Loose Leaf for Foundations of Financial Management Format: Loose-leaf

17th Edition

ISBN: 9781260464924

Author: BLOCK

Publisher: Mcgraw Hill Publishers

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 5, Problem 17P

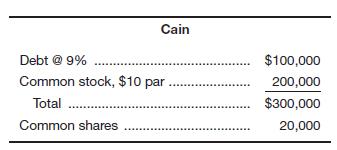

The capital structure for Cain Supplies is presented below. Compute the stock price for Cain if it sells at 19 times earnings per share and EBIT is

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Shoobee, Inc. has asked its financial manager to measure the cost of each specific type of capital as well as the weighted average of capital. The WACC it to be measured by using the following weights:

50% long term, 10% preferred stock, and 40% common stock equity (retained earnings, new common stock issuance, or both). The firm tax is 25%.

Debt: The firm can sell for P980, a 10-year, P1,000 par value bond paying annual interest at 13% coupon rate. A flotation cost of 3% of the par value is required in addition to the discount of P20 per bond.

Preferred stock: 8 percent (annual dividend) preferred stock having a par value of P100 can be sold for P65. An additional fee of P2.00 per share must be paid to the underwriters.

Common stock: The firm’s common stock is currently selling for P50 per share. The recent dividend paid was P4.00 per share. Its dividend payments which have approximately 60% of earnings per share in each past 6 years follows:

Year

Dividend

2021

P4.00

2020

3.75…

Planet Express has liabilities of $400 and assets of $1000. The average YTM on its debt is 10% and the tax rate is 20%. The company has announced $1 annual dividends in perpetuity and has a stock price of $5. What is the company’s weighted average cost of capital (WACC)? Why is the tax rate included in the WACC? How can the WACC be used to evaluate potential investments?

Munich Re Inc. is expected to pay a dividend of $4.82 in one year, which is expected to grow by 4% a year forever. The stock currently sells for $72 a share.

The before-tax cost of debt is 6% and the tax rate is 34%.

The target capital structure consists of 30% debt and 70% equity.

What is the company's weighted average cost of capital?

Chapter 5 Solutions

Loose Leaf for Foundations of Financial Management Format: Loose-leaf

Ch. 5 - Discuss the various uses for break-even analysis....Ch. 5 - What factors would cause a difference in the use...Ch. 5 - Explain how the break-even point and operating...Ch. 5 - Prob. 4DQCh. 5 - What does risk taking have to do with the use of...Ch. 5 - Discuss the limitations of financial leverage....Ch. 5 - Prob. 7DQCh. 5 - Explain how combined leverage brings together...Ch. 5 - Explain why operating leverage decreases as a...Ch. 5 - Prob. 10DQ

Ch. 5 - Prob. 1PCh. 5 - Prob. 2PCh. 5 - Prob. 3PCh. 5 - Draw two break-even graphs-one for a conservative...Ch. 5 - Prob. 5PCh. 5 - Shawn Pen & Pencil Sets Inc. has fixed costs of ....Ch. 5 - Calloway Cab Company determines its break-even...Ch. 5 - Prob. 8PCh. 5 - Boise Timber Co. computes its break-even point...Ch. 5 - The Sterling Tire Company’s income statement for...Ch. 5 - Prob. 11PCh. 5 - Healthy Foods Inc. sells 50-pound bags of grapes...Ch. 5 - United Snack Company sells 50-pound bags of...Ch. 5 - Prob. 14PCh. 5 - Prob. 15PCh. 5 - Lenow’s Drug Stores and Hall’s Pharmaceuticals...Ch. 5 - The capital structure for Cain Supplies is...Ch. 5 - Sterling Optical and Royal Optical both make glass...Ch. 5 - Prob. 19PCh. 5 - Sinclair Manufacturing and Boswell Brothers Inc....Ch. 5 - DeSoto Tools Inc. is planning to expand...Ch. 5 - Prob. 23PCh. 5 - Prob. 24PCh. 5 - Prob. 25PCh. 5 - Mr. Gold is in the widget business. He currently...Ch. 5 - Delsing Canning Company is considering an...Ch. 5 - Prob. 2WECh. 5 - Now click on "Financials." Look at the Income...Ch. 5 - Prob. 4WECh. 5 - Prob. 5WE

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Dillon Labs has asked its financial manager to measure the cost of each specific type of capital as well as the weighted average cost of capital. The weighted average cost is to be measured by using the following weights: 30% long-term debt, 10% preferred stock, and 60% common stock equity (retained earnings, new common�� stock, or both). The firm's tax rate is 23%. Debt : The firm can sell for $1030 a 14-year, $1,000-par-value bond paying annual interest at a 8.00% coupon rate. A flotation cost of 2% of the par value is required. Preferred stock: 9.00% (annual dividend) preferred stock having a par value of $100 can be sold for $92.An additional fee of $2 per share must be paid to the underwriters. Common stock: The firm's common stock is currently selling for $90 per share. The stock has paid a dividend that has gradually increased for many years, rising from $2.00 ten years ago to the $3.26 dividend payment, D0, that the company just recently made.…arrow_forwardSarensen Systems Inc. is expected to pay a dividend of $2.50 at year end (D), the dividend is expected to grow at a constant rate of 5.50% a year, and the common stock currently sells for $ 37.50 a share. The before -tax cost of debt is 7.50 %, and the tax rate is 40% . The target capital structure consists of 45% debt and 55% common equity.What is the company's WACC if all the equity used is from retained earnings?arrow_forwardSerenity Systems Inc. is expected to pay a $2.50 dividend at year end (D, = $2.50), the dividend is expected to grow at a constant rate of 5.50% a year, and the common stock currently sells for $52.50 a share. The before-tax cost of debt is 7.50%, and the tax rate is 40%. The target capital structure consists of 45% debt and 55% common equity. What is the company's WACC if all the equity used is from retained earnings?arrow_forward

