Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

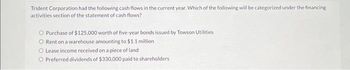

Transcribed Image Text:Trident Corporation had the following cash flows in the current year. Which of the following will be categorized under the financing

activities section of the statement of cash flows?

O Purchase of $125,000 worth of five-year bonds issued by Towson Utilities

O Rent on a warehouse amounting to $1.1 million

O Lease income received on a piece of land

O Preferred dividends of $330,000 paid to shareholders

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- 33. An entity had the following activities during the current year: Acquired share capital of another entity 2,000,000 Sold an investment with carrying amount of P2,000,000 1,500,000 Acquired a one-year certificate of deposit from a bank 5,000,000 Interest on the deposit received from the bank 500,000 Collected dividends on share investments 300,000 What amount should be reported as net cash used in investing activities? a. 5,500,000 b. 5,000,000 c. 4,700,000 d. 6,300,000arrow_forwardOriole Company purchased treasury stock with a cost of $68200 during 2022. During the year, the company paid dividends of $24800 and issued bonds payable for proceeds of $1086200. Cash flows from financing activities for 2022 total $93000 net cash outflow. $993200 net cash inflow. $1129600 net cash inflow. $1061400 net cash inflow.arrow_forwardOarrow_forward

- Abakada Incorporated acquired all the assets and liabilities of Egaha Company on January 1, 2018. The consideration are as follows: Cash Equipment Cash contingency Stock contingency Bank loan, at face value The cash payments are distributed to the following payees: Former owners of Egaha Company Lawyers for legal services Actuarial for valuation of Egaha's net assets Bank, transaction costs for the bank loan 2,000,000 500,000 30,000 50,000 1,000,000 Business Combination Page 4 of 5 1,800,000 80,000 50,000 70,000 Answer the following independent questions: 19. If the fair value of net assets of Egaha amounted to Php3,000,000, how much is the goodwill (bargain purchase gain) on business combination? 20. If bargain purchase gain on the acquisition amounted to Php40,000, how much could be the fair value of net assets acquired?arrow_forwardDuring 2010, Arizona Company issued $500,000 in long-term bonds at 96, repaid $75,000 of bonds at face value, paid interest of $40,000, and paid dividends of $25,000. Prepare the cash flows from the financing activities section of the statement of cash flows.arrow_forwardWainwright Corporation had the following activities in 2020. Sale of land $180,000. Purchase of inventory $845,000. Purchase of treasury stock $72,000. Purchase of equipment $415,000. Issuance of common stock $320,000. Purchase of available-for-sale debt securities $59,000. Compute the amount Wainwright should report as net cash provided (used) by investing activities in its 2020 statement of cash flows.arrow_forward

- Morray Corporation had the following transactions. Classify each of these transactions by type of cash flow activity (operating, investing, or financing). 1. Issued $160,000 of bonds payable. 2. Paid utilities expense. 3. Issued 500 shares of preferred stock for $45,000. 4. Sold land and a building for $250,000. 5. Loaned $30,000 to Dead End Corporation, receiving Dead End's 1-year, 12% note.arrow_forwardRequired information [The following information applies to the questions displayed below.] In preparation for developing its statement of cash flows for the year ended December 31, 2021, Rapid Pac, Inc., collected the following information: Fair value of shares issued in a stock dividend Payment for the early extinguishment of long-term bonds (book value: $93.0 million) Proceeds from the sale of treasury stock (cost: $29.0 million) Gain on sale of land. Proceeds from sale of land Purchase of Microsoft common stock Declaration of cash dividends. Distribution of cash dividends declared in 2020. Cash Flows From Investing Activities: Net cash inflows (outflows) from investing activities ($ in millions) $116.0 Required: 1. In Rapid Pac's statement of cash flows, what were net cash inflows (or outflows) from investing activities for 2021? (Amounts to be deducted should be indicated with a minus sign. Enter your answers in millions rounded to 1 decimal place (i.e., 5,500,000 should be entered…arrow_forwardOriole Corporation had the following activities in 2020. 1. 2. 3. Sale of land $163,000 Purchase of inventory $878,000 Purchase of treasury stock $69,000 Net cash used Purchase of equipment $433,000 5. Issuance of common stock $340,000 6. Purchase of available-for-sale debt securities $60,000 Compute the amount Oriole should report as net cash provided (used) by investing activities in its 2020 statement of cash flows. (Show amounts that decrease cash flow with either a-sign e.g. -15,000 or in parenthesis e.g. (15,000).) by investing activities 4. $ LAarrow_forward

- In preparing a company's statement of cash flows for the most recent year, Jeffers Corporation reported the following information: $ 107,000 62,000 Repayment of outstanding bonds Purchase of treasury stock Issuance of common stock Payment of cash dividends 46,000 15,000 Net cash flows from financing activities for the year were: Multiple Choice $230,000 of net cash used. INarrow_forwardCoronary, Inc. had the following transactions during 2020: Purchased new fixed assets for $35,000 Converted $20,000 worth of preferred shares to common shares Received cash dividends of $11,000. Paid cash dividends of $20,000. • Repaid mortgage principal of $17,000 . . . Assuming Coronary follows U.S. GAAP, which of the following amounts represents Coronary's cash flows from investing and cash flows from financing in 2020? Investing: ($35,000); Financing: ($37,000) Investing: ($24,000); Financing: ($26,000) Investing: ($35,000): Financing: ($26,000)arrow_forwardTom Hanks Company had the following account activity Increase in income taxes payable $100,000 Increase in bonds payable 240,000 Sale of investments 130,000 Issuance of common stock 120,000 Payment of cash dividends 70,000 Purchased treasury stock 25,000 Net cash provided by financing activities is:arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education