Cornerstones of Financial Accounting

4th Edition

ISBN: 9781337690881

Author: Jay Rich, Jeff Jones

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

What is the company's

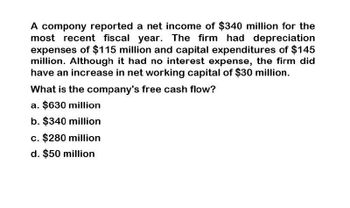

Transcribed Image Text:A compony reported a net income of $340 million for the

most recent fiscal year. The firm had depreciation

expenses of $115 million and capital expenditures of $145

million. Although it had no interest expense, the firm did

have an increase in net working capital of $30 million.

What is the company's free cash flow?

a. $630 million

b. $340 million

c. $280 million

d. $50 million

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- The Berndt Corporation expects to have sales of 12 million. Costs other than depreciation are expected to be 75% of sales, and depreciation is expected to be 1.5 million. All sales revenues will be collected in cash, and costs other than depreciation must be paid for during the year. Berndts federal-plus-state tax rate is 40%. Berndt has no debt. a. Set up an income statement. What is Berndts expected net income? Its expected net cash flow? b. Suppose Congress changed the tax laws so that Berndts depreciation expenses doubled. No changes in operations occurred. What would happen to reported profit and to net cash flow? c. Now suppose that Congress changed the tax laws such that, instead of doubling Berndts depreciation, it was reduced by 50%. How would profit and net cash flow be affected? d. If this were your company, would you prefer Congress to cause your depreciation expense to be doubled or halved? Why?arrow_forwardCarter Swimming Pools has $16 million in net operating profit after taxes (NOPAT) in the current year. Carter has $12 million in total net operating assets in the current year and had $10 million in the previous year. What is its free cash flow?arrow_forwardA company recently reported operating income of $500.0 million, depreciation of $50.0 million, and had a tax rate of 21%. The firm's expenditures on fixed assets and net operating working capital totaled $10.0 million. How much was its free cash flow, in millions? O $435.00 O $455.00 O $335.00arrow_forward

- In its most recent fiscal year, Boba Tea Corp reported net income of $300,000,000. Looking at its financial statements, we observe that the firm reported depreciation expenses of $125,000,000 and capital expenditures of $150,000,000. The firm had no debt but did experience an increase in NWC of $20,000,000. What is Boba Tea's free cash flow? Select one: O a. $170 million b. $255 million c. $150 million d. $5 million Clear my choice-arrow_forwardDollar Inc. recently reported operating income (EBIT) of $3.25 million, depreciation of $0.56 million, and had a tax rate of 40%. The firm's expenditures on fixed assets and net operating working capital totaled $0.37 million. How much was its free cash flow, in millions? $2.36 $1.93 $2.03 $2.14 $2.25arrow_forwardVasudevan Inc. recently reported operating income of $5.95 million, depreciation of $1.20 million, and had a tax rate of 40%. The firm's expenditures on fixed assets and net working capital totaled $0.6 million. How much was its free cash flow, in millions? a. $4.13 b. $4.38 c. $4.17 d. $3.63 e. $3.59arrow_forward

- DataDyne Company reported EBIT of $590 million for the most recent fiscal year. Interest expense were $10 million and the current tax rate was 20%. The firm had depreciation expenses of $100 million and capital expenditures of $150 million. In addition, the firm did have a decrease in net working capital of $30 million. What is DataDyne's free cash flow?arrow_forwardCompany DotThrive reported the following financial results. Operating income is $61.32 million and depreciation and amortization is $6.84 million. The company spent $11.69 million buying new equipment and sold $4.50 million old equipment (this is the after-tax salvage). Net working capital increased by $2.63 million from previous year. The company's tax bracket is 21%. What's the company's Free Cash Flow (FCF) for the year? Note: the unit of your answer should be in millions of dollars, with 2 decimal points.arrow_forwardGiven are the following data for year 1:Revenue = $45 million; Variable cost = $10 million; Fixed cost = $5 million; Depreciation = $1 million; Interest expense = $3 million; Capital expenditure = $12 million; Change in working capital = $2 million. Corporate tax rate is 30%. Calculate the free cash flow to firm (FCFF) for year 1: a. $4.2 million b. $6.3 million c. $7.3 million d. $5.2 millionarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Cengage Learning

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning