Cornerstones of Financial Accounting

4th Edition

ISBN: 9781337690881

Author: Jay Rich, Jeff Jones

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

What was the amount of the cash flow to stockholder's on these financial accounting question?

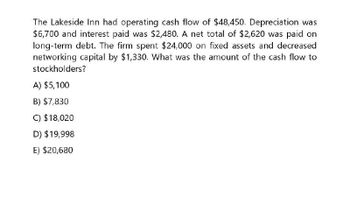

Transcribed Image Text:The Lakeside Inn had operating cash flow of $48,450. Depreciation was

$6,700 and interest paid was $2,480. A net total of $2,620 was paid on

long-term debt. The firm spent $24,000 on fixed assets and decreased

networking capital by $1,330. What was the amount of the cash flow to

stockholders?

A) $5,100

B) $7,830

C) $18,020

D) $19,998

E) $20,680

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Muffin's Masonry, Inc.'s, balance sheet lists net fixed assets as $24 million. The fixed assets could currently be sold for $39 million. Muffin's current balance sheet shows current liabilities of $10.5 million and net working capital of $9.5 million. If all the current accounts were liquidated today, the company would receive $7.75 million cash after paying the $10.5 million in current liabilities. What is the book value of Muffin's Masonry's assets today and the market value of these assets? (Enter your answer in millions of dollars rounded to 2 decimal places.) Current assets Fixed assets Total BOOK VALUE MARKET VALUE (in millions of dollars)arrow_forwardMuffin’s Masonry, Inc.’s, balance sheet lists net fixed assets as $26 million. The fixed assets could currently be sold for $43 million. Muffin’s current balance sheet shows current liabilities of $11.5 million and net working capital of $10.5 million. If all the current accounts were liquidated today, the company would receive $7.85 million cash after paying the $11.5 million in current liabilities. What is the book value of Muffin’s Masonry’s assets today and the market value of these assets? (Enter your answer in millions of dollars rounded to 2 decimal places.) BOOK VALUE MARKET VALUE (in millions of dollars) Current assets Fixed assets Totalarrow_forwardDisturbed, Incorporated, had the following operating results for the past year: sales = $22,642; depreciation = $1,450; interest expense = $1,168; costs = $16,560. The tax rate for the year was 21 percent. What was the company's operating cash flow? Multiple Choice $2,737 ○ $7,468 о $3,464 ○ $3,303 ○ $5,355arrow_forward

- Muffin’s Masonry, Inc.’s, balance sheet lists net fixed assets as $19 million. The fixed assets could currently be sold for $29 million. Muffin’s current balance sheet shows current liabilities of $8.0 million and net working capital of $7.0 million. If all the current accounts were liquidated today, the company would receive $7.50 million cash after paying the $8.0 million in current liabilities. What is the book value of Muffin’s Masonry’s assets today and the market value of these assets? (Enter your answer in millions of dollars rounded to 2 decimal places.) current assets fixed assets totalarrow_forwardHelp me please asaparrow_forwardThompson's Jet Skis has an operating cash flow of $11,618. Depreciation is $2,345 and interest paid is $395. A net total of $485 was paid on long-term debt. The firm spent $6,180 on fixed assets and decreased net working capital by $420. What is the cash flow of the firm?arrow_forward

- Need help pleasearrow_forwardMuffin's Masonry, Inc.'s balance sheet lists net fixed assets as $33 million. The fixed assets could currently be sold for $57 million. Muffin's current balance sheet shows current liabilities of $15.0 million and net working capital of $14.0 million. If all the current accounts were liquidated today, the company would receive $8.20 million cash after paying the $15.0 million in current liabilities.What is the book value of Muffin's Masonry's assets today and the market value of these assets?arrow_forwardNighthawk Steel, a manufacturer of specialized tools, has $5,220,000 in assets. Temporary current assets Permanent current assets Capital assets Total assets $1,240,000 1,740,000 2,240,000 $5,220,000 Short-term rates are 4 percent. Long-term rates are 6.5 percent. (Note that long-term rates imply a return to any equity). Ear before interest and taxes are $1,080,000. The tax rate is 25 percent. Assume the term structure of interest rates becomes imm with short-term rates going to 9 percent and long-term rates 4.5 percentage points lower than short-term rates. If long-term financing is perfectly matched (hedged) with long-term asset needs, and the same is true of short-term financing, earnings be after taxes? Eor an example of perfectly hedged plans see Figure 6-8. Earning after taxes $arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Cengage Learning

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:9781111581565

Author:Gaylord N. Smith

Publisher:Cengage Learning