DeSoto Tools Inc. is planning to expand production. The expansion will cost

After the expansion, sales are expected to increase by

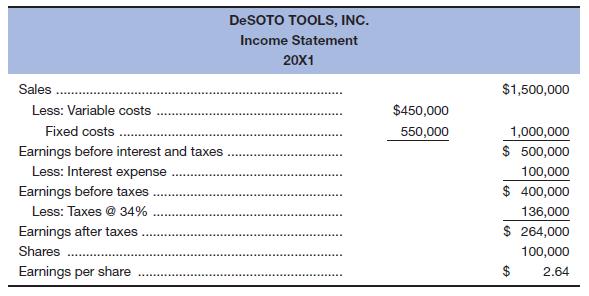

a. Calculate the degree of operating leverage, the degree of financial leverage, and the degree of combined leverage before expansion. (For the degree of operating leverage, use the formula developed in footnote 2; for the degree of combined leverage, use the formula developed in footnote 3. These instructions apply throughout this problem.)

b. Construct the income statement for the two alternative financing plans.

c. Calculate the degree of operating leverage, the degree of financial leverage, and the degree of combined leverage, after expansion.

d. Explain which financing plan you favor and the risks involved with each plan.

Want to see the full answer?

Check out a sample textbook solution

Chapter 5 Solutions

Loose Leaf for Foundations of Financial Management Format: Loose-leaf

- The Rodriguez Company is considering an average-risk investment in a mineral water spring project that has an initial after-tax cost of 170,000. The project will produce 1,000 cases of mineral water per year indefinitely, starting at Year 1. The Year-1 sales price will be 138 per case, and the Year-1 cost per case will be 105. The firm is taxed at a rate of 25%. Both prices and costs are expected to rise after Year 1 at a rate of 6% per year due to inflation. The firm uses only equity, and it has a cost of capital of 15%. Assume that cash flows consist only of after-tax profits because the spring has an indefinite life and will not be depreciated. a. What is the present value of future cash flows? (Hint: The project is a growing perpetuity, so you must use the constant growth formula to find its NPV.) What is the NPV? b. Suppose that the company had forgotten to include future inflation. What would they have incorrectly calculated as the projects NPV?arrow_forwardTowson Industries is considering an investment of $256,950 that is expected to generate returns of $90,000 per year for each of the next four years. What Is the Investments internal rate of return?arrow_forwardA manufacturing company is considerign the purchase of new machinery to increase its production capacity. The company has identified a new machine that costs $500,000 and is expected to increase production by 20%. The company expects to sell the additional products for $600,000, resulting in a net profit of $100,000. The company can finance the purchase through a bank loan with an interest rate of 5% over a five year term. What is the expected return on investment (ROI) for the purchase of the new machinery 5% 10% 20% 25%arrow_forward

- Blossom Corp. management is planning to convert an existing warehouse into a new plant that will increase its production capacity by 45 percent. The cost of this project will be $8,467,824. It will result in additional cash flows of $2,312,200 for the next eight years. The discount rate is 11.83 percent. What is the Payback period, NPV, and IRR?arrow_forwardPhillips Refining plans to expand capacity by purchasing equipment that will provide additional smelting capacity. The cost of the initial investment is expected to be $16 million. The company expects revenue to increase by $3.8 million per year after the expansion. If the company’s MARR is 18% per year, how long will it take for the company to recover its investment? Identify the engineering economy symbols involved and their values.arrow_forwardAcme Inc. has invested $50,000 in a new assembly line. Products produced by the new assembly line are sold for $100 per unit. Fixed annual costs are $10,000 while variable annual costs are $10 per unit. The assembly line will remain in operation for 10 years, after which it will be sold for $15,000. The company has a MARR of 15%. What is the minimum annual production volume required to generate a profit?arrow_forward

- The company is looking to invest $800,000 for two addition lines for production. Our current ROI targets are at 15%. These two lines would then produce annual profits of $65,000 for each line. Do you think the company should move forward with this purchase?arrow_forwardDeSoto Tools Incorporated is planning to expand production. The expansion will cost $2,200,000, which can be financed either by bonds at an interest rate of 9 percent or by selling 44,000 shares of common stock at $50 per share. The current income statement before expansion is as follows: DESOTO TOOLS INCORPORATEDIncome Statement 20X1 Sales $ 3,020,000 Variable costs 906,000 Fixed costs 802,000 Earnings before interest and taxes $ 1,312,000 Interest expense 420,000 Earnings before taxes $ 892,000 Taxes @ 35% 312,200 Earnings after taxes $ 579,800 Shares 120,000 Earnings per share $ 4.83 After the expansion, sales are expected to increase by $1,520,000. Variable costs will remain at 30 percent of sales, and fixed costs will increase to $1,354,000. The tax rate is 35 percent. Calculate the degree of operating leverage, the degree of financial leverage, and the degree of combined leverage before expansion. (For the degree of operating leverage, use the formula:…arrow_forwarda company is considering the purchase of a new machine for 480,000. Management predicts that the machine can produce sales of 180,000 each year for the next 10 years. Expenses are expected to include direct materials, direct labor, and factory overhead totaling 120,000 per year including depreciation of 30,000 per year. The company's tax rate is 40%. What is the payback period for the new machine?arrow_forward

- ABC Manufacturing expects to sell 1,025 units of product in 2022 at an average price of $100,000 each based on current demand. The Chief Marketing Officer forecasts growth of 50 units per year through 2026. So, the demand will be 1,025 units in 2022, 1,075 units in 2023, etc. and the $100,000 price will remain consistent for all five years of the investment life. However, ABC cannot produce more than 1,000 units annually based on current capacity. In order to meet demand, ABC must either update the current plant or replace it. If the plant is replaced, an initial working capital investment of $6,000,000 is required and these funds will be released at the end of the investment life to be used elsewhere. The following table summarizes the projected data for both options: Update Replace Initial investment in 2022 $ 125,000,000 $ 130,000,000 Terminal salvage value in 2026 $ 8,000,000 $…arrow_forwardJordan Corporation is considering a new product that will be very popular for a couple of years and then slowly lose its commercial appeal. Sales are projected to be $90,000 in year one, $100,000 in year two, $60,000 in year three, $40,000 in year four, $20,000 in year five, and $10,000 in the final year six. Expenses are expected to be 30% of sales with net working capital requirements to be 15% of the following time period’s revenue. Equipment of $126,000 will be required for the launch of the product; this equipment can be depreciated straight-line over six years and will be worthless at the end of the project. The Tax Rate is 22% and the opportunity cost of capital is 14.5%. What is the Internal Rate of Return (rounded to two places)?arrow_forwardJordan Corporation is considering a new product that will be very popular for a couple of years and then slowly lose its commercial appeal. Sales are projected to be $90,000 in year one, $100,000 in year two, $60,000 in year three, $40,000 in year four, $20,000 in year five, and $10,000 in the final year six. Expenses are expected to be 40% of sales with net working capital requirements to be 15% of the following time period’s revenue. Equipment of $126,000 will be required for the launch of the product; this equipment can be depreciated straight-line over six years and will be worthless at the end of the project. The Tax Rate is 20% and the opportunity cost of capital is 14.5%. What is the Internal Rate of Return (rounded to two places)? Multiple Choice 32.61% None of the above 13.39% 18.32% 19.46%arrow_forward

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College