Concept explainers

Problem 20-7BA

FIFO: Process cost summary, equivalent units, cost estimates

C2 C3 C4 P4

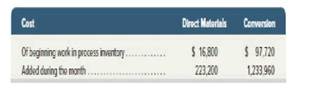

Belda Co. mates organic juice in two departments: cutting and blending. Direct materials are added at the beginning of each process, and conversion costs are added evenly throughout each process. The company uses the FIFO method of

Required

- Prepare the cutting departments process cost summary for March using the FIFO method.

- Prepare the

journal entry dated March 31 to transfer the cost of completed units to the blending department, - The company provides incentives to department managers by paying monthly bonuses based on their success in controlling costs per equivalent unit of production, Assume that the production department overestimates the percentage of completion for units in ending inventory with the result that its

equivalent units of production for March are overstated, What impact does this error have on bonuses paid to the managers of the production department? What impact, if any, does this error have on these managers' April bonuses?

Want to see the full answer?

Check out a sample textbook solution

Chapter 20 Solutions

Fundamental Accounting Principles

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub