Financial Accounting Intro Concepts Meth/Uses

14th Edition

ISBN: 9781285595047

Author: Weil

Publisher: Cengage

expand_more

expand_more

format_list_bulleted

Question

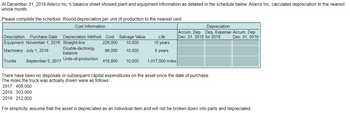

Transcribed Image Text:At December 31, 2018 Allarco Inc.'s balance sheet showed plant and equipment information as detailed in the schedule below. Allarco Inc. calculates depreciation to the nearest

whole month.

Please complete the schedule. Round depreciation per unit of production to the nearest cent.

Cost Information

Depreciation

Description

Purchase Date

Equipment November 1, 2016

Depreciation Method Cost Salvage Value

Straight-line

226,000

10,000

Double-declining-

Machinery July 1, 2018

96,000

10,000

Life

10 years

5 years

Accum. Dep. Dep. Expense Accum. Dep.

Dec. 31, 2018 for 2019

Dec. 31, 2019

balance

Trucks

September 5, 2017

Units-of-production

416,800 10,000

1,017,000 miles

There have been no disposals or subsequent capital expenditures on the asset since the date of purchase.

The miles the truck was actually driven were as follows:

2017: 408,000

2018: 303,000

2019: 212,000

For simplicity, assume that the asset is depreciated as an individual item and will not be broken down into parts and depreciated.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- When depreciation is recorded each period, what account is debited? a. Depreciation Expense b. Cash c. Accumulated Depreciation d. The fixed asset account involved Use the following information for Multiple-Choice Questions 7-4 through 7-6: Cox Inc. acquired a machine for on January 1, 2019. The machine has a salvage value of $20,000 and a 5-year useful life. Cox expects the machine to run for 15,000 machine hours. The machine was actually used for 4,200 hours in 2019 and 3,450 hours in 2020.arrow_forwardHonesty Manufacturing purchased a machine on 1 July, 2017. The following financial information has been collected to calculate the depreciation at 30 June 2019: Cost $58,500 Expected salvage value $1,000 Estimated useful life in years 5 Estimated useful life in hours 200,000 Hours used in 2020 is: 48,000 Required: Calculate the depreciation expense of the machine for the year ended 30 June 2019 using: a) Straight-line method b) Unit of activity method c) Declining balance method using double straight-line ratearrow_forwardDengararrow_forward

- Record the journal entries for Depreciation and Disposal each machine .arrow_forwardTerry Wade, the new controller of Pronghorn Company, has reviewed the expected usefullives and salvage values of selected depreciable assets at the beginning of 2022. Here are his findings: Type of Asset Building Warehouse Date (a) Acquired Jan. 1, 2016 Jan. 1, 2017 Cost $807,000 Revised annual depreciation $ 106,000 Accumulated Depreciation Jan. 1, 2022 $115,800 20,360 Compute the revised annual depreciation on each asset in 2022. Building $ Useful life (in Years) Old Proposed 40 25 50 Warehouse 20 All assets are depreciated by the straight-line method. Pronghorn Company uses a calendar year in preparing annual adjusting entries and financial statements. After discussion, management has agreed to accept Terry's proposed changes. (The "Proposed" useful life is total life, not remaining life.) Salvage Value Old $35,000 4,200 Proposed $66,400 24,140arrow_forwardVictor Mineli, the new controller of Splish Brothers Inc. has reviewed the expected useful lives and salvage values of selected depreciable assets at the beginning of 2022. Here are his findings: Type of Asset Building Warehouse Date Acquired Jan 1, 2014 Jan 1, 2017 Cost $824,000 107,000 Accumulated Depreciation Jan. 1, 2022 $156,800 Revised annual depreciation $ Useful life (in years) Building Old 40 20.540 25 $ Proposed 58 20 Warehouse Salvage Value Old Proposed $37,200 All assets are depreciated by the straight-line method. Splish Brothers Inc. uses a calendar year in preparing annual adjusting entries and financial statements. After discussion, management has agreed to accept Victor's proposed changes. (The "Proposed" useful life is total life, not remaining life) Compute the revised annual depreciation on each asset in 2022. (Round answers to O decimal places, e.g. 5.125.) $40,000 4,300 12.960 SUPPORTarrow_forward

- Required: Prepare the journal entry at 31 December 2021 to record the depreciation for 2021. Show your workings.arrow_forwardThe following are long-term asset transactions of Company Q. Purchased a piece of equipment that cost $250,000 on January 1, 2011. The equipment will last 8 years and have a residual value of $10,000. Compute the following using the straight-line method of depreciation. Accumulated Depreciation in 2013 Depreciation Expense in 2014 Net Book Value in 2016arrow_forwardDiscarding an asset On October 31, 2018, Alternative Landscapes discarded equipment that had a cost of $26,920. Accumulated Depreciation as of December 31, 2017, was $25,000. Assume annual depreciation on the equipment is $1,920. Journalize the partial-year depreciation expense and disposal of the equipment.arrow_forward

- Subject: accountingarrow_forward(Depreciation Computations—SYD, DDB—Partial Periods) Judds Company purchased a new plant asset on April 1, 2017, at a cost of $711,000. It was estimated to have a service life of 20 years and a salvage value of $60,000. Judds’ accounting period is the calendar year.Instructions(a) Compute the depreciation for this asset for 2017 and 2018 using the sum-of-the-years’-digits method.(b) Compute the depreciation for this asset for 2017 and 2018 using the double-declining-balance method.arrow_forwardDengerarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...

Accounting

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning