Performing ratio analysis using real-world data

Companies in the coal mining business use a lot of property, plant, and equipment. Not only is there the significant investment they must make in the equipment used to extract and process the coal, but they must also purchase the rights to the coal reserves themselves.

Goodyear Tire & Rubber Company, Inc. is the largest tire manufacturer in North America.

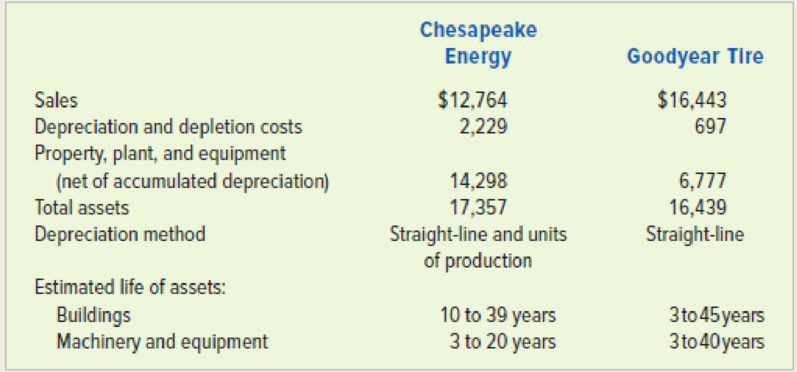

Chesapeake Energy Corporation claims to be the largest private-sector coal company in the world. The following information was taken from these companies’ December 31, 2015, annual reports. All dollar amounts are in millions.

Required

a. Calculate depreciation costs as a percentage of sales for each company. (Round to three decimal places.)

b. Calculate buildings, property, plant, and equipment as a percentage of total assets for each company. (Round to three decimal places.)

c. Based only on the percentages calculated in Requirements a and b, which company appears to be using its assets most efficiently? Explain your answer.

d. Identify some of the problems a financial analyst encounters when trying to compare the used of long-term assets of Chesapeake versus Goodyear.

Want to see the full answer?

Check out a sample textbook solution

Chapter 6 Solutions

Survey Of Accounting

- Analyze and compare CSX, Union Pacific, and YRC Worldwide CSX Corporation (CSX) and Union Pacific Corporation (UNP) are major railroads, operating primarily in the eastern and western portion of the United States, respectively. YRC Worldwide Inc. (YRCW) is one of the largest trucking companies in the United States. The sales and total assets (in millions) for a recent year for each company are as follows: a. Compute the asset turnover ratio for each company. Round to two decimal places. b. Which of the two railroad companies is more efficient in generating revenues from its assets? c. How does YRCs asset turnover ratio compare to the two railroads? Why?arrow_forwardFedEx Corporation and United Parcel Service, Inc. compete in the package delivery business. The major fixed assets for each business include aircraft, sorting and handling facilities, delivery vehicles, and information technology. The sales and average book value of fixed assets reported on recent financial statements for each company were as follows: a. Compute the fixed asset turnover ratio for each company. Round to one decimal place. b. Which company appears more efficient in using fixed assets? c. Interpret the meaning of the ratio for the more efficient company.arrow_forwardHeather Smith Cosmetics (HSC) manufactures a variety of products and is organized into three divisions (investment centers): soap products, skin lotions, and hair products. Information about the most recent year's operations follows. The information includes the value of intangible assets, including research and development, patents, and other innovations that are not included on HSC's balance sheet. Were these intangibles to be included in the financial statements (as they are for EVAⓇ), the increase in the balance sheet and the increase in after-tax operating income would be as given below: Soap products Skin lotions Division Hair products Minimum desired rate of return Cost of capital Required: Operating Income $ 3,250,000 2,750,000 5,000,000 5.00% 4.00% Average Total Assets $ 60,000,000 33,000,000 55,000,000 Value of Intangibles $ 1,500,000 8,000,000 1,000,000 Intangibles' Effect on Income $ 1,000,000 6,000,000 700,000 1. Calculate the return on investment (ROI) for each division.…arrow_forward

- Dr. Feng wants to invest in the Australian mining sector. The following list of companies has been provided to you in order to evaluate whether these companies appear to be in financial difficulties and which company is the best investment option. Please provide a brief summary about the financial status of each of the companies and provide a recommendation for the investment choice. Justify your recommendations. 1). BHP Group LtdCurrent ratio in 6/2016 = 1.44 times (or 1.44:1) Current ratio in 6/2017 = 1.85 times (or 1.85:1) Current ratio in 6/2018 = 2.51 times (or 2.51:1) Current ratio in 6/2019 = 1.89 times (or 1.89:1) Current ratio in 6/2020 = 1.45 times (or 1.45:1) ROCE in 6/2016 = 21.2% ROCE in 6/2017 = 26.7% ROCE in 6/2018 = 40.4% ROCE in 6/2019 = 42.1% ROCE in 6/2020 = 37.6% Z-score in 2018 = 2.69Z-score in 2019 = 2.77 Z-score in 2020 =2.39 2). Rio Tinto LtdCurrent ratio in 12/2016 = 1.61 times (or 1.61:1) Current ratio in 12/2017 = 1.71 times (or 1.71:1) Current ratio in…arrow_forwardQuestion: FineTech Ltd. is a manufacturing company that produces electronic gadgets. During the last financial year, the company invested heavily in research and development (R&D) to enhance product innovation and competitive advantage. As a result, FineTech incurred significant R&D expenses in the process. The company is now preparing its financial statements and needs to decide whether to treat these R&D expenses as operating expenses or capitalize them as intangible assets. Explain the concept of research and development costs in accounting, the criteria for capitalization, and the implications of each accounting treatment on FineTech's financial statements and financial performance. Additionally, discuss how these accounting decisions may impact investors, creditors, and other stakeholders in their assessment of FineTech's financial position and profitability.arrow_forwardMegan and Ray Limited (hereafter referred to as “Megan and Ray” or “the company”) is a major construction companythat has most of its operations in Southern Africa, in fact, its corporate office is in Sandton, in Gauteng province, SouthAfrica. The company is listed on the JSE. It is one of the biggest companies in the construction sector in South Africa. It’sJSE’s sector market capitalisation is currently estimated at 25%. The company has been doing relatively well despite therecent global economic hardships which have negatively affected this sector and now the Covid -19 pandemic is alsoexacerbating the problem. Recently, the company acquired rights to build 3 bridges on some of the major highways inSouthern Mozambique. This business venture is surely a good opportunity for the company to continue to do relativelywell and survive the aforementioned economic problems. The company’s management proposes to finance the newoperation through a rights issue of ordinary shares. At present,…arrow_forward

