Loose Leaf for Foundations of Financial Management Format: Loose-leaf

17th Edition

ISBN: 9781260464924

Author: BLOCK

Publisher: Mcgraw Hill Publishers

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 3, Problem 6P

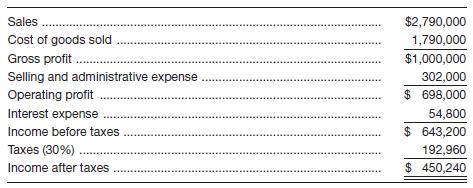

Dr. Zhivà€go Diagnostics Corp.’s income statement for 20X1 is as follows:

a. Compute the profit margin for 20X1.

b. Assume that in 20X2, sales increase by 10 percent and cost of goods sold increases by 20 percent. The firm is able to keep all other expenses the same. Assume a tax rate of 30 percent on income before taxes. What is income after taxes and the profit margin for 20X2?

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

The net profit margin tells how much profit a company makes for every dollar it generates in revenue. If N is the net income (the income after taxes have been paid) and R is the total revenue, then the net profit margin M is given by

M(N, R) = .

A certain company pays a tax rate of 10% on its income.

(a) Use I for the income before taxes, and express the net income N in terms of I. (Be careful: N is the part of I left after taxes-not the part you pay in taxes.)

N =

(b) Use a formula to express the net profit margin in terms of the variables I and R.

M =

In this problem, p is the price per unit in dollars and q is the number of units.

Suppose the weekly demand for a product is given by p + 2g = 840 and the weekly supply before taxation is given by p = 0.02g2 + 0.55g + 7.4. Find the tax per item that produces

maximum tax revenue. (Round your answer to the nearest cent.)

$ 483.17

Find the tax revenue. (Round your answer to the nearest whole dollar.)

$ 40,089

The net profit margin tells how much profit a company makes for every dollar it generates in revenue. If N is the net income (income after taxes have been paid) and R is the total revenue, then the net profit margin M is M (N,R) =N/R. This company pays a tax rate of 35% on its income.

A) let I represent the company’s income before taxes. Express N as a function of I. (n is the part of I left after taxes)

B) express M in terms of I and R

Chapter 3 Solutions

Loose Leaf for Foundations of Financial Management Format: Loose-leaf

Ch. 3 - If we divide users of ratios into short-term...Ch. 3 - Explain how the Du Pont system of analysis breaks...Ch. 3 - If the accounts receivable turnover ratio is...Ch. 3 - Prob. 4DQCh. 3 - Is there any validity in rule-of-thumb ratios for...Ch. 3 - Why is trend analysis helpful in analyzing ratios?...Ch. 3 - Inflation can have significant effects on income...Ch. 3 - What effect will disinflation following a highly...Ch. 3 - Why might disinflation prove favorable to...Ch. 3 - Comparisons of income can be very difficult for...

Ch. 3 - Low Carb Diet Supplement Inc. has two divisions....Ch. 3 - Database Systems is considering expansion into a...Ch. 3 - Prob. 3PCh. 3 - Prob. 4PCh. 3 - Prob. 5PCh. 3 - Dr. Zhivà€go Diagnostics Corp.’s income...Ch. 3 - The Haines Corp. shows the following financial...Ch. 3 - Easter Egg and Poultry Company has $2,000,000 in...Ch. 3 - Prob. 9PCh. 3 - Prob. 10PCh. 3 - Baker Oats had an asset turnover of 1.6 times per...Ch. 3 - AllState Trucking Co. has the following ratios...Ch. 3 - Front Beam Lighting Company has the following...Ch. 3 - Prob. 14PCh. 3 - Prob. 15PCh. 3 - Jerry Rice and Grain Stores has $4,780,000 in...Ch. 3 - Prob. 17PCh. 3 - Prob. 18PCh. 3 - Prob. 19PCh. 3 - Prob. 20PCh. 3 - Jim Short’s Company makes clothing for schools....Ch. 3 - The balance sheet for Stud Clothiers is shown...Ch. 3 - The Lancaster Corporation’s income statement is...Ch. 3 - Prob. 24PCh. 3 - Prob. 25PCh. 3 - Prob. 26PCh. 3 - Prob. 27PCh. 3 - Prob. 28PCh. 3 - The Global Products Corporation has three...Ch. 3 - Prob. 30PCh. 3 - Prob. 31PCh. 3 - Prob. 32PCh. 3 - Prob. 33PCh. 3 - Prob. 34PCh. 3 - The following information is from Harrelson...Ch. 3 - Using the financial statements for the Snider...Ch. 3 - Given the financial statements for Jones...Ch. 3 - Prob. 2WE

