Horngren's Cost Accounting: A Managerial Emphasis (16th Edition)

16th Edition

ISBN: 9780134475585

Author: Srikant M. Datar, Madhav V. Rajan

Publisher: PEARSON

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 23, Problem 23.27E

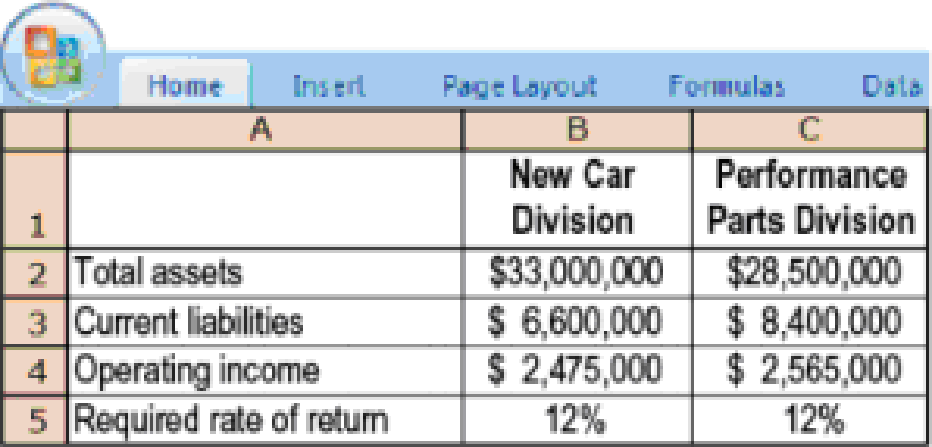

ROI, RI, EVA. Performance Auto Company operates a new car division (that sells high-performance sports cars) and a performance parts division (that sells performance-improvement parts for family cars). Some division financial measures for 2017 are as follows:

- 1. Calculate

return on investment (ROI) for each division using operating income as a measure of income and total assets as a measure of investment. - 2. Calculate residual income (RI) for each division using operating income as a measure of income and total assets minus current liabilities as a measure of investment.

- 3. William Abraham, the new car division manager, argues that the performance parts division has loaded up on a lot of short-term debt” to boost its RI. Calculate an alternative RI for each division that is not sensitive to the amount of short-term debt taken on by the performance parts division. Comment on the result.

- 4. Performance Auto Company, whose tax rate is 40%, has two sources of funds: long-term debt with a market value of $18,000,000 at an interest rate of 10% and equity capital with a market value of $12,000,000 and a

cost of equity of 15%. Applying the same weighted-average cost of capital (WACC) to each division, calculate EVA for each division. - 5. Use your preceding calculations to comment on the relative performance of each division.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Performance Auto Company operates a new car division (that sells high performance sports cars) and a performance parts division (that sells performance-improvement parts for family cars). Some division financial measures for 2017 are as follows:

E (Click the icon to view the data.)

Read the requirements.

Data table

rounded to one decimal place in the format X.X%.)

Requirements

New Car

Performance

1. Calculate return on investment (ROI) for each division using operating income

as a measure of income and total assets as a measure of investment.

Division

Parts Division

2. Calculate residual income (RI) for each division using operating income as a

Total assets

2$

35,000,000 $

32,312,500

measure of income and total assets minus current liabilities as a measure of

investment.

Current liabilities

2$

6,500,000 $

৪,000,000

3. William Abraham, the New Car Division manager, argues that the performance

parts division has "loaded up on a lot of short-term debt" to boost its RI.

Operating income

$4…

Analyzing profitability

Camden Company has divided its business into segments based on sales territories: East Coast, Midland, and West Coast. Following are financial data for 2018:

Prepare an income statement for Camden Company for 2018 using the contribution margin format assuming total fixed costs for the company Were $435,000. Include columns for each business segment and a column for the total company.

Profit Margin, Investment Turnover, and return on investment

The condensed income statement for the Consumer Products Division of Fargo Industries Inc. is as follows (assuming no service department charges):

Sales

Cost of goods sold

Gross profit

Administrative expenses

Income from operations

The manager of the Consumer Products Division is considering ways to increase the return on investment.

a. Using the DuPont formula for return on investment, determine the profit margin, investment turnover, and return on investment of the Consumer Products Division, assuming that $1,950,000 of assets have been

invested in the Consumer Products Division. Round the investment turnover to one decimal place.

