Concept explainers

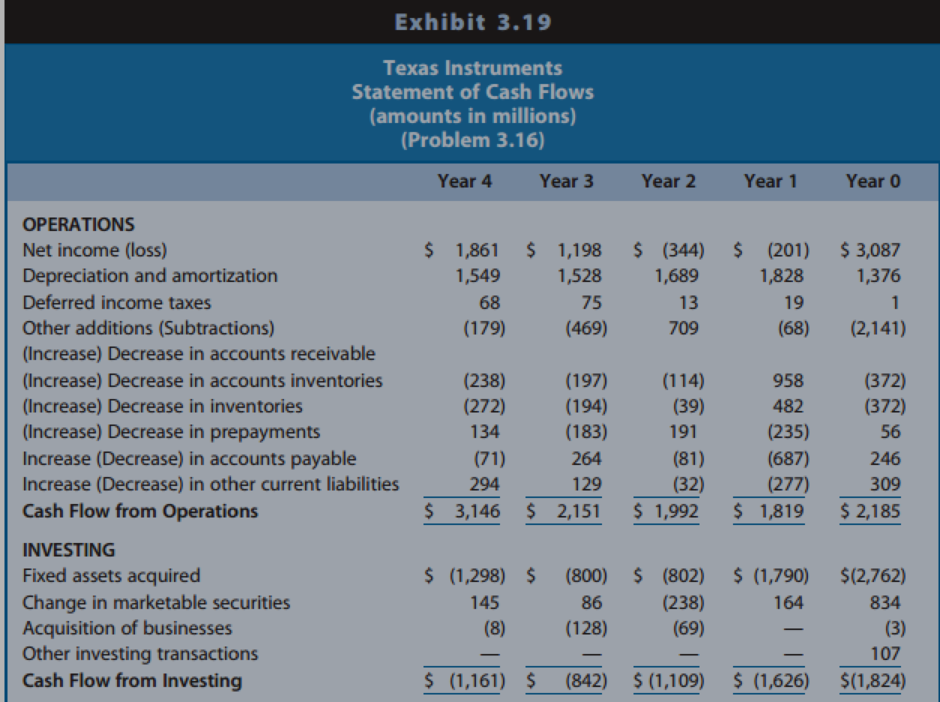

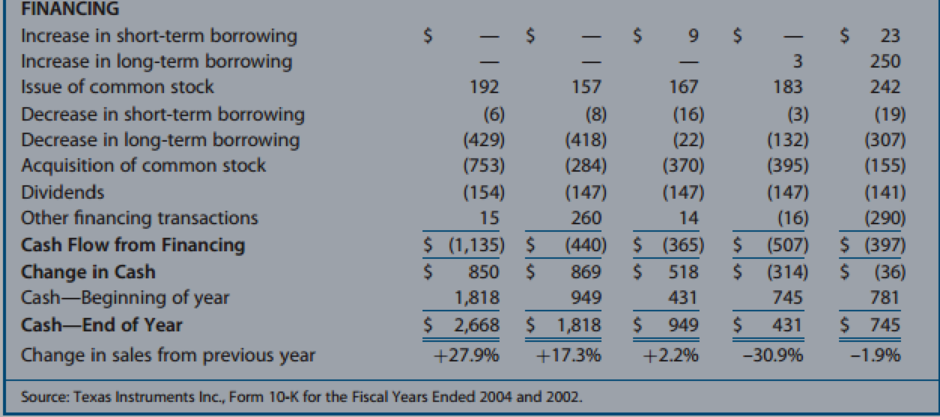

Interpreting the Statement of Cash Flows. Texas Instruments primarily develops and manufactures semiconductors for use in technology-based products for various industries. The manufacturing process is capital-intensive and subject to cyclical swings in the economy. Because of overcapacity in the industry and a cutback on spending for technology products due to a recession, semiconductor prices collapsed in Year 1 and commenced a steady comeback during Years 2 through 4.

Exhibit 3.19 presents a statement of cash flows for Texas Instruments for Year 0 to Year 4.

REQUIRED

Discuss the relations between net income and cash flows from operations and among cash flows from operating, investing, and financing activities for the firm over the five-year period.

Want to see the full answer?

Check out a sample textbook solution

Chapter 3 Solutions

Financial Reporting, Financial Statement Analysis and Valuation

- Your consulting firm was recently hired to improve the performance of RP Inc, which is highly profitable but has been experiencing cash shortages due to its high growth rate. As one part of your analysis, you want to determine the firm’s cash conversion cycle. Using the following information and a 365-day year, what is the firm’s present cash conversion cycle?arrow_forward(Calculating free cash flows) Spartan Stores is expanding operations with the introduction of a new distribution center. Not only will sales increase but investment in inventory will decline due to increased efficiencies in getting inventory to showrooms. As a result of this new distribution center, Spartan expects a change in EBIT of $900,000. Although inventory is expected to drop from $82,000 to $65,000, accounts receivables are expected to climb as a result of increased credit sales from $85,000 to $190,000. In addition, accounts payable are expected to increase from $67,000 to $84,000. This project will also produce $400,000 of bonus depreciation in year 1 and Spartan Stores is in the 35 percent marginal tax rate. What is the project's free cash flow in year 17 The project's free cash flow in year 1 is $ (Round to the nearest dollar) GTTSarrow_forwardElmdale Enterprises is deciding whether to expand its production facilities. Although long-term cash flows are difficult to estimate, management has projected the following cash flows for the first two years (in millions of dollars): (Click on the following icon in order to copy its contents into a spreadsheet.) Revenues COGS and Operating expenses other than depreciation Depreciation Increase in net working capital Capital expenditures Marginal corporate tax rate Year 1 121.2 49.3 24.7 5.3 30.7 a. What are the incremental earnings for this project for years 1 and 2? b. What are the free cash flows for this project for the first two years? 35% a. What are the incremental earnings for this project for years 1 and 2? The incremental earnings for year 1 is million. (Round to one decimal place.) Year 2 159.8 57.3 32.8 8.9 38.4 35%arrow_forward

