June is as follows: Vulcan Company Income Statement For the Month Ended June 30 Sales Variable expenses Contribution margin Fixed expenses Net operating income $ Management is disappointed with the company's performance and is wondering what can be done to improve profits. By examining sales and cost records, you have determined the following: 800,000 300,000 500,000 475,000 $ 25,000 a. The company is divided into two sales territories-Northern and Southern. The Northern Territory recorded $400,000 in sales and $220,000 in variable expenses during June; the remaining sales and variable expenses were recorded in the Southern Territory. Fixed expenses of $156,000 and $100,000 are traceable to the Northern and Southern Territories, respectively. The rest of the fixed expenses are common to the two territories. b. The company is the exclusive distributor for two products-Paks and Tibs. Sales of Paks and Tibs totaled $100,000 and…arrow_forwardSegment Reporting and Decision-Making Vulcan Company’s contribution format income statement for June is as follows: Management is disappointed with the company’s performance and is wondering what can be done to improve profits. By examining sales and cost records, you have determined the following: a. The company is divided into two sales territories—Northern and Southern. The Northern territory recorded $300,000 in sales and $156,000 in variable expenses during June; the remaining sales and variable expenses were recorded in the Southern territory. Fixed expenses of $120,000 and $108,000 are traceable to the Northern and Southern territories, respectively. The rest of the fixed expenses are common to the two territories. b. The company is the exclusive distributor for two products—Paks and Tibs. Sales of Paks and Tibs totaled 550,000 and 5250,000, respectively, in the Northern territory during June. Variable expenses are 22% of the selling price for Paks and 58% for Tibs. Cost records…arrow_forward

- Vulcan Company's contribution format income statement for June is as follows: Vulcan Company Income Statement For the Month Ended June 30 Sales Variable expenses Contribution margin Fixed expenses Net operating income $ 850,000 308,000 Management is disappointed with the company's performance and is wondering what can be done to improve profits. By examining sales and cost records, you have determined the following: 542,000 490,000 $ 52,000 a. The company is divided into two sales territories-Northern and Southern. The Northern Territory recorded $400,000 in sales and $200,000 in variable expenses during June, the remaining sales and variable expenses were recorded in the Southern Territory. Fixed expenses of $152,000 and $126,000 are traceable to the Northern and Southern Territories, respectively. The rest of the fixed expenses are common to the two territories. b. The company is the exclusive distributor for two products-Paks and Tibs. Sales of Paks and Tibs totaled $180,000 and…arrow_forwardVulcan Company’s contribution format income statement for June is as follows: Vulcan CompanyIncome StatementFor the Month Ended June 30 Sales $ 900,000 Variable expenses 400,000 Contribution margin 500,000 Fixed expenses 475,000 Net operating income $ 25,000 Management is disappointed with the company’s performance and is wondering what can be done to improve profits. By examining sales and cost records, you have determined the following: The company is divided into two sales territories—Northern and Southern. The Northern Territory recorded $400,000 in sales and $160,000 in variable expenses during June; the remaining sales and variable expenses were recorded in the Southern Territory. Fixed expenses of $176,000 and $140,000 are traceable to the Northern and Southern Territories, respectively. The rest of the fixed expenses are common to the two territories. The company is the exclusive distributor for two products—Paks and Tibs. Sales of Paks and…arrow_forwardVulcan Company’s contribution format income statement for June is as follows: Vulcan CompanyIncome StatementFor the Month Ended June 30 Sales $ 900,000 Variable expenses 400,000 Contribution margin 500,000 Fixed expenses 450,000 Net operating income $ 50,000 Management is disappointed with the company’s performance and is wondering what can be done to improve profits. By examining sales and cost records, you have determined the following: The company is divided into two sales territories—Northern and Southern. The Northern Territory recorded $500,000 in sales and $200,000 in variable expenses during June; the remaining sales and variable expenses were recorded in the Southern Territory. Fixed expenses of $245,000 and $88,000 are traceable to the Northern and Southern Territories, respectively. The rest of the fixed expenses are common to the two territories. The company is the exclusive distributor for two products—Paks and Tibs. Sales of Paks and Tibs…arrow_forward