Profit margin

Investment turnover

Rate of return on investment

Profit margin

Investment turnover

$1,170,000

526,500

$643,500

409,500

$234,000

b. If expenses could be reduced by $58,500 without decreasing sales, what would be the impact on the profit margin, investment turnover, and return on…

Chapter 23 Solutions

Horngren's Cost Accounting: A Managerial Emphasis (16th Edition)

Ch. 23 - Prob. 23.1QCh. 23 - Prob. 23.2QCh. 23 - What factors affecting ROI does the DuPont method...Ch. 23 - RI is not identical to ROI, although both measures...Ch. 23 - Describe EVA.Ch. 23 - Give three definitions of investment used in...Ch. 23 - Distinguish between measuring assets based on...Ch. 23 - Prob. 23.8QCh. 23 - Why is it important to distinguish between the...Ch. 23 - Prob. 23.10Q

Ch. 23 - Managers should be rewarded only on the basis of...Ch. 23 - Explain the role of benchmarking in evaluating...Ch. 23 - Explain the incentive problems that can arise when...Ch. 23 - Prob. 23.14QCh. 23 - Prob. 23.15QCh. 23 - During the current year, a strategic business unit...Ch. 23 - Assuming an increase in price levels over time,...Ch. 23 - If ROI Is used to evaluate a managers performance...Ch. 23 - The Long Haul Trucking Company is developing...Ch. 23 - ABC Inc. desires to maintain a capital structure...Ch. 23 - ROI, comparisons of three companies. (CMA,...Ch. 23 - Prob. 23.22ECh. 23 - ROI and RI. (D. Kleespie, adapted) The Sports...Ch. 23 - ROI and RI with manufacturing costs. Excellent...Ch. 23 - ROI, RI, EVA. Hamilton Corp. is a reinsurance and...Ch. 23 - Goal incongruence and ROI. Comfy Corporation...Ch. 23 - ROI, RI, EVA. Performance Auto Company operates a...Ch. 23 - Capital budgeting, RI. Ryan Alcoa, a new associate...Ch. 23 - Prob. 23.29ECh. 23 - ROI, RI, EVA, and performance evaluation. Cora...Ch. 23 - Prob. 23.31ECh. 23 - Prob. 23.32ECh. 23 - ROI performance measures based on historical cost...Ch. 23 - ROI, measurement alternatives for performance...Ch. 23 - Multinational firms, differing risk, comparison of...Ch. 23 - ROI, Rl, DuPont method, investment decisions,...Ch. 23 - Division managers compensation, levers of control...Ch. 23 - Executive compensation, balanced scorecard. Acme...Ch. 23 - Financial and nonfinancial performance measures,...Ch. 23 - Prob. 23.40PCh. 23 - Prob. 23.41PCh. 23 - RI, EVA, measurement alternatives, goal...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Tan Corporation of Japan has two regional divisions with headquarters in Osaka and Yokohama. Selected data on the two divisions follow: Sales Net operating income Average operating assets Required 1 Required 2 Required: 1. For each division, compute the return on investment (ROI). 2. Assume that the company evaluates performance using residual income and that the minimum required rate of return for any division is 17%. Compute the residual income for each division. Complete this question by entering your answers in the tabs below. ROI Osaka $ 10,100,000 $ 808,000 $ 2,525,000 Osaka Division For each division, compute the return on investment (ROI). % Yokohama $ 31,000,000 $ 3,100,000 $ 15,500,000 Yokohama %arrow_forwardArlington Clothing, Inc., shows the following information for its two divisions for year 1. Sales revenue Cost of sales Allocated corporate overhead Other general and administration Required: a. Compute divisional operating income for the two divisions. Ignore taxes. b-1. What are the gross margin and operating margin percentages for both divisions? b-2. How well have these divisions performed? Req A Complete this question by entering your answers in the tabs below. Operating income Lake Region $4,040,000 2,631,300 242,400 541,900 Req B1 stion 10- Hom... Req B2 Compute divisional operating income for the two divisions. Ignore taxes. (Enter your answers in thousa to 1 decimal place.) Coastal Region $12,950,000 6,475,000 777,000 3,743,000 Lake Region Coastal Region Reg A Req B1 > < Prevarrow_forwardTan Corporation of Japan has two regional divisions with headquarters in Osaka and Yokohama. Selected data on the two divisions follow: Sales Net operating income Average operating assets Required 1 Required 2 Required: 1. For each division, compute the return on investment (ROI). 2. Assume that the company evaluates performance using residual income and that the minimum required rate of return for any division is 18%. Compute the residual income for each division. Complete this question by entering your answers in the tabs below. ROI Osaka $ 9,400,000 $ 752,000 $ 2,350,000 Osaka Division For each division, compute the return on investment (ROI). % Yokohama $ 24,000,000 $ 2,400,000 $8,000,000 Yokohama %arrow_forward

