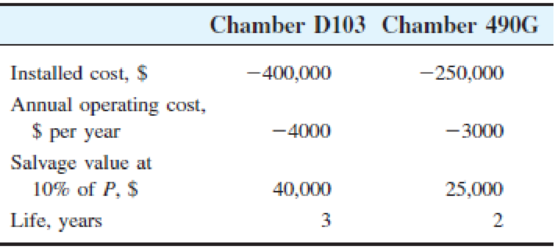

Estimates have been presented to Holly Farms, which is considering two environmental chambers for a project that will detail laboratory confirmations of on-line bacteria tests in chicken meat for the presence of E. coli 0157:H7 and Listeriamono-cytogenes. (a) If the project will last for 6 years and i = 10% per year, perform an AW evaluation to determine which chamber is more economical. (b) Chamber D103 can be purchased with different options and, therefore, at different installed costs. They range from $300,000 to $500,000. Will the selection change if one of these other models is installed? (c) Use single-cell spreadsheet functions to solve part (b).

Want to see the full answer?

Check out a sample textbook solution

Chapter 5 Solutions

Basics Of Engineering Economy

Additional Business Textbook Solutions

Contemporary Engineering Economics (6th Edition)

Principles of Economics (12th Edition)

Microeconomics (9th Edition) (Pearson Series in Economics)

Foundations of Economics (8th Edition)

Principles of Microeconomics (MindTap Course List)

Macroeconomics (Book Only)

- Airodyne Wind, Inc. has wind tunnels that can operate vertically or horizontally for evaluating the effects of air flow on a component’s PCB response and reliability. The company expects to build a new tunnel that will be outfitted with multiple sensor ports. For the estimates below, calculate the equivalent annual cost of the project. First cost, $ −800,000 Replacement cost, year 2, $ −300,000 AOC, $/year −950,000 Salvage value, $ 250,000 Life, years 4 Interest rate, % 10arrow_forwardState University tuition and fees can be paid using one of two plans. Early-bird: Pay total amount due one year in advance and get a 10% discount. On-time: Pay total amount due when classes start. If the cost of tuition and fees is $20,000 per year, (a) how much is paid in the early-bird plan, and (b) at an interest rate of 6% per year, what is the equivalent amount of the savings compared to paying when classes start, that is, 1 year later than the early-bird plan?arrow_forwardConcurris Prototyping is committed to using the newest and finest equipment in its labs. Accordingly, Wilma, a senior engineer, has recommended that a 2-year-old piece of precision measurement equipment be replaced immediately. She believes it can be demonstrated that the proposed equipment is economically advantageous at a 15% per year return and a planning horizon of 5 years Perform the replacement analysis using the annual worth method. a 5-year study period, and the estimates below. Was Wilma correct? Equipment Proposed 42,000 Original purchase price. S Current market value, S Remaining life, years stimated value in 5 years, S Salvage value after 15 years. S AOCES per year The AW of the defender a $- Wilma Click to select correct Current -30,000 15.000 5 2000 -13.000 15 30.000 5.000 -3,000 and the AW of the challenger is $-arrow_forward

- Dexcon Technologies, Inc., is evaluating two alternatives to produce its new plastic filament with tribological (i.e., low friction) properties for creating custom bearings for 3-D printers. The estimates associated with each alternative are shown below. Using a MARR of 15% per year, which alternative has the lower present worth? Method First Cost M&O Cost, per Year Salvage Value Life DDM $-240,000 $-30,000 $2,000 2 years LS $-480,000 $-15,000 $23,000 4 years The present worth for the DDM method is $ The present worth for the LS method is $ The (Click to select) v method is selected.arrow_forwardA 50m2 apartment is for sale for $50,000 down payment plus $100,000 at the end of 1 year. The seller even offers the cash payment opportunity for which he asks for $124,000. If the market interest rate is 2.5% per month, what is the best alternative?arrow_forwardA company that manufactures clear PVC pipes is investigating the production options of batch and continuous processing. Estimated cash flows are: Batch Process First cost ($) Annual cost ($ per year) Salvage value, any year, Continuous -69,000 -48,000 -140,000 -31,000 20,000 25,000 Life (years) 3-10 The chief operating officer (COO) has asked you to determine if the batch option, using an interest rate of 15% per year, would ever have an annual worth lower than that of the continuous flow system. The continuous flow process was previously determined to have Its lowest cost over a 5-year life cycle, but the batch process can be used from 3 to 10 years. If selecting the batch process is sensitive to its useful life, what is the minimum life that makes It more attractive? The batch system will be less expensive than the continuous flow if it lasts over years.arrow_forward

