Basics Of Engineering Economy

2nd Edition

ISBN: 9780073376356

Author: Leland Blank, Anthony Tarquin

Publisher: MCGRAW-HILL HIGHER EDUCATION

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 5, Problem 40APQ

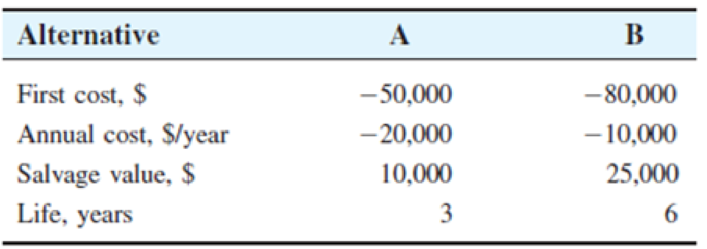

Use an interest rate of 10% per year.

The equivalent annual worth of alternative A over an infinite time period is closest to:

- a. $ − 25,000

- b. $ − 27,200

- c. $ − 31,600

- d. $ − 37,100

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Your company has a $300,000 loan for a new security system it just bought. The annual payment is $ 28,500 and the interest rate is

7% per year for 20 years. Your company decides that it can afford to pay $40,000,000 per year. After how many payments (years)

will the loan be paid off?

Answer is Blank 1 years

Note: do not use comma, no need to put the unit of measure and final answer must be in 2 decimal places

Street lighting fixtures and their sodium vapor bulbs for a two-block area of a large city need to be installed at a first

cost (investment cost) of $120,000. Annual maintenance expenses are expected to be $6,650 for the first 10 years

and $10,000 each year thereafter upto 25 years. With an interest rate of 10% per year, what is the present worth cost

of this project?

Choose the closest answer below.

OA. The present worth cost of the project is $251,632.

OB. The present worth cost of the project is $271,133.

OC. The present worth cost of the project is $236,922.

OD. The present worth cost of the project is $190,186.

An investor has invested $250,000 in a new rental

property. Her estimated annual costs are $6000 and

annual revenues are $20,000. What rate of return per

year will the investor make over a 30-year period

ignoring the salvage value? If the property can be

sold for $200,000 what is the rate of return?

Chapter 5 Solutions

Basics Of Engineering Economy

Ch. 5 - Prob. 1PCh. 5 - Prob. 2PCh. 5 - Prob. 3PCh. 5 - Prob. 4PCh. 5 - Prob. 5PCh. 5 - Prob. 6PCh. 5 - Prob. 7PCh. 5 - Prob. 8PCh. 5 - Prob. 9PCh. 5 - Prob. 10P

Ch. 5 - Two machines with the following cost estimates are...Ch. 5 - Prob. 12PCh. 5 - Prob. 13PCh. 5 - Prob. 14PCh. 5 - Prob. 15PCh. 5 - Prob. 16PCh. 5 - Prob. 17PCh. 5 - Prob. 18PCh. 5 - Estimates have been presented to Holly Farms,...Ch. 5 - Prob. 20PCh. 5 - Prob. 21PCh. 5 - Prob. 22PCh. 5 - Prob. 23PCh. 5 - Prob. 24PCh. 5 - Prob. 25PCh. 5 - Prob. 26PCh. 5 - A major repair on the suspension system of Janes...Ch. 5 - Prob. 28PCh. 5 - Prob. 29PCh. 5 - Prob. 30PCh. 5 - Prob. 31PCh. 5 - Prob. 32APQCh. 5 - Prob. 33APQCh. 5 - Prob. 34APQCh. 5 - Prob. 35APQCh. 5 - Prob. 36APQCh. 5 - The AW values of three revenue alternatives are ...Ch. 5 - Prob. 38APQCh. 5 - Prob. 39APQCh. 5 - Use an interest rate of 10% per year. The...Ch. 5 - Prob. 41APQCh. 5 - Prob. 42APQ

Additional Business Textbook Solutions

Find more solutions based on key concepts

(Studying Economics) According to the text, economics majors on average make more money than most other majors ...

ECON: MICRO4 (New, Engaging Titles from 4LTR Press)

• Illustrate and interpret shifts in the short-run and long-run aggregate supply curves.

Economics of Money, Banking and Financial Markets, The, Business School Edition (5th Edition) (What's New in Economics)

Determine the price elasticity of demand if, in response to an increase in price of 10 percent, quantity demand...

Microeconomics

Suppose the own price elasticity of demand for good X is -3, its income elasticity is 1, its advertising elasti...

Managerial Economics & Business Strategy (Mcgraw-hill Series Economics)

• Illustrate and interpret shifts in the short-run and long-run aggregate supply curves.

