Financial Reporting, Financial Statement Analysis and Valuation

8th Edition

ISBN: 9781285190907

Author: James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 3, Problem 25PC

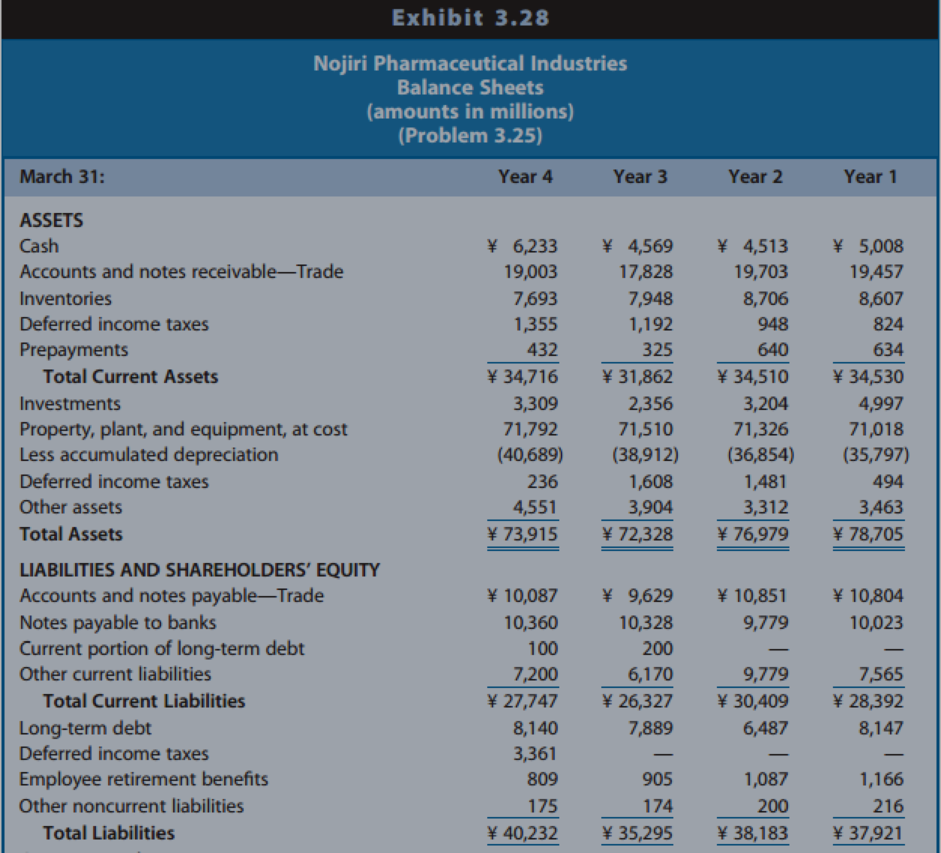

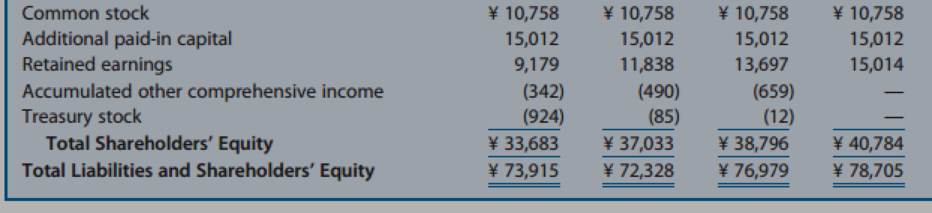

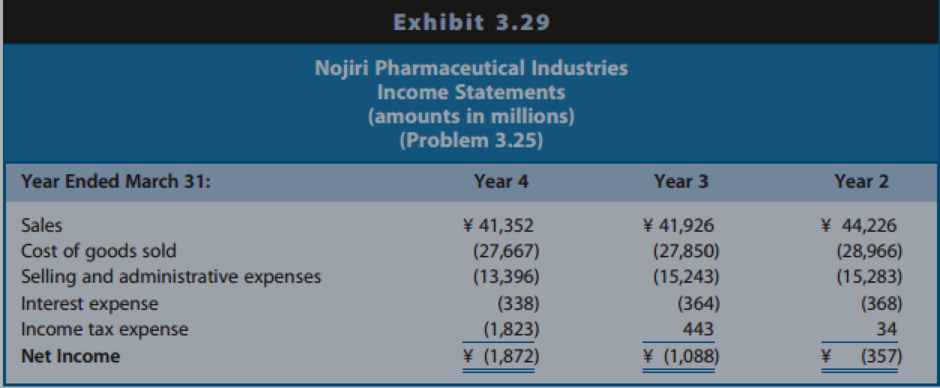

Preparing a Statement of Cash Flows from

REQUIRED

- a. Prepare a worksheet for the preparation of a statement of cash flows for Nojiri Pharmaceutical Industries for each of the years ending March 31, Year 2 to Year 4. Follow the format of Exhibit 3.14 in the text. Notes to the financial statements indicate the following:

- (1) The changes in Accumulated Other Comprehensive Income relate to revaluations of Investments in Securities to market value. The remaining changes in Investments in Securities result from purchases and sales. Assume that the sales occurred at no gain or loss.

- (2) No sales of property, plant, and equipment took place during the three-year period.

- (3) The changes in Other Noncurrent Assets are investing activities.

- (4) The changes in Employee Retirement Benefits relate to provisions made for retirement benefits net of payments made to retired employees, both of which the statement of cash flows classifies as operating activities.

- (5) The changes in Other Noncurrent Liabilities are financing activities.

- b. Prepare a comparative statement of cash flows for Year 2, Year 3, and Year 4.

- c. Discuss the relations among net income and cash flow from operations and the pattern of cash flows from operating, investing, and financing transactions for Year 2, Year 3, and Year 4.

Expert Solution & Answer

Trending nowThis is a popular solution!

Students have asked these similar questions

46. Mohammed has made an analysis of the two food producing companies in Oman. The analysis is on comparing their cash conversion cycle. Though there was little difference between the two companies but a significant change was observed in the results of previous year to this year. The cash conversion cycle of both companies has increased which means ___________.

a.

The companies are not managing their account receivables

b.

The companies are receiving the cash late and payments are made early

c.

All of the options

d.

The companies are not effectively managing inventory

