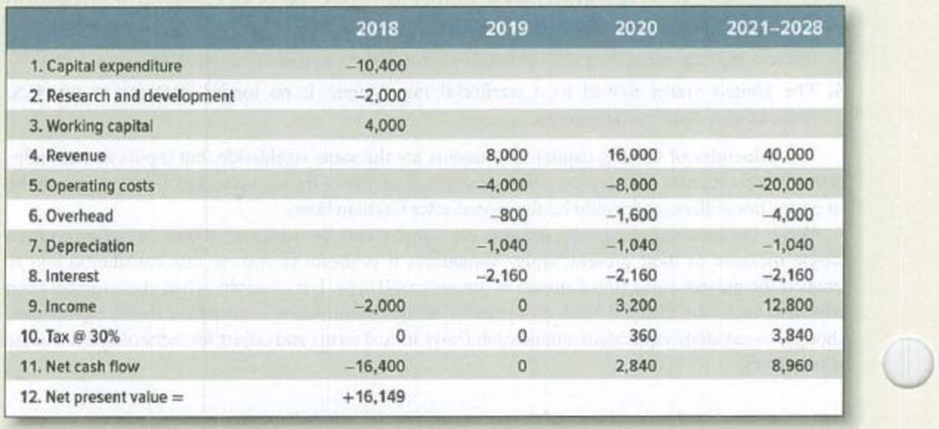

Cash flows Reliable Electric, a major Ruritanian producer of electrical products, is considering a proposal to manufacture a new type of industrial electric motor that would replace most of its existing product line. A research breakthrough has given Reliable a two-year lead on its competitors. The project proposal is summarized in Table 6.4.

- a. Read the notes to the table carefully. Which entries make sense? Which do not? Why or why not?

- b. What additional information would you need to construct a version of Table 6.4 that makes sense?

Construct such a table and recalculate NPV. Make additional assumptions as necessary.

TABLE 6.4 Cash flows and present value of Reliable Electric’s proposed investment ($thousands). See Problem 2.

Notes:

1. Capital expenditure: $8 million for new machinery and $2.4 million for a warehouse extension. The full cost of the extension has been charged to this project, although only about half of the space is currently needed. Since the new machinery will be housed in an existing factory building, no charge has been made for land and building.

2. Research and development: $1.82 million spent in 2017. This figure was corrected for 10% inflation from the time of expenditure to date. Thus 1.82 × 1.1 = $2 million.

3. Working capital: Initial investment in inventories.

4. Revenue: These figures assume sales of 2,000 motors in 2019, 4,000 in 2020, and 10,000 per year from 2021 through 2028. The Initial unit price of $4,000 is

5. Operating costs: These include all direct and indirect costs. Indirect costs (heat, light, power,

6. Overhead: Marketing and administrative costs, assumed equal to 10% of revenue.

7. Depreciation: Straight-line for 10 years.

8. Interest: Charged on capital expenditure and working capital at Reliable’s current borrowing rate of 15%.

9. Income: Revenue less the sum of research and development, operating costs, overhead, depreciation, and interest.

10. Tax: 30% of income. However, income is negative in 2018. This loss is carried forward and deducted from taxable income in 2020.

11. Net cash flow: Assumed equal to income less tax.

12.

Want to see the full answer?

Check out a sample textbook solution

Chapter 6 Solutions

PRIN.OF CORPORATE FINANCE

- 4. Investment timing options Companies often need to choose between making an investment now or waiting until the company can gather more relevant information about the potential project. This opportunity to wait before making the decision is called the investment timing option. Consider the case: Tolbotics Inc. is considering a three-year project that will require an initial investment of $44,000. If market demand is strong, Tolbotics Inc. thinks that the project will generate cash flows of $29,000 per year. However, if market demand is weak, the company believes that the project will generate cash flows of only $2,000 per year. The company thinks that there is a 50% chance that demand will be strong and a 50% chance that demand will be weak. If the company uses a project cost of capital of 12%, what will be the expected net present value (NPV) of this project? (Note: Do not round intermediate calculations and round your answer to the nearest whole dollar.) -$7,111 O-$6,433 O-$7,788…arrow_forwardQuestion 1 You recently went to work for Ndejiku Company, a supplier of auto repair parts used in the after-market with products from Daimler, Chrysler, Ford, and other automakers. Your boss, the chief financial officer (CFO), has just handed you the estimated cash flows for two proposed projects. Project X involves adding a new item to the firm’s ignition system line. Project Y involves an add-on to an existing line, and its cash flows would decrease over time. Both projects have 4-year lives. Here are the projects’ net cash flows (in thousands of kwachas): Year 0 1 2 3 4 Project X -110,000 10,000 60,000 80,000 90,000 Project Y -110,000 90,000 60,000 30,000 10,000 If Ndejiku’s cost of capital is 10%. Advise whether one or both of the projects should be accepted using: Payback period method if Projects are mutually exclusive Projects are Independent of each other Net Present Value (NPV) if projects are independent of each otherarrow_forwardThe J.R. Ryland Computer Company is considering a plant expansion to enable the company to begin production of a new computer product. The companys president must determine whether to make the expansion a medium- or large-scale project. Demand for the new product is uncertain, which for planning purposes may be low demand, medium demand, or high demand. The probability estimates for demand are 0.20, 0.50, and 0.30, respectively. Letting x and y indicate the annual profit in thousands of dollars, the firms planners developed the following profit forecasts for the medium-and large-scale expansion projects. a. Compute the expected value for the profit associated with the two expansion alternatives. Which decision is preferred for the objective of maximizing the expected profit? b. Compute the variance for the profit associated with the two expansion alternatives. Which decision is preferred for the objective of minimizing the risk or uncertainty?arrow_forward

- Put answer in table format Yokam Company is considering two alternative projects. Project 1 requires an initial investment of $560,000 and has a present value of cash flows of $2,200,000.0. Project 2 requires an initial investment of $5,000,000 and has a present value of cash flows of $7,000,000. 1. Compute the profitability index for each project.2. Based on the profitability index, which project should the company prefer?arrow_forwardQuestion 3 A firm is looking to evaluate the income coming from a project. The project has alowest possible income of $1,036.31, a likely income of $2,113.29 and a maximum income of $2,904.68. What is a the risk mitigated income that a firm should use their analysis? Enter your answer below (no $ sign), and show your work in your drobox submission. Your Answer:arrow_forward23 The Hanks Co is considering two projects. Project A consists of building a bee sanctuary on the firm's small parcel of land. Project B consists of building a retail store on on that same parcel. The parcel can accommodate only one of the projects. Which method of analysis is most appropriate for an analyst to employ? A. Accounting rate of return B. Profitability index C. NPV D. Payback E. IRRarrow_forward

- Question 1 Assuming that you have beeh appointed finance director of BPX Bhd. The company is considering investing in the production of an electronic device used in automobile. There are two mutually exclusive projects available to achieve the plan. Project I Return in one year (RM) 60,000 60,000 Project II State of economy Probability Good 0.3 58,000 62,000 Moderate 0.5 Poor 0.2 50,000 48,000 Project I or II would require an investment of RM50,000. The company has a current market value of RM800,000. The estimated returns of the market in one year are: Good state 20%, Moderate state 15% and Poor state 10% respectively. Assume that the treasury bill rate as 9%. The research director projects that the company's share price will move in line with the market. Required (in no more than 1,000 words, show all relevant workings) (a) Calculate i market variance ii. systematic risk for Project I iii. systematic risk for Project II iv. covariance between Project I and the market v. covariance…arrow_forwardREQUIRED Calculate the Payback Period of Machine A (expressed in years, months and days). Calculate the Net Present Value of both Calculate the Accounting Rate of Return on initial investment (expressed to two decimal places) of both machines. Calculate the Internal Rate of Return of Machine B (expressed to two decimal places). If the time value of money is taken into account, which machine should be chosen? Why? INFORMATION The directors of Lomax Ltd intend expanding the company and they have the choice of purchasing one of two machines at the end of 2022 viz. Machine A or Machine B. Both machines have a five-year life, with only Machine A having a residual value of R300 000. The annual volume of production of each machine is estimated at 6 000 pallets (comprising 500 bricks each), which can be sold at R520 per pallet. Depreciation is calculated on the machines using the…arrow_forward2A- The management of Unter Corporation, an architectural design firm, is considering an investment with the following cash flows: 1. Determine the payback period of the investment. 2. Would the payback period be affected if the cash inflow in the last year were several times aslarge? 2B- A piece of laborsaving equipment has just come onto the market that Mitsui Electronics, Ltd., could use to reduce costs in one of its plants in Japan. Relevant data relating to the equipment follow:Required:Compute the payback period for the equipment. If the company requires a payback period offour years or less, would the equipment be purchased?arrow_forward

- QUESTION 1 Agro Tech Corporation is considering investing in a new IT system for selling to its clients. The company has identified two new possible systems, which would be suitable for its customers. Only one of the systems can be selected and the directors are looking for guidance on which system would be the best. The company requires a 15% rate of return on projects of this nature. The installation cost per project will be R100 000 each, while systems can be disposed for R200 000 each after five- years life span. Cash flows for Agro Tech Corporation: IT System (Rands) PERIOD 1 2 3 4 5 SYSTEM A -4 000 000 R1 800 000 R1 700 000 R1 600 000 R1 500 000 R1 400 000 SYSTEM B -3 500 000 1 500 000 1 500 000 1 500 000 1 400 000 R1 300 000 Required: 1.1 Determine the payback period in years, months and days for both systems 1.2 Based on your calculations in 1.1, which system should Agro Tech Corporation consider? Why? 1.3 Calculate the Net Present Value for both systems. 1.4 Calculate the…arrow_forwardCASE STUDY Giangelo Corporation would like to venture in manufacturing a specialized tool that is required by a semi-conductor company. In order to accomplish this, it is considering two options that both require raising large amount of funds. First option (Project X) is the construction of a factory building and acquisition of machineries for an estimated cost of P30 million. The other alternative (Project Y) is the acquisition of an existing company that manufactures the same tool at a price of P50 million. In order to fund the project, the Company will have to apply for a loan from a bank and issue shares of stocks. The management contemplated a more leveraged approach by availing the 70% of the financial requirements through loan borrowing and the rest from the issuance of shares. The interest on bank loan is at 11% per annum while the issuance of shares will require return to stockholders at 8% per annum. The applicable income tax rate is 25%. Both of the projects will have…arrow_forwardYou are the investment manager of an appliance company. The industry is currently in the expansion face and the CEO would like to capture as much of the market share as possible. You asked your analysts to submit project proposals as summarized below. Project Discount Rate Investment Annual Cash Flow Project Life (Years) 10 3M 1M 5 12 4M 1M 8 8 5M 2M 4 8 3M 1.5M 3 12 3M 1M 6 Which projects should the manager choose? If you were given unlimited capital, which projects should be implemented? ABCDEarrow_forward

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Essentials of Business Analytics (MindTap Course ...StatisticsISBN:9781305627734Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. AndersonPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Essentials of Business Analytics (MindTap Course ...StatisticsISBN:9781305627734Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. AndersonPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College