Loose Leaf for Foundations of Financial Management Format: Loose-leaf

17th Edition

ISBN: 9781260464924

Author: BLOCK

Publisher: Mcgraw Hill Publishers

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 5, Problem 16P

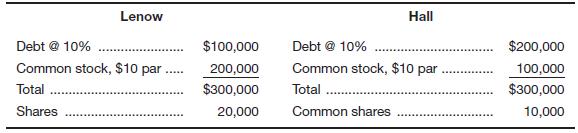

Lenow’s Drug Stores and Hall’s Pharmaceuticals are competitors in the discount drug chain store business. The separate capital structures for Lenow and Hall are presented here:

a. Compute earnings per share if earnings before interest and taxes are

b. Explain the relationship between earnings per share and the level of EBIT.

c. If the cost of debt went up to 12 percent and all other factors remained equal, what would be the break-even level for EBIT?

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Using the DuPont method, evaluate the effects of the following relationships for the Butters Corporation.

a. Butters Corporation has a profit margin of 5.5 percent and its return on assets (investment) is 15.5 percent. What is its assets

turnover?

Note: Round your answer to 2 decimal places.

Assets turnover ratio

b. If the Butters Corporation has a debt-to-total-assets ratio of 25.00 percent, what would the firm's return on equity be?

Note: Input your answer as a percent rounded to 2 decimal places.

Return on equity

%

Return on equity

times

c. What would happen to return on equity if the debt-to-total-assets ratio decreased to 20.00 percent?

Note: Input your answer as a percent rounded to 2 decimal places.

$

You are given the financial information for the Unic Company:

Earnings Before Interest and Tax (EBIT) = $126.58

Corporate tax rate (TC) = 0.21

Debt (D) = $500

Unlevered cost of capital (RU) = 0.20

The cost of debt capital is 10 percent.

Question:

Determine the value of Unic Company equity?

Determine the cost of equity capital for Unic Company?

Determine the WACC for Unic Company?

Margaret O'Flaherty, a portfolio manager for MCF Investments, is considering investing in Alpine Chemical 7% bonds, which mature in

10 years. She asks you to analyze the company to determine the riskiness of the bonds.

Alpine Chemical Company Financial Statements

Years Ended December 31,

($ in millions)

20X1

20X2

20X3

20X4

20X5

20X6

Assets

Cash

$ 55

$

1,637

2,021

190

$

2,143

1,293

157

249

$

1,394

1,258

3,493

1,322

Accounts receivable

3,451

1,643

2,087

Inventories

945

Other current assets

17

27

55

393

33

171

5,097

6,181

Current assets

3,114

5,038

2,543

2,495

3,986

5,757

3,138

3,865

2,707

5,619

2,841

2,778

5,265

4,650

2,177

2,473

Gross fixed assets

7,187

3,893

3,465

2,716

Less: Accumulated depreciation

Net fixed assets

2,619

3,294

Total assets

$6,338

$5,609

$5,485

$6,605

$7,813

$8,559

Liabilities and net worth

Notes payable

Accounts payable

$1,300

338

$

525

2$

750

$1,750

$1,900

673

638

681

743

978

Accrued liabilities

303

172

359

359

483

761

Current liabilities

1,501

1,985

1,997

1,457…

Chapter 5 Solutions

Loose Leaf for Foundations of Financial Management Format: Loose-leaf

Ch. 5 - Discuss the various uses for break-even analysis....Ch. 5 - What factors would cause a difference in the use...Ch. 5 - Explain how the break-even point and operating...Ch. 5 - Prob. 4DQCh. 5 - What does risk taking have to do with the use of...Ch. 5 - Discuss the limitations of financial leverage....Ch. 5 - Prob. 7DQCh. 5 - Explain how combined leverage brings together...Ch. 5 - Explain why operating leverage decreases as a...Ch. 5 - Prob. 10DQ

Ch. 5 - Prob. 1PCh. 5 - Prob. 2PCh. 5 - Prob. 3PCh. 5 - Draw two break-even graphs-one for a conservative...Ch. 5 - Prob. 5PCh. 5 - Shawn Pen & Pencil Sets Inc. has fixed costs of ....Ch. 5 - Calloway Cab Company determines its break-even...Ch. 5 - Prob. 8PCh. 5 - Boise Timber Co. computes its break-even point...Ch. 5 - The Sterling Tire Company’s income statement for...Ch. 5 - Prob. 11PCh. 5 - Healthy Foods Inc. sells 50-pound bags of grapes...Ch. 5 - United Snack Company sells 50-pound bags of...Ch. 5 - Prob. 14PCh. 5 - Prob. 15PCh. 5 - Lenow’s Drug Stores and Hall’s Pharmaceuticals...Ch. 5 - The capital structure for Cain Supplies is...Ch. 5 - Sterling Optical and Royal Optical both make glass...Ch. 5 - Prob. 19PCh. 5 - Sinclair Manufacturing and Boswell Brothers Inc....Ch. 5 - DeSoto Tools Inc. is planning to expand...Ch. 5 - Prob. 23PCh. 5 - Prob. 24PCh. 5 - Prob. 25PCh. 5 - Mr. Gold is in the widget business. He currently...Ch. 5 - Delsing Canning Company is considering an...Ch. 5 - Prob. 2WECh. 5 - Now click on "Financials." Look at the Income...Ch. 5 - Prob. 4WECh. 5 - Prob. 5WE

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Ilumina Corp is trying to determine its optimal capital structure. The company’s capital structure consists of debt and common stock. In order to estimate the cost of debt, the company has produced the following table: Percent financed with debt (wd) Percent financed with equity (wc) Debt-to-equity ratio (D/S) After-tax cost of debt (%) 0.25 0.75 0.25/0.75 = 0.33 6.9% 0.35 0.65 0.35/0.65 = 0.5385 7.1% 0.50 0.50 0.50/0.50 = 1.00 8.0% The company uses the CAPM to estimate its cost of common equity, rs. The risk-free rate is 5% and the market risk premium is 6%. Ilumina estimates that its beta with 10% debt is 1. The company’s tax rate, T, is 40%. On the basis of this information, what is the company’s optimal capital structure, and what is the firm’s cost of capital at this optimal capital structure? (Please show work)arrow_forwardUsing the DuPont method, evaluate the effects of the following relationships for the Butters Corporation. A.Butters Corporation has a profit margin of 5.5 percent and its return on assets (investment) is 8.75 percent. What is its assets turnover? Round your answer to 2 decimal places. ______ times B.If the Butters Corporation has a debt-to-total-assets ratio of 65.00 percent, what would the firm’s return on equity be? Note: Input your answer as a percent rounded to 2 decimal places. C.What would happen to return on equity if the debt-to-total-assets ratio decreased to 60.00 percent? Input your answer as a percent rounded to 2 decimal places.arrow_forwardPlease if you can help with these 2, better skip pls Assume the following relationships for the Caulder Corp.: Sales/Total assets 1.5× Return on assets (ROA) 8.0% Return on equity (ROE) 15.0% Calculate Caulder's profit margin and debt-to-capital ratio assuming the firm uses only debt and common equity, so total assets equal total invested capital. Do not round intermediate calculations. Round your answers to two decimal places. Profit margin: % Debt-to-capital ratio: % 2. Thomson Trucking has $9 billion in assets, and its tax rate is 25%. Its basic earning power (BEP) ratio is 11%, and its return on assets (ROA) is 5.25%. What is its times-interest-earned (TIE) ratio? Round your answer to two decimal places.arrow_forward

- A1 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 A B V 1 X Sales Costs Net income ✓ C Income statement $ Sales increase Payout rate fx $ Dividends Add. To RE D 36,000 29,800 6,200 15% 50% Pro forma income statement Sales Costs Net income E F G Assets $ Total $ Assets H Total I Balance sheet 26,400 Debt Equity 26,400 Total Complete the following analysis. Do not hard code values in your calculations. Pro forma balance sheet Debt Equity Total $ External financing needed $ J 6,300 20,100 26,400 Karrow_forwardAssume you are given the following relationships for the Haslam Corporation: Calculate Haslam’s profit margin and liabilities-to-assets ratio. Suppose half its liabilities are in the form of debt. Calculate the debt-to-assets ratio.arrow_forwardAssume that the current ratio for Arch Company is 3.5, its acid-test ratio is 2.0, and its working capital is $360,000. Answer each of the following questions independently, always referring to the original information. Required: How much does the firm have in current liabilities? Note: Do not round intermediate calculations. If the only current assets shown on the balance sheet for Arch Company are Cash, Accounts Receivable, and Merchandise Inventory, how much does the firm have in Merchandise Inventory? Note: Do not round intermediate calculations. If the firm collects an account receivable of $119,000, what will its new current ratio and working capital be?arrow_forward

