PRIN.OF CORPORATE FINANCE

13th Edition

ISBN: 9781260013900

Author: BREALEY

Publisher: RENT MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 6, Problem 26PS

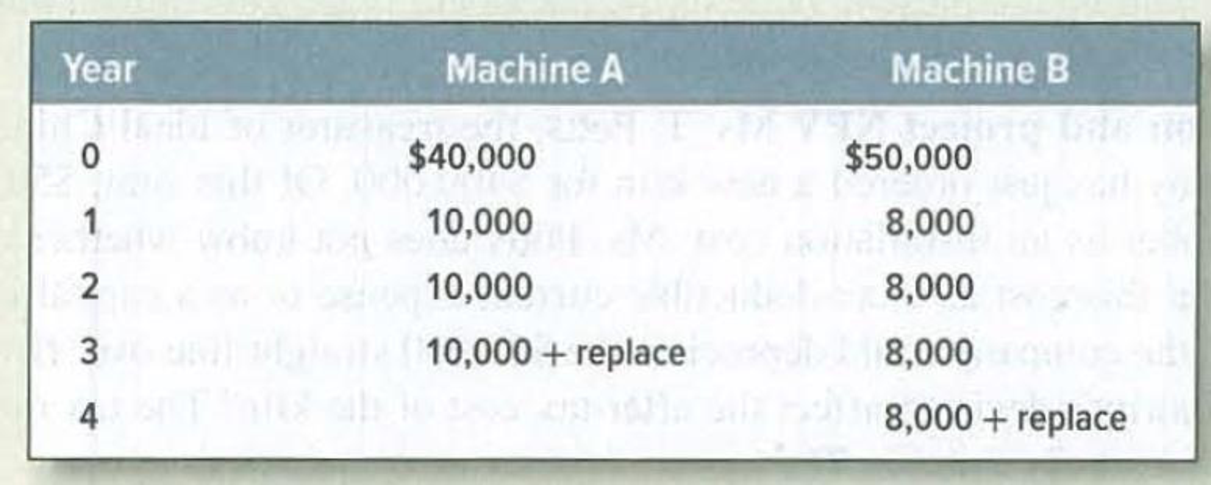

Mutually exclusive investments and project lives The Borstal Company has to choose between two machines that do the same job but have different lives. The two machines have the following costs:

These costs are expressed in real terms.

- a. Suppose you are Borstal’s

financial manager. If you had to buy one or the other machine and rent it to the production manager for that machine’s economic life, what annual rental payment would you have to charge? Assume a 6% real discount rate and ignore taxes. - b. Which machine should Borstal buy?

- c. Usually the rental payments you derived in part (a) are just hypothetical—a way of calculating and interpreting equivalent annual cost. Suppose you actually do buy one of the machines and rent it to the production manager. How much would you actually have to charge in each future year if there is steady 8% per year inflation? [Note: The rental payments calculated in part (a) are real cash flows. You would have to mark up those payments to cover inflation.]

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

An organization is trying to decide between two miling machines (standard or delue) for a manufacturing operation. Use present worth analysis and an interest rate of iR lo detes milling machine is preferred from an economic perspective.

iR=25%

R=4

An industrial firm uses economic analysis to determine which of two different machines to purchase. Each machine is capable. Each machine is capable of performing the same task in a given amount of time. Assume the MARR=8%. Use the following data for analysis:What is the approximate equivalent uniform annual cost of Machine X?

Segment analysis for a service company

Charles Schwab Corporation (SCHW) is one of the more Innovative brokerage and financial service companies in the United States. The company recently

provided information about its major business segments as follows (in millions):

Investor

Advisor

Services

Services

Revenues

$5,411

$2,067

Operating income

2,031

962

Depreciation

180

54

a. The Investor Services v segment serves the retail customer, you and me. These are the brokerage, Internet, and mutual fund services used by

individual Investors. The Advisor Services v

segment includes the same services provided for financial institutions, such as banks, mutual fund

managers, insurance companies, and pension plan administrators.

b. Indicate whether the following costs are a "Variable Cost" or a "Fixed Cost" in the "Investor Services" segment.

1. Commissions to brokers Varlable Cost v

2. Fees paid to exchanges for executing trades Variable Cost v

3. Depreciation on brokerage offices Flxed Cost v

4.…

Chapter 6 Solutions

PRIN.OF CORPORATE FINANCE

Ch. 6 - Cash flows Which of the following should be...Ch. 6 - Cash flows Reliable Electric, a major Ruritanian...Ch. 6 - Prob. 3PSCh. 6 - Prob. 4PSCh. 6 - Real and nominal flows Mr. Art Deco will be paid...Ch. 6 - Real and nominal flows Restate the net cash flows...Ch. 6 - Real and nominal flows Guandong Machinery is...Ch. 6 - Working capital Each of the following statements...Ch. 6 - Prob. 9PSCh. 6 - Project NPV Better Mousetraps research...

Ch. 6 - Project NPV A widget manufacturer currently...Ch. 6 - Project NPV Marsha Jones has bought a used...Ch. 6 - Project NPV United Pigpen is considering a...Ch. 6 - Project NPV Imperial Motors is considering...Ch. 6 - Project NPV and IRR A project requires an initial...Ch. 6 - Taxes and project NPV In the International Mulch...Ch. 6 - Depreciation and project NPV Suppose that Sudbury...Ch. 6 - Depreciation and project NPV Ms. T. Potts, the...Ch. 6 - Prob. 20PSCh. 6 - Prob. 21PSCh. 6 - Prob. 22PSCh. 6 - Equivalent annual cash flow Look at Problem 22...Ch. 6 - Equivalent annual cash flow Deutsche Transport can...Ch. 6 - Prob. 25PSCh. 6 - Mutually exclusive investments and project lives...Ch. 6 - Mutually exclusive investments and project lives...Ch. 6 - Mutually exclusive investments and project lives....Ch. 6 - Mutually exclusive investments and project lives...Ch. 6 - Mutually exclusive investments and project lives...Ch. 6 - Replacement decisions Machine C was purchased five...Ch. 6 - Replacement decisions Hayden Inc. has a number of...Ch. 6 - Replacement decisions. You are operating an old...Ch. 6 - Replacement decisions. A forklift will last for...Ch. 6 - The cost of excess capacity The presidents...Ch. 6 - Effective tax rates One measure of the effective...Ch. 6 - Equivalent annual costs We warned that equivalent...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Break-even analysis To be profitable, a firm must recover its costs. These costs include both its fixed and its variable costs. One way that a firm evaluates at what stage it would recover the invested costs is to calculate how many units or how much in dollar sales is necessary for the firm to earn a profit. Consider the case of Dynamic Defenses Corporation: Dynamic Defenses Corporation is considering a project that will have fixed costs of $12,000,000. The product will be sold for $32.50 per unit, and will incur a variable cost of $10.75 per unit. 1) Given Dynamic Defenses’s cost structure, it will have to sell (551,724/330,769/116,012/314,199) units to break even on this project (QBE). 2) Dynamic Defenses Corporation’s marketing sales director doesn’t think that the market for the firm’s goods is big enough to sell enough units to make the company’s target operating profit of $25,000,000. In fact, she believes that the firm will be able to sell only about…arrow_forwardInternational Paper is trying to find the best paper rolling machine to maximize sales volume. There are three machine options: Machine A, Machine B, and Machine C. Annual revenue is expected to be at one of three possible levels, High, $6 million; Medium, $3 million; or Low, $2 million; but is impacted by machine selection as the probabilities show in the table below: High Revenue Medium Revenue Low Revenue Machine A .1 .3 .6 Machine B .4 .4 .2 Machine C .5 .4 .1 Which machine should International Paper purchase to maximize the expected revenue, and wh sthe expected revenue? Group of answer choices Machine A, $2.7 million Machine B, $4.0 million Machine B, S4.6 million Machine C, $4.4 million none of the answers provided are correctarrow_forwardGiven Problem: A. If money is worth 17.383%, what is the Total Annual Cost of Machine B (using Annual Worth Method)? B. Which of the two machines is more economical?arrow_forward

