Intermediate Financial Management (MindTap Course List)

13th Edition

ISBN: 9781337395083

Author: Eugene F. Brigham, Phillip R. Daves

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

Please provide answer this question

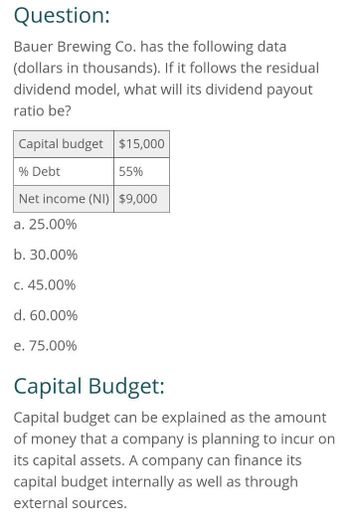

Transcribed Image Text:Question:

Bauer Brewing Co. has the following data

(dollars in thousands). If it follows the residual

dividend model, what will its dividend payout

ratio be?

Capital budget $15,000

% Debt

55%

Net income (NI) $9,000

a. 25.00%

b. 30.00%

c. 45.00%

d. 60.00%

e. 75.00%

Capital Budget:

Capital budget can be explained as the amount

of money that a company is planning to incur on

its capital assets. A company can finance its

capital budget internally as well as through

external sources.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Need help with this question solution financial Accountingarrow_forwardinvestment QUICK AND SLOW COST $1,000 each, are mutually exclusive, and have the following cash flows. The firm's cost of capital is 10 percent. Cash Inflows Year Q S 1 $1,300 $386 2 - 386 3 - 386 4 - 386 a. According to the net present value method of capital budgeting, which investment(s) should the firm make? b. According to the internal rate of return method of capital budgeting, which investment(s) should the firm make? c. If Q is chosen, the $1,300 can be reinvested and earn 12 percent. Does this information alter your conclusions concerning investing in Q and S? To answer, assume that S’s cash flows can be…arrow_forwardPlease provide correct answer general financearrow_forward

- Solve this general accounting questionarrow_forwardNeed help with this question solution general accountingarrow_forwardPrepare a sales budget including a column for each year in and a column for the total. The budgets should also include a schedule of expected cash collection, by year and in total.Make your assumptions about the type of sales (cash versus credit) and your credit terms clear.arrow_forward

- The Basics of Capital Budgeting Your division is considering two projects with the following cash flows (in millions): 0 1 2 3 Project A -$31 $7 $12 $22 Project B -$19 $13 $6 $5 What are the projects' NPVs assuming the WACC is 5%? Enter your answer in millions. For example, an answer of $10,550,000 should be entered as 10.55. Negative values, if any, should be indicated by a minus sign. Do not round intermediate calculations. Round your answer to two decimal places. Project A: $___ million Project B: $___ million What are the projects' NPVs assuming the WACC is 10%? Enter your answer in millions. For example, an answer of $10,550,000 should be entered as 10.55. Negative values, if any, should be indicated by a minus sign. Do not round intermediate calculations. Round your answer to two decimal places. Project A: $___ million Project B: $___ million What are the projects' NPVs assuming the…arrow_forwardPlease give me answer general accountingarrow_forwardAn efficient market is one in which prices__________ to new information quickly. External funding required = Total assets - ( __________ + owner's equity). A cash budget is a list of all __________ cash inflows and outflows over coming months. Value of equity = value of __________ - value of debt. Free cash flow = EBIT(1-Tax rate)+Depreciation - __________ expenditures - working capital investments. Acid test = (current__________ - inventory)/current Liabilities. The par value of a bond is the amount of money the holder will __________ on the bond's maturity date..arrow_forward

- Please see image for question to solve for.arrow_forwardyo template. Part 1- Capital Budgeting (Chapter 6) Questions Please use the following information to answer questions 1-6 Corp makes wooden tables and is creating its 2017 capital budget. It expects to sell 40 tables in 2017 at $150 per table. DM Inventory: BB = 50 b.f. of wood DEI = 75 b.f. of wood your calculations. Feel free to use the example in the notes as a Additional Information for 2017: DM per table: 6 board feet (b.f.) per table at $2.00 per b.f. DL per table: 2 DLH per table at $25 per DLH O/H is applied at a rate of $4 per DLH (and allocated O/H = actual O/H) WIP Inventory BB = 0 EB = 0 FG Inventory BB = 5 tables DEI = 15 tables For simplicity, assume costs and revenue per table are the same for previous years. Assume variable operating expenses are $12 per unit sold and fixed operating expenses are $90. 1) What is budgeted revenue for 2017 in dollars? 2) How many tables (FG units) should be produced in 2017? 3) What is the budgeted O/H cost per unit? octions those…arrow_forwardNet Present Value Method, Present Value Index, and Analysis for a service companyarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT Fundamentals Of Financial Management, Concise Edi...FinanceISBN:9781337902571Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals Of Financial Management, Concise Edi...FinanceISBN:9781337902571Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Fundamentals of Financial Management, Concise Edi...FinanceISBN:9781305635937Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management, Concise Edi...FinanceISBN:9781305635937Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781285867977Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781285867977Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Fundamentals of Financial Management, Concise Edi...FinanceISBN:9781285065137Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management, Concise Edi...FinanceISBN:9781285065137Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT

Fundamentals Of Financial Management, Concise Edi...

Finance

ISBN:9781337902571

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Fundamentals of Financial Management, Concise Edi...

Finance

ISBN:9781305635937

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781285867977

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Fundamentals of Financial Management, Concise Edi...

Finance

ISBN:9781285065137

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning