Loose Leaf for Foundations of Financial Management Format: Loose-leaf

17th Edition

ISBN: 9781260464924

Author: BLOCK

Publisher: Mcgraw Hill Publishers

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 5, Problem 20P

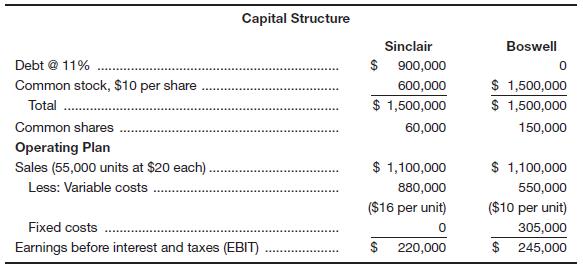

Sinclair Manufacturing and Boswell Brothers Inc. are both involved in the production of brick for the homebuilding industry. Their financial information is as follows:

a. If you combine Sinclair’s capital structure with Boswell’s operating plan, what is the degree of combined leverage? (Round to two places to the right of the decimal point.)

b. If you combine Boswell’s capital structure with Sinclair’s operating plan, what is the degree of combined leverage?

c. Explain why you got the results you did in part b.

d. In part b, if sales double, by what percentage will EPS increase?

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Here you will find some income statements and balance sheets for Sears Holdings (SHLD) and Taget Corp (TGT). Assume that you are a financial manager at Sear and want to compare your firm’s situation with that of Target. Calculate represenatative ratios for liquidity, asset management efficiency, financial leverage (capital structure), and profitability for both Sears and Target. How would you summarize the financial performance of Sears compared to target (its benchmark firm)?

Include Sears and Targets current ratio, acid-test ratio, average collection period, accounts receivable turnover, inventory turnover, debt ratio, timed interest earned, total asset turnover, fixed asset turnover, gross profit margin, operating profit margin, net profit margin, operating return on assets, and return on equity.

Carson Electronics’ management has long viewed BGT Electronics as an industry leader and uses this firm as a model firm for analyzing its own performance. The balance sheet and income statements for the two firms are as follows:

Calculate the following ratios for both Carson and BGT:

a) Debt ratio:

b) Average collection period:

c) Fixed asset turnover:

d) Return on equity:

Please describe a working capital management for 2 companies.

1. How their financial figure will be calculated.

2. Explain their performance.

3. Examine both of the companies based on risk factors; the upside and the dowside.

4. How is the justification should be dne based on their data and ratio.

5. Conclusion on the analysis.

Chapter 5 Solutions

Loose Leaf for Foundations of Financial Management Format: Loose-leaf

Ch. 5 - Discuss the various uses for break-even analysis....Ch. 5 - What factors would cause a difference in the use...Ch. 5 - Explain how the break-even point and operating...Ch. 5 - Prob. 4DQCh. 5 - What does risk taking have to do with the use of...Ch. 5 - Discuss the limitations of financial leverage....Ch. 5 - Prob. 7DQCh. 5 - Explain how combined leverage brings together...Ch. 5 - Explain why operating leverage decreases as a...Ch. 5 - Prob. 10DQ

Ch. 5 - Prob. 1PCh. 5 - Prob. 2PCh. 5 - Prob. 3PCh. 5 - Draw two break-even graphs-one for a conservative...Ch. 5 - Prob. 5PCh. 5 - Shawn Pen & Pencil Sets Inc. has fixed costs of ....Ch. 5 - Calloway Cab Company determines its break-even...Ch. 5 - Prob. 8PCh. 5 - Boise Timber Co. computes its break-even point...Ch. 5 - The Sterling Tire Company’s income statement for...Ch. 5 - Prob. 11PCh. 5 - Healthy Foods Inc. sells 50-pound bags of grapes...Ch. 5 - United Snack Company sells 50-pound bags of...Ch. 5 - Prob. 14PCh. 5 - Prob. 15PCh. 5 - Lenow’s Drug Stores and Hall’s Pharmaceuticals...Ch. 5 - The capital structure for Cain Supplies is...Ch. 5 - Sterling Optical and Royal Optical both make glass...Ch. 5 - Prob. 19PCh. 5 - Sinclair Manufacturing and Boswell Brothers Inc....Ch. 5 - DeSoto Tools Inc. is planning to expand...Ch. 5 - Prob. 23PCh. 5 - Prob. 24PCh. 5 - Prob. 25PCh. 5 - Mr. Gold is in the widget business. He currently...Ch. 5 - Delsing Canning Company is considering an...Ch. 5 - Prob. 2WECh. 5 - Now click on "Financials." Look at the Income...Ch. 5 - Prob. 4WECh. 5 - Prob. 5WE

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Source of capital Long-term debt Preferred stock Common stock equity Market value $700,000 $70,000 $400,000 Individual cost 7.6% 12.4% 14.8%arrow_forwardBased on the Massy Group, an investment holding company, answer the following questions. Provide a detail explanation and examples to the answers. Assess the company’s working capital position by analyzing its current assets and liabilities using common methods and measures and perform a comparison/difference to that of another company. Evaluate the efficiency of the company’s working capital management strategies, including inventory management, accounts receivable, and accounts payable and perform a comparison/difference to that of another company. Based on the assessment and evaluation above, provide ten recommendations for improving the company’s working capital management practices, providing examples for each one.arrow_forwardWu Systems has the following balance sheet. Assume that all current assets are used in operations. How much net operating working capital does the firm have?arrow_forward

- 1. Download the financial statements of any company and do the following analysis? a) Calculate and Comment on the gearing ratio of the companies? b) Write a note on the nature of the capital structure of the company and highlight the importance of leverage in capital structure. please mention the reference at the endarrow_forwardMr Rahman the owner of Cahaya Entreprise is interested to apply business financing from Bank Islam Behad. The financing will be used for purchasing business raw materials, payment for water and electrical bill as well as for worker salaries. What is the appropriate form of capital for financing application? Select one:A.Growth capital/ Modal pengembangan B.Working capital C.Fixed capital D.Initial capitalarrow_forwardWhich of the following statements is correct? Select one: A. Working capital is the initial capital injected into a company. OB. Working capital is equal to the net investment in current assets and current liabilities. C. Working capital is the minimum amount of capital required to run a business. OD. Working capital is a source of long-term finance.arrow_forward

- Using the following information for Handy Hardware, determine the capital structure that results in the lowest weighted average cost of capital (WACC) for the firm. Explain your answer.arrow_forwardHelp with the realtionship between financial leverage and profitability. Pelican Paper, Inc., and Timberland Forest, Inc., are rivals in the manufacture of craft papers. Some financial statement values for each company follow. Use them in a ratio analysis that compares the firms' financial leverage and profitability. a. Calculate the following debt and coverage ratios for the two companies. Discuss their financial risk and ability to cover the costs in relation to each other. (1) Debt ratio (2) Times interest earned ratio b. Calculate the following profitability ratios for the two companies. Discuss their profitability relative to each other. (1) Operating profit margin (2) Net profit margin (3) Return on total assets (4) Return on common equity c. In what way has the larger debt of Timberland Forest made it more profitable than Pelican Paper? What are the risks that Timberland's investors undertake when they choose to purchase its stock instead of Pelican's?arrow_forwardAs data is attached to the image. You are required to comment/analyze on Feroze 1888 Mills Ltd specifically the following three aspects. i) Chosen companies leverage.ii) Debt management.iii) DuPont variants i.e., profitability, asset efficiency, and leverage.Note: Do not Comment Shortly.arrow_forward

- Webster Company has compiled the information shown in the following table attached: . a. Calculate the weighted average cost of capital using book value weights. b. Calculate the weighted average cost of capital using market value weights. c. Compare the answers obtained in parts a and b. Explain the differences.arrow_forwardThe followings are the instructions for this case. Provide the excel file where the computations are done. GIVE ANSWERS PLEASE. I WILL UPVOTE! You have to use the following equation: WACC = Wd*Rd*(1-t)+We*Re. Where WACC stands for the Weighed average cost of capital, Wd is the weight of debt in the capital could be either market value weight or book value weight and it is calculated in the following way: Wd=D/(E+D), where D is either the book value of debt or the market value of debt, E is the book value of equity or the market value of equity. So keep in mind if you want Wd on book value basis, then both E and D must be on book value basis, if you want Wd on a market value basis, then both E and D must be on market value basis. Rd is the cost of debt (percentage cost of debt), t is the tax rate, We is the weight of equity in the capital could be either market value weight or book value weight, We = E/(E+D), as I explained Wd, it could be either on a book value or book value basis. Re…arrow_forwardDiscuss how such costs might influence the capital structure of the following.(1) A medium sized electronic company entering the home computer market and(2) An established company owning and managing a chain of hotelsarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT

Working capital explained; Author: The Finance Storyteller;https://www.youtube.com/watch?v=XvHAlui-Bno;License: Standard Youtube License