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- A company has the following income statement. What is its net operating profit after taxes (NOPAT)? Round it to a whole dollar. Will need to find EBIT first. Sales $ 1,050 Costs 600 Depreciation 170 EBIT $ ? Interest expense 50 EBT $ ? Taxes (24%) ? Net income $ ?arrow_forward2. You have the following information: Sales= JD 300 000 Net profit margin= 20%. Required: Calculate Net Incomearrow_forwardAssuming Sunny-D Cafe has a tax rate of 30 percent, calculate sales for the firm given the following financial information: net income of $37,900; interest expense of $11,500; depreciation expense of $14,200; and costs of $80,900. Points: 1 A. $144,500 B. $154,143 C. $160,743 D. $165,114 E. Remember to breathearrow_forward

- Please do both of the questions below:- 1. Use the following information to work out the net profit before tax:Cost of sales. $60,000 Interest payable. $4000 expenses. $20,000. sales turnover. $100,000 2. Vindhya Limited earns $200,000 in sales, has expenses of $80,000 and cost of goods sold amount to $90,000. What is the firm's gross profit?arrow_forwardA firm's income statement included the following data. The firm's average tax rate was 30%. (Round each step to the nearest dollar.) Cost of goods sold Income taxes paid Administrative expenses Interest expense Depreciation a. What was the firm's net income? Net income b. What must have been the firm's revenues? Revenues c. What was EBIT? EBIT tA $ 7,600.00 11,271.00 1,900.00 2,600.00 3,200.00 LAarrow_forwardAssume that sales of the Standard racket increase by $21,800. What would be the effect on net operating income? What would be the effect if Pro racket sales increased by $21,800? Do not prepare income statements; use the incremental analysis approach in determining your answer.arrow_forward

- 2. Conceptual Connection: Compute net profit margin for ERS. Round your answer to one decimal place. 6.6 % A If ERS is able to increase its service revenue by $100,000, what should be the effect on future income? If ERS had an incremental increase in revenue of $100,000, based on the net profit margin computed, what is the additional potential profit? 3. Conceptual Connection: Assume that ERS net profit margin was 8.5% for 2018. As an investor, what conclusions might you draw about ERS' future profitability? A declining profit margin implies that ERS is having difficulty maintaining control over its expenses.arrow_forward7. If net sales amounted to P200,000, net income before tax is P80,000 and the income tax rate is 30%, how much is the profit margin ratio? *a. 0.40b. 0.28c. 2.5d. 3.57 8. Interest expense for the year amounted to P90,000. Income tax expense is P100,000. If net income after tax is P620,000, what is the times interest earned ratio? *a. 6.2b. 9c. 6.888d. P720,000arrow_forwardA company has the following income statement. What is its net operating profit after taxes (NOPAT)? Round it to a whole dollar. Sales $ 1,200 Costs 600 Depreciation 170 EBIT $ ? Interest expense 50 EBT $ ? Taxes (20%) ? Net income $ ?arrow_forward

- A. Wally asks you to create an Income Statement for 2020 using the information below. 1. 2020 sales were 150% of last year’s sales2. Gross profit margin was 55%3. Operating profit margins were 15% 4. Interest expense fell to 7%, given a change in interest rates 5. The tax rate was 30% B. Based on the change in Income between 2020 and 2019, how would you say AndrewCo is doing?arrow_forwardKeller Cosmetics maintains an operating profit margin of 8.15% and a sales-to-assets ratio of 3.20. It has assets of $530,000 and equity of $330,000. Assume that interest payments are $33,000 and the tax rate is 30%. a. What is the return on assets? b. What is the return on equity? Note: For all requirement, enter your answers as a percent rounded to 2 decimal places. a. Return on assets b. Return on equity % %arrow_forwardProblem #1: Proforma Statements Prepare a common size income statement given the following information: Revenues = $100,000 COGS = $43,000 SG&A = $22,000 Interest Owed = $5,000 Tax Rate = 40% Problem #2: Proforma Statements Prepare a pro forma income statement from the data and common size income statement from #1, assuming that the sales will grow by 5% and all expenses but interest and taxes will scale with sales. 1, Use your plan of action to solve each problem, clearly outlining the procedures used, providing a concise explanation of each step, labeling relevant formulas, and showing worked out calculations and complete solutions. You may use an Excel spreadsheet or a calculator to help you perform the necessary calculations, but all corresponding work must be shown completely. 2. Answer all questions posed in the problem; if applicable, analyze and evaluate your results and provide a contextual explanation of the solutions you obtained. 3. Review your…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning

FIN 300 Lab 1 (Ryerson)- The most Important decision a Financial Manager makes (Managerial Finance); Author: AllThingsMathematics;https://www.youtube.com/watch?v=MGPGMWofQp8;License: Standard YouTube License, CC-BY

Working Capital Management Policy; Author: DevTech Finance;https://www.youtube.com/watch?v=yj-XbIabmFE;License: Standard Youtube Licence