FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

None

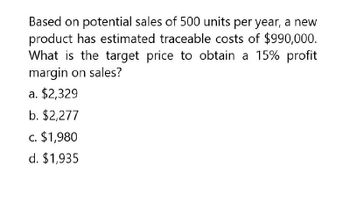

Transcribed Image Text:Based on potential sales of 500 units per year, a new

product has estimated traceable costs of $990,000.

What is the target price to obtain a 15% profit

margin on sales?

a. $2,329

b. $2,277

c. $1,980

d. $1,935

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- A company expects to sell 20,000 units of a product next year. Variable production cost is ₱15 and variable selling costs is 15% of the selling price. Fixed expenses are ₱250,000 per year. The firm set a target profit of ₱100,000 (ignoring tax). Based on the information, the unit selling price should be? a. ₱17.50 b. ₱17.65 c. ₱32.50 d. ₱38.24 e. ₱216.67arrow_forwardBeckham Company has the following information available: Selling price per unit: Variable cost per unit: Fixed costs per year: £400,000 Expected sales per year: 20,000 units What is the expected operating income (i.e. profit) for a year? Select one: O A. £500,000 O B. O C. £700,000 £680,000 £100 £55 O D. £480,000arrow_forwardThe costs and revenue projections for a new product are estimated. What is the estimated profit at a production rate of 20% above breakeven? Fixed cost = $456,000 per year Production cost per unit = $156 Revenue per unit = $342 The estimated profit is determined to be $ per year.arrow_forward

- Jamie Quinn, a sole proprietor, has the following projected figures for next year: Selling price per unit $150.00 Contribution margin per unit $45.00 Total fixed costs $630,000 What is the break-even point in dollars? a.$2,100,000 b.$426,000 c.$189,000 d.$900,000arrow_forwardA company sells its product at P18 per unit. Variable costs are P12 per unit and fixed costs are 150,000 per annum. The company wants to realize a profit of P60,000 during the year. What should be the sales revenue?arrow_forwardProduct X sells for $50 with variable costs of $36 per unit and annual fixed costs of $1,200,000. If the company wants to earn an operating income equal to 20% of sales, how many units must be sold, assuming all units produced are sold?arrow_forward

- The fixed cost at Harley motors are $1M annually. The main product has a revenue of $9.90 per unit and $4.50 variable cost What is the annual profit (or loss) if 150,000 units are sold?arrow_forwardProduct X generates a contribution to sales ratio of 50%. Fixed costs directly attributable to product X are £100,000 per annum. The sales revenue required to achieve an annual profit of £125,000 is A £450,000 B £400,000 C £125,000 D £100,000arrow_forwardcertain spare parts has a selling price of P150 if they would sell 8000 units per month. If for every P1.00 increase in selling price, 80 units less will be sold out per month. If the production cost is P100 per unit, find the price per unit for maximum profit per month. a. P150 b. P250 c. P175 d. P225arrow_forward

- Fill In The Blank Outlast Company's projected profit for the coming year follows: Total Per Unit Sales P200,000 P20 Less: Variable costs (120,000) (12) Contribution margin 80,000 P8 Less Fixed expenses (64,000) Operating Profit P 16,000 Requirements: 1. How many units must be sold to earn a profit of P30,000? units 3. Compute the additional profit that Outlast would earn if sales were P25,000 more than expected? P 3. For the projected level of sales, what is the margin of safety? P 4. Suppose Outlast would like to earn operating income equal to 20 percent of sales revenue. How many units must be sold for this goal to be realized? units NOTE: *If your answer is in monetary value, OMIT the peso sign (ex: if the answer is One hundred pesos just type 100) **If your answer is in thousands value, do not put space/s between the numbers and do not forget to type comma to indicate thousand value (ex: if the answer is one thousand just type 1,000) ***If your answer has decimal places, round your…arrow_forwardCompany XYZ currently produces and sells 40,000 units. At this level, the total contribution margin is $320,000 while the total fixed costs $80,000. If sales are expected to increase by 40% in the next period, how much would the new profit be ($)? O a. 336,000 O b. 272,000 O c. 304,000 O d. None of the given answers O e. 368,000arrow_forwardLipsion Ltd company is thinking about investing in one of two potential new productsfor sale. The projections are as follows: year revenue/ product s revenue/ product v0 (150,000) outlay (150000) outlay1 14000 150002 24000 253333 44000 520004 84000 63333 Calculate NPV of both products (to 1 d.p.) assuming a discount rate of 7%. Then decide which product should be selected and why ?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education