Concept explainers

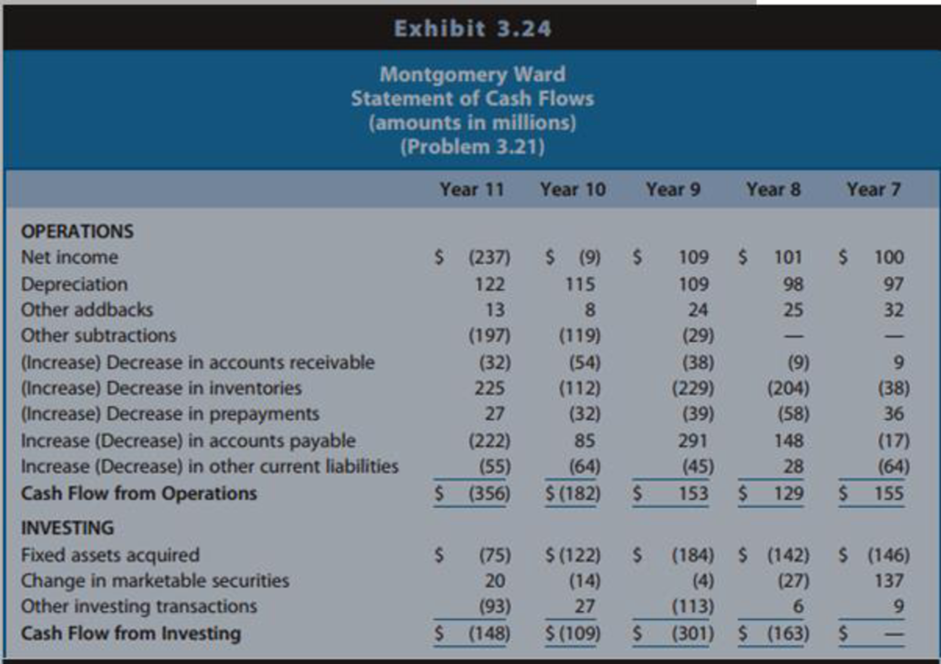

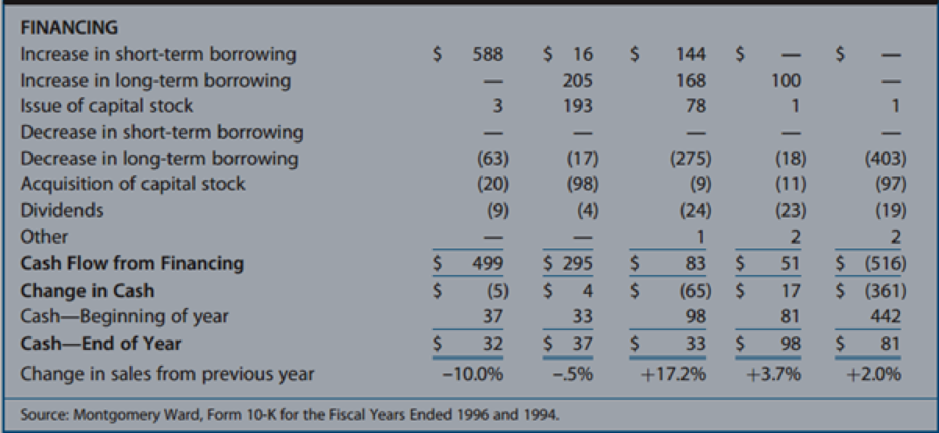

Interpreting the Statement of Cash Flows. Montgomery Ward

operates a retail department store chain. It filed for bankruptcy during the first quarter of Year 12.

Exhibit 3.24 presents a statement of cash flows for Montgomery Ward for Year 7 to Year 11.

The firm acquired Lechmere, a discount retailer of sporting goods and electronic products, during Year 9. It acquired Amoco Enterprises, an automobile club, during Year 11. During Year 10, it issued a new series of

REQUIRED

Discuss the relations between net income and cash flow from operations and among cash flows from operating, investing, and financing activities for the firm over the five-year period. Identify signals of Montgomery Ward's difficulties that might have led to its filing for bankruptcy.

Want to see the full answer?

Check out a sample textbook solution

Chapter 3 Solutions

Financial Reporting, Financial Statement Analysis and Valuation

- Dristell Incorporated had the following activities during the year (all transactions are for cash unless stated otherwise): a. A building with a book value of $419,000 was sold for $519,000. b. Additional common stock was issued for $179,000. c. Dristell purchased its own common stock as treasury stock at a cost of $84,500. d. Land was acquired by issuing a 6%, 10-year, $769,000 note payable to the seller. e. A dividend of $59,000 was paid to shareholders. f. An investment in Fleet Corporation's common stock was made for $139,000. g. New equipment was purchased for $74,500. h. A $99,500 note payable issued three years ago was paid in full. i. A loan for $119,000 was made to one of Dristell's suppliers. The supplier plans to repay Dristell this amount plus 10% interest within 18 months. Required: Calculate net cash flows from financing activities. (Cash outflows should be indicated with a minus sign.) DRISTELL INCORPORATED Statement of Cash Flows (partial) For the Year Ended December…arrow_forwardTrident Corporation had the following cash flows in the current year. Which of the following will be categorized under the financing activities section of the statement of cash flows? O Purchase of $125,000 worth of five-year bonds issued by Towson Utilities O Rent on a warehouse amounting to $1.1 million O Lease income received on a piece of land O Preferred dividends of $330,000 paid to shareholdersarrow_forwardComparative financial statements for Weaver Company follow: During this year, Weaver sold some equipment for $10 that had cost $49 and on which there wasaccumulated depreciation of $30. In addition, the company sold long-term investments for $50 thathad cost $38 when purchased several years ago. Weaver paid a cash dividend this year and thecompany repurchased $109 of its own stock. This year Weaver did not retire any bonds. Required:1. Using the direct method, adjust the company’s income statement for this year to a cash basis.2. Using the information obtained in (1) above, along with an analysis of the remaining balance sheetaccounts, prepare a statement of cash flows for this year.arrow_forward

- Texas, Inc., sold common stock for $560,000 and preferred stock for $36,000 during the current year. In addition, the company purchased treasury stock for $35,000 and paid dividends on common and preferred stock for $24,000. Determine the amount of cash provided by or used for financing activities during the year.arrow_forwardDristell Incorporated had the following activities during the year (all transactions are for cash unless stated otherwise): a. A building with a book value of $405,000 was sold for $505,000. b. Additional common stock was issued for $165,000. c. Dristell purchased its own common stock as treasury stock at a cost of $77,500. d. Land was acquired by issuing a 6%, 10-year, $755,000 note payable to the seller. e. A dividend of $45,000 was paid to shareholders. f. An investment in Fleet Corporation's common stock was made for $125,000. g. New equipment was purchased for $67,500. h. A $92,500 note payable issued three years ago was paid in full. i. A loan for $105,000 was made to one of Dristell's suppliers. The supplier plans to repay Dristell this amount plus 10% interest within 18 months. Required: Calculate net cash flows from financing activities. (Cash outflows should be indicated with a minus sign.)arrow_forwardDristell Incorporated had the following activities during the year (all transactions are for cash unless stated otherwise): a. A building with a book value of $415,000 was sold for $515,000. b. Additional common stock was issued for $175,000. c. Dristell purchased its own common stock as treasury stock at a cost of $82,500. d. Land was acquired by issuing a 6%, 10-year, $765,000 note payable to the seller. e. A dividend of $55,000 was paid to shareholders. f. An investment in Fleet Corporation's common stock was made for $135,000. g. New equipment was purchased for $72,500. h. A $97,500 note payable issued three years ago was paid in full. i. A loan for $115,000 was made to one of Dristell's suppliers. The supplier plans to repay Dristell this amount plus 10% interest within 18 months.arrow_forward

- Dristell Inc. had the following activities during the year (all transactions are for cash unless stated otherwise): a. A building with a book value of $400,000 was sold for $500,000. b. Additional common stock was issued for $160,000. c. Dristell purchased its own common stock as treasury stock at a cost of $75,000. d. Land was acquired by issuing a 6%, 10-year, $750,000 note payable to the seller. e. A dividend of $40,000 was paid to shareholders. f. An investment in Fleet Corp.'s common stock was made for $120,000. g. New equipment was purchased for $65,000. h. A $90,000 note payable issued three years ago was paid in full. i. A loan for $100,000 was made to one of Dristell's suppliers. The supplier plans to repay Dristell this amount plus 10% interest within 18 months. Required: Calculate net cash flows from financing activities. (Cash outflows should be indicated with a minus sign.) Net cash flowsarrow_forwardMcCorey Corporation recorded the following events last year: Repurchase by the company of its own common stock Sale of long-term investment Interest paid to lenders Dividends paid to the company's shareholders Collection by McCorey of a loan made to another company Payment of taxes to governmental bodies On the statement of cash flows, some of these events are classified as operating activities, some are classified as investing activities, and some are classified as financing activities. Based solely on the information above, the net cash provided by (used in) financing activities on the statement of cash flows would be: Multiple Choice O $(156,000) $(83,000) $ 27,000 $ 46,000 $ 8,500 $ 56,000 $ 32,000 $ 18,500 $91,500 $188,000arrow_forwardTexas, Inc., sold common stock for $560,000 and preferred stock for $36,000 during the cur-rent year. In addition, the company purchased treasury stock for $35,000 and paid dividends on common and preferred stock for $24,000. Determine the amount of cash provided by or used forfinancing activities during the year.arrow_forward

- Moore Company is preparing its statement of cash flows for the current year. During the year, the company retired two issuances of debt and properly recorded the transactions. These transactions were as follows: Paid cash of $12,700 to retire bonds payable with a face value of $15,000 and a book value of $13,300. Paid cash of $48,000 to retire bonds payable with a face value of $45,000 and a book value of $47,000. Required: Record, in journal entry form, the entries that Moore would make for the preceding transactions on its spreadsheet to prepare its statement of cash flows. If an amount box does not require an entry, leave it blank.arrow_forwardBurgess also provided the following information: The company sold equipment that had an original cost of $13 million and accumulated depreciation of $8 million. The cash proceeds from the sale were $8 million. The gain on the sale was $3 million. The company did not issue any new bonds during the year. The company paid a cash dividend during the year. The company did not complete any common stock transactions during the year. Required: 1. Using the indirect method, prepare a statement of cash flows for the year. (Enter your answers in millions not in dollars. List any deduction in cash and cash outflows as negative amounts.)arrow_forwardNew attempt is in progress. Some of the new entries may impact the last attempt grading. Your answer is partially correct. Sheffield Co. reported $158,600 of net income for 2020. The accountant, in preparing the statement of cash flows, noted the following items occurring during 2020 that might affect cash flows from operating activities. 1. Sheffield purchased 100 shares of treasury stock at a cost of $20 per share. These shares were then resold at $25 per share. 2. Sheffield sold 100 shares of IBM common at $180 per share. The acquisition cost of these shares was $150 per share. There were no unrealized gains or losses recorded on this investment in 2020. 3. Sheffield revised its estimate for bad debts. Before 2020, Sheffield’s bad debt expense was 1% of its receivables. In 2020, this percentage was increased to 2%. Net account for 2020 were $489,500, and net accounts receivable decreased by $12,200 during 2020. 4. Sheffield issued 500 shares of its $10 par…arrow_forward

Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning

Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning