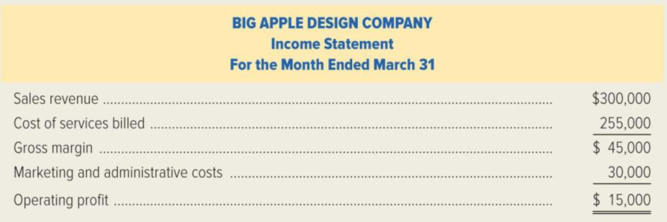

Big Apple Design Company specializes in designing commercial office space in Chicago. The firm’s president recently reviewed the following income statement and noticed that operating profits were below her expectations. She had a hunch that certain customers were not profitable for the company and asked the controller to perform a customer-profitability analysis showing profitability by customer for the month of March.

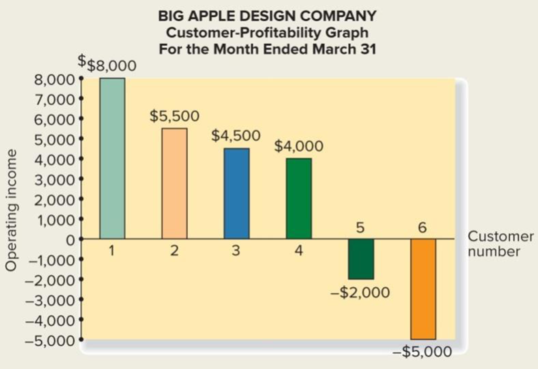

The controller provided the following customer-profitability graph:

Required: Put your-self in the position of Big Apple’s controller and write a memo to the president to accompany the customer-profitability graph. Comment on the implications of the customer-profitability analysis and raise four or more questions that should be addressed by the firm’s management team.

Want to see the full answer?

Check out a sample textbook solution

Chapter 5 Solutions

Managerial Accounting: Creating Value in a Dynamic Business Environment

- The Northwest regional manager of Logan Outdoor Equipment Company has conducted a study to determine how her store managers are allocating their time. A study was undertaken over three weeks that collected the following data related to the percentage of time each store manager spent on the tasks of attending required meetings, preparing business reports, customer interaction, and being idle. The results of the data collection appear in the following table: a. Create a stacked-bar chart with locations along the vertical axis. Reformat the bar chart to best display these data by adding axis labels, a chart title, and so on. b. Create a clustered-bar chart with locations along the vertical axis and clusters of tasks. Reformat the bar chart to best display these data by adding axis labels, a chart title, and the like. c. Create multiple bar charts in which each location becomes a single bar chart showing the percentage of time spent on tasks. Reformat the bar charts to best display these data by adding axis labels, a chart title, and so forth. d. Which form of bar chart (stacked, clustered, or multiple) is preferable for these data? Why? e. What can we infer about the differences among how store managers are allocating their time at the different locations?arrow_forwardThe following information is from Dessert Dynasty. The company runs three stores and the December Income Statement for all stores is shown. A. Find the missing values for retail revenue, ingredients, and operating income. B. Comment on the financial performance of each store. C. Identify a limitation of analyzing the information provided. You may want to consider using Microsoft Excel or another spreadsheet application for the numerical data. This information will be used in a subsequent question.arrow_forwardHenrys Cafe is a local restaurant that is growing quickly. While the company does not yet have a balanced scorecard, Henry has mentioned that being efficient in producing meals is a high priority of his business and appears to be a significant driver of profits. Henry tells you he gathers the following data: sales, cost of labor, employee turnover, labor hours, cost of ingredients, overhead costs, average training hours per employee, number of erroneous meals prepared, the time when orders were made (e.g., at 12:43 PM), the time when orders were delivered, and number of customers per day. a. Under which performance perspective on the balanced scorecard should Henrys strategic objective to efficiently produce meals be placed? b. Based on the data collected, what are at least three performance metrics Henry could develop to measure his strategic objective to efficiently produce meals? c. Identify whether the performance metrics you suggested in part (b) are leading or lagging indicators relative to a performance metric total cost of production per meal.arrow_forward

- The following situations describe scenarios that could use managerial accounting information: a. The manager of High Times Restaurant wants to determine the price to charge for various lunch plates. b. By evaluating the cost of leftover materials, the plant manager of a precision tool facility wants to determine how effectively the plant is being run. c. The division controller of West Coast Supplies needs to determine the cost of products left in inventory. d. The manager of the Maintenance Department of a large manufacturing company wants to plan next years anticipated expenditures. For each situation, discuss how managerial accounting information could be used.arrow_forwardABC Manufacturing is a producer of a local product used in house cleaning, called Agent C. The production manager is required to present a production report for the month August, however he got no idea on what information he needed for the report, and what analysis could be made to help the top management on their decision-making. The production manager sought your expertise on the subject matter and gave to you the following information: Sales (in Pesos) 4,957,875.00 22,500.00 Sales Volume Variable Costs: Cost of Direct Raw Materials 895,000.00 530,000.00 124,200.00 Cost of Direct Labor Cost of Packaging Materials Fixed Costs: Monthly Depreciation Monthly Rent of Warehouse Fixed Monthly Allowance for Electricity Other Fixed Manufacturing Overhead 650,000.00 100,000.00 675,000.00 146,700.00 Required: SENSITIVITY ANALYSIS If the selling price per unit is increased by 20% of its current price while the variable cost per unit is also increased by 30%, compute the following: g. How many…arrow_forwardABC Manufacturing is a producer of a local product used in house cleaning, called Agent C. The production manager is required to present a production report for the month August, however he got no idea on what information he needed for the report, and what analysis could be made to help the top management on their decision-making. The production manager sought your expertise on the subject matter and gave to you the following information: Sales (in Pesos) 4,957,875.00 22,500.00 Sales Volume Variable Costs: Cost of Direct Raw Materials 895,000.00 530,000.00 124,200.00 Cost of Direct Labor Cost of Packaging Materials Fixed Costs: Monthly Depreciation Monthly Rent of Warehouse Fixed Monthly Allowance for Electricity Other Fixed Manufacturing Overhead 650,000.00 100,000.00 675,000.00 146,700.00 Required: BREAKEVEN ANALYSIS 1. Compute the selling price per unit of Agent C. 2. Compute the variable cost per unit of Agent C. 3. Compute the variable cost rate of Agent C. 4. Compute the…arrow_forward

- B-You is a consulting firm that works with managers to improve their interpersonal skills. Recently, a representative of a high-tech research firm approached B-You's owner with an offer to contract for one year with B-You to improve the interpersonal skills of a newly hired manager. B-You reported the following costs and revenues during the past year (before the proposed contract). Sales revenue Costs Labor Equipment lease B-YOU Annual Income Statement Rent Supplies Officers' salaries Other costs Total costs Operating profit (loss) $ 560,000 260,000 42,000 35,000 30,000 160,000 20,000 $ 547,000 $ 13,000 If B-You decides to take the contract to help the manager, it will hire a full-time consultant at $85,500. The equipment lease will increase by 20 percent. Supplies will increase by an estimated 10 percent and other costs by 15 percent. The existing building has space for the new consultant. No new offices will be necessary for this work.arrow_forwardUrLink Company is a newly formed company specializing in high-speed Internet service for home and business. The owner, Lenny Kirkland, had divided the company into two segments: Home Internet Service and Business Internet Service. Each segment is run by its own supervisor, while basic selling and administrative services are shared by both segments.Lenny has asked you to help him create a performance reporting system that will allow him to measure each segment’s performance in terms of its profitability. To that end, the following information has been collected on the Home Internet Service segment for the first quarter of 2017. Budgeted Actual Service revenue $24,800 $25,000 Allocated portion of: Building depreciation 10,300 10,300 Advertising 4,700 4,200 Billing 3,200 3,200 Property taxes 1,100 1,200 Material and supplies 1,400 1,300 Supervisory salaries 9,400 9,400 Insurance 4,300 3,200 Wages…arrow_forwardTaylor Construction builds custom homes in Dallas, Texas. Brandon Taylor knows that his future depends on the quality of the homes he builds and the service he provides to customers. Most new-customer sales arise from word-of-mouth advertising by former customers.Identify the balanced scorecard perspective for each measure in the exercise. Perspective a. Number of customer complaints Internal business processesCustomerLearning & growthFinancial b. Employee turnover Learning & growthFinancialInternal business processesCustomer c. Net profit per house constructed Learning & growthFinancialInternal business processesCustomer d. Turnaround time on customer design changes Learning & growthInternal business processesCustomerFinancial e. Hours of training per employee Learning & growthFinancialInternal business processesCustomer f. Average labor cost per house CustomerLearning &…arrow_forward

- Horton Manufacturing Incorporated produces blinds and other window treatments for residential homes and offices. The owner is concerned about the maintenance costs for the production machinery because maintenance costs for the previous fiscal year were higher than he expected. The owner has asked you to assist in estimating future maintenance costs to better predict the firm's profitability. Together, you have determined that the best cost driver for maintenance costs is machine hours. The data from the previous fiscal year for maintenance costs and machine hours follow: Month 1 3 4 6 7 8 9 10 11 12 Maintenance Costs Machine Hours $ 2,665 2,710 2,760 2,860 2,895 3,045 2,905 2,945 2,820 2,610 2,630 2,930 Maintenance cost 1,566 1,670 1,685 1,735 1,855 1,890 1,865 1,885 1,775 1,450 1,630 1,465 Required: 1. Use the high-low method to estimate the fixed and variable portions for maintenance costs. (In your calculations, round "slope (unit variable cost)" to 4 decimal places. Enter the…arrow_forwardUsing This Information, Prepare a Contribution Income Statement For Fashionisto.arrow_forwardMillard Corporation is a wholesale distributor of office products. It purchases office products from manufacturers and distributes them in the West, Central, and East regions. Each of these regions is about the same size and each has its own manager and sales staff. The company has been experiencing losses for many months. In an effort to improve performance, management has requested that the monthly income statement be segmented by sales region. The company's first effort at preparing a segmented income statement for May is given below. Sales Regional expenses (traceable): Cost of goods sold Advertising Salaries Utilities Depreciation Shipping expense Total regional expenses Regional income (loss) before corporate expenses Corporate expenses: Advertising (general) General administrative expense Total corporate expenses Net operating income (loss) Variable expenses: Total variable expenses Traceable fixed expenses: Total traceable fixed expenses Common fixed expenses: Total common…arrow_forward

- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Essentials of Business Analytics (MindTap Course ...StatisticsISBN:9781305627734Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. AndersonPublisher:Cengage Learning

Essentials of Business Analytics (MindTap Course ...StatisticsISBN:9781305627734Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. AndersonPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub  Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning