Survey Of Accounting

5th Edition

ISBN: 9781259631122

Author: Edmonds, Thomas P.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 6, Problem 23P

Calculating

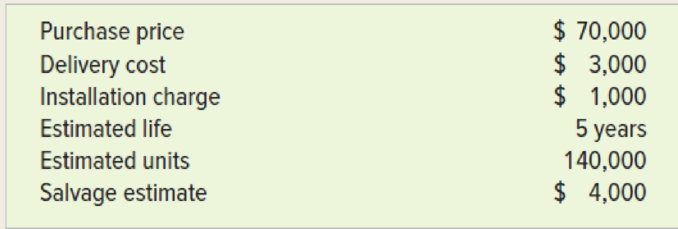

Banko Inc. manufactures sporting goods. The following information applies to a machine purchased on January 1, 2018:

During 2018, the machine produced 36,000 units and during 2019, it produced 38,000 units.

Required

Determine the amount of depreciation expense for 2018 and 2019 using each of the following methods:

a. Straight-line.

b. Double-declining-balance.

c. Units of production.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

A elearning.act.edu.om

Muscat LLC purchased a machine on 1st

January, 2019 for OMR 250,000. The rate of

depreciation is 20% p.a. under straight line

method. Replacement Cost of the machine on

31st December,2019 was OMR 350,000 and on

31st December, 2020 was OMR 500,000. The

company wishes to follow Current Cost

Accounting rather than the Historical Cost

Accounting.

a.

What is the amount of Depreciation

Adjustment?

b.

What is the amount of Additional

Depreciation?

C.

What is the amount of Back Log

Depreciation?

Banko Inc. manufactures sporting goods. The following information applies to a machine purchased on January 1, 2018:

purchase price

83200

delivery cost

7000

installation charge

3000

estimated life

5 years

estimated units

147000

salvage estimate

5000

determine the amount of depreciation expense for 2018 and 2019 using the following methods:

straight line

double declining balance

units of production

Name and briefly explain four methods of depreciation.

Mwakisha, a contractor, started business on 1 January 2018. Purchases and disposals of machines over the subsequent three years were as follows:

Machine Date of Cost Date of

Purchase Disposal

Shs.

MA 1 1 January 2018 5,000,000

MB 2 1 July 2019 2,500,000 1 June 2020

MC 3 1 October 2020 7,000,000

The machines are depreciated on straight line basis using a rate of…

Chapter 6 Solutions

Survey Of Accounting

Ch. 6 - 1. What is the difference between the functions of...Ch. 6 - Prob. 2QCh. 6 - Prob. 3QCh. 6 - 4. Define depreciation. What kind of asset...Ch. 6 - Prob. 5QCh. 6 - Prob. 6QCh. 6 - Prob. 7QCh. 6 - 8. Explain the historical cost concept as it...Ch. 6 - Prob. 9QCh. 6 - Prob. 10Q

Ch. 6 - Prob. 11QCh. 6 - 12. Explain straight-line, units-of-production,...Ch. 6 - Prob. 13QCh. 6 - Prob. 14QCh. 6 - Prob. 15QCh. 6 - Prob. 16QCh. 6 - 17. What is salvage value?Ch. 6 - Prob. 18QCh. 6 - Prob. 19QCh. 6 - Prob. 20QCh. 6 - Prob. 21QCh. 6 - 22. Why would a company choose to depreciate one...Ch. 6 - Prob. 23QCh. 6 - 27. How are capital expenditures made to improve...Ch. 6 - Prob. 25QCh. 6 - Prob. 26QCh. 6 - Prob. 27QCh. 6 - Prob. 28QCh. 6 - Prob. 1ECh. 6 - Prob. 2ECh. 6 - Prob. 3ECh. 6 - Prob. 4ECh. 6 - Prob. 5ECh. 6 - LO 8-1 Exercise 8-6 A Allocating costs for a...Ch. 6 - Effect of depreciation on the accounting equation...Ch. 6 - Prob. 8ECh. 6 - Prob. 9ECh. 6 - Prob. 10ECh. 6 - Events related to the acquisition, use, and...Ch. 6 - Prob. 12ECh. 6 - Prob. 13ECh. 6 - Prob. 14ECh. 6 - Prob. 15ECh. 6 - Prob. 16ECh. 6 - Prob. 17ECh. 6 - Prob. 18ECh. 6 - Prob. 19ECh. 6 - Prob. 20ECh. 6 - Prob. 21ECh. 6 - Accounting for acquisition of assets, including a...Ch. 6 - Calculating depreciation expense using three...Ch. 6 - Determining the effect of depreciation expense on...Ch. 6 - Prob. 25PCh. 6 - Prob. 26PCh. 6 - Prob. 27PCh. 6 - Prob. 28PCh. 6 - Revision of estimated salvage value Delta Machine...Ch. 6 - Purchase and use of tangible asset: Three...Ch. 6 - Recording continuing expenditures for plant assets...Ch. 6 - Prob. 32PCh. 6 - Prob. 33PCh. 6 - Prob. 34PCh. 6 - Prob. 35PCh. 6 - Performing ratio analysis using real-world data...Ch. 6 - Prob. 1ATCCh. 6 - ATC 6-3 Research Assignment Comparing Microsofts...Ch. 6 - Prob. 4ATCCh. 6 - ATC 6-5 Ethical Dilemma Whats an expense? Several...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Refer to the information for Cox Inc. above. What amount would Cox record as depreciation expense for 2019 if the units-of-production method were used ( Note: Round your answer to the nearest dollar)? a. $179,400 b. $184,000 c. $218,400 d. $224,000arrow_forwardHonesty Manufacturing purchased a machine on 1 July, 2017. The following financial information has been collected to calculate the depreciation at 30 June 2019: Cost $58,500 Expected salvage value $1,000 Estimated useful life in years 5 Estimated useful life in hours 200,000 Hours used in 2020 is: 48,000 Required: Calculate the depreciation expense of the machine for the year ended 30 June 2019 using: a) Straight-line method b) Unit of activity method c) Declining balance method using double straight-line ratearrow_forwardMuscat LLC purchased a machine on 1st January,2019 for OMR 125,000. The rate of depreciation is 20% p.a. under straight line method. Replacement Cost of the machine on 31st December,2019 was OMR 175,000 and on 31st December, 2020 was OMR 250,000. The company wishes to follow Current Cost Accounting rather than the Historical Cost Accounting. a. What is the amount of Depreciation Adjustment? b. What is the amount of Additional Depreciation? c. What is the amount of Back Log Depreciation?arrow_forward

- Banko Incorporated manufactures sporting goods. The following information applies to a machine purchased on January 1, Year 1. Purchase price Delivery cost Installation charge Estimated life Estimated units Salvage estimate During Year 1, the machine produced 46,000 units, and during Year 2 it produced 48,000 units. Required MACRS table: 5-Year Year property, & 20.00 a. Determine the amount of depreciation expense for Year 1 and Year 2 using straight-line method. b. Determine the amount of depreciation expense for Year 1 and Year 2 using double-declining-balance method. c. Determine the amount of depreciation expense for Year 1 and Year 2 using units of production method. d. Determine the amount of depreciation expense for Year 1 and Year 2 using MACRS, assuming that the machine is classified as seven-year property. (Round your answers to the nearest dollar amount.) 1 2 3 4 $58,000 $5,000 $3,000 32.00 19.20 11.52 11.52 5.76 7-Year property, 14.29 24.49 17.49 12.49 8.93 8.92 8.93 4.46 5…arrow_forwardOn July 31, 2018, Choice Landscapes discarded equipment that had a cost of $17,680. Accumulated Depreciation as of December 31, 2017, was $16,000. Assume annual depreciation on the equipment is $1,680. Journalize the partial-year depreciation expense and disposal of the equipment. (Record debits first, then credits Select the explanation on the last line of the journal entry table.) Journalize the partial-year depreciation expense. Date Accounts and Explanation Debit Credit Jul. 31arrow_forwardAt December 31, 2018 Allarco Inc.'s balance sheet showed plant and equipment information as detailed in the schedule below. Allarco Inc. calculates depreciation to the nearest whole month. Please complete the schedule. Round depreciation per unit of production to the nearest cent. Cost Information Depreciation Description Purchase Date Equipment November 1, 2016 Depreciation Method Cost Salvage Value Straight-line 226,000 10,000 Double-declining- Machinery July 1, 2018 96,000 10,000 Life 10 years 5 years Accum. Dep. Dep. Expense Accum. Dep. Dec. 31, 2018 for 2019 Dec. 31, 2019 balance Trucks September 5, 2017 Units-of-production 416,800 10,000 1,017,000 miles There have been no disposals or subsequent capital expenditures on the asset since the date of purchase. The miles the truck was actually driven were as follows: 2017: 408,000 2018: 303,000 2019: 212,000 For simplicity, assume that the asset is depreciated as an individual item and will not be broken down into parts and…arrow_forward

