Basics Of Engineering Economy

2nd Edition

ISBN: 9780073376356

Author: Leland Blank, Anthony Tarquin

Publisher: MCGRAW-HILL HIGHER EDUCATION

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 5, Problem 11P

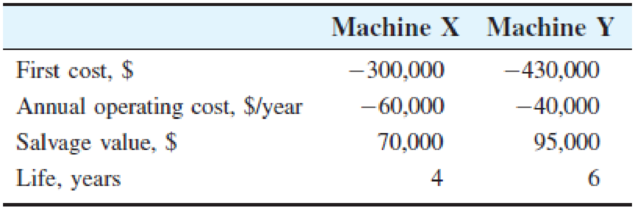

Two machines with the following cost estimates are under consideration for a dishwasher assembly process. Using an interest rate of 10% per year, determine which alternative should be selected on the basis of an annual worth analysis.

Expert Solution & Answer

Trending nowThis is a popular solution!

Students have asked these similar questions

The Bureau of Public Highways is considering two possible types of road surfacing with cost estimates per kilometer as follows:

Type A

Type B

First Cost

P500k

P650k

Resurfacing period

8 years

12 years

Resurfacing Cost

P200k

P250k

Average annual maintenance cost

P15k

P20k

The periodic resurfacing do not include the base of the subgrade. Compare these types by calculating the present worth for 24 year service, with no salvage value at the end of this time using interest rate of 10%. What is the Present Worth of Alternative B?

Evaluate a combined cycle power plant on the basis of the Present Worth Method (PW) when MARR is 12 % per year.Pertinent cost data are as follows:

(Power Plant (thousands of $)

Investment Cost: $12693

Useful life: 15 ears

Market Value (EOY 15) $3,000

Annual Operating expenses: $1,000

Overhaul cost-end of 5th year: $1897

Overhaul cost-end of 10th year. $1819

Ctrl

24 Calculate the perpetual equivalent annual cost

(years 1 through infinity) of $5 million in year 0,

$2 million in year 10, and $100,000 in years 11

through infinity. Use an interest rate of 10% per

year.

27 A new bridge across the Allegheny River in

Pittsburgh is expected to be permanent and will

have an initial cost of $30 million. This bridge must

be resurfaced every 5 years at a cost of $1 million.

Chapter 5 Solutions

Basics Of Engineering Economy

Ch. 5 - Prob. 1PCh. 5 - Prob. 2PCh. 5 - Prob. 3PCh. 5 - Prob. 4PCh. 5 - Prob. 5PCh. 5 - Prob. 6PCh. 5 - Prob. 7PCh. 5 - Prob. 8PCh. 5 - Prob. 9PCh. 5 - Prob. 10P

Ch. 5 - Two machines with the following cost estimates are...Ch. 5 - Prob. 12PCh. 5 - Prob. 13PCh. 5 - Prob. 14PCh. 5 - Prob. 15PCh. 5 - Prob. 16PCh. 5 - Prob. 17PCh. 5 - Prob. 18PCh. 5 - Estimates have been presented to Holly Farms,...Ch. 5 - Prob. 20PCh. 5 - Prob. 21PCh. 5 - Prob. 22PCh. 5 - Prob. 23PCh. 5 - Prob. 24PCh. 5 - Prob. 25PCh. 5 - Prob. 26PCh. 5 - A major repair on the suspension system of Janes...Ch. 5 - Prob. 28PCh. 5 - Prob. 29PCh. 5 - Prob. 30PCh. 5 - Prob. 31PCh. 5 - Prob. 32APQCh. 5 - Prob. 33APQCh. 5 - Prob. 34APQCh. 5 - Prob. 35APQCh. 5 - Prob. 36APQCh. 5 - The AW values of three revenue alternatives are ...Ch. 5 - Prob. 38APQCh. 5 - Prob. 39APQCh. 5 - Use an interest rate of 10% per year. The...Ch. 5 - Prob. 41APQCh. 5 - Prob. 42APQ

Additional Business Textbook Solutions

Find more solutions based on key concepts

Explain how to derive a total expenditures (TE) curve.

Macroeconomics (Book Only)

Assume the United States is an importer of televisions and there are no trade restrictions. US consumers buy 1 ...

Principles of Microeconomics

A typical discounted price of a AAA battery is 0.75. It is designed to provide 1.5 volts and 1.0 amps for about...

Engineering Economy (17th Edition)

Exercise B1 What point is preferred along an indifference Curve?

Principles of Economics 2e

The use of factor of production by business.

Economics Today and Tomorrow, Student Edition

A case study in this chapter discusses the federal minimum-wage law. a. Suppose the minimum wage is above the e...

Principles of Economics (MindTap Course List)

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- A sports wear factory has two alternative machines for producing jerseys. Costs are shown below. Minimum acceptable rate of return is 8%.What is the annual cost for machine X?arrow_forwardDetermine the FW of the following engineering project when the MARR is 15% per year. Is the project acceptable?arrow_forwardTwo machines can be used to produce a part from titanium. The costs and other cash flows associated with each alternative are estimated. The salvage values are constant regardless of when the machines are replaced. Determine which alternative(s) should be selected for further analysis if alternatives must have a payback of 5 years or less. Perform the analysis with (a) i = 0%, and (b) i = 10% per year. Machine Semiautomatic Automatic First cost, $ −40,000 −90,000 Net annual income, $ per year 10,000 15,000 Maximum life, years 10 10 Salvage value, $ 0 0arrow_forward

- J. Doe must choose between two different models. The analysis period considered is 6 years. Model 1 has a life of four years with a first cost of $13,500 and maintenance costs of $1,250 per year in years 2, 3, and 4 (no maintenance costs in year 1). The salvage value for this model at the end of its life is $4,271 (For year 2 the salvage value is $7,594). Model 2 has a life of three years with a first cost of $15,000 and maintenance costs of $700 per year. Its salvage value at the end of its life is $9,300 (year 3). Which of the two models should be chosen by J. Doe if considering a MARR of 12%.arrow_forwardEvaluate a combined cycle power plant on the basis of the FW method when the MARR is 12% per year. Pertinent cost data are as follows : Power Plant (thousands of $) Investment cost $13,000 Useful life 15 years Market value (EOY 15) $3,000 Annual operating expenses $1,000 Overhaul cost—end of 5th year $200 Overhaul cost—end of 10th year $550 WITH DIAGRAM CASH FLOW THANK YOUarrow_forwardFabco, Inc., is considering the purchase of flow valves that will reduce annual operating costs by $10,000 per year for the next 12 years. Fabco’s MARR is 7%/year. Using an annual worth approach, determine the maximum amount Fabco should be willing to pay for the valves.arrow_forward

- Two mutually exclusive alternatives have the estimates shown below. Use annual worth analysis to determine which should be selected at an interest rate of 10% per year. Q R First cost, $ −42,000 −80,000 AOC, $ per year −6,000 −7,000 in year 1, increasing by $1,000 per year thereafter Salvage value, $ 0 4,000 Life, years 2 4arrow_forwardEcology group wishes to purchase a piece of equipment for recycling of various metals. Machine 1 costs $300000, has a tife of 10 years, an annual cost of $30000, and requires one operator at a cost of $72 per hour. It can process 10 tons per hour. Machine 2 costs $180000, has a life of 6 years, an annual cost of $15000, and requires two operators at a cost of $72 per hour each to process 6 tons per hour. Determine the annual breakeven tonnage of scrap metal at i=10% per year.arrow_forwardA company that makes food-friendly silicone (for use in cooking and baking pan coatings) is considering the independent projects shown, all of which can be considered to be viable for only 10 years. If the company’s MARR is 15% per year, determine which should be selected on the basis of a present worth analysis. Financial values are in $1000 units. A B C D First cost, $ −1,200 −2,000 −5,000 −7,000 Annual net income, $/year 200 400 1100 1300 Salvage value, $ 5 6 8 7arrow_forward

- Which of the following is closest to the equivalent annual worth of a project with an initial cost of $40,000, annual costs of $8,000 and a salvage value of $10,000 after 5 years? Assume an interest rate of 8% per year.arrow_forwardA large textile company is trying to decide which sludge dewatering process it should use ahead of its sludge drying operation. The costs associated with centrifuge and belt press systems are shown. Compare them on the basis of their annual worths using an interest rate of 10% per year. System Centrifuge Belt Press First cost, $ −235,000 −150,000 AOC, $/year −48,000 −41,000 Overhaul in year 2, $ -- −26,000 Salvage value, $ 40,000 10,000 Life, years 6 4 The annual worth of the centrifuge system is $− , and the annual worth of the belt press system is $− . The system selected on the basis of the annual worth analysis is the (Click to select) belt press centrifuge system.arrow_forwardAn engineer is trying to decide which process to use to reduce sludge volume prior to disposal. Belt filter presses (BFP) will cost $203,000 to buy and $85,000 per year to operate. Belts will be replaced one time per year at a cost of $5500. Centrifuges (Cent) will cost $396,000 to buy and $119,000 per year to operate, but because the centrifuge will produce a thicker “cake”, the sludge hauling cost to the monofill will be $37,000 per year less than for the belt presses. The useful lives are 5 and 10 years for alternatives BFP and Cent, respectively, and the salvage values are assumed to be 10% of the first cost of each process whenever they are closed down or replaced. Use PW evaluation to select the more economical process at an interest rate of 6% per year over (a) the LCM of lives, and (b) a study period of 8 years. Are the decisions the same?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education

Valuation Analysis in Project Finance Models - DCF & IRR; Author: Financial modeling;https://www.youtube.com/watch?v=xDlQPJaFtCw;License: Standard Youtube License