Horngren's Financial & Managerial Accounting, The Managerial Chapters (6th Edition)

6th Edition

ISBN: 9780134486857

Author: Tracie L. Miller-Nobles, Brenda L. Mattison, Ella Mae Matsumura

Publisher: PEARSON

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 19, Problem 39BP

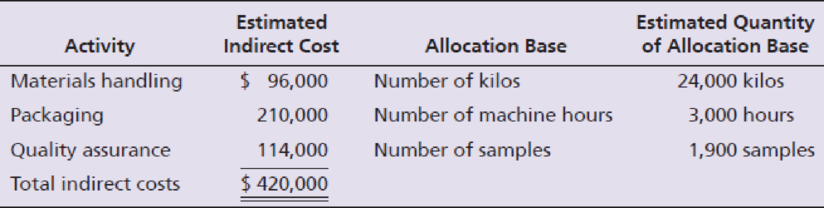

Harcourt Pharmaceuticals manufactures an over-the-counter allergy medication. The company sells both large commercial containers of 1,000 capsules to health care facilities and travel packs of 20 capsules to shops in airports, train stations, and hotels. The following information has been developed to determine if an activity-based costing system would be beneficial:

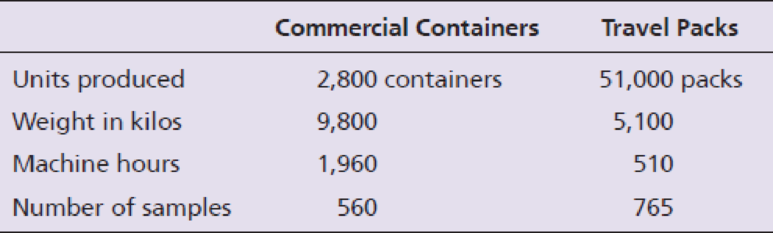

Other production information includes the following:

Requirements

- 1. Harcourt’s original single plantwide

overhead allocation rate system allocated indirect costs to products at $140.00 per machine hour. Compute the total indirect costs allocated to the commercial containers and to the travel packs under the original system. Then compute the indirect cost per unit for each product. Round to two decimal places. - 2. Compute the predetermined overhead allocation rate for each activity.

- 3. Use the predetermined overhead allocation rates to compute the activity-based costs per unit of the commercial containers and the travel packs. Round to two decimal places. (Hint: First compute the total activity-based costs allocated to each product line, and then compute the cost per unit.)

- 4. Compare the indirect activity-based costs per unit to the indirect costs per unit from the traditional system. How have the unit costs changed? Explain why the costs changed as they did.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Comparing costs from ABC and single-rate systems

Harcourt Pharmaceuticals manufactures an over—the counter allergy medication. The company sells both large commercial containers of 1,000 capsules to health care facilities and travel packs of 20 capsules to shops in airports, train stations, and hotels. The following information has been developed to determine if an activity-based costing system would be beneficial:

Other production information includes the following:

Requirements

Harcourt’s original single plantwide overhead allocation rate system allocated indirect costs to products at $140.00 per machine hour. Compute the total indirect costs allocated to the commercial containers and to the travel packs under the original system. Then compute the indirect cost per unit for each product. Round to two decimal places.

Compute the predetermined overhead allocation rate for each activity.

Use the predetermined overhead allocation rates to compute the activity-based costs per unit of the…

Carter, Incorporated, produces two products, Product A and Product B. Carter uses a traditional volume-based costing system in which direct labor hours are the allocation base. Carter is considering switching to an ABC system by splitting its manufacturing overhead cost across three activities: Design, Production, and Inspection. The cost of each activity and usage of the cost drivers are as follows:

Activity Pool (Driver)

Cost of Pool

Usage by Product A

Usage by Product B

Design (engineering hours)

$ 300,000

200

300

Production (direct labor hours)

500,000

100,000

300,000

Inspection (batches)

200,000

300

100

Carter manufactures 10,000 units of Product A and 7,500 units of Product B per month.

Required:

Calculate the predetermined overhead rate under the traditional costing system.

Calculate the activity rate for Design.

Calculate the activity rate for Machining.

Calculate the activity rate for Inspection.

Calculate the indirect manufacturing costs assigned to each unit…

Gigabyte, Inc. manufactures three products for the computer industry:

Gismos (product G): annual sales, 8,000 units Thingamajigs (product T): annual sales, 15,000 units Whatchamacallits (product W): annual sales, 4,000 units

The company uses a traditional, volume-based product-costing system with manufacturing over-head applied on the basis of direct-labor dollars. The product costs have been computed as follows:

Product G Product T Product W Raw material ..........................$ 35.00 $52.50 $17.50 Direct labor 16(.8 hr.at $20) 12(.6 hr at $20) 8(.4 hr at $20)

Manufacturing overhead* ......140.00 105.00 70.00

Total product cost ..................$191.00 $169.50 $95.50 *Calculation of predetermined overhead rate:

Manufacturing overhead budget:

Machine setup...................................................................................$…

Chapter 19 Solutions

Horngren's Financial & Managerial Accounting, The Managerial Chapters (6th Edition)

Ch. 19 - The Santos Shirt Company manufactures shirts in...Ch. 19 - Prob. 2TICh. 19 - Prob. 3TICh. 19 - Prob. 4TICh. 19 - Prob. 5TICh. 19 - Prob. 6TICh. 19 - Prob. 7TICh. 19 - Prob. 8TICh. 19 - Prob. 9TICh. 19 - Prob. 10TI

Ch. 19 - Prob. 11TICh. 19 - Prob. 12TICh. 19 - Which statement is false? a. Using a single...Ch. 19 - Compute It uses activity-based costing. Two of...Ch. 19 - Compute It uses activity-based costing. Two of...Ch. 19 - Compute It uses activity-based costing. Two of...Ch. 19 - Compute It can use ABC information for what...Ch. 19 - Prob. 6QCCh. 19 - Companies enjoy many benefits from using JIT....Ch. 19 - Which account is not used in JIT costing? a....Ch. 19 - The cost of lost future sales after a customer...Ch. 19 - Spending on testing a product before shipment to...Ch. 19 - What is the formula to compute the predetermined...Ch. 19 - How is the predetermined overhead allocation rate...Ch. 19 - Describe how a single plantwide overhead...Ch. 19 - Why is using a single plantwide overhead...Ch. 19 - Why is the use of departmental overhead allocation...Ch. 19 - What is activity-based management? How is it...Ch. 19 - How many cost pools are in an activity-based...Ch. 19 - What are the four steps to developing an...Ch. 19 - Why is ABC usually considered more accurate than...Ch. 19 - List two ways managers can use ABM to make...Ch. 19 - Define value engineering. How is it used to...Ch. 19 - Explain the difference between target price and...Ch. 19 - How can ABM be used by service companies?Ch. 19 - What is a just-in-time management system?Ch. 19 - Explain how the work cell manufacturing layout...Ch. 19 - What are the inventory accounts used in JIT...Ch. 19 - How is the Conversion Costs account used in JIT...Ch. 19 - Prob. 18RQCh. 19 - Which accounts are adjusted for the underallocated...Ch. 19 - Prob. 20RQCh. 19 - Prob. 21RQCh. 19 - Prevention is much cheaper than external failure....Ch. 19 - What are quality improvement programs?Ch. 19 - Prob. 24RQCh. 19 - Prob. 1SECh. 19 - The Oakman (Company (see Short Exercise S19-1) has...Ch. 19 - Activity-based costing requires four steps. List...Ch. 19 - Prob. 4SECh. 19 - Darby Corp. is considering the use of...Ch. 19 - The following information is provided for Orbit...Ch. 19 - Jaunkas Corp. manufactures mid-fi and hi-fi stereo...Ch. 19 - Spectrum Corp. makes two products: C and D. The...Ch. 19 - Refer to Short Exercise S19-8. Spectrum Corp....Ch. 19 - Haworth Company is a management consulting firm....Ch. 19 - Refer to Short Exercise S19-10. Haworth desires a...Ch. 19 - Prob. 12SECh. 19 - Prime Products uses a JIT management system to...Ch. 19 - Stegall, Inc. manufactures motor scooters. For...Ch. 19 - Koehler makes handheld calculators in two models:...Ch. 19 - Koehler (see Exercise E19-15) makes handheld...Ch. 19 - Koehler (see Exercise E19-15 and Exercise E19-16)...Ch. 19 - Franklin, Inc. uses activity-based costing to...Ch. 19 - Turbo Champs Corp. uses activity-based costing to...Ch. 19 - Eason Company manufactures wheel rims. The...Ch. 19 - Refer to Exercise E19-20. For 2019, Easons...Ch. 19 - Refer to Exercises E19-20 and E19-21. Controller...Ch. 19 - Treat Dog Collars uses activity-based costing....Ch. 19 - Western, Inc. is a technology consulting firm...Ch. 19 - Refer to Exercise E19-24. The president of Western...Ch. 19 - Prob. 26ECh. 19 - Refer to Exercise E19-26. Western desires a 20%...Ch. 19 - Lally, Inc. produces universal remote controls....Ch. 19 - Prob. 29ECh. 19 - Darrel Co. makes electronic components. Chris...Ch. 19 - Prob. 31ECh. 19 - Prob. 32ECh. 19 - Willitte Pharmaceuticals manufactures an...Ch. 19 - The Alright Manufacturing Company in Rochester,...Ch. 19 - Oscar, Inc. manufactures bookcases and uses an...Ch. 19 - Blanchette Plant Service completed a special...Ch. 19 - Low Range produces fleece jackets. The company...Ch. 19 - Stella, Inc. is using a costs-of-quality approach...Ch. 19 - Harcourt Pharmaceuticals manufactures an...Ch. 19 - The Alexander Manufacturing Company in Rochester,...Ch. 19 - Martin, Inc. manufactures bookcases and uses an...Ch. 19 - Rennie Plant Service completed a special...Ch. 19 - High Mountain produces fleece jackets. The company...Ch. 19 - Roxi, Inc. is using a costs-of-quality approach to...Ch. 19 - Download an Excel template for this problem online...Ch. 19 - This problem continues the Piedmont Computer...Ch. 19 - Prob. 1TIATCCh. 19 - Harris Systems specializes in servers for...Ch. 19 - Harris Systems has decided to adopt ABC. To remain...Ch. 19 - Prob. 1EICh. 19 - Anu Ghai was a new production analyst at RHI,...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Evans, Inc., has a unit-based costing system. Evanss Miami plant produces 10 different electronic products. The demand for each product is about the same. Although they differ in complexity, each product uses about the same labor time and materials. The plant has used direct labor hours for years to assign overhead to products. To help design engineers understand the assumed cost relationships, the Cost Accounting Department developed the following cost equation. (The equation describes the relationship between total manufacturing costs and direct labor hours; the equation is supported by a coefficient of determination of 60 percent.) Y=5,000,000+30X,whereX=directlaborhours The variable rate of 30 is broken down as follows: Because of competitive pressures, product engineering was given the charge to redesign products to reduce the total cost of manufacturing. Using the above cost relationships, product engineering adopted the strategy of redesigning to reduce direct labor content. As each design was completed, an engineering change order was cut, triggering a series of events such as design approval, vendor selection, bill of materials update, redrawing of schematic, test runs, changes in setup procedures, development of new inspection procedures, and so on. After one year of design changes, the normal volume of direct labor was reduced from 250,000 hours to 200,000 hours, with the same number of products being produced. Although each product differs in its labor content, the redesign efforts reduced the labor content for all products. On average, the labor content per unit of product dropped from 1.25 hours per unit to one hour per unit. Fixed overhead, however, increased from 5,000,000 to 6,600,000 per year. Suppose that a consultant was hired to explain the increase in fixed overhead costs. The consultants study revealed that the 30 per hour rate captured the unit-level variable costs; however, the cost behavior of other activities was quite different. For example, setting up equipment is a step-fixed cost, where each step is 2,000 setup hours, costing 90,000. The study also revealed that the cost of receiving goods is a function of the number of different components. This activity has a variable cost of 2,000 per component type and a fixed cost that follows a step-cost pattern. The step is defined by 20 components with a cost of 50,000 per step. Assume also that the consultant indicated that the design adopted by the engineers increased the demand for setups from 20,000 setup hours to 40,000 setup hours and the number of different components from 100 to 250. The demand for other non-unit-level activities remained unchanged. The consultant also recommended that management take a look at a rejected design for its products. This rejected design increased direct labor content from 250,000 hours to 260,000 hours, decreased the demand for setups from 20,000 hours to 10,000 hours, and decreased the demand for purchasing from 100 component types to 75 component types, while the demand for all other activities remained unchanged. Required: 1. Using normal volume, compute the manufacturing cost per labor hour before the year of design changes. What is the cost per unit of an average product? 2. Using normal volume after the one year of design changes, compute the manufacturing cost per hour. What is the cost per unit of an average product? 3. Before considering the consultants study, what do you think is the most likely explanation for the failure of the design changes to reduce manufacturing costs? Now use the information from the consultants study to explain the increase in the average cost per unit of product. What changes would you suggest to improve Evanss efforts to reduce costs? 4. Explain why the consultant recommended a second look at a rejected design. Provide computational support. What does this tell you about the strategic importance of cost management?arrow_forwardYoung Company is beginning operations and is considering three alternatives to allocate manufacturing overhead to individual units produced. Young can use a plantwide rate, departmental rates, or activity-based costing. Young will produce many types of products in its single plant, and not all products will be processed through all departments. In which one of the following independent situations would reported net income for the first year be the same regardless of which overhead allocation method had been selected? a. All production costs approach those costs that were budgeted. b. The sales mix does not vary from the mix that was budgeted. c. All manufacturing overhead is a fixed cost. d. All ending inventory balances are zero.arrow_forwardBrees, Inc., a manufacturer of golf carts, has just received an offer from a supplier to provide 2,600 units of a component used in its main product. The component is a track assembly that is currently produced internally. The supplier has offered to sell the track assembly for 66 per unit. Brees is currently using a traditional, unit-based costing system that assigns overhead to jobs on the basis of direct labor hours. The estimated traditional full cost of producing the track assembly is as follows: Prior to making a decision, the companys CEO commissioned a special study to see whether there would be any decrease in the fixed overhead costs. The results of the study revealed the following: 3 setups1,160 each (The setups would be avoided, and total spending could be reduced by 1,160 per setup.) One half-time inspector is needed. The company already uses part-time inspectors hired through a temporary employment agency. The yearly cost of the part-time inspectors for the track assembly operation is 12,300 and could be totally avoided if the part were purchased. Engineering work: 470 hours, 45/hour. (Although the work decreases by 470 hours, the engineer assigned to the track assembly line also spends time on other products, and there would be no reduction in his salary.) 75 fewer material moves at 30 per move. Required: 1. Ignore the special study, and determine whether the track assembly should be produced internally or purchased from the supplier. 2. Now, using the special study data, repeat the analysis. 3. Discuss the qualitative factors that would affect the decision, including strategic implications. 4. After reviewing the special study, the controller made the following remark: This study ignores the additional activity demands that purchasing would cause. For example, although the demand for inspecting the part on the production floor decreases, we may need to inspect the incoming parts in the receiving area. Will we actually save any inspection costs? Is the controller right?arrow_forward

- Stacks manufactures two different levels of hockey sticks: the Standard and the Slap Shot. The total overhead of $600,000 has traditionally been allocated by direct labor hours, with 400,000 hours for the Standard and 200.000 hours for the Slap Shot. After analyzing and assigning costs to two cost pools, it was determined that machine hours is estimated to have $450.000 of overhead, with 30,000 hours used on the Standard product and 15,000 hours used on the Slap Shot product. It was also estimated that the inspection cost pool would have $150,000 of overhead, with 25,000 hours for the Standard and 5,000 hours for the Slap Shot. What is the overhead rate per product, under traditional and under ABC costing?arrow_forwardBumblebee Mobiles manufactures a line of cell phones. The management has identified the following overhead costs and related cost drivers for the coming year. The following were incurred in manufacturing two of their cell phones, Bubble and Burst, during the first quarter. REQUIREMENT Review the worksheet called ABC that follows these requirements. You have been asked to determine the cost of each product using an activity-based cost system. Note that the problem information is already entered into the Data Section of the ABC worksheet.arrow_forwardPinter Company had the following environmental activities and product information: 1. Environmental activity costs 2. Driver data 3. Other production data Required: 1. Calculate the activity rates that will be used to assign environmental costs to products. 2. Determine the unit environmental and unit costs of each product using ABC. 3. What if the design costs increased to 360,000 and the cost of toxic waste decreased to 750,000? Assume that Solvent Y uses 6,000 out of 12,000 design hours. Also assume that waste is cut by 50 percent and that Solvent Y is responsible for 14,250 of 15,000 pounds of toxic waste. What is the new environmental cost for Solvent Y?arrow_forward

- Larsen, Inc., produces two types of electronic parts and has provided the following data: There are four activities: machining, setting up, testing, and purchasing. Required: 1. Calculate the activity consumption ratios for each product. 2. Calculate the consumption ratios for the plantwide rate (direct labor hours). When compared with the activity ratios, what can you say about the relative accuracy of a plantwide rate? Which product is undercosted? 3. What if the machine hours were used for the plantwide rate? Would this remove the cost distortion of a plantwide rate?arrow_forwardEclipse Motor Company manufactures two types of specialty electric motors, a commercial motor and a residential motor, through two production departments, Assembly and Testing. Presently, the company uses a single plantwide factory overhead rate for allocating factory overhead to the two products. However, management is considering using the multiple production department factory overhead rate method. The following factory overhead was budgeted for Eclipse: Direct machine hours were estimated as follows: In addition, the direct machine hours (dmh) used to produce a unit of each product in each department were determined from engineering records, as follows: a. Determine the per-unit factory overhead allocated to the commercial and residential motors under the single plantwide factory overhead rate method, using direct machine hours as the allocation base. b. Determine the per-unit factory overhead allocated to the commercial and residential motors under the multiple production department factory overhead rate method, using direct machine hours as the allocation base for each department. c. Recommend to management a product costing approach, based on your analyses in (a) and (b). Support your recommendation.arrow_forwardWrappers Tape makes two products: Simple and Removable. It estimates it will produce 369,991 units of Simple and 146,100 of Removable, and the overhead for each of its cost pools is as follows: It has also estimated the activities for each cost driver as follows: Â How much is the overhead allocated to each unit of Simple and Removable?arrow_forward

- Plata Company has identified the following overhead activities, costs, and activity drivers for the coming year: Plata produces two models of microwave ovens with the following activity demands: The companys normal activity is 21,000 machine hours. Calculate the total overhead cost that would be assigned to Model X using an activity-based costing system: a. 230,000 b. 240,000 c. 280,000 d. 190,000arrow_forwardPelder Products Company manufactures two types of engineering diagnostic equipment used in construction. The two products are based upon different technologies, X-ray and ultrasound, but are manufactured in the same factory. Pelder has computed the manufacturing cost of the X-ray and ultrasound products by adding together direct materials, direct labor, and overhead cost applied based on the number of direct labor hours. The factory has three overhead departments that support the single production line that makes both products. Budgeted overhead spending for the departments is as follows: Pelders budgeted manufacturing activities and costs for the period are as follows: The budgeted cost to manufacture one ultrasound machine using the activity-based costing method is: a. 225. b. 264. c. 293. d. 305.arrow_forwardThe following product costs are available for Stellis Company on the production of erasers: direct materials, $22,000; direct labor, $35,000; manufacturing overhead, $17,500; selling expenses, $17,600; and administrative expenses; $13,400. What are the prime costs? What are the conversion costs? What is the total product cost? What is the total period cost? If 13,750 equivalent units are produced, what is the equivalent material cost per unit? If 17,500 equivalent units are produced, what is the equivalent conversion cost per unit?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Excel Applications for Accounting Principles

Accounting

ISBN:9781111581565

Author:Gaylord N. Smith

Publisher:Cengage Learning

Cost Accounting - Definition, Purpose, Types, How it Works?; Author: WallStreetMojo;https://www.youtube.com/watch?v=AwrwUf8vYEY;License: Standard YouTube License, CC-BY