- Consider the following simplified financial statements for the Yoo Corporation. Assume there are no income taxes and the company pays out half of net income in the form of a cash dividend. Costs and assets vary with sales, but debt and equity do not. Prepare the pro forma statements and determine the external financing needed. Income statement $ Sales Costs Net income Sales increase Payout rate 36,000 29,800 $ 6,200 Dividends ALL 15% 50% Pro forma income statement Sales Costs Net income Balance sheet 26,400 Debt Equity Total $ 26,400 Total Assets $ Complete the following analysis. Do not hard code values in your calculations. Pro forma balance sheet Debt Assets Total Equity Total $ External financing needed $ 6,300 20,100 26,400arrow_forwardAssume that the current ratio for Arch Company is 3.5, its acid-test ratio is 1.5, and its working capital is $330,000. Answer each of the following questions independently, always referring to the original information. Required: a. How much does the firm have in current liabilities? Note: Do not round intermediate calculations. b. If the only current assets shown on the balance sheet for Arch Company are Cash, Accounts Receivable, and Merchandise Inventory, how much does the firm have in Merchandise Inventory? Note: Do not round intermediate calculations. c. If the firm collects an account receivable of $101,000, what will its new current ratio and working capital be? Note: Round "Current ratio" to 1 decimal place. d. If the firm pays an account payable of $53,000, what will its new current ratio and working capital be? Note: Do not round intermediate calculations. Round "Current ratio" to 1 decimal place. e. If the firm sells inventory that was purchased for $50,000 at a cash price…arrow_forwardAaron Athletics is trying to determine its optimal capital structure. The company’s capital structure consists of debt and common equity. In order to estimate the cost of capital at various debt levels the company has constructed the following table: Percent financed with debt (wD) Percent financed with equity (ws) Before tax cost of debt 0.10 0.90 7.0% 0.20 0.80 7.2% 0.30 0.70 8.0% 0.40 0.60 8.8% 0.50 0.50 9.6% The company uses the CAPM to estimate its cost of equity, rS . The risk-free rate is 4% and the market risk premium is 5%. Aaron estimates that if it had no debt its beta would be 1.0. (It’s unlevered beta equals 1.0). The company’s tax rate is 40%. On the basis of this information, what is the company’s optimal capital structure, and what is the WACC at that capital structure? (Show your calculations at each debt level).arrow_forward

- Assume you are given the following relationships for the Clayton Corporation: Sales/total assets 1.5 Return on assets (ROA) 3% Return on equity (ROE) 5% Calculate Clayton's profit margin and debt ratio.arrow_forwardCalculate the following ratios based on the balance sheet, income statement and cash flow prepared in question ROE Return on Capital Employed (post-tax) Net Profit Margin EBITDA Margin Effective Tax Rate Operating Cost Ratio Gross Profit Margin Total Asset Turnover Ratio Fixed Asset Turnover Ratio Receivables Turnover Ratio Leverage Ratio [Avg. Total Assets / Avg. Total Equity] FCF / EBITDA Interest Coverage Ratio Debt Service Coverage Ratio Basic EPS (Assume Face Value of each share is INR 10) Debt : Equity Ratio Income Statement (INR Cr) Units Mar/14 Saleable Units 4,570 Revenues Gross Revenues INR Cr 2,116 Less: Environment Cess INR Cr 5 Net Revenues INR Cr 2,121 Growth (%) -1.9% Expenses O&M Expenses (% of Project Costs) INR Cr 146 YoY Escalation 5.72% EBITDA INR Cr 1,974 Margin (%) 93.1% Book Depreciation INR Cr 439 Interest Expenses INR…arrow_forwardThe Amer Company has the following characteristics:Sales 1,000Total assets 1,000Total debt/Total assets 35.00%Basic earning power (BEP) ratio 20.00%Tax rate 40.00%Interest rate on total debt 4.57%What is Amer’s ROE?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT

Financial ratio analysis; Author: The Finance Storyteller;https://www.youtube.com/watch?v=MTq7HuvoGck;License: Standard Youtube License