- Dillon Labs has asked its financial manager to measure the cost of each specific type of capital as well as the weighted average cost of capital. The weighted average cost is to be measured by using the following weights: 30% long-term debt, 10% preferred stock, and 60% common stock equity (retained earnings, new common stock, or both). The firm's tax rate is 23%. Debt : The firm can sell for $1030 a 14-year, $1,000-par-value bond paying annual interest at a 8.00% coupon rate. A flotation cost of 2% of the par value is required. Preferred stock: 9.00% (annual dividend) preferred stock having a par value of $100 can be sold for $92.An additional fee of $2 per share must be paid to the underwriters. Common stock: The firm's common stock is currently selling for $90 per share. The stock has paid a dividend that has gradually increased for many years, rising from $2.00 ten years ago to the $3.26 dividend payment, D0, that the company just recently made.…arrow_forwardSteph & Sons has a capital structure that consists of 20 percent equity and 80 percent debt. The company expects to report $3 million in net income this year, and 60 percent of the net income will be paid out as dividends. What is the equity structure of the target capital structure?arrow_forwardABC Inc. is expected to pay a $2.50 dividend at year end (D1 = $2.50), the dividend is expected to grow at a constant rate of 5.50% a year, and the common stock currently sells for $52.50 a share. The before-tax cost of debt is 7.50% and the tax rate is 40%. The target capital structure consist of debt and 55% common equity. What is the companys WACC if all the equity used is from retained earnings?arrow_forward

- Sorensen Systems Inc. is expected to pay a $2.50 dividend at year end (D1 = $2.50), the dividend is expected to grow at a constant rate of 5.50% a year, and the common stock currently sells for $87.50 a share. The before-tax cost of debt is 7.50%, and the tax rate is 25%. The target capital structure consists of 45% debt and 55% common equity. What is the company's WACC if all the equity used is from retained earnings? Do not round your intermediate calculations.arrow_forwardSorensen Systems Inc. is expected to pay a $2.50 dividend at year end (D1 = $2.50), the dividend is expected to grow at a constant rate of 5.50% a year, and the common stock currently sells for $87.50 a share. The before-tax cost of debt is 7.50%, and the tax rate is 25%. The target capital structure consists of 45% debt and 55% common equity. What is the company's WACC if all the equity used is from retained earnings? Do not round your intermediate calculations. a. 5.69% b. 7.35% c. 5.10% d. 7.13% e. 6.62%arrow_forwardYou are given the following information for Lighting Power Company. Assume the company's tax rate is 25 percent. Debt: Common stock: 430,000 shares outstanding, selling for $61 per share; the beta is 1.12. 18,500 shares of 3.7 percent preferred stock outstanding, a $100 par value, currently selling for $82 per share. 6 percent market risk premium and 4.7 percent risk-free rate. What is the company's WACC? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g.. 32.16.) Preferred stock: Market: 10,000 5.9 percent coupon bonds outstanding. $1,000 par value, 25 years to maturity, selling for 107 percent of par; the bonds make semiannual payments. WACC %arrow_forward

- Tarbox Tobacco Inc. is all equity financed and generates perpetual annual EBIT of $300. Assume that the EBIT, and all other cash flows, occur at year end and that we are currently at the beginning of a year. Assume that Tarbox has a 100% payout rate. Tarbox has 1, 500 shares outstanding. The stock holders of Tarbox require a return of 5%. Assume that the tax rate is 0%. What is the price per share for Tarbox stock? (Round to the nearest whole number.)arrow_forwardReingaart Systems is expected to pay a $3.4 dividend at year end (D1 = $3.4), the dividend is expected to grow at a constant rate of 5.8% a year, and the common stock currently sells for $65 a share. The before-tax cost of debt is 7.8%, and the tax rate is 29%. The target capital structure consists of 56% debt and 44% common equity. What is the company's WACC if all equity is from retained earnings? O 8.55% O 7.65% O 7.95% O 7.35% 8.25%arrow_forwardBob-Bye, Inc. has asked its financial manager to measure the cost of each specific type of capital as well as the weighted average cost of capital. The WACC is to be measured by using the following weights:: 40% long term debt, 10% preferred stock, and 50% common stock equity (retained earnings,new common stock or both). The firm’s tax is 30%. Debt: The firm can sell for P980, a 10-year, P1,000 par value bond paying annual interest at 13% coupon rate. A flotation cost of 3% of the par value is required in addition to the discount of P20 per bond. Preferred Stock: 8 percent (annual divided) preferred stock having a par value of P100 can be sold for P65. An additional fee of P2 per share must be paid to the underwriters. Common Stock: The firm’s common stock is currently selling for P50 per share. The dividend expected to be paid at the end of the coming year is P4 per share.. Its dividend payments which have been approximately 60% of earnings per share in each of the past 5…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education

What is WACC-Weighted average cost of capital; Author: Learn to invest;https://www.youtube.com/watch?v=0inqw9cCJnM;License: Standard YouTube License, CC-BY