Economics of Money, Banking and Financial Markets, The, Business School Edition (4th Edition) (The Pearson Series in Economics)

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- Q) The maintenance costs associated with a machine are $2000 per year for the first ten years and $1000 per year thereafter. The machine has an infinite life. If interest is 10% per year, what is the present worth of the annual disbursements? Explain it early but not solve in excel. Typed or handwriting only use.arrow_forwardThe Engineering Economist is a quarterly journal that once cost $20 for 1 year, $38 for 2 years, or $56 for 3 years. (a) What is the IRR for subscribing for 2 years rather than for 1 year at a time? (b) What is the IRR for subscribing for 3 years rather than for 1 year at a time?arrow_forwardPlease answer the follow up questions in part (d) and (f) pleasearrow_forward

- A man buys a corporate bond from a bond brokerage house for $875. The bond has a face value of $1000 and a 4% coupon rate paid semiannually. If the bond will be paid off at the end of 12 years, what rate of return will the man receive?arrow_forwardAn investment of $8,000 nine years ago has accumulated to $16,000 now. The compound rate of return earned on the investment is closest to:a. 6%b. 8%c. 10%d. 12%arrow_forwardMr. Smith has saved RM1 800 each year for 20 years in Unit trust account. A year after the saving period ended, Mr. Smith withdrew RM7 500 each year for a period of 5 years. In the sixth and seventh years, he only withdrew RM5 000 per year. In the eighth year, he decided to withdraw the remaining money in his account. The interest rate was 6% per year throughout the whole period. Q1 (a) Draw the cash flow diagram SK 5K 7.5K 7.5K 7 SK 7.5K 7.5K 4 6 26 27 20 21 22 23 24 25 28 1.8K 1.8K iSK (b) Determine the remaining amount of money that he can withdraw at the end of the eighth year 1800 E, 6%, 20) (,6%,8) = 7500 (.6%, 5) (F. 6%.,3) + 5x (.6%, 2) + 5K (E, 6%, 1) + Xarrow_forward

- Use economic equivalence to determine the amount of money or value of i that makes the following statements correct. (a) $5000 today is equivalent to $4275 exactly 1 year ago at i = ___% per year. (b) A car that costs $28,000 today will cost $____ a year from now at i = 4% per year. (c) At i = 4% per year, a car that costs $28,000 now, would have cost $____ one year ago. (d) Last year, Jackson borrowed $20,000 to buy a preowned boat. He repaid the principal of the loan plus $2750 interest after only 1 year. This year, his brother Henri borrowed $15,000 to buy a car and expects to pay it off in only 1 year plus interest of $2295. The rate that each brother paid for his loan is ___ % for Jackson and ___ % per year for Henri. (e) Last year, Sheila turned down a job that paid $75,000 per year. This year, she accepted one that pays $81,000 per year. The salaries are equivalent at i = ____% per year.arrow_forwardshow your solution The present sum needed to provide for an annual withdrawal of $1,500 for 25 years beginning 5 years from now at an interest rate of 10% per year is closest to: a.$8,500 b.$9,300 c.less than $6,500 d.more than $10,000arrow_forwardWall’s Pharmacy will have to sell a new product that has an estimated revenue of $5,100 per month and costs of $1,000 per month with an initial purchase of $28,000. How long will Wall's Pharmacy have to sell a new product if the MARR is 3% per month? Wall's Pharmacy will have to sell a new product for __ months.arrow_forward

- Street lighting fixtures and their sodium vapor bulbs for a two-block area of a large city need to be installed at a first cost (investment cost) of $130,000. Annual maintenance expenses are expected to be$6,500for the first8years and$8,500 each year thereafter upto 25years. With an interest rate of 9% per year, what is the present worth cost of this project? Choose the closest answer below. A) $202,422 B $238,597 C) $249,468 D) $277,339arrow_forwardQ3 solution needed. another pic is just for helping materialarrow_forwardWhich alternative in the table below should be selected when the MRR = 6% per year? The life of each Kalternative is 10 years. Increment Considered A Investment cost A (Annual Revenues less. Costs) IRR on A Investment Cost A(A-DN) $800 $154 14.1% The IRR on A(C-B) is %. (Round to one decimal place.) A(B-A) $700 $114 10.0% A(C-B) $1,100 $170 ? A(D-C) $1,300 $130 2arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education

Valuation Analysis in Project Finance Models - DCF & IRR; Author: Financial modeling;https://www.youtube.com/watch?v=xDlQPJaFtCw;License: Standard Youtube License