- Profit Margin, Investment Turnover, and Return on Investment The condensed income statement for the Consumer Products Division of Tri-State Industries Inc. is as follows (assuming no support department allocations): Sales Cost of goods sold Gross profit Administrative expenses Operating income The manager of the Consumer Products Division is considering ways to increase the return on investment. a. Using the DuPont formula for return on investment, determine the profit margin, investment turnover, and return on investment of the Consumer Products Division, assuming that $143,750,000 of assets have been invested in the Consumer Products Division. If required, round your answers to one decimal place. Profit margin $230,000,000 (126,500,000) $103,500,000 (64,400,000) $39,100,000 Investment turnover Return on investment % Investment turnover Return on investment b. If expenses could be reduced by $3,450,000 without decreasing sales, what would be the impact on the profit margin, investment…arrow_forwardZuds, Helpful Hardware's manufacturing division of lawn-mowing and snow removal equipment, segments its business according to customer type: Professional and Residential. The following divisional information was available for the past year. View the divisional information. Requirements Round all of your answers to four decimal places. 1. Calculate each division's ROI. 2. Calculate each division's profit margin. Interpret your results. 3. Calculate each division's asset turnover. Interpret your results. 4. Use the expanded ROI formula to confirm your results from Requirement 1. What can you conclude?arrow_forwardThe Custodial Division of Clark's Corporate Services (CCS) has assets of $1.2 million. During the past year, the division had profits of $228,000. CCS has a cost of capital of 7.5 percent. Ignore taxes. Required: a. Compute the divisional ROI for the Custodial Division. b. Compute the divisional RI for the Custodial Division. Complete this question by entering your answers in the tabs below. Required A Required B Compute the divisional ROI for the Custodial Division. Divisional ROI % Required A Required B >arrow_forward

- 7. Responsibility Accounting: a. What is a cost center? Give an example of a cost center b. What is a Profit center? Give an example of a profit center c. What is an investment center? Give an example of an investment center d. What is management by exception: e. The Hydride Division of Murdoch Corporation is an investment center. It has $1,000,000 of operating assets. During 2022, the Hydride Division earned operating income of $400,000 on $5,000,000 of sales. Murdoch's companywide return on investment or desired rate of return is approximately 20% SHOW WORK FOR CREDIT! 1. What is the ROI? 2. What is the margin? 3. What is the turnover? 4. What is the residual income?arrow_forwardThe following revenue data were taken from the December 31, 2017, General Electric annual report (10-K): For each segment and each year, calculate intersegment sales (another name for transfer sales) as a percentage of total sales. Using Microsoft Excel or another spreadsheet application, create a clustered column graph to show the 2016 and 2017 percentages for each division. Comment on your observations of this data. How might a division sales manager use this data?arrow_forwardThe following revenue data were taken from the December 31, 2017, Coca-Cola annual report (10-K): For each segment and each year, calculate intersegment sales (another name for transfer sales) as a percentage of total sales, Using Microsoft Excel or another spreadsheet application, create a clustered column graph to show the 2016 and 2017 percentages for each division. Comment on your observations of this data. How might a division sales manager use this data?arrow_forward

- Forchen, Inc., provided the following information for two of its divisions for last year: Required: 1. For the Small Appliances Division, calculate: a. Average operating assets b. Margin c. Turnover d. Return on investment (ROI) 2. For the Cleaning Products Division, calculate: a. Average operating assets b. Margin c. Turnover d. Return on investment (ROI) 3. What if operating income for the Small Appliances Division was 2,000,000? How would that affect average operating assets? Margin? Turnover? ROI? Calculate any changed ratios (round to four significant digits).arrow_forwardAugustus Electrical Company has 2 divisions, one in Georgetown and one in Berbice Guyana and information on the both divisions are as follows: Georgetown Berbice Total assets $100,000 $500,000 Current liabilities 25,000 150,000 Revenue 50,000 50,000 Income before tax 20,000 75,000 Required: Calculate the return on investment (ROI) using net income and total assets as the measure of income and investment for the Berbice division. a.150% b.1.5% c.15% d.20%arrow_forwardThe vice president of operations of Moab Bike Company is evaluating the performance of two divisions organized as investment centers. Invested assets and condensed income statement data for the past year ending October 31, 20Y9, for each division are as follows: (P14-5) Touring Bike Division Trail Bike Division Sales $1,500,000 $5,00 Cost of goods sold Operating expenses Invested assets 900,000 4,000,000 495,000 968,000 750,000 3,600,000 Instructions 1. Prepare condensed divisional income statements for the year ended October 31, 20Y9, assuming that there were no service department charges. Touting Bike Division Trial Bike Divisionarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:9781305961883

Author:Carl Warren

Publisher:Cengage Learning

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Introduction to Divisional performance measurement - ACCA Performance Management (PM); Author: OpenTuition;https://www.youtube.com/watch?v=pk8Mzoqr4VA;License: Standard Youtube License