Indicate how you would expect the following strategies to affect the company’s net cash flows

from operating activities (1) in the near future and (2) in later periods (after the strategy’s long-term effects have “taken hold”). Fully explain your reasoning.

a. A successful pharmaceutical company substantially reduces its expenditures for research anddevelopment.b. A restaurant that previously sold only for cash adopts a policy of accepting bank credit cards,such as Visa and MasterCard.c. A manufacturing company reduces by 50 percent the size of its inventories of raw materials(assume no change in inventory storage costs).d. Through tax planning, a rapidly growing real estate developer is able to defer significantamounts of income taxes.e. A rapidly growing software company announces that it will stop paying cash dividends for theforeseeable future and will instead distribute stock dividends.

Styles

Editing

QUESTION TWO

Voice

Sensitivity

Editor

Rem

Selamat Islamic Bank Berhad (SIBB) just announced its financial report for the year ended

2016. Table below is a summary of CIBB's financial report.

(a)

Items

RM (000)

Income Statement

Operating Revenue

Net Income

Expenses

Profit after tax and zakat

3,662,444

1,540,333

700,343

543,443

Statement of Financial Position

Current Asset

Current Liability- Demand deposit

Total Debt

Total Assets

4,332,300

10,635,054

42,091,092

45,620,442

3,729,590

Total Equity Capital

Evaluate SIBB's performance based on the following financial ratios and explain what each

ratio means.

i.

The capability of management in converting assets into net earnings.

i.

The effectiveness of management to control cost, expenses and service price

O Focus

目

(United Kingdom)

ENC

Chapter 3 Solutions

Financial Reporting, Financial Statement Analysis and Valuation

Ch. 3 - Need for a Statement of Cash Flows. The accrual...Ch. 3 - Articulation of the Statement of Cash Flows with...Ch. 3 - Classification of Interest Expense. Under U.S....Ch. 3 - Prob. 4QECh. 3 - Classification of Changes in Short-Term Financing....Ch. 3 - Classification of Cash Flows Related to...Ch. 3 - Treatment of Non-Cash Exchanges. The acquisition...Ch. 3 - Computing Cash Collections from Customers....Ch. 3 - Computing Cash Payments to Suppliers. Lowes...Ch. 3 - Computing Cash Payments for Income Taxes. Visa...