- Heather Smith Cosmetics (HSC) manufactures a variety of products and is organized into three divisions (investment centers): soap products, skin lotions, and hair products. Information about the most recent year’s operations follows. The information includes the value of intangible assets, including research and development, patents, and other innovations that are not included on HSC’s balance sheet. Were these intangibles to be included in the financial statements (as they are for EVA®), the increase in the balance sheet and the increase in after-tax operating income would be as given below: Calculate EVA® for each division.arrow_forwardCompare Fed Ex and UPS FedEx Corporation (FDX) and United Parcel Service, Inc. (UPS) compete in the package delivery business. The major fixed assets for each business include aircraft, sorting and handling facilities, delivery vehicles, and information technology. The sales and average book value of fixed assets reported on recent financial statements for each company were as follows: a. Compute the fixed asset turnover ratio for each company. Round to one decimal place. b. Which company appears more efficient in using fixed assets? c. Interpret the meaning of the ratio for the more efficient company.arrow_forwardHeather Smith Cosmetics (HSC) manufactures a variety of products and is organized into three divisions (investment centers): soap products, skin lotions, and hair products. Information about the most recent year's operations follows. The information includes the value of intangible assets, including research and development, patents, and other innovations that are not included on HSC's balance sheet. Were these intangibles to be included in the financial statements (as they are for EVA"), the increase in the balance sheet and the increase in after-tax operating income would be as given below: Division Soap products Skin lotions. Hair products Minimum desired rate of return Cost of capital Operating Income $ 3,248,500 2,748,500 4,998,500 1. Return on investment (ROI) 2. Residual income (RI) 3. EVAⓇ Soap Products 5.00% 4.00% % Average Total Assets $ 59,998,500 32,998,500 54,998,500 Required: 1. Calculate the return on investment (ROI) for each division. (Round your answers to 2 decimal…arrow_forward

- Bethesda Mining is a midsized coal mining company with 20mines located in Ohio, Pennsylvania, West Virginia, andKentucky. The company operates deep mines as well as stripmines. Most of the coal mined is sold under contract, withexcess production sold on the spot market.The coal mining industry, especially high-sulfur coaloperations such as Bethesda, has been hard-hit byenvironmental regulations. Recently, however, a combinationof increased demand for coal and new pollution reductiontechnologies has led to an improved market demand for highsulfur coal. Bethesda has been approached by Mid-OhioElectric Company with a request to supply coal for its electricgenerators for the next 4 years. Bethesda Mining does nothave enough excess capacity at its existing mines to guaranteethe contract. The company is considering opening a strip minein Ohio on 5,000 acres of land purchased 10 years ago for $4million. Based on a recent appraisal, the company feels itcould receive $6.5 million on an aftertax…arrow_forwardBethesda Mining is a midsized coal mining company with 20mines located in Ohio, Pennsylvania, West Virginia, andKentucky. The company operates deep mines as well as stripmines. Most of the coal mined is sold under contract, withexcess production sold on the spot market.The coal mining industry, especially high-sulfur coaloperations such as Bethesda, has been hard-hit byenvironmental regulations. Recently, however, a combinationof increased demand for coal and new pollution reductiontechnologies has led to an improved market demand for highsulfur coal. Bethesda has been approached by Mid-OhioElectric Company with a request to supply coal for its electricgenerators for the next 4 years. Bethesda Mining does nothave enough excess capacity at its existing mines to guaranteethe contract. The company is considering opening a strip minein Ohio on 5,000 acres of land purchased 10 years ago for $4million. Based on a recent appraisal, the company feels itcould receive $6.5 million on an aftertax…arrow_forwardNextG Limited is a leading manufacturer of automotive components. It supplies to the original equipment manufacturers as well as the replacement market. Its projects typically have a short life as it introduces new models periodically. You have recently joined NextG Limited as a financial analyst reporting to Mr. Atiamoh, the CFO of the company. He has provided you the following information about two mutually exclusive projects. A and B, that are being considered by the Executive Committee of NextG Limited:Project A is an extension of an existing line. Its cash flow will decrease over time. Project B involves a new product. Building its market will take some time and hence its cash flow will increase over time.The expected net cash flows of the two mutually exclusive projects are as follows. Mr. Atiamoh believes that all the two projects have risk characteristics similar to the average risk of the firm and hence NextG’s cost of capital of 10 percent will apply to them and both…arrow_forward

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning

Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Auditing: A Risk Based-Approach to Conducting a Q...AccountingISBN:9781305080577Author:Karla M Johnstone, Audrey A. Gramling, Larry E. RittenbergPublisher:South-Western College Pub

Auditing: A Risk Based-Approach to Conducting a Q...AccountingISBN:9781305080577Author:Karla M Johnstone, Audrey A. Gramling, Larry E. RittenbergPublisher:South-Western College Pub