- Comparing Theee Depreciation Methods Dexter Industries purchased packaging equipment on January 8 for $233,400. The equipment was expected to have a useful ife of three years, or 6,300 operating hours, and a residual value of $19,200. The equipment was used for 2,520 hours during Year 1, 1,953 hours in Year 2, and 1,827 hours in Year 3. Required: 1. Determine the amount of depreciation expense for the three years ending December 31, Year 1, Year 2, Vear 3, by (a) the straight-ine method, (b) the unite-of- activity method, and (e) the double-decining-balance method, Also determine the total depreciation expense for the three years by each method. Note: For all methods, round the answer for each year to the nearest whole dollar. Depreciation Expense Straight-Line Nethod Units-of-Activity Method Double-Declining-Balance Method Year Year 1 Year 2 Year 3 Total 2. What method yields the highest depreciation expense for Year 17 3. What method ylelds the most depreciation over the three-year…arrow_forwardDepreciating a fixed asset During 2018, Starbucks purchased fixed assets costing approximately $1.8 billion. Assume that the company purchased the assets at the beginning of the year, uses straight-line depreciation, and normally depreciates its equipment over four years. Assume a zero salvage value. Compute the book value of the equipment at the end of each of the four years. Complete a chart like the following. 2018 2019 2020 2021 Total Depreciation expense (in millions) Cash outflow associated with the purchase of the equipment (in millions) What is the purpose of the adjustments at the end of each period?arrow_forwardLMN Company purchased factory equipment for $64,000 on January 1, 2016. The equipment is estimated to have a useful life of 12 years, at which point it will have a residual value of $4,000. LMN Company uses the straight-line method to account for depreciation. What is the journal entry on December 31, 2016 to record the yearly depreciation? Select one: a. Debit depreciation expense $5,000; Credit Equipment $5,000 b. Debit depreciation expense $5,333; Credit Accumulated depreciation: $5,333 c. Debit depreciation expense $5,000; Debit accumulated depreciation: $5,000 d. Debit depreciation expense $5,000; Credit Accumulated depreciation: $5,000arrow_forward

- On August 31, 2017, Advanced Automotive purchased a copy machine for $62,500. Advanced Automotive expects the machine to last for five years and to have a residual value of $2,500. Compute depreciation expense on the machine for the year ended December 31, 2017, using the straight-line method. Begin by selecting the formula to calculate the company's depreciation expense on the machine for the year ended December 31, 2017. Then enter the amounts and calculate the depreciation expense. (Abbreviation used: Acc. = accumulated. Do not round intermediary calculations. Only round the amount you input for straight-line depreciation to the nearest dollar.) Straight-line | ]x( / 12) = depreciationarrow_forwardGiven the data, prepare a depreciation table (Depreciation Expense, Accumulated Depreciation, Carrying Amount) for the following methods: 1. Straight line 2. Service hours 3. Production method Also, identify the Gain or Loss for each year and every deprecation method if the machine is sold at: End of 1st Yr - 500,000 End of 2nd Yr - 360,000 End of 3rd Yr - 260,000 End of 4th Yr - 165,000 End of 5th Yr - 40,000arrow_forwardAt December 31, 2018 Weber Inc.'s balance sheet showed plant and equipment information as detailed in the schedule below. Weber Inc. calculates depreciation to the nearest whole month. Please complete the schedule. Round depreciation per unit of production to the nearest cent. Cost Information Description Purchase Date Depreciation Method Cost Salvage Value Life Double-declining- Machinery May 2, 2018 240,000 10,000 10 years balance Depreciation Accum. Dep. Dec. Dep. Expense Accum. Dep. Dec. 31, 2018 for 2019 31, 2019 There have been no disposals or subsequent capital expenditures on the asset since the date of purchase. For simplicity, assume that the asset is depreciated as an individual item and will not be broken down into parts and depreciated.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Cengage Learning

Depreciation -MACRS; Author: Ronald Moy, Ph.D., CFA, CFP;https://www.youtube.com/watch?v=jsf7NCnkAmk;License: Standard Youtube License