Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

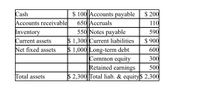

Wu Systems has the following

Transcribed Image Text:$ 100 Accounts payable

650 Accruals

550 Notes payable

$ 1,300 Current liabilities

$ 1,000| Long-term debt

Common equity

Retained earnings

$ 2,300 Total liab. & equity$ 2,300

Cash

$ 200

Accounts receivable

110

590

$ 900

Inventory

Current assets

Net fixed assets

600

300

500

Total assets

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- What is the weighted average cost of capital (WACC)? The cost of all of the capital for a project or company The cost of all of the equity for a project or company The cost of all of the debt for a project or company The cost of all of the venture capital for a project or companyarrow_forwardThe balance sheet contributes to financial reporting by providing a basis for all of the following except Group of answer choices evaluating the capital structure of the enterprise. assessing the liquidity and financial flexibility of the enterprise. determining the increase in cash due to operations. computing rates of return.arrow_forwardWhich of the following is not true about the information provided in the income statement? OIt helps in evaluating the past performance of the enterprise. O It provides a basis for predicting future performance. It helps assess the risk or uncertainty of generating future cash flows. O It helps in evaluating working capital.arrow_forward

- Which of the following would increase cash flow for a firm? a. A purchase of fixed assets b. Cash sales c. Purchase of markatable securities d. Credit salesarrow_forwardThe finance balance sheet is is the same as the accounting balance sheet which is used to determine the firm's capital structure the same as the accounting balance sheet, but it does not have to balance. the same as the accounting balance sheet but uses historical values. based on market values and is used to determine the firm's capital structurearrow_forwardA company's cost of capital refers to Multiple Choice O O the rate management expects to pay on all borrowed and equity funds. the total cost of a capital project. cost of printing and registering common stock shares. the rate of return earned on total assets.arrow_forward

- What is the primary purpose of computing the cost of capital? a. To determine the market value of the company's shares b. To assess the company's liquidity position c. To evaluate the profitability of investment projects d. To compare the company's performance with industry peersarrow_forwardWhat are three steps involved in the calculation of cost of capital for the company.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education