FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Analyzing profitability analysis, service company

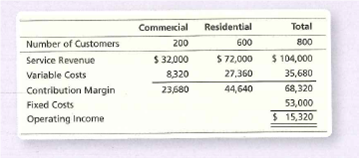

Burlington Internet Services is an Internet service provider for commercial and residential Customers. The company provided the following data for its two types of customers for the month of August:

For each type of customer, determine both the contribution margin per customer and the contribution margin ratio. Round to twos decimal places. Which type of service and more profitable?

Transcribed Image Text:Commecial

Residential

Total

Number of Customers

200

600

800

Service Revenue

$ 32,000

$72,000

$ 104,000

Variable Costs

8320

27,360

35,680

Contribution Margin

23,680

44,640

68,320

Fixed Costs

53,000

Operating Income

$ 15,320

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Compute and Discuss the following financial ratios: -Gross Profit Margin (Gross Profit / Sales) -Net Profit Margin (Net Income / Sales) The transactions for the Year ending December 31 for The Fitness Center were as follows: The company had Cash Sales of $750,000 for Membership Fees for the fitness center. The company had Cash Sales of $400,000 for Personal Trainer Fees for the fitness center. The company had Cash Sales of $850,000 for Equipment Sales for the distribution center. The Cost of Goods Sold from the Equipment Inventory for the Equipment Sales was $300,000 for the distribution center. The company purchased Equipment Inventory on credit (Accounts Payable) in the amount of $500,000 for the distribution center. The company paid $2,500 Cash for Towel Laundry Expense for the fitness center. The company paid $250,000 Cash for the CEO Wage Expense. The company paid $1,500 Cash for Advertising Expense for the fitness center. The company paid $100,000 Cash for the Sales Salaries…arrow_forwardPresented here is the income statement for Big Sky Incorporated for the month of February: Sales $ 60,000 Cost of goods sold 51,900 Gross profit $ 8, 100 Operating expenses 15,200 Operating loss $ (7,100) Based on an analysis of cost behavior patterns, it has been determined that the company's contribution margin ratio is 19%. Required: Rearrange the preceding income statement to the contribution margin format. If sales increase by 10%, what will be the firm's operating income (or loss)? Calculate the amount of revenue required for Big Sky to break even.arrow_forwardVariable Costs, Contribution Margin, Contribution Margin Ratio Super-Tees Company plans to sell 20,000 T-shirts at $19 each in the coming year. Product costs include: Direct materials per T-shirt $6.65 $1.33 Direct labor per T-shirt Variable overhead per T-shirt $0.57 Total fixed factory overhead $43,000 Variable selling expense is the redemption of a coupon, which averages $0.95 per T-shirt; fixed selling and administrative expenses total $13,000.arrow_forward

- sarrow_forwardPlease refer to the sample and paraphrase the revenue and gross profit. Changing the company name to Newmont Corporation. Please write a close word count to the sample. Thanks!arrow_forwardAs a part of an employment interview, you are given the partial income statement and selected financial ratios shown for Sneaky Pete's, a chain of western stores. Sneaky Pete's is organized into two divisions: Mountain and Valley. You are told that corporate overhead costs are allocated to divisions based on relative sales. Required: a. Complete the income statements for both divisions and the corporation as a whole. (Enter all values as positive value. Round your answers to 1 decimal place.) Mountain Division Valley Division Сoгporate Sales Cost of sales Gross margin SG&A Allocated corporate costs 18.0 72.0 Operating income Tax expense (@25%) After-tax income 134.4 52.50 % Gross margin percentage Operating margin Profit margin 66.00 % 56.00 % 26.00 % 21.20 % 22.40 % 19.50 % 15.90 % 16.80 %arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education