- Vulcan Company's contribution format income statement for June is as follows: Vulcan Company Income Statement For the Month Ended June 30 Sales Variable expenses Contribution margin Fixed expenses Net operating income $ 900,000 400,000 500,000 450,000 $ 50,000 Management wants to improve profits and gathered the following data: a. The company is divided into two sales territories-Northern and Southern. The Northern Territory recorded $400,000 in sales and $180,000 in variable expenses during June; the remaining sales and variable expenses were recorded in the Southern Territory. Fixed expenses of $200,000 and $115,000 are traceable to the Northern and Southern Territories, respectively. The rest of the fixed expenses are common to the two territories. b. The company is the exclusive distributor for two products-Paks and Tibs. Sales of Paks and Tibs totaled $170,000 and $230,000, respectively, in the Northern territory during June. Variable expenses are 22% of the selling price for Paks…arrow_forwardVulcan Company's contribution format income statement for June is es follows: Vulcan Company Income Statenent For the Month Ended June 30 Sales Variable expenses Contribution margin Fixed expenses $ 9e0, e00 488, 00e 492, 800 455,000 Net operating income $ 37,000 Management is disoppointed with the company's performance and is wondering what con be done to improve profits. By examining soles and cost records, you have determined the following: a. The company is divided into two sales territories-Northern and Southern. The Northern Territory recorded $400,000 in sales and $168,000 in variable expenses during June; the remaining sales and variable expenses were recorded in the Southern Territory. Fixed expenses of $204,000 and $120,000 are traceable to the Northern and Southern Territories, respectively. The rest of the fixed expenses are common to the two territories. b. The company is the exclusive distributor for two products-Paks and Tibs. Sales of Paks and Tibs totaled $210,000 and…arrow_forwardVulcan Company's contribution format income statement for June is as follows: Vulcan Company Income Statement Sales Variable expenses Contribution margin Fixed expenses Net operating income For the Month Ended June 30 $750,000 336,000 414,000 378,000 $ 36,000 Management wants to improve profits and gathered the following data: a. The company is divided into two sales territories-Northern and Southern. The Northern territory recorded $300,000 in sales and $156,000 in variable expenses during June; the remaining sales and variable expenses were recorded in the Southern territory. Fixed expenses of $120,000 and $108,000 are traceable to the Northern and Southern territories, respectively. The rest of the fixed expenses are common to the two territories. b. The company is the exclusive distributor for two products-Paks and Tibs. Sales of Paks and Tibs totaled $50,000 and $250,000, respectively, in the Northern territory during June. Variable expenses are 22% of the selling price for Paks…arrow_forward

- Vulcan Company's contribution format income statement for June is as follows: Vulcan Company Income Statement For the Month Ended June 30 Sales Variable expenses Contribution margin Fixed expenses Net operating income Management wants to improve profits and gathered the following data: a. The company is divided into two sales territories-Northern and Southern. The Northern Territory recorded $400,000 in sales and $220,000 in variable expenses during June; the remaining sales and variable expenses were recorded in the Southern Territory. Fixed expenses of $156,000 and $100,000 are traceable to the Northern and Southern Territories, respectively. The rest of the fixed expenses are common to the two territories. $ 800,000 300,000 500,000 475,000 $ 25,000 b. The company is the exclusive distributor for two products-Paks and Tibs. Sales of Paks and Tibs totaled $100,000 and $300,000, respectively, in the Northern territory during June. Variable expenses are 25% of the selling price for Paks…arrow_forwardA company reports the following contribution margin income statement. Contribution Margin Income Statement For Year Ended December 31 Sales (19,200 units at $22.50 each) Variable costs (19,200 units at $18.00 each) Contribution margin. Fixed costs Income The manager believes the company can increase sales volume to 22,000 total units by increasing advertising costs by $16,200. Required A Required B Complete this question by entering your answers in the tabs below. Contribution Margin Income Statement For Year Ended December 31 $ 432,000 345,600 Prepare a contribution margin income statement assuming the company incurs the additional advertising costs and sales volume increases to 22,000 units. Sales Variable costs Contribution margin 86,400 64,800 $ 21,600 Fixed costs Incomearrow_forwardVulcan Company's contribution format income statement for June is as follows: Vulcan Company Income Statement For the Month Ended June 30 Sales Variable expenses Contribution margin Fixed expenses Net operating income $ 750,000 336,000 414,000 378,000 $ 36,000 Management wants to improve profits and gathered the following data: a. The company is divided into two sales territories-Northern and Southern. The Northern territory recorded $300,000 in sales and $156,000 in variable expenses during June; the remaining sales and variable expenses were recorded in the Southern territory. Fixed expenses of $120,000 and $108,000 are traceable to the Northern and Southern territories, respectively. The rest of the fixed expenses are common to the two territories. b. The company is the exclusive distributor for two products-Paks and Tibs. Sales of Paks and Tibs totaled $50,000 and $250,000, respectively, in the Northern territory during June. Variable expenses are 22% of the selling price for Paks…arrow_forward

- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College