Managerial Accounting: The Cornerstone of Business Decision-Making

7th Edition

ISBN: 9781337115773

Author: Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 3, Problem 40E

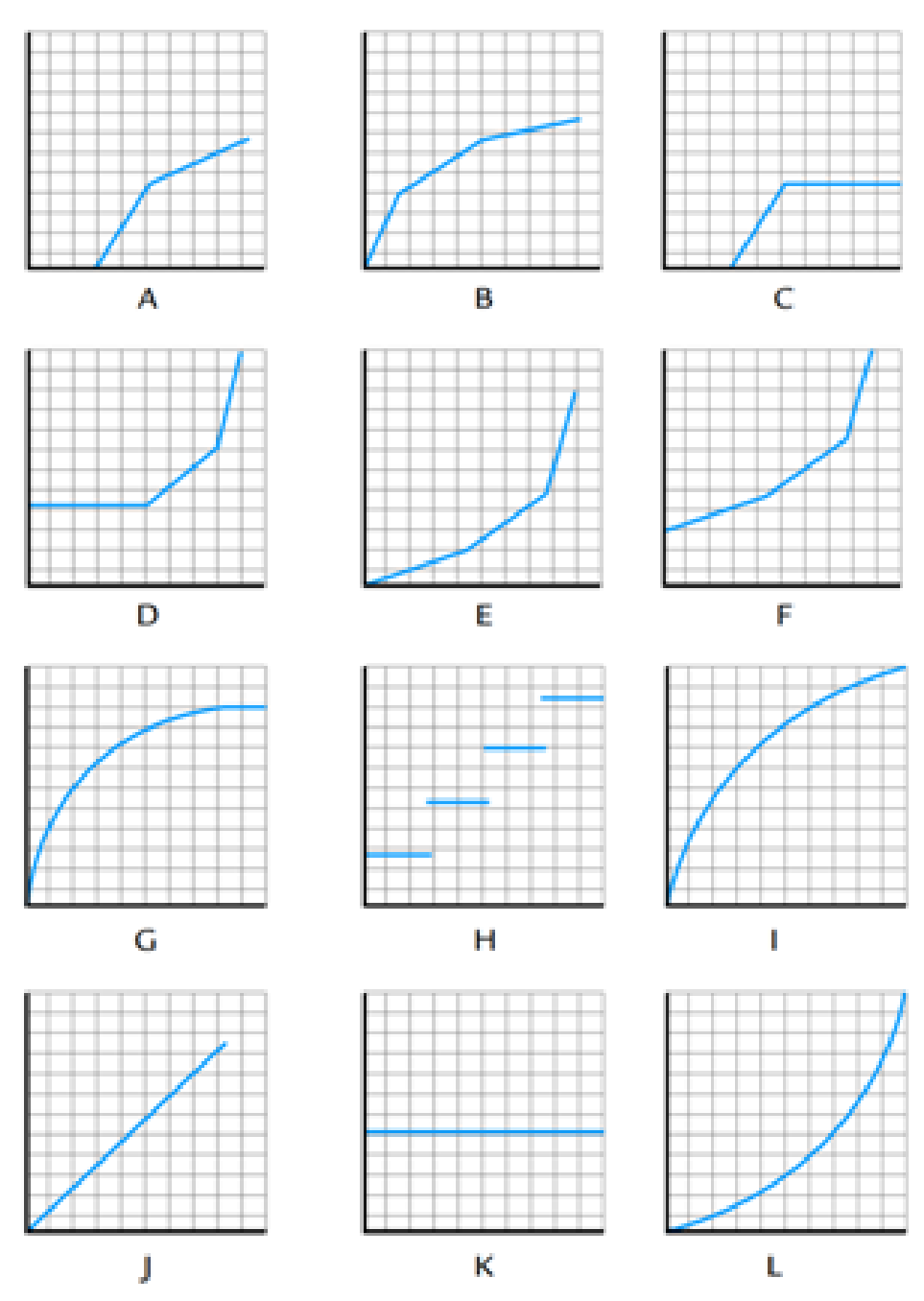

Matching Cost Behavior Descriptions to Cost Behavior Graphs

Select the graph (A through L) that best matches the numbered (1 through 7) italicized descriptions of various cost behavior. For each graph, the vertical (y) axis represents total dollars of cost, and the horizontal (x) axis represents output units during the period. The graphs may be used more than once.

- 1. The cost of depreciation. The asset being

depreciated is a large piece of production machinery equipment where thestraight-line depreciation method is used.letter _________

- 2. The cost of operating a forklift. The forklift is used to move work-in-process inventory in groups of 100 units across the factory floor.

letter _________

- 3. The cost of direct materials. The first 2,000 pounds of direct materials are free because they are donated by the local city government. After that, the direct materials cost consists of a per-unit amount that decreases after a threshold of 2,500 total pounds is reached.

letter _________

- 4. The cost of inspecting finished goods inventory. Each unit is inspected by a quality expert who is paid the same amount for each unit inspected.

letter _________

- 5. The cost of product shipping for all output shipped in the period. The shipping cost per unit decreases with each unit shipped up to a certain number of units, at which time the shipping cost per unit remains constant.

letter _________

- 6. The cost of compliance with Environmental Protection Agency (EPA) regulations. An electric car plant manufactures car batteries. Part of the manufacturing process involves the emission of toxic chemicals into the environment, which is regulated by the EPA in the form of a fee assessed on a per-unit manufactured basis. The per-unit cost of complying with these regulations increases with every fifth battery produced.

letter ______

- 7. The cost of customer energy consumption. The local electric utility company uses a pricing system designed to encourage customers to conserve energy usage. Therefore, the rate per kilowatt-hour that is charged to customers increases with each hour the customer consumes.

letter _______

Expert Solution & Answer

Trending nowThis is a popular solution!

Students have asked these similar questions

Select the graph (A through L) that best matches the numbered (1 through 7) italicized descriptions of various cost behavior. For each graph, the vertical (y) axis represents total dollars of cost,and the horizontal (x) axis represents output units during the period. The graphs may be usedmore than once.1. The cost of depreciation. The asset being depreciated is a large piece of production machinery equipment where the straight-line depreciation method is used.letter ______2. The cost of operating a forklift. The forklift is used to move work-in-process inventory ingroups of 100 units across the factory floor.letter ______3. The cost of direct materials. The first 2,000 pounds of direct materials are free because theyare donated by the local city government. After that, the direct materials cost consists of aper-unit amount that decreases after a threshold of 2,500 total pounds is reached.letter ______4. The cost of inspecting finished goods inventory. Each unit is inspected by a…

Depreciation of plant, calculated on a straight-line basis

Chart number?

Explanation?

State and classify the items as per Theory of constraints:

1.Depreciation of a machinery

2.Rental utilities

3.R & D costs

4.Equipment & buildings-costs

5.Raw materials in stock

6.Sales of the product

7.Inventory-Finished goods

Chapter 3 Solutions

Managerial Accounting: The Cornerstone of Business Decision-Making

Ch. 3 - Prob. 1DQCh. 3 - What is a driver? Give an example of a cost and...Ch. 3 - Suppose a company finds that shipping cost is...Ch. 3 - Some firms assign mixed costs to either the fixed...Ch. 3 - Explain the difference between committed and...Ch. 3 - Explain why the concept of relevant range is...Ch. 3 - Why do mixed costs pose a problem when it comes to...Ch. 3 - Describe the cost formula for a strictly fixed...Ch. 3 - Describe the cost formula for a strictly variable...Ch. 3 - What is the scattergraph method, and why is it...

Ch. 3 - Describe how the scattergraph method breaks out...Ch. 3 - What are the advantages of the scattergraph method...Ch. 3 - Prob. 13DQCh. 3 - What is meant by the best-fitting line?Ch. 3 - What is the difference between the unit cost of a...Ch. 3 - Prob. 16DQCh. 3 - (Appendix 3A) Explain the meaning of the...Ch. 3 - A factor that causes or leads to a change in a...Ch. 3 - Which of the following would probably be a...Ch. 3 - Prob. 3MCQCh. 3 - In the cost formula, the term 128,000,000 a. is...Ch. 3 - In the cost formula, the term 12,000 a. is the...Ch. 3 - Prob. 6MCQCh. 3 - Prob. 7MCQCh. 3 - The following cost formula for total purchasing...Ch. 3 - An advantage of the high-low method is that it a....Ch. 3 - Prob. 10MCQCh. 3 - Prob. 11MCQCh. 3 - Prob. 12MCQCh. 3 - The total cost for monthly supervisory cost in a...Ch. 3 - Yates Company shows the following unit costs for...Ch. 3 - (Appendix 3A) In the method of least squares, the...Ch. 3 - Creating and Using a Cost Formula Big Thumbs...Ch. 3 - Using High-Low to Calculate Fixed Cost, Calculate...Ch. 3 - Using High-Low to Calculate Predicted Total...Ch. 3 - Using High-Low to Calculate Predicted Total...Ch. 3 - Using Regression to Calculate Fixed Cost,...Ch. 3 - Inventory Valuation under Absorption Costing Refer...Ch. 3 - Inventory Valuation under Variable Costing Refer...Ch. 3 - Absorption-Costing Income Statement Refer to the...Ch. 3 - Variable-Costing Income Statement Refer to the...Ch. 3 - Creating and Using a Cost Formula Kleenaire Motors...Ch. 3 - Using High-Low to Calculate Fixed Cost, Calculate...Ch. 3 - Using High-Low to Calculate Predicted Total...Ch. 3 - Brief Exercise 3-28 Using High-Low to Calculate...Ch. 3 - Using Regression to Calculate Fixed Cost,...Ch. 3 - Inventory Valuation under Absorption Costing Refer...Ch. 3 - Inventory Valuation under Variable Costing Refer...Ch. 3 - Brief Exercise 3-32 Absorption-Costing Income...Ch. 3 - Brief Exercise 3-33 Variable-Costing Income...Ch. 3 - Variable and Fixed Costs What follows are a number...Ch. 3 - Cost Behavior, Classification Smith Concrete...Ch. 3 - Prob. 36ECh. 3 - Prob. 37ECh. 3 - Prob. 38ECh. 3 - Step Costs, Relevant Range Bellati Inc. produces...Ch. 3 - Matching Cost Behavior Descriptions to Cost...Ch. 3 - Examine the graphs in Exercise 3-40. Required: As...Ch. 3 - Prob. 42ECh. 3 - Prob. 43ECh. 3 - High-Low Method Refer to the information for Luisa...Ch. 3 - Scattergraph Method Refer to the information for...Ch. 3 - Method of Least Squares Refer to the information...Ch. 3 - Use the following information for Exercises 3-47...Ch. 3 - Use the following information for Exercises 3-47...Ch. 3 - Method of Least Squares, Developing and Using the...Ch. 3 - The method of least squares was used to develop a...Ch. 3 - Identifying the Parts of the Cost Formula;...Ch. 3 - Inventory Valuation under Absorption Costing...Ch. 3 - Inventory Valuation under Variable Costing Lane...Ch. 3 - Income Statements under Absorption and Variable...Ch. 3 - (Appendix 3A) Method of Least Squares Using...Ch. 3 - (Appendix 3A) Method of Least Squares Using...Ch. 3 - Identifying Fixed, Variable, Mixed, and Step Costs...Ch. 3 - Identifying Use of the High-Low, Scattergraph, and...Ch. 3 - Identifying Variable Costs, Committed Fixed Costs,...Ch. 3 - Scattergraph, High-Low Method, and Predicting Cost...Ch. 3 - Method of Least Squares, Predicting Cost for...Ch. 3 - Cost Behavior, High-Low Method, Pricing Decision...Ch. 3 - Prob. 63PCh. 3 - Variable and Fixed Costs, Cost Formula, High-Low...Ch. 3 - Cost Separation About 8 years ago, Kicker faced...Ch. 3 - Variable-Costing and Absorption-Costing Income...Ch. 3 - Refer to the information for Farnsworth Company...Ch. 3 - (Appendix 3A) Scattergraph, High-Low Method,...Ch. 3 - (Appendix 3A) Separating Fixed and Variable Costs,...Ch. 3 - (Appendix 3A) Cost Formulas, Single and Multiple...Ch. 3 - Suspicious Acquisition of Data, Ethical Issues...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- The cost behavior patterns below are lettered A through H. The vertical axes of the graphs represent total dollars of expense, and the horizontal axes represent production in units, machine hours, or direct labor hours. In each case, the zero point is at the intersection of the two axes. Each graph may be used no more than once. Required: Select the graph that matches the lettered cost described here. a. Depreciation of equipmentthe amount of depreciation charged is computed based on the number of machine hours that the equipment was operated. b. Electricity billflat fixed charge, plus a variable cost after a certain number of kilowatt hours are used. c. City water billcomputed as follows: d. Depreciation of equipmentthe amount is computed by the straight-line method. e. Rent on a factory building donated by the citythe agreement calls for a fixed fee payment, unless 200,000 labor hours are worked, in which case no rent need be paid. f. Salaries of repair workersone repair worker is needed for every 1,000 machine hours or less (i.e., 0 to 1,000 hours requires one repair worker, 1,001 to 2,000 hours requires two repair workers, etc.).arrow_forwardIdentify each of the following costs as either a product cost (PROD) or a period cost (PER). Depreciation—Office equipment.arrow_forwardWhich of the following is an example of a cost that varies in proportion to changes in the activity base? Depreciation on machinery Packaging cost Factory rent Insurance costarrow_forward

- Identify each of the following costs as either a product cost (PROD) or a period cost (PER). Depreciation—Factory equipment.arrow_forwardWhich one of the following accounts is an asset similar to work-in-process inventory? Group of answer choices Construction in Progress Cost of Construction Billings in Excess of Cost Revenue from Long-Term Contractsarrow_forwardWhich of the following is a prime cost? A. indirect materials B. direct labor C. administrative expenses D. factory depreciation expensesarrow_forward

- Classify the following manufacturing costs of Business Solutions as either (a) variable (V) or fixed (F)and (b) direct (D) or indirect (I). Depreciation on manufacturing toolsarrow_forwardDetermine the following is best described as a fixed, variable, or mixed cost with respectto product units. Depreciation expense of warehouse.arrow_forwardWhat would be the classification of depreciation of office building as to (1) variability, (2) relation to a product, and (3) planning, control and analytical purposes, respectively? * Variable, period cost, sunk cost. Fixed, product cost, out-of-pocket cost. O Variable, product cost, out-of-pocket cost. Fixed, period cost, sunk cost.arrow_forward

- Identify each of the following costs as either a product cost or a period cost. Factory maintenance sales commissions depreciation factory equipmentarrow_forwardWhich of the following correctly describes the term cost driver? a. The inflation rate which causes costs to rise b. The primary factor which is correlated with the amount of cost incurred to produce a product c. The initial purchase price of direct materials d. The total material, labor, and overhead cost of a completed jobarrow_forwardSelect and “X” in the column that corresponds to the cost classification for each of the following scenarios. Some items may fit in more than one column.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:9781305087408

Author:Edward J. Vanderbeck, Maria R. Mitchell

Publisher:Cengage Learning

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Cost Classifications - Managerial Accounting- Fixed Costs Variable Costs Direct & Indirect Costs; Author: Accounting Instruction, Help, & How To;https://www.youtube.com/watch?v=QQd1_gEF1yM;License: Standard Youtube License