- Elmdale Enterprises is deciding whether to expand its production facilities. Although long-term cash flows are difficult to estimate, management has projected the following cash flows for the first two years (in millions of dollars): (Click on the following icon in order to copy its contents into a spreadsheet.) Revenues COGS and Operating expenses other than depreciation Depreciation Increase in net working capital Capital expenditures Marginal corporate tax rate Year 1 101.2 48.1 22.7 3.1 31.6 a. What are the incremental earnings for this project for years 1 and 2? b. What are the free cash flows for this project for the first two years? 35% Year 2 160.1 38.1 35.2 7.8 40.6 35%arrow_forwardYou have recently been hired to improve the performance of Multiplex Corporation, which has been experiencing a severe cash shortage. As one part of your analysis, you want to determine the firm’s cash conversion cycle. Using the following information and a 365-day year,(a) what is your estimate of the firm’s current cash conversion cycle? Current inventory = $241,000.00 • Annual sales = $1,200,000.00 • Accounts receivable = $300,000.00 • Accounts payable = $245,000.00 • Total annual purchases = $600,000.00 • Purchases credit terms: net 30 days. • Receivables credit terms: net 50 days.arrow_forwardABC has a problem with its cash conversion cycle. Based on records, ABC has receivables, inventory and payable turnovers of 3.5, 5.6, and 7.7 times a year. The industry averages for ages of receivables, inventory and payables are 30, 60, and 45 days. Management of which working capital component should ABC prioritize to improve? Final answer must be the suggested decrease in average age of that specific component (e.g., if average age of receivables is to be decreased by 5.33 days, then final answer must be 5.33. Use 365 days in a year." answerarrow_forward

- You have recently been hired to improve the performance of Multiplex Corporation, which has been experiencing a severe cash shortage. As one part of your analysis, you want to determine the firm’s cash conversion cycle. Using the following information and a 365-day year,(a) what is your estimate of the firm’s current cash conversion cycle? • Current inventory = $ 180,000.00 • Annual sales = $ 700,000.00 • Accounts receivable = $ 165,000.00 • Accounts payable = $ 85,000.00 • Total annual purchases = $ 567,000.00 • Purchases credit terms: net 30 days. • Receivables credit terms: net 50 days.arrow_forwardYour consulting firm was recently hired to improve the performance of RP Inc, which is highly profitable but has been experiencing cash shortages due to its high growth rate. As one part of your analysis. you want to determine the firm's cash conversion cycle. Using the following information and a 365-day year, what is the firm's present cash conversion cycle? Average inventory Annual sales Annual cost of goods seld Average accounts receivable Average accunts payable P5.000 P00.000 PH0,000 P0,000 F5000 140.6 days 120.6 days 133.6 days 148.0 days O 126.9 daysarrow_forwardYou have recently been hired to improve the performance of Multiplex Corporation, which has been experiencing a severe cash shortage. As one part of your analysis, you want to determine the firm’s cash conversion cycle. Using the following information and a 365-day year,(b) what is your Net Working Capital • Current inventory = $ 180,000.00 • Annual sales = $ 700,000.00 • Accounts receivable = $ 165,000.00 • Accounts payable = $ 85,000.00 • Total annual purchases = $ 567,000.00 • Purchases credit terms: net 30 days. • Receivables credit terms: net 50 days.arrow_forward

- Etobicoke Enterprises is deciding whether to expand its production facilities. Although long-term cash flows are difficult to estimate, management has projected the following cash flows for the first two years (in millions of dollars): Revenues Operating Expenses (other than depreciation) CCA Increase in Net Working Capital Capital Expenditures Marginal Corporate Tax Rate Year 1 128.5 47.2 29.9 3.1 28.7 35% Year 2 155.5 63.7 34.1 8.9 41.6 35% a. What are the incremental earnings for this project for years 1 and 2? (Note: Assume any incremental cost of goods sold is included as part of operating expenses.) b. What are the free cash flows for this project for the first two years?arrow_forwardConsolidated Natural Gas Company (CNG), with corporate headquarters in Pittsburgh, Pennsylvania, is one of the largest producers, transporters, distributors, and marketers of natural gas in North America. Periodically, the company experiences a decrease in the value of its gas- and oil-producing properties, and a special charge to income was recorded in order to reduce the carrying value of those assets. Assume the following information. In 2016, CNG estimated the cash inflows from its oil- and gas-producing properties to be $375,000 per year. During 2017, the write-downs described above caused the estimate to be decreased to $275,000 per year. Production costs (cash outflows) associated with all these properties were estimated to be $125,000 per year in 2016, but this amount was revised to $155,000 per year in 2017.Instructions(Assume that all cash flows occur at the end of the year.)(a) Calculate the present value of net cash flows for 2016–2018 (three years), using the 2016…arrow_forwardSummit Manufacturing’s most recent statements of cash flows indicate that the firm has paid large dividends to its stockholders in each of the past three years. Upon noting this information, A : potential investors would be more likely to invest in Summit, but potential lenders may be less likely to grant the company a loan. B : potential investors would be less likely to invest in Summit, but potential lenders may be more likely to grant the company a loan. C : potential investors would be less likely to invest in Summit, and potential lenders may be less likely to grant the company a loan. D : potential investors would be more likely to invest in Summit, and potential lenders may be more likely to grant the company a loan.arrow_forward

Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning

Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning