Managerial Accounting: Creating Value in a Dynamic Business Environment

11th Edition

ISBN: 9781259569562

Author: Ronald W Hilton Proffesor Prof, David Platt

Publisher: McGraw-Hill Education

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 5, Problem 27E

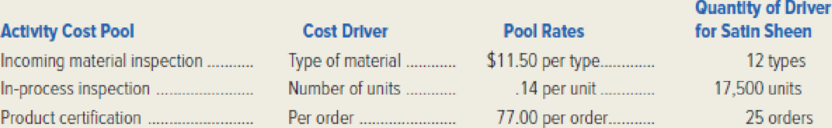

Urban Elite Cosmetics has used a traditional cost accounting system to apply quality-control costs uniformly to all products at a rate of 14.5 percent of direct-labor cost. Monthly direct-labor cost for Satin Sheen makeup is $27,500. In an attempt to more equitably distribute quality-control costs, management is considering activity-based costing. The monthly data shown in the following chart have been gathered for Satin Sheen makeup.

Required:

- 1. Calculate the monthly quality-control cost to be assigned to the Satin Sheen product line under each of the following product-costing systems. (Round to the nearest dollar.)

- a. Traditional system, which assigns

overhead on the basis of direct-labor cost. - b. Activity-based costing.

- a. Traditional system, which assigns

- 2. Does the traditional product-costing system overcost or undercost the Satin Sheen product line with respect to quality-control costs? By what amount?

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Urban Elite Cosmetics has used a traditional cost accounting system to apply quality-control costs uniformly to all products at a rate of 14.5 percent of direct-labor cost. Monthly direct-labor cost for Satin Sheen makeup is $27,500. In an attempt to more equitably distribute quality-control costs, management is considering activity-based costing. The monthly data shown in the following chart have been gathered for Satin Sheen makeup.

Required:1. Calculate the monthly quality-control cost to be assigned to the Satin Sheen product line under each of the following product-costing systems. (Round to the nearest dollar.)a. Traditional system, which assigns overhead on the basis of direct-labor cost.b. Activity-based costing.2. Does the traditional product-costing system overcost or undercost the Satin Sheen product line with respect to quality-control costs? By what amount?

Urban Elite Cosmetics has used a traditional cost accounting system to apply quality-control costs uniformly to all products at a rate of 14.5 percent of direct-labor cost. Monthly direct-labor cost for Satin Sheen makeup is $27,500. In an attempt to more equitably distribute quality-control costs, management is considering activity-based costing. The monthly data shown in the following chart have been gathered for Satin Sheen makeup. Activity Cost Pool Cost Driver Pool Rates Quantity of Driver for Satin Sheen Incoming material inspection Type of material $ 11.50 per type 12 types In-process inspection Number of units 0.14 per unit 17,500 units Product certification Per order 77.00 per order 25 orders Required: 1. Calculate the monthly quality-control cost to be assigned to the Satin Sheen product line under each of the following product-costing systems. a. Traditional system, which assigns overhead on the basis of direct-labor cost. b. Activity-based costing. 2. Does the traditional…

Mission Company is preparing its annual profit plan. As part of its analysis of the profitability of individual products, the controller estimates the

amount of overhead that should be allocated to the individual product lines from the information provided below. (CMA adapted)

Multiple Choice

Units produced

Material moves per product line

Direct labor-hours per product line

Budgeted material handling costs: $279,500

Under an activity-based costing (ABC) system, the materials handling costs allocated to one unit of Specialty Windows would be:

$6,450.00.

$2,170.68.

$12,900.00.

Wall Mirrors

220

5

1,100

$10,320.00.

Specialty Windows

20

60

1,200

Chapter 5 Solutions

Managerial Accounting: Creating Value in a Dynamic Business Environment

Ch. 5 - Briefly explain how a traditional, volume-based...Ch. 5 - Prob. 2RQCh. 5 - Explain how an activity-based costing system...Ch. 5 - What are cost drivers? What is their role in an...Ch. 5 - List and briefly describe the four broad...Ch. 5 - How can an activity-based costing system alleviate...Ch. 5 - Prob. 7RQCh. 5 - How is the distinction between direct and indirect...Ch. 5 - Explain the concept of a pool rate in...Ch. 5 - Briefly explain two factors that tend to result in...

Ch. 5 - List three factors that are important in selecting...Ch. 5 - Prob. 12RQCh. 5 - Explain why a new product-costing system may be...Ch. 5 - Prob. 14RQCh. 5 - Are activity-based costing systems appropriate for...Ch. 5 - Explain why maintaining their medical-services...Ch. 5 - How could the administration at Immunity Medical...Ch. 5 - Prob. 18RQCh. 5 - Prob. 19RQCh. 5 - What is meant by the term activity analysis? Give...Ch. 5 - Prob. 21RQCh. 5 - What is meant by customer-profitability analysis?...Ch. 5 - Explain the relationship between customer profit...Ch. 5 - What is a customer profitability profile?Ch. 5 - Describe the use of practical capacity in a TDABC...Ch. 5 - Tioga Company manufactures sophisticated lenses...Ch. 5 - Urban Elite Cosmetics has used a traditional cost...Ch. 5 - Kentaro Corporation manufactures Digital Video...Ch. 5 - Kentaro Corporation manufactures Digital Video...Ch. 5 - Prob. 31ECh. 5 - Refer to the description given for Wheelco, Inc....Ch. 5 - Prob. 33ECh. 5 - United Technologies Corporation implemented...Ch. 5 - Redwood Company sells craft kits and supplies to...Ch. 5 - Non-value-added costs occur in nonmanufacturing...Ch. 5 - Since you have always wanted to be an...Ch. 5 - Prob. 39ECh. 5 - Prob. 42ECh. 5 - Big Apple Design Company specializes in designing...Ch. 5 - Prob. 44ECh. 5 - Borealis Manufacturing has just completed a major...Ch. 5 - Ontario, Inc. manufactures two products, Standard...Ch. 5 - Kitchen Kings Toledo plant manufactures three...Ch. 5 - Prob. 48PCh. 5 - Maxey Sons manufactures two types of storage...Ch. 5 - Prob. 50PCh. 5 - John Patrick has recently been hired as controller...Ch. 5 - The controller for Tulsa Medical Supply Company...Ch. 5 - Prob. 53PCh. 5 - Prob. 54PCh. 5 - Prob. 55PCh. 5 - World Gourmet Coffee Company (WGCC) is a...Ch. 5 - Knickknack, Inc. manufactures two products: Odds...Ch. 5 - Prob. 58PCh. 5 - Marconi Manufacturing produces two items in its...Ch. 5 - Gigabyte, Inc. manufactures three products for the...Ch. 5 - Refer to the new target prices for Gigabytes three...Ch. 5 - Prob. 62PCh. 5 - Better Bagels, Inc. manufactures a variety of...Ch. 5 - Midwest Home Furnishings Corporation (MHFC)...Ch. 5 - Fresno Fiber Optics, Inc. manufactures fiber optic...Ch. 5 - Refer to the information given in the preceding...Ch. 5 - Whitestone Company produces two subassemblies,...Ch. 5 - Morelli Electric Motor Corporation manufactures...Ch. 5 - Refer to the product costs developed in...Ch. 5 - Morelli Electric Motor Corporations controller,...

Additional Business Textbook Solutions

Find more solutions based on key concepts

1. For Frank’s Funky Sounds, straight-line depreciation on the trucks is a

Learning Objective 1

a. variable cos...

Horngren's Accounting (12th Edition)

List five asset accounts, three liability accounts, and five expense accounts included in the acquisition and p...

Auditing And Assurance Services

E6-14 Using accounting vocabulary

Learning Objective 1, 2

Match the accounting terms with the corresponding d...

Horngren's Accounting (11th Edition)

Fundamental and Enhancing Characteristics. Identify whether the following items are fundamental characteristics...

Intermediate Accounting

Bank loan; accrued interest LO132 On October 1, Eder Fabrication borrowed 60 million and issued a nine-month, ...

INTERMEDIATE ACCOUNTING

Determine the estimated cost of the work performed each week given the tasks—with their associated costs and sc...

Construction Accounting And Financial Management (4th Edition)

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Scattergraph, High-Low Method, and Predicting Cost for a Different Time Period from the One Used to Develop a Cost Formula Refer to the information for Farnsworth Company on the previous page. Required: 1. Prepare a scattergraph based on the 10 months of data. Does the relationship appear to be linear? 2. Using the high-low method, prepare a cost formula for the receiving activity. Using this formula, what is the predicted cost of receiving for a month in which 1,450 receiving orders are processed? 3. Prepare a cost formula for the receiving activity for a quarter. Based on this formula, what is the predicted cost of receiving for a quarter in which 4,650 receiving orders are anticipated? Prepare a cost formula for the receiving activity for a year. Based on this formula, what is the predicted cost of receiving for a year in which 18,000 receiving orders are anticipated? Use the following information for Problems 3-60 and 3-61: Farnsworth Company has gathered data on its overhead activities and associated costs for the past 10 months. Tracy Heppler, a member of the controllers department, has convinced management that overhead costs can be better estimated and controlled if the fixed and variable components of each overhead activity are known. One such activity is receiving raw materials (unloading incoming goods, counting goods, and inspecting goods), which she believes is driven by the number of receiving orders. Ten months of data have been gathered for the receiving activity and are as follows:arrow_forwardBumblebee Mobiles manufactures a line of cell phones. The management has identified the following overhead costs and related cost drivers for the coming year. The following were incurred in manufacturing two of their cell phones, Bubble and Burst, during the first quarter. REQUIREMENT Review the worksheet called ABC that follows these requirements. You have been asked to determine the cost of each product using an activity-based cost system. Note that the problem information is already entered into the Data Section of the ABC worksheet.arrow_forwardMethod of Least Squares, Predicting Cost for Different Time Periods from the One Used to Develop a Cost Formula Refer to the information for Farnsworth Company on the previous page. However, assume that Tracy has used the method of least squares on the receiving data and has gotten the following results: Required: 1. Using the results from the method of least squares, prepare a cost formula for the receiving activity. 2. Using the formula from Requirement 1, what is the predicted cost of receiving for a month in which 1,450 receiving orders are processed? (Note: Round your answer to the nearest dollar.) 3. Prepare a cost formula for the receiving activity for a quarter. Based on this formula, what is the predicted cost of receiving for a quarter in which 4,650 receiving orders are anticipated? Prepare a cost formula for the receiving activity for a year. Based on this formula, what is the predicted cost of receiving for a year in which 18,000 receiving orders are anticipated?arrow_forward

- Fisher Fixtures manufactures three types of lighting fixtures, with model names of Silver, Gold, and Platinum. It applies all indirect costs according to an annual predetermined rate based on direct labor-hours. The plant controller has recommended that the company switch to an activity-based costing system. The controller's staff prepared the following cost estimates for next year (year 2) for the recommended cost drivers. Activity Recommended Cost Driver Estimated Cost Estimated Cost Driver Activity Purchasing material Number of purchase orders $ 115,200 240 purchase orders Receiving material Direct materials cost 217,600 $ 2,720,000 Setting up equipment Number of production runs 211,560 120 runs Machine depreciation and maintenance Machine-hours 72,590 14,518 hours Ensuring regulatory compliance Number of inspections 423,900 54 inspections Shipping Number of units shipped 1,040,400 578,000 units Total estimated cost $ 2,081,250 In addition, management…arrow_forwardFisher Fixtures manufactures three types of lighting fixtures, with model names of Silver, Gold, and Platinum. It applies all indirect costs according to an annual predetermined rate based on direct labor-hours. The plant controller has recommended that the company switch to an activity-based costing system. The controller's staff prepared the following cost estimates for next year (year 2) for the recommended cost drivers. Activity Recommended Cost Driver Estimated Cost Estimated Cost Driver Activity Purchasing material Number of purchase orders $ 130,800 240 purchase orders Receiving material Direct materials cost 238,400 $ 2,980,000 Setting up equipment Number of production runs 231,840 120 runs Machine depreciation and maintenance Machine-hours 80,260 16,052 hours Ensuring regulatory compliance Number of inspections 459,000 54 inspections Shipping Number of units shipped 1,087,200 604,000 units Total estimated cost $ 2,227,500 In addition, management…arrow_forwardFisher Fixtures manufactures three types of lighting fixtures, with model names of Silver, Gold, and Platinum. It applies all indirect costs according to an annual predetermined rate based on direct labor-hours. The plant controller has recommended that the company switch to an activity-based costing system. The controller's staff prepared the following cost estimates for next year (year 2) for the recommended cost drivers. Activity Recommended Cost Driver Estimated Cost Estimated Cost Driver Activity Purchasing material Number of purchase orders $ 138,000 240 purchase orders Receiving material Direct materials cost 248,000 $ 3,100,000 Setting up equipment Number of production runs 241,200 120 runs Machine depreciation and maintenance Machine-hours 83,800 16,760 hours Ensuring regulatory compliance Number of inspections 475,200 54 inspections Shipping Number of units shipped 1,108,800 616,000 units Total estimated cost $ 2,295,000 In addition, management…arrow_forward

- BOTE Inc. produces sustainable plastic bottles, The following tables show the detailed production budgets, volumes, costs, ABC cost drivers and the traditional volume-based costing (VBC) overhead allocation based on direct labor hours (overhead rate base). Production Data for the Year Plastic bottle Selling price 6.00 Budget units of production 20,000 Material cost per unit P 0.50 Direct labor hours per unit 0.05 Direct labor cost per hour P 5.00 quality inspections per unit 0.025 Machine hours per unit 0.3 Moves required per unit 4 Activity Conversion Costs for 20,000 units (Budgeted Overhead Cost) Indirect Cost Components Costs (Php) Cost Driver Total Depreciation on machinery 75,000 Machine hours 4,010 Quality and finishing 24,000 No of quality inspections 6,000 Material handling 30,000 No. of moves 63,848 Total Indirect Cost 129,000 The budgeted direct…arrow_forwardMission Company is preparing its annual profit plan. As part of its analysis of the profitability of individual products, the controller estimates the amount of overhead that should be allocated to the individual product lines from the information provided below (CMA adapted) Multiple Choice Units produced Material moves per product line Direct labor-hours per product line Budgeted material handling costs: $594,000 Under a traditional costing system that allocates overhead on the basis of direct labor-hours, the materials handling costs allocated to one unit of Wall Mirrors would be O $1000 $1.350 $5,400 Wall Mirrors 210 5 1,050 $22.000 Specialty Nindows 25 46arrow_forwardBarnett Products manufactures three types of remote-control devices: Economy, Standard, and Deluxe. The company, which uses activity-based costing, has identified five activities (and related cost drivers). Each activity, its budgeted cost, and related cost driver is identified below. First picture The following information pertains to the three product lines for next year: Second picture Under Barnett's activity-based costing system, what is the per-unit overhead cost of Deluxe? a.$277. b.$267. c.None of the answers is correct. d.$419.arrow_forward

- Crane, Inc. uses activity-based costing as the basis for information to set prices for its six lines of seasonal coats. Activity Cost Pools Sizing and cutting Stitching and trimming Wrapping and packing Sizing and cutting Stitching and trimming Estimated Overhead Wrapping and packing $4,108,500 1,439,100 $ Compute the activity-based overhead rates using the following budgeted data for each of the activity cost pools. (Round answers to 2 decimal places, e.g. 12.25.) $ LA 325,500 $ Estimated Use of Cost Drivers per Activity 166,000 machine hours 78,000 labor hours 35,000 finished units Activity-based overhead rates per machine hour per labor hour per finished unitarrow_forwardMarvin's Kitchen Supply delivers restaurant supplies throughout the city. The firm adds 10 percent to the cost of the supplies to cover the delivery cost. The delivery fee is meant to cover the cost of delivery. A consultant has analyzed the delivery service using activity- based costing methods and identified four activities. Data on these activities follow. Activity Processing order Loading truck Delivering merchandise Processing invoice Total overhead Order value Number of orders Number of items Number of invoices Cost Driver Number of orders Number of items Number of orders Number of invoices Two of Marvin's customers are City Diner and Le Chien Chaud. Data for orders and deliveries to these two customers follow. City Diner Le Chien Chaud $75,000 $90,000 110 1,500 150 Required A Cost Driver Volume 52 600 12 Cost $ 75,000 150,000 90,000 72,000 $387,000 Required B City Diner Le Chien Chaud Driver Volume 5,000 orders 100,000 items Required: a. What would the delivery charge for each…arrow_forwardMack Precision Tool and Die has two production departments, Fabricating and Finishing, and two service departments, Repair and Quality Control. Direct costs for each department and the proportion of service costs used by the various departments for the month of March follow: Department Fabricating Finishing Repair Quality Control Proportion of Services Used by Quality Direct Costs Repair Control Fabricating $ 148,600 114, 200 49,200 92,000 Required: Use the step method to allocate the service costs, using the following: From: a. The order of allocation starts with Repair. b. The allocations are made in the reverse order (starting with Quality Control). Service department costs Quality control Complete this question by entering your answers in the tabs below. Repair Total costs allocated 8 0.8 S Required A Required B Use the step method to allocate the service costs, using the following: The allocations are made in the reverse order (starting with Quality Control). Note: Amounts to be…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:9781111581565

Author:Gaylord N. Smith

Publisher:Cengage Learning

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:9781305087408

Author:Edward J. Vanderbeck, Maria R. Mitchell

Publisher:Cengage Learning

Inspection and Quality control in Manufacturing. What is quality inspection?; Author: Educationleaves;https://www.youtube.com/watch?v=Ey4MqC7Kp7g;License: Standard youtube license