Horngren's Cost Accounting: A Managerial Emphasis (16th Edition)

16th Edition

ISBN: 9780134475585

Author: Srikant M. Datar, Madhav V. Rajan

Publisher: PEARSON

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 23, Problem 23.34P

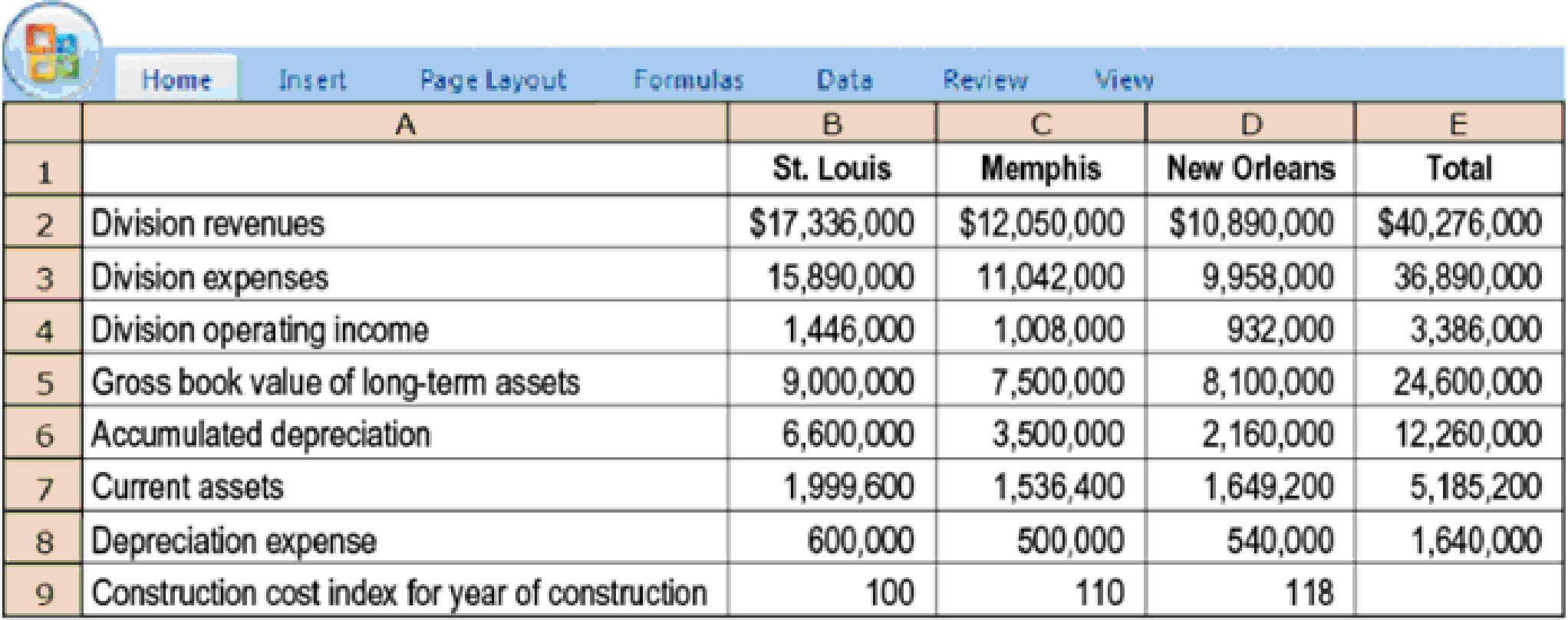

- 1. Calculate ROI for each division using net book value of total assets. Required

- 2. Using the technique in Figure 23-2, compute ROI using current-cost estimates for long-term assets and

depreciation expense. The construction cost index for 2017 is 122. Estimated useful life of operational assets is 15 years. - 3. How does the choice of long-term asset valuation affect management decisions regarding new capital investments? Why might this choice be more significant to the St. Louis division manager than to the New Orleans division manager?

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Liability?

Solve this question financial accounting

Production Efficiency

Chapter 23 Solutions

Horngren's Cost Accounting: A Managerial Emphasis (16th Edition)

Ch. 23 - Prob. 23.1QCh. 23 - Prob. 23.2QCh. 23 - What factors affecting ROI does the DuPont method...Ch. 23 - RI is not identical to ROI, although both measures...Ch. 23 - Describe EVA.Ch. 23 - Give three definitions of investment used in...Ch. 23 - Distinguish between measuring assets based on...Ch. 23 - Prob. 23.8QCh. 23 - Why is it important to distinguish between the...Ch. 23 - Prob. 23.10Q

Ch. 23 - Managers should be rewarded only on the basis of...Ch. 23 - Explain the role of benchmarking in evaluating...Ch. 23 - Explain the incentive problems that can arise when...Ch. 23 - Prob. 23.14QCh. 23 - Prob. 23.15QCh. 23 - During the current year, a strategic business unit...Ch. 23 - Assuming an increase in price levels over time,...Ch. 23 - If ROI Is used to evaluate a managers performance...Ch. 23 - The Long Haul Trucking Company is developing...Ch. 23 - ABC Inc. desires to maintain a capital structure...Ch. 23 - ROI, comparisons of three companies. (CMA,...Ch. 23 - Prob. 23.22ECh. 23 - ROI and RI. (D. Kleespie, adapted) The Sports...Ch. 23 - ROI and RI with manufacturing costs. Excellent...Ch. 23 - ROI, RI, EVA. Hamilton Corp. is a reinsurance and...Ch. 23 - Goal incongruence and ROI. Comfy Corporation...Ch. 23 - ROI, RI, EVA. Performance Auto Company operates a...Ch. 23 - Capital budgeting, RI. Ryan Alcoa, a new associate...Ch. 23 - Prob. 23.29ECh. 23 - ROI, RI, EVA, and performance evaluation. Cora...Ch. 23 - Prob. 23.31ECh. 23 - Prob. 23.32ECh. 23 - ROI performance measures based on historical cost...Ch. 23 - ROI, measurement alternatives for performance...Ch. 23 - Multinational firms, differing risk, comparison of...Ch. 23 - ROI, Rl, DuPont method, investment decisions,...Ch. 23 - Division managers compensation, levers of control...Ch. 23 - Executive compensation, balanced scorecard. Acme...Ch. 23 - Financial and nonfinancial performance measures,...Ch. 23 - Prob. 23.40PCh. 23 - Prob. 23.41PCh. 23 - RI, EVA, measurement alternatives, goal...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Introduction to Divisional performance measurement - ACCA Performance Management (PM); Author: OpenTuition;https://www.youtube.com/watch?v=pk8Mzoqr4VA;License: Standard Youtube License