Managerial Accounting: Tools for Business Decision Making

7th Edition

ISBN: 9781118334331

Author: Jerry J. Weygandt, Paul D. Kimmel, Donald E. Kieso

Publisher: WILEY

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 6, Problem 6.10E

Determine break-even point in dollars for two divisions.

(L0 2), AP

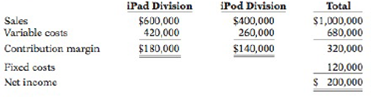

Personal Electronix sells iPads and iPods. The business is divided into two divisions along product lines. CVP income statements for a recent quarters activity are presented below.

Instructions

(a) Determine sales mix percentage and contribution margin ratio for each division.

(b) Calculate the company’s weighted-average contribution margin ratio.

(c) Calculate the company’s break-even point in dollars.

(d) Determine the sales level in dollars for each division at the break-even point.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Munoz Company operates three segments. Income statements for the segments imply that profitability could be improved if Segment

A were eliminated.

Segment

Sales

Cost of goods sold

Sales commissions

MUNOZ COMPANY

Income Statements for Year 2

Contribution margin

General fixed operating expenses (allocation of president's salary)

Advertising expense (specific to individual divisions)

Net income (loss)

Complete this question by entering your answers in the tabs below.

A

$ 171,000

(123,000)

Required A Required B

Prepare a schedule of relevant sales and costs for Segment A.

Relevant Rev. and Cost items for Segment A

$251,000 $256,000

(91,000)

(81,000)

(24,000)

(23,000)

152,000

(40,000)

0

136,000

(17,000)

31,000

(34,000) (42,000)

(6,000) (16,000)

$ (9,000) $ 78,000

Required

a. Prepare a schedule of relevant sales and costs for Segment A.

b. Prepare comparative income statements for the company as a whole under two alternatives: (1) the retention of Segment A and (2)

the elimination of Segment…

Fanning Company operates three segments. Income statements for the segments imply that profitability could be improved if Segment

A were eliminated.

Segment

Sales

Cost of goods sold

Sales commissions

Contribution margin

General fixed operating expenses (allocation of president's salary)

Advertising expense (specific to individual divisions)

Net income (loss)

FANNING COMPANY

Income Statements for Year 2

Complete this question by entering your answers in the tabs below.

Required A Required B

Prepare a schedule of relevant sales and costs for Segment A.

Relevant Revenue and Cost Items for Segment A

Effect on income

$

Required

a. Prepare a schedule of relevant sales and costs for Segment A.

b. Prepare comparative income statements for the company as a whole under two alternatives: (1) the retention of Segment A and (2)

the elimination of Segment A.

A

$ 169,000

(123,000)

(20,000)

26,000

(37,000)

(5,000)

$ (16,000)

0

B

$242,000

(92,000)

(32,000)

118,000

(35,000)

(19,000)

$ 64,000

с

$ 262,000…

a. Present a cost-profit-volume analysis that shows the effect of adding the $8,500 annual

premium to the company's fixed costs by showing current and revised CVP Income Statements.

Include a column to the right of each income statement where each line item is expressed as a

percentage of sales (called a common size income statement).

b. Visualize the changes to net income in a chart.

c. Advise the company using your quantitative support and qualitative. reasoning as to whether

the company should purchase the insurance.

A-Float Pools Company

Income Statement (Pools Maintenance Div.)

For the Year Ended December 31, 2022

In

Sales (2,000 clients)

Cost of Services

Gross profit

Operating expenses

Selling

Administrative

Net Income

$165,000

$225,000

$1,100,000

627,000

$473,000

$390,000

$83.000

Chapter 6 Solutions

Managerial Accounting: Tools for Business Decision Making

Ch. 6 - What is meant by CVP analysis?Ch. 6 - Provide three examples of management decisions...Ch. 6 - Prob. 3QCh. 6 - Describe the features of a CVP income statement...Ch. 6 - The traditional income statement for Wheat Company...Ch. 6 - Prob. 6QCh. 6 - What is meant by the term sales mix? How does...Ch. 6 - Prob. 8QCh. 6 - Prob. 9QCh. 6 - Prob. 10Q

Ch. 6 - What is the theory of constraints? Provide some...Ch. 6 - What is meant by "cost structure? Explain how a...Ch. 6 - What is operating leverage? How does a company...Ch. 6 - Prob. 14QCh. 6 - Prob. 15QCh. 6 - Prob. 16QCh. 6 - Distinguish between absorption costing and...Ch. 6 - Prob. 18QCh. 6 - Prob. 19QCh. 6 - Prob. 20QCh. 6 - Prob. 21QCh. 6 - Prob. 22QCh. 6 - Determine missing amounts for contribution margin....Ch. 6 - Hamby Inc. has sales of 2,000,000 for the first...Ch. 6 - Prob. 6.3BECh. 6 - Prob. 6.4BECh. 6 - Prob. 6.5BECh. 6 - Prob. 6.6BECh. 6 - NoFly Corporation sells three different models of...Ch. 6 - Information for NoFly Corporation is given in...Ch. 6 - Prob. 6.9BECh. 6 - Prob. 6.10BECh. 6 - In Marshall Company, data concerning two products...Ch. 6 - Prob. 6.12BECh. 6 - Prob. 6.13BECh. 6 - Prob. 6.14BECh. 6 - Prob. 6.15BECh. 6 - Compute product costs under variable costing. (LO...Ch. 6 - Compute product costs under absorption costing....Ch. 6 - Prob. 6.18BECh. 6 - Prob. 6.19BECh. 6 - Victoria Company reports the following operating...Ch. 6 - Prob. 6.2DICh. 6 - Zoom Corporation manufactures and sells three...Ch. 6 - Prob. 6.4DICh. 6 - Prob. 6.1ECh. 6 - In the month of June, Jose Heberts Beauty Salon...Ch. 6 - Compute net income under different alternatives....Ch. 6 - Prob. 6.4ECh. 6 - Prob. 6.5ECh. 6 - Yard Tools manufactures lawnmowers, weed-trimmers,...Ch. 6 - PDQ Repaint has 200 auto-maintenance service...Ch. 6 - Express Delivery is a rapidly growing delivery...Ch. 6 - Prob. 6.9ECh. 6 - Determine break-even point in dollars for two...Ch. 6 - Mars Company manufactures and sells three...Ch. 6 - Compute contribution margin and determine the...Ch. 6 - Helena Company manufactures and sells two...Ch. 6 - The CVP income statements shown below are...Ch. 6 - Casas Modernas of Juarez, Mexico, is contemplating...Ch. 6 - Prob. 6.16ECh. 6 - Compute product cost and prepare an income...Ch. 6 - Prob. 6.18ECh. 6 - Crate Express Co. produces wooden crates used for...Ch. 6 - Midlands Inc. had a bad year in 2016. For the...Ch. 6 - Lorge Corporation has collected the following...Ch. 6 - Determine break-even sales under alternative sales...Ch. 6 - Prob. 6.4APCh. 6 - The following CVP income statements are available...Ch. 6 - Bonita Beauty Corporation manufactures cosmetic...Ch. 6 - Prepare income statements under absorption costing...Ch. 6 - Dilithium Batteries is a division of Enterprise...Ch. 6 - CURRENT DESIGNS Current Designs manufactures two...Ch. 6 - Prob. 6.1BYPCh. 6 - Managerial Analysis For nearly 20 years,...Ch. 6 - Real-World Focus In a recent report, the Del Monte...Ch. 6 - The June 8, 2009, edition of the Wall Street...Ch. 6 - Prob. 6.6BYPCh. 6 - Ethics Case Brett Stem was hired during January...Ch. 6 - Prob. 6.9BYP