Ch. 3 - Interpreting the Relation between Net Income and...Ch. 3 - Interpreting the Relation between Net Income and...Ch. 3 - Interpreting Relations among Cash Flows from...Ch. 3 - Interpreting Relations among Cash Flows from...Ch. 3 - Interpreting the Statement of Cash Flows. The...Ch. 3 - Interpreting the Statement of Cash Flows. Texas...Ch. 3 - Interpreting the Statement of Cash Flows. Tesla...Ch. 3 - Interpreting the Statement of Cash Flows. Gap Inc....Ch. 3 - Prob. 19PCCh. 3 - Prob. 20PCCh. 3 - Interpreting the Statement of Cash Flows....Ch. 3 - Extracting Performance Trends from the Statement...Ch. 3 - Interpreting a Direct Method Statement of Cash...Ch. 3 - Prob. 24PCCh. 3 - Preparing a Statement of Cash Flows from Balance...Ch. 3 - Prob. 26PCCh. 3 - Preparing a Statement of Cash Flows from Balance...Ch. 3 - Prob. 1AICCh. 3 - Prob. 1BICCh. 3 - Prob. 1CICCh. 3 - Prob. 1DICCh. 3 - Prob. 1EICCh. 3 - Prob. 1FICCh. 3 - Prob. 1GICCh. 3 - Prob. 1HICCh. 3 - Prob. 2AICCh. 3 - Prob. 2BICCh. 3 - Prob. 2CICCh. 3 - Prob. 2DICCh. 3 - Prob. 2EICCh. 3 - Prob. 2FICCh. 3 - Prob. 3IC

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Explain challenging face by the malaysian government in order the transitions from cash accouting to accrual accounting to be successful during covid-19 pandemic ..with explaination and examplesarrow_forwardInternational Finance (chapter 21) Question: Classify each of the following as debits or credits in the U.S. balance of payments. Americans buy chocolate from the Swiss. U.S. gives foreign aid to Bosnia. British investors purchase U.S. government bonds American tourists travel to Australia Volkswagen earns profits in the United States from its new cars Toyota builds a new plant in Ohio Capital Records sells rock and roll music in Swedenarrow_forwardThe following table contains data for a hypothetical closed economy that uses the dollar as its currency. Suppose GDP in this country is $1,110 million. Enter the amount for consumption. National Income Account Government Purchases (G) Taxes minus Transfer Payments (T) Consumption (C) Investment (I) Complete the following table by using national income accounting identities to calculate national saving. In your calculations, use data from the preceding table. National Saving (S) = Public Saving Y-T-G S Value (Millions of dollars) 300 240 Y-C-T $ Complete the following table by using national income accounting identities to calculate private and public saving. In your calculations, use data from the initial table. Private Saving million million 210 million Based on your calculations, the government is running a budgetarrow_forward

- You are establishing a new warehouse in sparks Nevada to better accommodate your customers in the western half of the U.S .you will have to access a specific amount of cash in a periodic basis as the need rises . What is your best funding option ? A.family and friends B. Intermediate loan C.angel investor D. Trade credit E.Venture Capitalist F. Short term loan G.IPO H. Personal assets I. Long term loan J. Bank line of creditarrow_forwardReview the statement of cash flows for Tesla Motors Inc. in ATC 14-1 on page 688. Discuss the cash position of the company by considering the following: Does the company’s cash flow position appear to be improving?arrow_forwardConsider the following data for this company (image) True or False and why: This company raised cash in 2020 by increasing borrowing from suppliers. True or False and why: Despite having lower operating cash flow in 2020, this company managed to maintain its investments in the business during 2020 by reducing cash holdings True or False and why: This company raised cash from investors to manage the crisis in 2020 and suspended any payments to investors during 2020arrow_forward

