Financial Reporting, Financial Statement Analysis and Valuation

8th Edition

ISBN: 9781285190907

Author: James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

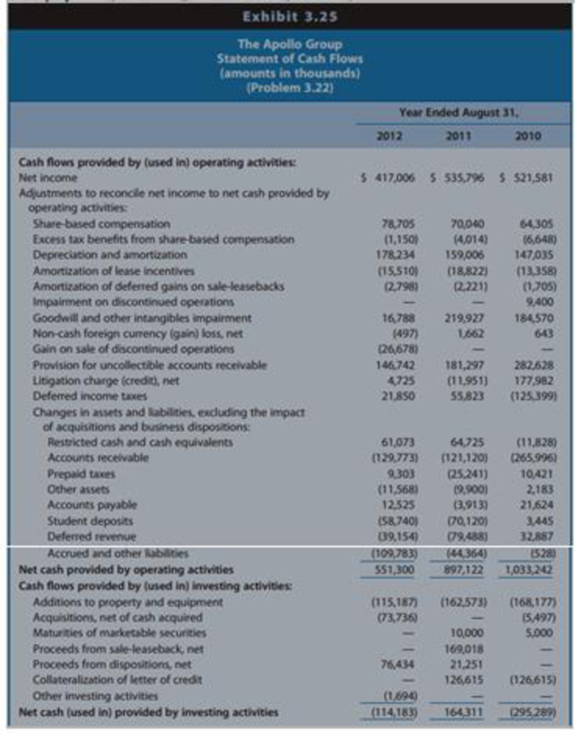

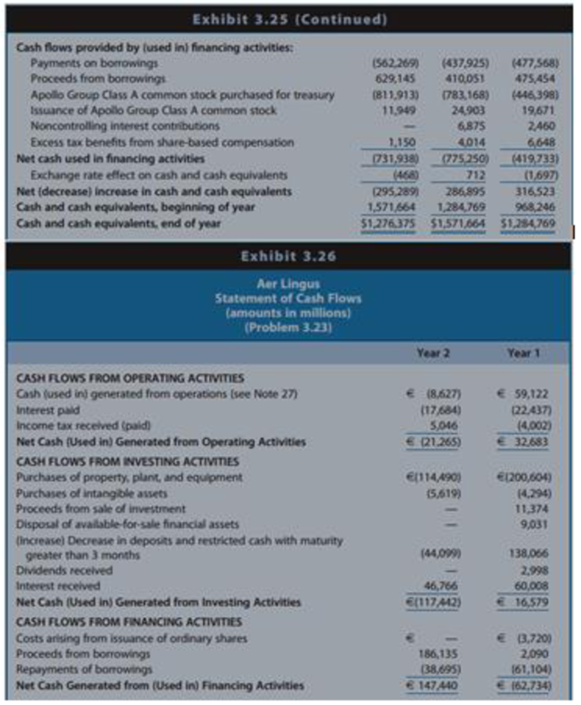

Chapter 3, Problem 23PC

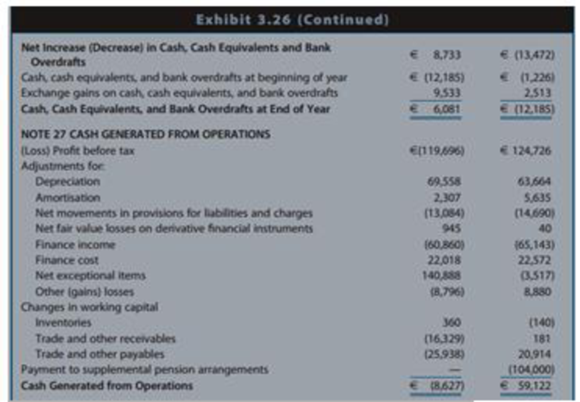

Interpreting a Direct Method Statement of Cash Flows. Aer Lingus is an international airline based in Ireland. Exhibit 3.26 provides the statement of cash flows for Year 1 and Year 2, which includes a footnote from the financial statements. Year 2 was characterized by weakening consumer demand for air travel due to a recession and record high fuel prices. In addition, Year 2 includes exceptional items totaling €141 million, which reflect a staff restructuring program for early retirement (€118 million), takeover defense costs due to a bid by Ryanair (€18 million), and other costs (€5 million).

REQUIRED

- a. Based on information in the statement of cash flows, compare and contrast the cash flows for Years 1 and 2. Explain significant differences in individual reconciling items and direct cash flows.

- b. The format of Aer Lingus’ statement of cash flows is the direct method, as evidenced by the straightforward titles used in the operating section. How is this statement different from the presentation that Aer Lingus would report using the indirect method?

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

A company that manufactures diaphragm seals has identified the cash flows shown below with a certain part of the manufacturing and sales functions.Determine the no-return payback period.First cost of equipment, $ -130,000Annual expenses, $/year -45,000Annual revenue, $/year 75,000

Blossom Chemicals management identified the following cash flows as significant in its year-end meeting with analysts: During the

year Blossom had repaid existing debt of $316,800 and raised additional debt capital of $645,800. It also repurchased stock in the

open market for a total of $44,470. What is the net cash provided by financing activities? (If an amount reduces the cash flow then enter

with negative sign preceding the number e.g.-45 or parentheses e.g. (45).)

Net cash provided by financing activities

$

Chadwick Enterprises, Incorporated, operates several restaurants throughout the Midwest. Three of its restaurants located in the

center of a large urban area have experienced declining profits due to declining population. The company's management has decided

to test the assets of the restaurants for possible impairment. The relevant information for these assets is presented below at the end of

2024. Assume that Chadwick Enterprises prepares its financial statements according to International Financial Reporting Standards.

Book value

Estimated undiscounted sum of future cash flows

Fair value

Assume that the fair value amount given equals both (a) the fair value less costs to sell and (b) the present value of estimated future

cash flows.

Required:

1. Determine the amount of the impairment loss, if any, reported in the 2024 income statement.

2. Determine the amount of the impairment loss assuming that the estimated undiscounted sum of future cash flows is $8.6 million

and fair value is…

Chapter 3 Solutions

Financial Reporting, Financial Statement Analysis and Valuation

Ch. 3 - Need for a Statement of Cash Flows. The accrual...Ch. 3 - Articulation of the Statement of Cash Flows with...Ch. 3 - Classification of Interest Expense. Under U.S....Ch. 3 - Prob. 4QECh. 3 - Classification of Changes in Short-Term Financing....Ch. 3 - Classification of Cash Flows Related to...Ch. 3 - Treatment of Non-Cash Exchanges. The acquisition...Ch. 3 - Computing Cash Collections from Customers....Ch. 3 - Computing Cash Payments to Suppliers. Lowes...Ch. 3 - Computing Cash Payments for Income Taxes. Visa...

Ch. 3 - Interpreting the Relation between Net Income and...Ch. 3 - Interpreting the Relation between Net Income and...Ch. 3 - Interpreting Relations among Cash Flows from...Ch. 3 - Interpreting Relations among Cash Flows from...Ch. 3 - Interpreting the Statement of Cash Flows. The...Ch. 3 - Interpreting the Statement of Cash Flows. Texas...Ch. 3 - Interpreting the Statement of Cash Flows. Tesla...Ch. 3 - Interpreting the Statement of Cash Flows. Gap Inc....Ch. 3 - Prob. 19PCCh. 3 - Prob. 20PCCh. 3 - Interpreting the Statement of Cash Flows....Ch. 3 - Extracting Performance Trends from the Statement...Ch. 3 - Interpreting a Direct Method Statement of Cash...Ch. 3 - Prob. 24PCCh. 3 - Preparing a Statement of Cash Flows from Balance...Ch. 3 - Prob. 26PCCh. 3 - Preparing a Statement of Cash Flows from Balance...Ch. 3 - Prob. 1AICCh. 3 - Prob. 1BICCh. 3 - Prob. 1CICCh. 3 - Prob. 1DICCh. 3 - Prob. 1EICCh. 3 - Prob. 1FICCh. 3 - Prob. 1GICCh. 3 - Prob. 1HICCh. 3 - Prob. 2AICCh. 3 - Prob. 2BICCh. 3 - Prob. 2CICCh. 3 - Prob. 2DICCh. 3 - Prob. 2EICCh. 3 - Prob. 2FICCh. 3 - Prob. 3IC

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Collinsworth LTD., a U.K. company, prepares its financial statements according to International Financial Reporting Standards. Late in its 2021 fiscal year, a significant adverse change in business climate indicated to management that the assets of its appliance division may be impaired. The following data relate to the division’s assets: (£ in millions)Book value £220Undiscounted sum of estimated future cash flows 210Present value of future cash flows 150Fair value less cost to sell (determined by appraisal) 145 Required:1. What amount of impairment loss, if any, should Collinsworth recognize?2. Assume that Collinsworth prepares its financial statements according to U.S. GAAP and that fair value less cost to sell…arrow_forwardPreparing a Statement of Cash Flows from Balance Sheets and Income Statements. Nojiri Pharmaceutical Industries develops, manufactures, and markets pharmaceutical products in Japan. The Japanese economy experienced recessionary conditions in recent years. In response to these conditions, the Japanese government increased the proportion of medical costs that is the patients responsibility and lowered the prices for prescription drugs. Exhibits 3.28 and 3.29 present the firms balance sheets and income statements for Years 1 through 4. REQUIRED a. Prepare a worksheet for the preparation of a statement of cash flows for Nojiri Pharmaceutical Industries for each of the years ending March 31, Year 2 to Year 4. Follow the format of Exhibit 3.14 in the text. Notes to the financial statements indicate the following: (1) The changes in Accumulated Other Comprehensive Income relate to revaluations of Investments in Securities to market value. The remaining changes in Investments in Securities result from purchases and sales. Assume that the sales occurred at no gain or loss. (2) No sales of property, plant, and equipment took place during the three-year period. (3) The changes in Other Noncurrent Assets are investing activities. (4) The changes in Employee Retirement Benefits relate to provisions made for retirement benefits net of payments made to retired employees, both of which the statement of cash flows classifies as operating activities. (5) The changes in Other Noncurrent Liabilities are financing activities. b. Prepare a comparative statement of cash flows for Year 2, Year 3, and Year 4. c. Discuss the relations among net income and cash flow from operations and the pattern of cash flows from operating, investing, and financing transactions for Year 2, Year 3, and Year 4.arrow_forwardFor 2023, Grace Enterprises reported sales of $2,700,000, cost of goods sold of $1,900,000, and its A/R days on hand were 37 days for the year, decreasing from 43 days last year. Calculate the cash impact of the change in A/R collection from 2022 to 2023, is a negative impact to cash. including a (-) sign if the change Iarrow_forward

- Vison software reported the following amounts on its balance sheets at December 31, 2020, 2019, and 2018 *Data table provided* Sales and profits are high. Nevertheless, Vision is experiencing a cash shortage. Perform a vertical analysis of Vision Software's assets at the end of years 2020, 2019, and 2018. Use the analysis to explain the reason for the cash shortage.arrow_forwardRequired: Solutions and explanation The beginning cash balance of Arizona Corp. is P700,000. It foresees the following cashflows for the month: (A) Collections from customers - P1,000,000, (B) Payments to suppliers - P550,000, (C) Other operating cash expenses - P50,000, (D) Payments to creditors - P50,000 and (E) collection of a receivable from an officer - P80,000. If Arizona needs to have a month-end balance of P1,000,000, how much should it borrow or (invest)? * (P130,000) P110,000 (P110,000) P130,000arrow_forwardI need help on this problem. Pearce Enterprises reported the following information for the past year of operation: Transaction Free Cash Flow $250,000 Operating-cash-flow-to-current-liabilities raition 1.0 times Operating-cash-flow-to-capital-expenditures ratio 3.0 times a) Recorded credit sales of $9,000 b) Collected $4,000owed from customers c) Purchased $28,000 of equipment on long-term credit d) Purchased $16,000 of equipment for cash e) Paid $10,000 of wages with cash f) Recorded utility bill of $1,750 that has not been paid For each transaction, indicate whether the ratio will (I) Increase, (D) decrease, or (N) have no effect.arrow_forward

- A manufacturer of diaphragm seals has identified the cash flows shown for manufacturing and sales functions. Determine the no-return payback period. First cost of equipment, $ −130,000 Annual expenses, $ per year −45,000 Annual revenue, $ per year 75,000arrow_forwardPlease give a detailed analysis of the financial statements given below for Joshua & White Technologies. Your analysis should include answers to the questions as follows (not limited to these questions): Has the company’s liquidity position improved or worsened? Has the company’s ability to manage its assets improved or worsened? How has the company’s profitability changed during the last year? Joshua & White Technologies: December 31 Balance Sheets (Thousands of Dollars) Assets 2019 2018 Cash and cash equivalents $21,000 $20,000 Short-term investments 3,759 3,240 Accounts Receivable 52,500 48,000 Inventories 84,000 56,000 Total current assets $161,259 $127,240 Net fixed assets 223,097 200,000 Total assets $384,356 $327,240 Liabilities and equity Accounts payable $33,600 $32,000 Accruals 12,600 12,000…arrow_forwardA) i. The following data were extracted from the financial statements of Zinc Incorporated. Assuming the year has 365 days, calculate the operating cycle and cash conversion cycle of Zinc Inc. Annual credit sales - $70,000 Annual cost of goods sold = $42,500 Inventory = $7,500 Accounts receivable = $4,800 Accounts payable= $4,000 II). Discuss three important ways in which the CCC could be reduced.arrow_forward

- Koch Engineering plc has produced the following information for its most recent financial year: (Click here to view the financial data.) Following a review of the working capital investment of the business, it was decided that liquidity could be improved if the following changes were made: 1. An decrease in the average settlement period for trade receivables to 35 days. 2. An increase in the average settlement period for trade payables to 50 days. 3. A decrease in the average inventories turnover period to 55 days. Calculate the extra cash that the business should generate by implementing each of the proposed changes. (Enter the answes in £m, round to one decimal place.) ... Trade receivables = £ m Trade payables = £m Inventories = £ marrow_forwardPrepare a statement of cash flow for Maligaya Enterprise for the month ended November 30, 2021.Given were the following data:Operating expenses P 250,000 Additional investment by owner. P175,000 Payment to suppliers P160,000 Loan from bank. P280,000 Partial Payment of bank loan. P25,000 Collection from customers. P212,500 Payment of dividends. P20,000 Decrease in office equipment. P160,000arrow_forwardOn December 31, 2022, Marizor Company believed that the assets of a cash generating unit are impaired based on an analysis of economic indicators. The assets and liabilities of the cash generating unit at carrying amount on December 31, 2022 are: Cash 4,000,000 6,000,000 1,000,000 7,000,000 22,000,000 4,000,000 Accounts receivable Allowance for doubtful accounts Inventory Property, plant and equipment Accumulated depreciation Goodwill 3,000,000 Accounts payable Loans payable The entity determined that the value in use of the cash generating unit is P28,000,000. The accounts receivable are considered collectible, except those considered doubtful. The carrying amount of the inventory is lower than fair value less cost of disposal. What is the impairment loss to be allocated to property, plant and equipment? 2,000,000 1,000,000 A. 3,600,000 В. 6,000,000 С. 3,000,000 D. 1,800,000arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning

Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning

Financial Reporting, Financial Statement Analysis...

Finance

ISBN:9781285190907

Author:James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:Cengage Learning

The KEY to Understanding Financial Statements; Author: Accounting Stuff;https://www.youtube.com/watch?v=_F6a0ddbjtI;License: Standard Youtube License