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Patterson Company operates three segments. Income statements for the segments imply that profitability could be improved if Segment A were eliminated. PATTERSON COMPANY Income Statements for the Year 2014 Segment Sales А В С $169,000 $243,000 $258,000 (80,000) (31,000) (121,000) (17,000) Cost of goods sold Sales commissions (88,000) (30,000) Contribution margin General fixed oper. exp. (allocation of president's salary) Advertising expense (specific to individual divisions) 132,000 31,000 140,000 (34,000) (48,000) (32,000) (6,000) (11,000) (9,000) $73,000 $108,000 Net income Required: a. Prepare a schedule of relevant sales and costs for Segment A. Relevant Rev. and Cost items for Segment A Effect on income b. Prepare comparative income statements for the company as a whole under two alternatives: (1) the retention of Segment A and (2) the elimination of Segment A. PATTERSON COMPANY Comparative Income Statements for the Year 2014 Eliminate Seg. A Keep Seg.A Decision Sales Cost of goods…arrow_forwardPatterson Company operates three segments. Income statements for the segments imply that profitability could be improved if Segment A were eliminated. PATTERSON COMPANY Income Statements for the Year 2014 Segment Sales A В C $162,000 $242,000 $263,000 (84,000) (30,000) (80,000) (31,000) Cost of goods sold Sales commissions (128,000) (18,000) Contribution margin General fixed oper. exp. (allocation of president's salary) Advertising expense (specific to individual divisions) 16,000 128,000 152,000 (35,000) (39,000) (33,000) (3,000) (15,000) (26,000) $ 78,000 119,000 Net income Required: a. Prepare a schedule of relevant sales and costs for Segment A. Relevant Rev. and Cost items for Segment A Effect on income b. Prepare comparative income statements for the company as a whole under two alternatives: (1) the retention of Segment A and (2) the elimination of Segment A PATTERSON COMPANY Comparative Income Statements for the Year 2014 Eliminate Seg. A Keep Seg. A Decision Sales Cost of…arrow_forwardAnalyzing profitability analysis, service company Burlington Internet Services is an Internet service provider for commercial and residential Customers. The company provided the following data for its two types of customers for the month of August: For each type of customer, determine both the contribution margin per customer and the contribution margin ratio. Round to twos decimal places. Which type of service and more profitable?arrow_forward

- The following revenue data were taken from the December 31, 2017, General Electric annual report (10-K): For each segment and each year, calculate intersegment sales (another name for transfer sales) as a percentage of total sales. Using Microsoft Excel or another spreadsheet application, create a clustered column graph to show the 2016 and 2017 percentages for each division. Comment on your observations of this data. How might a division sales manager use this data?arrow_forwardWest Island distributes a single product. The companys sales and expenses for the month of June are shown. Using the information presented, answer these questions: A. What is the break-even point in units sold and dollar sales? B. What is the total contribution margin at the break-even point? C. If West Island wants to earn a profit of $21,000, how many units would they have to sell? D. Prepare a contribution margin income statement that reflects sales necessary to achieve the target profit.arrow_forwardThe following information is from Daves Sporting Goods. Daves is a Midwest sporting goods store with three regional stores. The August income statement for all stores is shown. A. Comment on the operating income results for each store. B. Now assume the costs allocated from corporate is an uncontrollable cost for each store. How does this change your assessment of each store?arrow_forward

- Customers as a Cost Object Morrisom National Bank has requested an analysis of checking account profitability by customer type. Customers are categorized according to the size of their account: low balances, medium balances, and high balances. The activities associated with the three different customer categories and their associated annual costs are as follows: Additional data concerning the usage of the activities by the various customers are also provided: Required: (Note: Round answers to two decimal places.) 1. Calculate a cost per account per year by dividing the total cost of processing and maintaining checking accounts by the total number of accounts. What is the average fee per month that the bank should charge to cover the costs incurred because of checking accounts? 2. Calculate a cost per account by customer category by using activity rates. 3. Currently, the bank offers free checking to all of its customers. The interest revenues average 90 per account; however, the interest revenues earned per account by category are 80, 100, and 165 for the low-, medium-, and high-balance accounts, respectively. Calculate the average profit per account (average revenue minus average cost from Requirement 1). Then calculate the profit per account by using the revenue per customer type and the unit cost per customer type calculated in Requirement 2. 4. CONCEPTUAL CONNECTION After the analysis in Requirement 3, a vice president recommended eliminating the free checking feature for low-balance customers. The bank president expressed reluctance to do so, arguing that the low-balance customers more than made up for the loss through cross-sales. He presented a survey that showed that 50% of the customers would switch banks if a checking fee were imposed. Explain how you could verify the presidents argument by using ABC.arrow_forwardUsing the information in the previous exercises about Marleys Manufacturing, determine the operating income for department B, assuming department A sold department B 1,000 units during the month and department A reduces the selling price to the market price.arrow_forwardSmithen Company, a wholesale distributor, has been operating for only a few months. The company sells three products-sinks, mirrors, and vanities. Budgeted sales by product and in total for the coming month are shown below based on planned unit sales as follows: Sinks Mirrors Vanities Total Units 1,000 500 500 2,000 Percentage of total sales Sales Variable expenses Contribution margin Contribution margin per unit Fixed expenses Operating income Break-even point in unit sales: Percentage sex 25% 25% 100% Break-even point in sales dollars: Total Fixed expenses. Weighted-average CM per unit Sinks 48% Product Mirrors 20% $264,000 100.00% $110,000 100.00% $176,000 100.00% $550,000 100.00% 80,000 30.30% 72,000 65.45% 82,000 46.59% 219,300 39.87% 53.41% 60.13% $184,000 $ 94,000 330,700 69.70% 38,000 34.55% S 76.00 $ 184.00 $ 188.00 Fixed expenses Overall CM ratio $293,300 $158.00 Vanities 32% $293,300 0.60 1,856.33 units Total 100% 293,300 $ 37,400 = $487,798.61 *($184.00 0.50) + ($76.00 x…arrow_forward

- Refer to the information for Jasper Company on the previous page.Required:1. Prepare an income statement for Jasper for last year. Calculate the percentage of sales for eachline item on the income statement. (Note: Round percentages to the nearest tenth of a percent.)2. CONCEPTUAL CONNECTION Briefly explain how a manager could use the incomestatement created for Requirement 1 to better control costs.arrow_forward(a) Prepare a multiple-step income statement.(b) Calculate the gross profit rate and the profit margin and explain what each means.(c) Assume the marketing department has presented a plan to increase advertisingexpenses by $340 million. It expects this plan to result in an increase in both net sales and cost of goods sold of 25%. (Hint: Increase both sales revenue and sales returns and allowances by 25%.) Redo parts (a) and (b) and discuss whether this plan has merit. (Assume a tax rate of 34%, and round all amounts to whole dollars.)arrow_forward1. Shown below is an income statement in the traditional format for Ellie Inc, which has a contribution margin ratio of 25%. Sales ...... Cost of goods sold... Gross profit...... Operating expenses: Selling... Administrative.... Operating income $100,000 (70,000) $ 30,000 (5,000) (10,000) $ 15,000 Prepare an income statement in the contribution margin format. b. Calculate the sales per unit, variable expense per unit, and contribution margin per unit if 10,000 units were produced and sold. c. Calculate the cost formula (Y=a+bX). d. Calculate the firm's break even point in units.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

Cost-Volume-Profit (CVP) Analysis and Break-Even Analysis Step-by-Step, by Mike Werner; Author: Accounting Step by Step;https://www.youtube.com/watch?v=D0MOfse9OWk;License: Standard Youtube License