Intermediate Financial Management (MindTap Course List)

13th Edition

ISBN: 9781337395083

Author: Eugene F. Brigham, Phillip R. Daves

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 19, Problem 1P

Reynolds Construction (RC) needs a piece of equipment that costs $200. RC can either lease the equipment or borrow $200 from a local bank and buy the equipment. Reynolds’s

- a.

- (1) What is RC’s current debt ratio?

- (2) What would be the company’s debt ratio if it purchased the equipment?

- (3) What would be the debt ratio if the equipment were leased and the lease not capitalized?

- (4) What would be the debt ratio if the equipment were leased and the lease were capitalized? Assume that the present value of the lease payments is equal to the cost of the equipment.

- b. Would the company’s financial risk be different under the leasing and purchasing alternatives?

Expert Solution & Answer

Trending nowThis is a popular solution!

Students have asked these similar questions

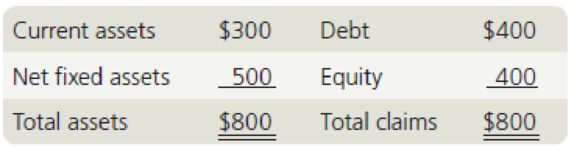

Reynolds Construction (RC) needs a piece of equipment that costs $200. RC can either lease the equipment or borrow $200 from a local bank and buy the equipment. Reynolds's balance sheet prior to the acquisition of the equipment is as follows:

Current assets: $300 Debt: $400

Net Fixed Assets: 500 Equity: 400

Total assets: 800 Total claims: 800

a. (1) What is RC's current debt ratio?

(2) What would be the company's debt ratio if it purchased the equipment?

(3) What would be the debt ratio if the equipment were leased and the lease was not capitalized?

(4) What would be the debt ratio if the equipment were leased and the lease were capitlaized? Assume that the present value of the lease payments is equal to the cost of the equipment.

b. Would the company's financial risk be different under the leasing and purchasing alternatives?

A company decided to lease a food truck to promote sales across the country. The truck cost $65,000 and the company signed an irrevocable five-year lease. The company is trying to determine how to account for this asset. Which Financial Accounting Standards Board (FASB) guideline should the company use to report the truck?

Capitalize the lease only because its non-cancellable.

Capitalize the leased asset only if the company also capitalizes installment purchases.

Capitalize the lease because it is a fixed asset.

Capitalize the lease because it is long-term.

Johnstone Company is facing several decisions regarding investing and financing activities. Address each decision independently. (FV of $1, PV of $1, FVA of $1, FVAD of $1 and PVAD of$1) (Use appropriate factor(s) from the tables provided.)

1.On June 30, 2021, the Johnstone Company purchased equipment form Genovese Corp. Johnstone agreed to pay Genovese $20,000 on the purchase date and the balance in five annual installments of $8,000 on each June 30 beginning June 30, 2022. Assuming that an interest rate of 10% properly reflects the time value of money in this situation, at what amount should Johnstone value the equipment?

2.Johnstone needs to accumulate sufficient funds to pay a $5000,000 debt that comes due on December 31, 2026. The company will accumulate the funds by making five equal annual deposits to an account paying 9% interest compounded annually. Determine the required annual deposit if the first deposit is made on December 31, 2021.

3.On January 1, 2021, Johnstone leased…

Chapter 19 Solutions

Intermediate Financial Management (MindTap Course List)

Ch. 19 - Define each of the following terms: a. Lessee;...Ch. 19 - Distinguish between operating leases and financial...Ch. 19 - Prob. 3QCh. 19 - Prob. 4QCh. 19 - Prob. 5QCh. 19 - Prob. 6QCh. 19 - Prob. 7QCh. 19 - Prob. 8QCh. 19 - Reynolds Construction (RC) needs a piece of...Ch. 19 - Lease versus Buy Consider the data in Problem...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Johnstone Company is facing several decisions regarding investing and financing activities. Address each decision independently. (FV of $1, PV of $1, FVA of $1, FVAD of $1 and PVAD of$1) (Use appropriate factor(s) from the tables provided.) 1.On June 30, 2021, the Johnstone Company purchased equipment form Genovese Corp. Johnstone agreed to pay Genovese $20,000 on the purchase date and the balance in five annual installments of $8,000 on each June 30 beginning June 30, 2022. Assuming that an interest rate of 10% properly reflects the time value of money in this situation, at what amount should Johnstone value the equipment? 2.Johnstone needs to accumulate sufficient funds to pay a $5000,000 debt that comes due on December 31, 2026. The company will accumulate the funds by making five equal annual deposits to an account paying 9% interest compounded annually. Determine the required annual deposit if the first deposit is made on December 31, 2021. 3.On January 1, 2021, Johnstone leased…arrow_forwardJohnstone Company is facing several decisions regarding investing and financing activities. Address each decision independently. (FV of $1, PV of $1, FVA of $1, FVAD of $1 and PVAD of$1) (Use appropriate factor(s) from the tables provided.) 1.On June 30, 2021, the Johnstone Company purchased equipment from Genovese Corp. Johnstone agreed to pay Genovese $20,000 on the purchase date and the balance in five annual installments of $8,000 on each June 30 beginning June 30, 2022. Assuming that an interest rate of 10% properly reflects the time value of money in this situation, at what amount should Johnstone value the equipment? 2.Johnstone needs to accumulate sufficient funds to pay a $5000,000 debt that comes due on December 31, 2026. The company will accumulate the funds by making five equal annual deposits to an account paying 9% interest compounded annually. Determine the required annual deposit if the first deposit is made on December 31, 2021. 3.On January 1, 2021, Johnstone leased…arrow_forwardYouth Company is in financial trouble and could not meet maturing installments and interest on its bank loan of P5,000,000. The accrued interest on the loan on this date is P1,000,000. Youth Company and the bank agreed on a “dacion en pago” arrangement. Thus the mortgaged land and building were given by Youth Company as full payment for the loan including accrued interest. The cost of the land is P1,500,000 and the building, P6,000,000 with accumulated depreciation of P1,800,000. The fair value of the land and building is about P5,900,000. 1. What amount of gain (loss) on debt restructuring and gain (loss) on exchange respectively, would be recognized by Youth if the US GAAP is applied?arrow_forward

- What is the maximum price you would be willing to pay for the business? If an investor group purchased the restaurant near the campus for $255, 867 and the fair value of the assets they acquired was $202,000, identify the account along with its balance, that is used to record the additional amount paid over the fair value of the assets.arrow_forwardJohnstone Company is facing several decisions regarding investing and financing activities. Address each decision independently. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from the tables provided.) 1. On June 30, 2021, the Johnstone Company purchased equipment from Genovese Corp. Johnstone agreed to pay Genovese $23,000 on the purchase date and the balance in five annual installments of $6,000 on each June 30 beginning June 30, 2022. Assuming that an interest rate of 10% properly reflects the time value of money in this situation, at what amount should Johnstone value the equipment?2. Johnstone needs to accumulate sufficient funds to pay a $530,000 debt that comes due on December 31, 2026. The company will accumulate the funds by making five equal annual deposits to an account paying 5% interest compounded annually. Determine the required annual deposit if the first deposit is made on December 31, 2021.3. On January 1, 2021,…arrow_forwardJohnstone Company is facing several decisions regarding investing and financing activities. Address each decision independently. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from the tables provided.)1. On June 30, 2021, the Johnstone Company purchased equipment from Genovese Corp. Johnstone agreed to pay Genovese $26,000 on the purchase date and the balance in five annual installments of $9,000 on each June 30 beginning June 30, 2022. Assuming that an interest rate of 11% properly reflects the time value of money in this situation, at what amount should Johnstone value the equipment?arrow_forward

- Mondesto Company has the following debts: The company also has a number of other assets that are not pledged in any way. The creditors holding Debt 2 want to receive at least $142,000. For how much do these free assets have to be sold so that the creditors associated with Debt 2 will receive exactly $142,000?arrow_forwardShea Corporaton has an asset which is required to be shown at fair value on the balance sheet. Shea Corporation has immediate access to two different active markets as of the balance sheet date. In the Urban Market , the price for the asset is $26, sales commissions are $3, and the costs to transport the asset to the Urban market are $4. In the Rural Market , the price for the asset is $25, sales commissions are $1, and the costs to transport the asset to the Rural market are $2. Additional information is as follows: Market Entity Specific Volume Market Volume Urban 75% 20% Rural 25% 80% Which market should Shea use ? Based upon the market you selected what is the fair value for the asset? (do not include dollar signs, decimals or commas in your answer)arrow_forwardShea Corporaton has an asset which is required to be shown at fair value on the balance sheet. Shea Corporation has immediate access to two different active markets as of the balance sheet date. In the Urban Market , the price for the asset is $26, sales commissions are $3, and the costs to transport the asset to the Urban market are $4. In the Rural Market , the price for the asset is $25, sales commissions are $1, and the costs to transport the asset to the Rural market are $2. Additional information is as follows: Market Entity Specific Volume Market Volume Urban 75% 20% Rural 25% 80% Question 11 Which market should Shea use ? Based upon the market you selected what is the fair value for the asset? (do not include dollar signs, decimals or commas in your answer)arrow_forward

- On October 1, 2024, a company purchased a piece of land by agreeing to pay the seller $450,000 in two years. If the company had borrowed the money from a bank to pay the seller immediately, management estimates the bank would have required interest of 9% For what amount should the company record the land on the date of purchase (rounded to the nearest dollar)? (PV of $1. and PVA of $1) Multiple Choice O O $450,000 $369.000 $412,844 $378,756arrow_forwardXYZ company bought a car with a list price of $30,000. They had to pay $1,500 sales tax in addition to the $30,000 cost. What would happen? O The car would be valued on the balance sheet on the day of acquisition at $31,500. O The car would be valued on the balance sheet at $30,000. The car would be valued on the balance sheet at $28,500. O XYZ company would have tax expense of $1500.arrow_forwardА. Place an "X" in the blank for the following items which you believe should be included in the cost of a piece of equipment? 1. Purchase price 2. Sales tax 3. Electricity to run the equipment 4. Installation cost 5. Insurance while being transported 6. Insurance while in use 7. Freight charges В. Your company signed a contract to construct a new building so you borrowed $600,000 on February 1, 2021 and issued a three-year, 6% note which pays interest annually. You spent $200,000 for construction on April 1, 2021 and an additional $300,000 on November 1. How much interest should be capitalized in 2021? Please show your calculations. С. Your company spent $30,000 for repairs and modifications to significantly increase the life of your equipment. What entry should be made for the $30,000? D. You bought equipment on January 1, 2018, for $62,000. The equipment has an estimated life of 8 years and an estimated salvage value of $6,000. Your company uses the straight- line method of…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT

Accounting for Finance and Operating Leases | U.S. GAAP CPA Exams; Author: Maxwell CPA Review;https://www.youtube.com/watch?v=iMSaxzIqH9s;License: Standard Youtube License