Effect of

The following events apply to Gulf Seafood for the 2018 fiscal year:

1. The company started when it acquired $60,000 cash by issuing common stock.

2. Purchased a new cooktop that cost $40,000 cash.

3. Earned $72,000 in cash revenue.

4. Paid $25,000 cash for salaries expense.

5. Adjusted the records to reflect the use of the cooktop. Purchased on January 1, 2018, the cooktop has an expected useful life of four years and an estimated salvage value of $4,000. Use straightline depreciation. The

Required

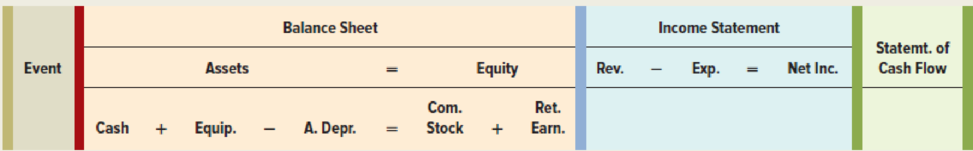

a. Record the previous transactions in a horizontal statements model like the following one.

b. What amount of depreciation expense would Gulf Seafood report on the 2018 income statement?

c. What amount of

d. Would the

Want to see the full answer?

Check out a sample textbook solution

Chapter 6 Solutions

Survey Of Accounting

- Wildhorse Company uses the straight-line method of depreciation. The company's fiscal year end is December 31. The following transactions occurred during 2025. Jan. 1 May 13 Dec. 31 Purchased equipment from the Indigo Company on account for $14,700 plus sales tax of $1,975 and shipping costs of $625. Paid for $540 routine maintenance on the equipment. Recorded 2025 depreciation on the basis of a 3-year life and estimated salvage value of $6,950. Prepare the necessary entries. (If no entry is required, select "No Entry" for the account titles and enter O for the amounts. Credit account titles are automatically indented when the amount is entered. Do not indent manually. List all debit entries before credit entries.) Date Account Titles and Explanation Debit Creditarrow_forwardStarz service uses the straight-line method of depreciation. The company’s fiscal year-end is December 31. The following transactions occurred during 2022. January 1 Purchased equipment from the barre company on account for 12,500 plus sales tax of 1,125 and shipping cost of 225 May 13 Incurred 140 routine maintenance on the equipment. Dec 31 Recorded 2022 depreciation on the basis of 3-year life and estimated salvage value of $4,850 Prepare the necessary adjusting journal entries, show computations and explanations of the adjusting entries on the answer sheet. Dates Accounts debit Creditarrow_forwardThe following events apply to Gulf Seafood for the Year 1 fiscal year: The company started when it acquired $19,000 cash by issuing common stock. Purchased a new cooktop that cost $14,100 cash. Earned $21,700 in cash revenue. Paid $12,400 cash for salaries expense. Adjusted the records to reflect the use of the cooktop. Purchased on January 1, Year 1, the cooktop has an expected useful life of four years and an estimated salvage value of $2,400. Use straight-line depreciation. The adjusting entry was made as of December 31, Year 1. What amount of depreciation expense would Gulf Seafood report on the Year 1 income statement? What amount of accumulated depreciation would Gulf Seafood report on the December 31, Year 2, balance sheet? Would the cash flow from operating activities be affected by depreciation in Year 1?arrow_forward

- The following events apply to Gulf Seafood for the Year 1 fiscal year: 1. The company started when it acquired $38,000 cash by issuing common stock. 2. Purchased a new cooktop that cost 15800 cash 3. Earned 21200 in cash revenue 4. Paid 13500 cash for salaries expense 5. Adjusted the records to reflect the use of the cooktop. Purchased on January 1, Year 1, the cooktop has an expected useful life of five years and an estimated salvage value of $2,800. Use straight-line depreciation. The adjusting entry was made as of December 31, Year 1. a. Record the events in general journal format and post to T-accounts.arrow_forwardA depreciation schedule for semi-trucks of ISIDRO MANUFACTURING COMPANY was requested by your auditor soon after December 31, 2017, showing the additions, retirements, depreciation, and other data affecting the income of the company in the 4-year period 2014 to 2017, inclusive. The following data were ascertained. Balance of Trucks account, Jan. 1, 2014 Truck No. 1 purchased Jan. 1, 2011, cost P180,000 Truck No. 2 purchased July 1, 2011, cost 220,000 Truck No. 3 purchased Jan. 1, 2013, cost 300,000 Truck No. 4 purchased July 1, 2013, cost 240,000Balance, Jan. 1, 2014 P940,000 The Accumulated Depreciation—Trucks account previously adjusted to January 1, 2014, and entered in the ledger, had a balance on that date of P302,000 (depreciation on the four trucks from the respective dates of purchase, based on a 5-year life, no salvage value). No charges had been made against the account before January 1, 2014. Transactions between January 1, 2014, and December 31, 2017, which were recorded…arrow_forwardDepreciating a fixed asset During 2018, Starbucks purchased fixed assets costing approximately $1.8 billion. Assume that the company purchased the assets at the beginning of the year, uses straight-line depreciation, and normally depreciates its equipment over four years. Assume a zero salvage value. Compute the book value of the equipment at the end of each of the four years. Complete a chart like the following. 2018 2019 2020 2021 Total Depreciation expense (in millions) Cash outflow associated with the purchase of the equipment (in millions) What is the purpose of the adjustments at the end of each period?arrow_forward

- The following events apply to Gulf Seafood for the Year 1 fiscal year: The company started when it acquired $19,000 cash by issuing common stock. Purchased a new cooktop that cost $14,100 cash. Earned $21,700 in cash revenue. Paid $12,400 cash for salaries expense. Adjusted the records to reflect the use of the cooktop. Purchased on January 1, Year 1, the cooktop has an expected useful life of four years and an estimated salvage value of $2,400. Use straight-line depreciation. The adjusting entry was made as of December 31, Year 1. Record the above transactions in a horizontal statements model. What amount of depreciation expense would Gulf Seafood report on the Year 1 income statement? What amount of accumulated depreciation would Gulf Seafood report on the December 31, Year 2, balance sheet? Would the cash flow from operating activities be affected by depreciation in Year 1?arrow_forwardCurrent Attempt in Progress Prepare the journal entries to record the following transactions for Blue Spruce Inc., which has a calendar year end and uses straight- line depreciation. (a) On June 30, 2022, the company sold office equipment for $21,500. The office equipment originally cost $34,000 and had accumulated depreciation to the date of disposal of $15,500. (If no entry is required, select "No entry" for the account titles and enter O for the amounts. Credit account titles are automatically indented when amount is entered. Do not indent manually. Record journal entries in the order presented in the problem. List all debit entries before credit entries.) Date June 30, 2022 Sept 30, 2022 Save for Later Account Titles and Explanation Debit Attempts-0 of 1 used Crediarrow_forwardThe following events apply to Gulf Seafood for the Year 1 fiscal year: The company started when it acquired $19,000 cash by issuing common stock. Purchased a new cooktop that cost $14,100 cash. Earned $21,700 in cash revenue. Paid $12,400 cash for salaries expense. Adjusted the records to reflect the use of the cooktop. Purchased on January 1, Year 1, the cooktop has an expected useful life of four years and an estimated salvage value of $2,400. Use straight-line depreciation. The adjusting entry was made as of December 31, Year 1. Record the above transactions in a horizontal statements model.arrow_forward

- A copier was purchased for $7,211.45 on February 3, 2015. 200% MACRS is the method used to depreciate this copier and the depreciation is recorded at the end of each month. On August 27, 2015, the copier breaks and a cash refund of $6,200.00 is provided. Create the general journal entry to record the assest disposal of this copier (check figure: Loss on Asset Disposal = $224.75)arrow_forwardRequired information Skip to question [The following information applies to the questions displayed below.] The following transactions relate to Academy Towing Service. Assume the transactions for the purchase of the wrecker and any capital improvements occur on January 1 of each year. Year 1 Acquired $73,000 cash from the issue of common stock. Purchased a used wrecker for $35,000 cash. It has an estimated useful life of three years and a $6,000 salvage value. Paid sales tax on the wrecker of $4,000. Collected $59,100 in towing fees. Paid $12,300 for gasoline and oil. Recorded straight-line depreciation on the wrecker for Year 1. Closed the revenue and expense accounts to Retained Earnings at the end of Year 1. Year 2 Paid for a tune-up for the wrecker’s engine, $1,200. Bought four new tires, $1,550. Collected $65,000 in towing fees. Paid $18,300 for gasoline and oil. Recorded straight-line depreciation for Year 2. Closed the revenue and expense accounts to Retained Earnings at…arrow_forwardThe following events apply to Gulf Seafood for the Year 1 fiscal year:The company started when it acquired $60,000 cash by issuing common stock.Purchased a new cooktop that cost $40,000 cash.Earned $72,000 in cash revenue.Paid $25,000 cash for salaries expense.Adjusted the records to reflect the use of the cooktop. Purchased on January 1, Year 1, the cooktop has an expected useful life of four years and an estimated salvage value of $4,000. Use straight-line depreciation. The adjusting entry was made as of December 31, Year 1. Requireda. Record the events in general journal format and post to T-accountsarrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education