ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

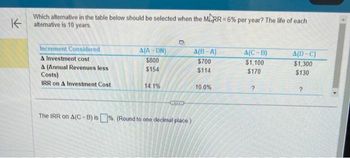

Transcribed Image Text:Which alternative in the table below should be selected when the MRR = 6% per year? The life of each

Kalternative is 10 years.

Increment Considered

A Investment cost

A (Annual Revenues less.

Costs)

IRR on A Investment Cost

A(A-DN)

$800

$154

14.1%

The IRR on A(C-B) is %. (Round to one decimal place.)

A(B-A)

$700

$114

10.0%

A(C-B)

$1,100

$170

?

A(D-C)

$1,300

$130

2

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- 6arrow_forwardArmy Research Laboratory scientists developed a diffusion-enhanced adhesion process which is expected to significantly improve the performance of multifunction hybrid composites. NASA engineers estimate that composites made using the new process will result in savings in space exploration projects. The cash flows for one project are estimated. Determine the rate of return per year. Year, t Cost ($1000) Savings ($1000) 0 −210 — 1 −150 — 2–5 — 100 + 60(t − 2)arrow_forwardA mechanical device will cost $20,000 when purchased. Maintenance will cost $1,000 per year. The device will generate revenues of $5,000 per year for 5 years. The salvage value is $7000. Draw the following: (A) Complete cash flow diagram (B) Simplified cash flow diagram.arrow_forward

- A consulting engineering firm is considering two models of SUVs for the company principals. A GM model will have a first cost of $36,000, an operating cost of $4000, and a salvage value of $15,000 after 3 years. A Ford model will have a first cost of $32,000, an operating cost of $3100, and also have a $15,000 resale value, but after 4 years. (a) At an interest rate of 15% per year, which model should the consulting firm buy? Conduct an annual worth analysis. (b) What are the PW values for each vehicle?arrow_forwardEconomic Study Methodsarrow_forwardA man buys a corporate bond from a bond brokerage house for $875. The bond has a face value of $1000 and a 4% coupon rate paid semiannually. If the bond will be paid off at the end of 12 years, what rate of return will the man receive?arrow_forward

- K Consider the following EOY cash flows for two mutually exclusive alternatives (one must be chosen). The MARR is 4% per year. Capital investment Annual expenses Useful life Market value at end of useful life The PW of the Lead Acid is $ The PW of the Lithium Ion is $ Click the icon to view the interest and annuity table for discrete compounding when i = 4% per year. (a) Determine which alternative should be selected based on the PW method. Assume repeatability and use a study period of 18 years. Lead Acid Lead Acid $7,000 $2,250 6 years $0 Lithium Ion Lithium Ion $13,000 $2,300 9 years $2,600 Which alternative should be selected? Choose the correct answer below. The AW of the Lead Acid is $ The AW of the Lithium lon is $ Lead Acid Lithium Ion (Round to the nearest dollar.) (Round to the nearest dollar.) (b) Determine which alternative should be selected based on the AW method, also assuming repeatability. . (Round to the nearest dollar.) (Round to the nearest dollar.) Which…arrow_forwardHow much will Sonja have in a savings account 12 years from now if she deposits $3000 now and $5000 four years from now? The account earns interest at a rate of 10% per year. (a) $10,720 (b) $9,415 (c) $20,133 (d) $15,630 (e) Greater than $22,000arrow_forwardFor the cash flows shown, determine the incremental cash flow between machines B and A for (a) year 0, (b) in year 3, and (c) in year 6. Machine First Cost, $ АОС, $/year Salvage value, $ 3,000 Life, years B -15,000 -25,000 -1,600 -400 6,000 3 4 O (a) = -10000 (b) = -1800 (c) = 1200 %3D !3! O (a) = -10000 (b) = 13200 (c) = 4200 !3! %3! O (a) = -10000 (b) = 13200 (c) =6000 %3! %3D O (a) = -10000 (b) = 13200 (c) = 13200 %3Darrow_forward

- Mechanical engineer at Company B is considering five equivalent projects, some of which have different life expectations. Salvage value is nil for all alternatives. Assuming that the company’s MARR is 13% per year, determine which should be selected (a) if they are independent, and (b) if they are mutually (c) Explain why your selection in part (b) is correct. First Cost, $ Net Annual Income, $/Year Life, Years A -20,000 +5,500 4 B −10,000 +2,000 6 C −15,000 3,800 6 D −60,000 +11,000 12 E −80,000 +9,000 12arrow_forwardBarron Chemical uses a thermoplastic polymer to enhance the appearance of certain RV panels. The initial cost of one process was $126,000 with annual costs of $48,000. Revenues are $80,000 in year 1, increasing by $100O per year. A salvage value of $20,000 was realized when the process was discontinued after 8 years. What rate of return did the company make on the process? The rate of return made by the company is %.arrow_forwardStreet lighting fixtures and their sodium vapor bulbs for a two-block area of a large city need to be installed at a first cost (investment cost) of $130,000. Annual maintenance expenses are expected to be$6,500for the first8years and$8,500 each year thereafter upto 25years. With an interest rate of 9% per year, what is the present worth cost of this project? Choose the closest answer below. A) $202,422 B $238,597 C) $249,468 D) $277,339arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education