- Suppose that a manufacturer can produce a part for $11.00 with a fixed cost of $7,000. Alternately, the manufacturer could contract with a supplier in Asia to purchase the part at a cost of $13.00, which includes transportation. a. If the anticipated production volume is 1,300 units, compute the total cost of manufacturing and the total cost of outsourcing. b. What is the best decision? a. The total cost of manufacturing is $.arrow_forwardRequirement 1. If SnowDreams cannot reduce its costs, what profit will it earn? State your answer in dollars and as a percent of assets. Will investors be happy with the profit level? Complete the following table to calculate SnowDreams' projected income. Revenue at market price Less: Total costs Operating incomearrow_forward1. Determine the minimum transfer price that Cutting Division would accept. 2. Determine the maximum transfer price that the Assembly Division would pay. 3. If Cutting Division will accept the offer of Assembly Division, how much is the change in its operating income ? 4. If Cutting Division will make a counter offer of P45.25 per part, how much is the change in the operating income of Assembly Division assuming that its external supplier could not supply its needed quantity?arrow_forward

- Compare two competing, mutually exclusive new machines that have only cost data given and tell which of the following statements is true regarding the present worth of the incremental investment at your investment interest rate. (a) If it is greater than zero, we chose the alternative with the largest initial investment expense. (b) The internal rate of return will always be equal to the investment rate of return. (c) Neither machine is chosen if there is only cost data and the present worth is less than zero. (d) If it is less then zero, we chose the alternative with the smallest initial investment expense.arrow_forwardAs a manager, you have to choose between two options for new production equipment. Machine A will increase fixed costs by a substantial margin but will produce greater sales volume at the current price. Machine B will only slightly increase fixed costs but will produce considerable savings on variable cost per unit. No additional sales are anticipated if Machine B is selected. What are the relative merits of both machines, and how could you go about analyzing which machine is the better investment for the company in terms of both net operating income and break-even?arrow_forwardHudson Corporation is considering three options for managing its data warehouse: continuing with its own staff, hiring an outside vendor to do the managing, or using a combination of its own staff and an outside vendor. The cost of the operation depends on future demand. The annual cost of each option (in thousands of dollars) depends on demand as follows: If the demand probabilities are 0.2, 0.5, and 0.3, which decision alternative will minimize the expected cost of the data warehouse? What is the expected annual cost associated with that recommendation? Construct a risk profile for the optimal decision in part (a). What is the probability of the cost exceeding $700,000?arrow_forward

- Reynolds Construction (RC) needs a piece of equipment that costs 200. RC can either lease the equipment or borrow 200 from a local bank and buy the equipment. Reynoldss balance sheet prior to the acquisition of the equipment is as follows: a. (1) What is RCs current debt ratio? (2) What would be the companys debt ratio if it purchased the equipment? (3) What would be the debt ratio if the equipment were leased and the lease not capitalized? (4) What would be the debt ratio if the equipment were leased and the lease were capitalized? Assume that the present value of the lease payments is equal to the cost of the equipment. b. Would the companys financial risk be different under the leasing and purchasing alternatives?arrow_forward1. What is the profit per day of Machine A? 2. What is the profit per day of Machine B? 3. What would the percent of parts rejected have to be for Machine B to be as profitable as Machine A?arrow_forwardThe constraint at Pickrel Corporation is time on a particular machine. The company makes three products that use this machine. Data concerning those products appear below: Selling price per unit Variable cost per unit Minutes on the constraint Multiple Choice O Assume that sufficient time is available on the constrained machine to satisfy demand for all but the least profitable product. Up to how much should the company be willing to pay to acquire more of this constrained resource? (Round your intermediate calculations to 2 decimal places.) O $27.36 per unit $15.60 per minute $13.10 per minute VD $ 344.85 $ 270.18 5.70 $104.52 per unit JT $ 415.40 $310.88 6.70 SM $ 119.32 $ 91.96 1.90arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning Essentials of Business Analytics (MindTap Course ...StatisticsISBN:9781305627734Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. AndersonPublisher:Cengage Learning

Essentials of Business Analytics (MindTap Course ...StatisticsISBN:9781305627734Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. AndersonPublisher:Cengage Learning  Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning

Essentials of Business Analytics (MindTap Course ...

Statistics

ISBN:9781305627734

Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Publisher:Cengage Learning

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

Capital Budgeting Introduction & Calculations Step-by-Step -PV, FV, NPV, IRR, Payback, Simple R of R; Author: Accounting Step by Step;https://www.youtube.com/watch?v=hyBw-NnAkHY;License: Standard Youtube License