- Which of the following is a section of a cash flow statement? Select one: a.Fixed costs outflows b.Cash basis accounting systems c.Wage taxes d.EIN Question 22 Question text If you invest $1,525,000 in a business and earn a return of $775,000, what is your ROI? Select one: a.42% b.45% c.51% d.1.96% Question 23 Question text If Jacques invests $20,000 at 10% interest for 3 years, what will the future value of the money be? Select one: a.$26,620.00 b.$6620.00 c.$20,606.02 d.$26,000.00 Question 24 Question text Two common risks to cash flow stability are ________ and ________. Select one: a.credit squeeze; burn rate b.surplus inventory; pilferage c.burn rate; pilferage d.surplus inventory; credit squeeze Question 25 Question text A suggested allowance for contingencies and emergencies at start-up is _____ of estimated start-up costs. Select one: a.5 percent b.10 percent c.25 percent d.40 percentarrow_forwardReview the statement of cash flows for Tesla Motors Inc. in ATC 14-1 on page 688. Discuss the cash position of the company by considering the following: How is Tesla repaying its debt?arrow_forwardAnalyse and comment on the impact of the following events on a companies balance sheet, income statement and cash flow statement. E. g. Company purchases Machinery for $100,000 in cash. Effect. Obvious impact Fixed Asset increased, Balance sheet affected. Company will start recording depreciation expense in Income Statement Cash Outfi ow will reduce balance of cash on balance sheet. Current Ratio likely affected adversely and Working Capital. Analysis. Company may experience increase in Accounts Payable because of such a substantial cash outflow. This will affect Current Liabilities. Or. Company may have to seek short term loan from the bank as a back up in case there is any disturbance in receivables in the future. To counter this substantial cash outflow. Company should have negotiated with a bank a low interest loan to purchase machine over time in instalments. 1)A Manufacturing company ABC: relies on several suppliers for raw materials, often these materials are purchased on 90…arrow_forward

- People's Bank of China boosts liquidity with open market operations The People's Bank of China, China's central, conducted an open market operation that injected 270 billion yuan into China's banking system. Suppose People's Bank of China buys 20 billion yuan of government securities from ICBC. Show how the transaction changes the balance sheets by filling in the numbers. Source: www.chinadaily.com.cn and finance.yahoo.com, October 8, 2018. In the open market operation described in the news clip, explain whether the People's Bank of China buys or sells People's Bank of China securities. Assets Liabilities (billions of yuan) (billions of yuan) The People's Bank of China securities because Securities Reserves of ICBC A. buys; money is being injected into the banking system ICBC O B. sells; interest rates are falling Assets Liabilities C. buys; an open market operation by definition is a purchase of securities (billions of yuan) (billions of yuan) Securities O D. sells; money is being…arrow_forwardA’Sharqiyah University College of Business Administration Financial institution & markets Home Work Assignment for Midterm Preparation Introduction-Part-1-Topic1 1. Discuss why study financial markets and institution? 2. Briefly, what is the basic difference between primary and secondary markets? 3. Briefly, what is the basic difference between money and capital market? 4. How foreign exchange markets deals in currency along with spot and forward exchange transactions? 5. Discuss the types of financial institutions and what are service performed by the financial intuitions? а. --have turned to U.S. and other markets to expand their investment opportunities b. ---became more global as the value of stocks traded in foreign markets soared с. markets have served as a major source of international capital -are the conduit through which monetary policy actions impact the economy in general ----provides greater incentive to collect a d. е. firm's information and monitor actions. f.…arrow_forwardWhat is the US financial position in terms of cash flow when consumers in Japan buy baseball jerseys from their favorite US baseball teams, considering that the jerseys are manufactured in the United States? outflow, credit inflow, credit outflow, debit inflow, debitarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning

Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Reporting, Financial Statement Analysis...

Finance

ISBN:9781285190907

Author:James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:Cengage Learning

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

Financial Accounting: The Impact on Decision Make...

Accounting

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Cengage Learning

The KEY to Understanding Financial Statements; Author: Accounting Stuff;https://www.youtube.com/watch?v=_F6a0ddbjtI;License: Standard Youtube License