Fundamental Accounting Principles

24th Edition

ISBN: 9781259916960

Author: Wild, John J., Shaw, Ken W.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 20, Problem 14E

Exercise 20-14

Production cost flow and measurement;

P4

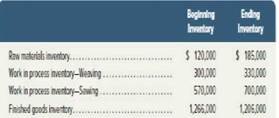

Pro-Weave manufactures stadium blankets by passing the products through a weaving department and a sewing department. The following information is

The Mowing additional information describes the company's manufacturing activities for June:

available regarding its June inventories:

Required

- Compute the (a) cost of products transferred from weaving to sewing, (b) cost of products transferred from sewing to finished goods, and (c) cost of goods sold.

- Prepare journal entries dated June 30 to record (a) goods transferred from weaving to sewing, (b) goods transferred from sewing to finished goods, and (c) sale of finished goods.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Abc

Hello tutor please give me correct solution

General accounting

Chapter 20 Solutions

Fundamental Accounting Principles

Ch. 20 - Prob. 1DQCh. 20 - Prob. 2DQCh. 20 - Prob. 3DQCh. 20 - Prob. 4DQCh. 20 - Prob. 5DQCh. 20 - Explain in simple terms the notion of equivalent...Ch. 20 - Prob. 7DQCh. 20 - Prob. 8DQCh. 20 - Direct labor costs flow through what accounts in a...Ch. 20 - Prob. 10DQ

Ch. 20 - Prob. 11DQCh. 20 - Prob. 12DQCh. 20 - Prob. 13DQCh. 20 - Companies such as Apple commonly prepare a process...Ch. 20 - Prob. 15DQCh. 20 - Prob. 16DQCh. 20 - Prob. 17DQCh. 20 - How could a company manager use a process cost...Ch. 20 - Explain a hybrid costing system. Identify' a...Ch. 20 - Prob. 1QSCh. 20 - Prob. 2QSCh. 20 - Process vs. job order operations C1 For each of...Ch. 20 - Physical flow reconciliation C2 Prepare a physical...Ch. 20 - Prob. 5QSCh. 20 - A FIFO: Computing equivalent units C4 Refer to QS...Ch. 20 - Prob. 7QSCh. 20 - Prob. 8QSCh. 20 - Prob. 9QSCh. 20 - Prob. 10QSCh. 20 - Prob. 11QSCh. 20 - Prob. 12QSCh. 20 - Prob. 13QSCh. 20 - Prob. 14QSCh. 20 - Prob. 15QSCh. 20 - Prob. 16QSCh. 20 - A FIFO: Journal entry to transfer costs P4 Refer...Ch. 20 - Prob. 18QSCh. 20 - Weighted average: Assigning costs to output C3...Ch. 20 - Prob. 20QSCh. 20 - Prob. 21QSCh. 20 - Prob. 22QSCh. 20 - Recording costs of materials P1 Hotwax mates...Ch. 20 - Prob. 24QSCh. 20 - Recording costs of factory overhead P1 P3 Prepare...Ch. 20 - Recording transfer of costs to finished goods P4...Ch. 20 - Exercise 20-1 Process vs. job order operations C1...Ch. 20 - Exercise 20-2 Comparing process and job order...Ch. 20 - Prob. 3ECh. 20 - Prob. 4ECh. 20 - Prob. 5ECh. 20 - Prob. 6ECh. 20 - Prob. 7ECh. 20 - Exercise 20-8 Weighted average: Computing...Ch. 20 - Prob. 9ECh. 20 - Prob. 10ECh. 20 - Prob. 11ECh. 20 - Prob. 12ECh. 20 - Exercise 20-13A

FIFO: Completing a process cost...Ch. 20 - Exercise 20-14 Production cost flow and...Ch. 20 - Exercise 20-15 Recording product costs P1 P2 P3...Ch. 20 - Prob. 16ECh. 20 - Prob. 17ECh. 20 - Prob. 18ECh. 20 - Prob. 19ECh. 20 - Prob. 20ECh. 20 - Prob. 21ECh. 20 - Exercise 20-22 Recording costs of labor P2 Prepare...Ch. 20 - Prob. 23ECh. 20 - Prob. 24ECh. 20 - Exercise 20-25 Recording cost flows in a process...Ch. 20 - Exercise 20-26 Interpretation of journal entries...Ch. 20 - Prob. 1APSACh. 20 - Prob. 2APSACh. 20 - Prob. 3APSACh. 20 - Problem 20-4A Weighted average: Process cost...Ch. 20 - Problem 20-5AA FIFO: Process cost summary:...Ch. 20 - Prob. 6APSACh. 20 - Prob. 7APSACh. 20 - Prob. 1BPSBCh. 20 - Prob. 2BPSBCh. 20 - Prob. 3BPSBCh. 20 - Prob. 4BPSBCh. 20 - Problem 20-5BA FIFO: Process cost summary;...Ch. 20 - Problem 20-6BAFIFO: Costs per equivalent unit;...Ch. 20 - Problem 20-7BA FIFO: Process cost summary,...Ch. 20 - Prob. 20SPCh. 20 - Prob. 20CPCh. 20 - Prob. 1GLPCh. 20 - Apple has entered into contracts that require the...Ch. 20 - Apple and Google work to maintain high-quality and...Ch. 20 - Prob. 3AACh. 20 - Prob. 1BTNCh. 20 - Prob. 2BTNCh. 20 - Many companies use technology to help them improve...Ch. 20 - Prob. 4BTNCh. 20 - Prob. 5BTNCh. 20 - Prob. 6BTN

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- On January 1, 2024, Maywood Hydraulics leased drilling equipment from Aqua Leasing for a four-year period ending December 31, 2027, at which time possession of the leased asset will revert back to Aqua. • The equipment cost Aqua $423,414 and has an expected economic life of five years. Aqua and Maywood expect the residual value at December 31, 2027, to be $60,000. Negotiations led to Maywood guaranteeing a $85,000 residual value. • Equal payments under the lease are $120,000 and are due on December 31 of each year with the first payment being made on December 31, 2024. Maywood is aware that Aqua used a 7% interest rate when calculating lease payments. Note: Use tables, Excel, or a financial calculator. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) Required: 1. & 2. Prepare the appropriate entries for Maywood on January 1, 2024 and December 31, 2024, related to the lease. Note: If no entry is required for a transaction/event, select "No journal entry required" in…arrow_forwardWhat is the break even point in sales provide answerarrow_forwardhelp me to solve this questionsarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning, College Accounting, Chapters 1-27 (New in Account...AccountingISBN:9781305666160Author:James A. Heintz, Robert W. ParryPublisher:Cengage Learning

College Accounting, Chapters 1-27 (New in Account...AccountingISBN:9781305666160Author:James A. Heintz, Robert W. ParryPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:9781305087408

Author:Edward J. Vanderbeck, Maria R. Mitchell

Publisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

College Accounting, Chapters 1-27

Accounting

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:Cengage Learning,

College Accounting, Chapters 1-27 (New in Account...

Accounting

ISBN:9781305666160

Author:James A. Heintz, Robert W. Parry

Publisher:Cengage Learning

Job Cost Sheet - Job Cost Accounting System; Author: Accounting Instruction, Help, & How To;https://www.youtube.com/watch?v=ElD8nKNXE1I;License: Standard Youtube License