- Two insulation thickness alternatives have been proposed for a process steam line subject to severe weather conditions. One alternative must be selected. Estimated installation cost and annual savings in heat loss are given below. \table[[\table[[Insulation], [ Thickness]], Installed Cost, \table[[Annual Savings in], [ Heat Loss]], Life of Insulation], [2cm, $20,000, $6,900 per year,4 years], [3cm, $35,000, $9,000 per year, 6 years]] The MARR = 10% per year. The study period is 12 years. Draw the cash flow diagram for each alternative over the entire study period. Two insulation thickness alternatives have been proposed for a process steam line subject to severe weather conditions. One alternative must be selected. Estimated installation cost and annual savings in heat loss are given below. Insulation Thickness 2cm Installed Cost $20,000 $35,000 Annual Savings in Heat Loss $6,900 per year $9,000 per year Life of Insulation 4 years 6 years 3cm = The MARR 10% per year. The study period…arrow_forwardoncurris Prototyping is committed to using the newest and finest equipment in its labs. Accordingly, Wilma, a senior engineer, has recommended that a 2 -year-old piece of precision measurement equipment be replaced immediately. She believes it can be demonstrated that the proposed equipment is economically advantageous at a 15%-per year return and a planning horizon of 5 years. Perform the replacement analysis using the annual worth method, a 5 -year study period, and the estimates below. Was Wilma correct? \table[[Equipment,Current,Proposed],[Original purchase price, $,-30,000,-42,000arrow_forwardCompare three alternatives on the basis of their capitalized costs at i= 8.00% per year and select the best alternative. (Include a minus sign if necessary.) Alternative E First Cost $-75000 AOC, per Year $-70000 Salvage Value $16000 Life, Years 2 The capitalized cost of alternative E is $-214212.68 X 9 and alternative G is $ -971460.48 9 F $-420000 $-14000 $66000 4 The best alternative is G G $-920000 $-5000 $750000 ∞ alternative F is $-515145.86 Xarrow_forward

- A company that manufactures magnetic flow meters expects to undertake a project that will have the cash flows estimated. First cost, $ −900,000 Equipment replacement cost in year 2, $ −300,000 Annual operating cost, $/year −950,000 Salvage value, $ 250,000 Life, years 4 At an interest rate of 10% per year, what is the equivalent annual cost of the project? Find the AW value using tabulated factors. The equivalent annual cost of the project is $− . Note:- Do not provide handwritten solution. Maintain accuracy and quality in your answer. Take care of plagiarism. Answer completely. You will get up vote for sure.arrow_forwardA company that manufactures magnetic flow meters expects to undertake a project that will have the cash flows estimated. First cost, $ −840,000 Equipment replacement cost in year 2, $ −300,000 Annual operating cost, $/year −890,000 Salvage value, $ 250,000 Life, years 4 At an interest rate of 10% per year, what is the equivalent annual cost of the project? Find the AW value using tabulated factors. The equivalent annual cost of the project is $− .arrow_forwardAn assembly operation at a software company now requires $100,000 per year in labor costs. A robot can be purchased and installed to automate this operation. The robot will cost $200,000. Maintenance and operation expenses of the robot are estimated to be $64,000 per year for the first 2 years and $10,000 thereafter. Replacement of minimal parts will cost $5000 every 3 years. Invested capital must earn at least 12% per year. What is the capitalized cost? (Draw cash flow diagram and show complete solution)arrow_forward

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education