Concept explainers

Sweet Sugar Company manufactures three products (white sugar, brown sugar, and powdered sugar) in a continuous production process. Senior management has asked the controller to conduct an activity-based costing study. The controller identified the amount of factory

Activity. Budgeted activity cost

Production. $489,900

Setup. 117,600

Inspection. 105,600

Shipping. 144,300

Customer service. 65,500

Total. $ 922,900

The activity bases identified for each activity are as follows:

Activity. Activity base.

Production. Machine hours

Setup. Number of set ups

Inspection. Number of Inspections

Shipping. Number of customer orders.

Customer service. Number of customer service requests.

The activity bases usage Quantities and units produced for the three products were determined from corporate records and are as follows:

(Image 1)

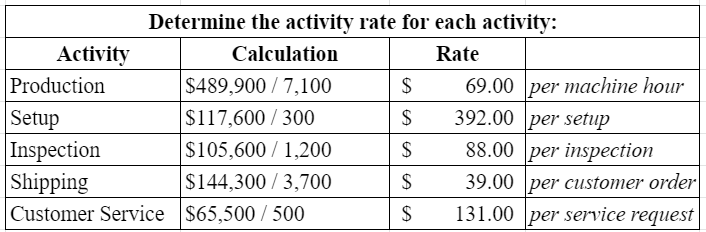

Step 2 in (image 2)

Answer:

Part 1:

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 3 images

- Logan Products has two production departments-assembly and finishing. These are supported by two service departments-sourcing (purchasing and handling of materials and human resources) and operations (work scheduling, supervision, and inspection). Logan has the following labor hours devoted by each of the service departments to the other departments. Sourcing Operations Sourcing 10,000 The costs incurred in the plant are as follows: Departments Sourcing Operations Assembly Finishing Total a Direct Method Assembly Finishing Step Method Assembly Finishing c. Reciprocal Method Total Labor Hours Used by Departments Operations 20,000 b. Assembly Finishing Departmental Costs $ 210,000 280,000 440,000 285,000 1,215,000 Required: 1. What are the costs allocated to the two production departments using (a) the direct method, (b) the step method, when the sourcing department that provides the greatest percentage of services to other service departments goes first, and (c) the reciprocal method?…arrow_forwardGreenwood Company manufactures two products—15,000 units of Product Y and 7,000 units of Product Z. The company uses a plantwide overhead rate based on direct labor-hours. It is considering implementing an activity-based costing (ABC) system that allocates all of its manufacturing overhead to four cost pools. The following additional information is available for the company as a whole and for Products Y and Z: Activity Cost Pool Activity Measure Estimated Overhead Cost Expected Activity Machining Machine-hours $ 227,700 11,000 MHs Machine setups Number of setups $ 153,900 270 setups Production design Number of products $ 91,000 2 products General factory Direct labor-hours $ 257,000 10,000 DLHs Activity Measure Product Y Product Z Machining 8,700 2,300 Number of setups 60 210 Number of products 1 1 Direct labor-hours 8,700 1,300 10. Using the ABC system, how much total manufacturing overhead cost would be assigned to Product Z? (Round your…arrow_forwardSaratoga Company manufactures jobs to customer specifications. The company is conducting a time-driven activity-based costing study in Its Purchasing Department to better understand how Purchasing Department labor costs are consumed by Individual jobs. To ald the study, the company provided the following data regarding its Purchasing Department and three of its many jobs: Number of employees Average salary per employee Weeks of employment per year Hours worked per week Practical capacity percentage $ 30,000 52 40 85% Requisition Processing 15 Bid Evaluation Inspection 45 30 Minutes per unit of the activity Job X Job Y Job Z Number of requisitions processed Number of bid evaluations 6 3 2 2 1 3 Number of inspections 5 1 5 Now assume that Saratoga Company would like to answer the following "what if" question using its time-driven activity-based costing system: Assuming our estimated activity demands for all jobs in the next period will be as shown below, how will this affect our job…arrow_forward

- Greenwood Company manufactures two products-13,000 units of Product Y and 5,000 units of Product Z. The company uses a plantwide overhead rate based on direct labor-hours. It is considering implementing an activity- based costing (ABC) system that allocates all of its manufacturing overhead to four cost pools. The following additional information is available for the company as a whole and for Products Y and Z: Activity Cost Pool Machining Machine setups Production design General factory Activity Measure Machining Windows DESKTOP- Windows Number of setups Number of products Direct labor-hours Total overhead cost Activity Measure Machine-hours Number of setups Number of products Direct labor-hours Product Y FEB +1 (252) 484-2153 Oh nun Product Y Product Z 8,800 3,200 240 40 1 1 8,800 3,200 11. Using the plantwide overhead rate, what percentage of the total overhead cost is allocated to Product Y an Product Z? (F your intermediate calculations to 2 decimal places. Round your answers to 2…arrow_forwardGreenwood Company manufactures two products—15,000 units of Product Y and 7,000 units of Product Z. The company uses a plantwide overhead rate based on direct labor-hours. It is considering implementing an activity-based costing (ABC) system that allocates all of its manufacturing overhead to four cost pools. The following additional information is available for the company as a whole and for Products Y and Z: Activity Cost Pool Activity Measure Estimated Overhead Cost Expected Activity Machining Machine-hours $ 231,000 11,000 MHs Machine setups Number of setups $ 180,000 300 setups Production design Number of products $ 94,000 2 products General factory Direct labor-hours $ 260,000 10,000 DLHs Activity Measure Product Y Product Z Machining 9,000 2,000 Number of setups 60 240 Number of products 1 1 Direct labor-hours 9,000 1,000 4. What is the activity rate for the Machine Setups activity cost pool?arrow_forwardMello Manufacturing Company is a diversified manufacturer that manufactures three products (Alpha, Beta, and Omega) in a continuous production process. Senior management has asked the controller to conduct an activity-based costing study. The controller identified the amount of factory overhead required by the critical activities of the organization as follows: Activity Activity Cost Pool Production $259,200 Setup 55,000 Materials handling 9,750 Inspection 60,000 Product engineering 123,200 Total $507,150 The activity bases identified for each activity are as follows: Activity Activity Base Production Machine hours Setup Number of setups Materials handling Number of parts Inspection Number of inspection hours Product engineering Number of engineering hours The activity-base usage quantities and units produced for the three products were determined from corporate records and are as follows: Machine Hours Number of…arrow_forward

- Greenwood Company manufactures two products-13,000 units of Product Y and 5,000 units of Product Z. The company uses a plantwide overhead rate based on direct labor-hours. It is considering implementing an activity- based costing (ABC) system that allocates all of its manufacturing overhead to four cost pools. The following additional information is available for the company as a whole and for Products Y and Z: Activity Cost Pool Machining Machine setups Production design General factory Activity Measure Machining DESKTOP- Windows Number of setups Number of products Direct labor-hours General factory cost Activity Measure Machine-hours Number of setups Number of products Direct labor-hours Product Y +1 (252) 484-2153 Oh nun Product Y Product Z 8,800 3,200 40 240 1 1 8,800 3,200 % 15. Using the ABC system, what percentage of the General Factory cost is assigned to Product Y and Product Z? (Round your intermediate calculations and final answers to 2 decimal places.) Product Z (@ 2 0…arrow_forwardSaratoga Company manufactures jobs to customer specifications. The company is conducting a time-driven activity-based costing study in its Purchasing Department to better understand how Purchasing Department labor costs are consumed by individual jobs. To aid the study, the company provided the following data regarding its Purchasing Department and three of its many jobs: Number of employees Average salary per employee 11 $ 27,000 Weeks of employment per year Hours worked per week 52 40 Practical capacity percentage 85% Requisition Minutes per unit of the activity Processing 15 Bid Evaluation Inspection 45 30 Job X Job Y Job Z Number of requisitions processed Number of bid evaluations 6 3 2 4 3 5 Number of inspections 7 3 7 Now assume that Saratoga Company would like to answer the following "what if" question using its time-driven activity-based costing system: Assuming our estimated activity demands for all jobs in the next period will be as shown below, how will this affect our job…arrow_forwardGreenwood Company manufactures two products—15,000 units of Product Y and 7,000 units of Product Z. The company uses a plantwide overhead rate based on direct labor-hours. It is considering implementing an activity-based costing (ABC) system that allocates all of its manufacturing overhead to four cost pools. The following additional information is available for the company as a whole and for Products Y and Z: Activity Cost Pool Activity Measure Estimated Overhead Cost Expected Activity Machining Machine-hours $ 227,700 11,000 MHs Machine setups Number of setups $ 153,900 270 setups Production design Number of products $ 91,000 2 products General factory Direct labor-hours $ 257,000 10,000 DLHs Activity Measure Product Y Product Z Machining 8,700 2,300 Number of setups 60 210 Number of products 1 1 Direct labor-hours 8,700 1,300 3. What is the activity rate for the Machining activity cost pool? (Round your answer to 2 decimal places.)arrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education