Concept explainers

Production run size and activity improvement

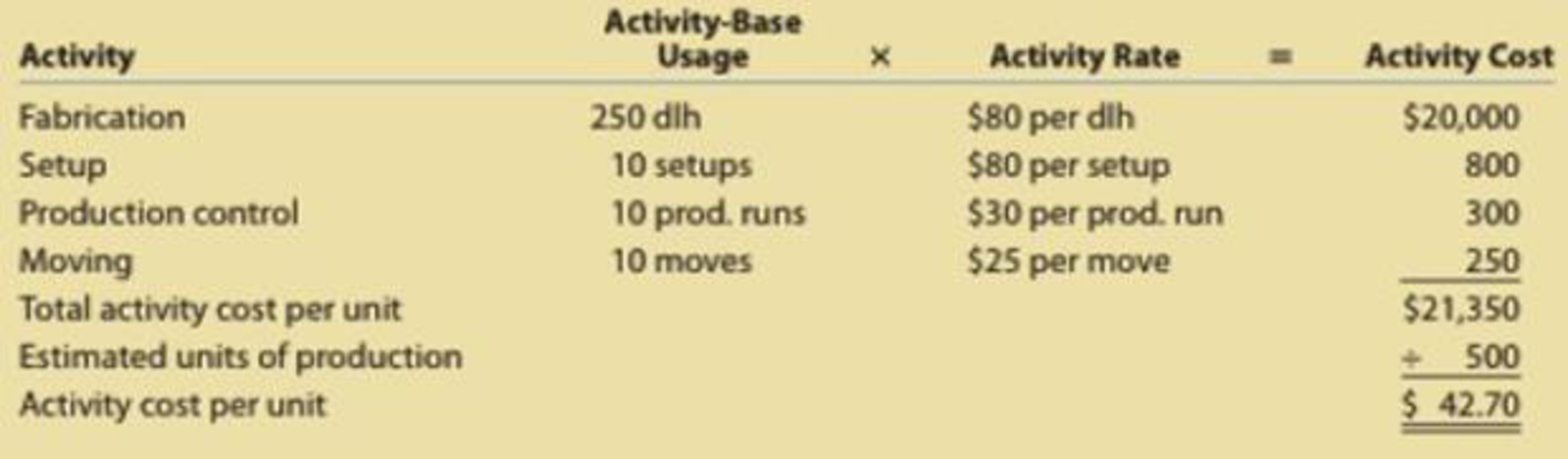

Littlejohn, Inc., manufactures machined parts for the automotive industry. The activity cost associated with Part XX-10 is as follows:

Each unit requires 30 minutes of fabrication direct labor. Moreover, Part XX-10 is manufactured in production run sizes of 50 units. Each production run is set up, scheduled (production control), and moved as a batch of 50 units. Management is considering improvements in the setup, production control, and moving activities in order to cut the production run sizes by half. As a result, the number of setups, production runs, and moves will double from 10 to 20. Such improvements are expected to speed the company’s ability to respond to customer orders.

- Setup is reengineered so that it takes 60% of the original cost per setup.

- Production control software will allow production control effort and cost per production run to decline by 60%.

- Moving distance was reduced by 40%, thus reducing the cost per move by the same amount.

- A. Determine the revised activity cost per unit under the proposed changes.

- B. Did these improvements reduce the activity cost per unit?

- C. What cost per unit for setup would be required for the solution in (a) to equal the base solution?

Trending nowThis is a popular solution!

Chapter 18 Solutions

Financial And Managerial Accounting

- Quick answer of this accounting questionsarrow_forwardUsing the data given for Cases 1 below, and assuming the use of the average cost method, compute the separate equivalent units of production - one for materials and one for labor and overhead - under each of the following assumptions (labor and factory over - head are applied evenly during the process in each assumption). Assumptions: At the beginning of the process, 75% of the materials go into production, and 25% go into production when the process is one- half completed. Case 1: Started in process - 5,000 units. Finished - 3,000 units. Work in process, end of the period, 2,000 units, three-fourths completed. For this problem, determine the equivalent units for labor and overhead. Determine the equivalent units for materials onlyarrow_forwardGeneral accountingarrow_forward

- Gantner Company had the following department information about physical units and percentage of completion: Work in process May1 (60%) Completed and transferred out Work in process, May 31 (40%) Physical Units 48,000 1,20,000 40,000 If materials are added at the beginning of the production process, what is the total number of equivalent units for materials during May? A. 155,200 B. 136,000 C. 168,000 D. 160,000arrow_forwardI need this question answer general Accountingarrow_forwardQuick answer of this accounting questionsarrow_forward

- The following refers to units processed by an ice cream maker in July. Compute the total equivalent units of production with respect to conversion for July using the weighted-average method. Gallons of Percent of Conversion Product Added Beginning work in process Goods started 4,08,000 35% 7,96,000 100 Goods completed 8,56,000 100 Ending work in 3,48,000 65 processarrow_forwardCalculate the company's profit margin??arrow_forwardWhat is the target price to obtain a 15% profit margin on sales?? General accountingarrow_forward

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning