Companies in different industries often use different proportions of current versus long-term assets to accomplish their business objective. The technology revolution resulting from the silicon microchip has often been led by two well-known companies: Microsoft and Intel. Although often thought of together, these companies are really very different. Using either the most current Forms 10-K or annual reports for Microsoft Corporation and Intel Corporation, complete the following requirements. To obtain the Forms 10-K, use either the EDGAR system following the instructions in Appendix A or the company’s website. Microsoft’s annual report is available on its website; Intel’s annual report is its Form 10-K.

Required

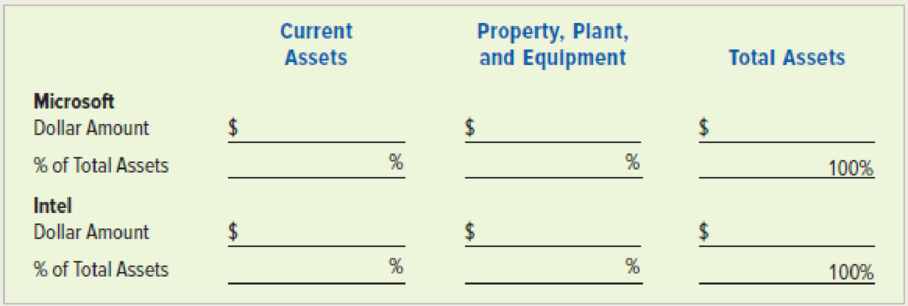

a. Fill in the missing data in the following table. The percentages must be computed; they are not

included in the companies’ 10-Ks. (Note: The percentages for current assets and property, plant,

and equipment will not sum to 100.)

b. Briefly explain why these two companies have different percentages of their assets in current

assets versus property, plant, and equipment.

Want to see the full answer?

Check out a sample textbook solution

Chapter 6 Solutions

Survey Of Accounting

- Texas Instruments (TI) designs and manufactures semiconductor products for use in computers, telecommunications equipment, automobiles, and other electronics-based products. The manufacturing of semiconductors is highly capital-intensive. Hewlett-Packard Corporation (HP) manufactures computer hardware and various imaging products, such as printers and fax machines. Exhibit 4.26 presents selected data for TI and HP for three recent years. Exhibit 4.25 Exhibit 4.26 REQUIRED a. Compute the fixed assets turnover for each firm for Years 1, 2, and 3. b. Suggest reasons for the differences in the fixed assets turnovers of TI and HP. c. Suggest reasons for the changes in the fixed assets turnovers of TI and HP during the three-year period.arrow_forwardUse the following information for Exercises 11-31 and 11-32: Washington Company has two divisions: the Adams Division and the Jefferson Division. The following information pertains to last years results: Washingtons actual cost of capital was 12%. Exercise 11-31 Economic Value Added Refer to the information for Washington Company above. Required: 1. Calculate the EVA for the Adams Division. 2. Calculate the EVA for the Jefferson Division. 3. CONCEPTUAL CONNECTION Is each division creating or destroying wealth? 4. CONCEPTUAL CONNECTION Describe generally the types of actions that Washingtons management team could take to increase Jefferson Divisions EVA?arrow_forwardConduct research on an ERP package, such as Microsoft Dynamics GP or Microsoft Dynamics NAV, for small to medium-sized (SME) organizations (between 30 million and 1 billion in revenues). Compare that package to the SAP system in terms of available modules, functionality, and so on.arrow_forward

- Communication The Norse Division of Gridiron Concepts Inc. experienced significant revenue and profit growth from 20Y4 to 20Y6 as shown in the following divisional income statements: There are no support department allocations, and the division operates as an investment center that must maintain a 15% return on invested assets. Determine the profit margin, investment turnover, and return on investment for the Norse Division for 20Y420Y6. Based on your computations, write a brief memo to the president of Gridiron Concepts Inc., Knute Holz, evaluating the divisions performance.arrow_forward23-Easa Saleh Al Gurg Group Careers company collecting and storing all kinds of information for future planning and decision making. Because of present Covid-19 pandemic situation, they found the decrease in sales revenue of the company and to take necessary actions, the management of the company collected information on percentage of product rejections, number of customer complaints. The category of information the company focusing on is termed as: O a. Financial Quantitative information O b. Financial Qualitative information O c. Non-Financial Qualitative information O d. Non-Financial Quantitative informationarrow_forward16/ Question Workspace Check My Work Morgan Manufacturing operates in an industry in which frequent changes in market conditions results in a hectic and volatile IT environment within the company. To keep abreast, Morgan’s system development team are engaged in a considerable level of new program development and application change activities. To efficiently manage the workload, the director of IT has combined the functions of systems development and program change into a single department. This allows programmers of new applications to also maintain those applications. To achieve cross training, programmers also maintain applications originally programmed by other IT personnel. This has resulted in an “open” library policy that allows programmers to access all programs stored in the SPL and download them to personal computers for maintenance. The immediate effect of this policy has been an increase in the work flow by reducing the startup time needed by programmers to…arrow_forward

- Question 2 Use the Goretex case to explain how the P.R.O.F.I.T. supports the assertion that it’s managerial practices and organisational culture make it ‘a great place to work’ The Case When Goretex developed the core technology on which most of its more than 2,000 worldwide patents is based, the company’s unique culture played a crucial role in allowing Gore to pursue multiple end-market applications simultaneously, enabling rapid growth from a niche business into a diversified multinational company. The company’s culture is team-based and designed to foster personal initiative. It is described on the company’s website as follows: There are no traditional organizational charts, no chains of command, nor predetermined channels of communication. Instead, we communicate directly with each other and are accountable to fellow members of our multidiscipline teams. We encourage hands-on innovation, involving those closest to a project in decision making. Teams organize around…arrow_forwardQUESTION 6 According to O'Reilly and Tushman, which of these best describes an ambidextrous structure? a. Rotating specialists among different cross-functional teams. Ob. Hiring only generalists in the different functions and divisions. O c. Creating autonomous units that focus on exploratory initiatives. O d. Encouraging mainstream division personnel to engage in exploration. QUESTION 7arrow_forward

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning

Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub