FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

thumb_up100%

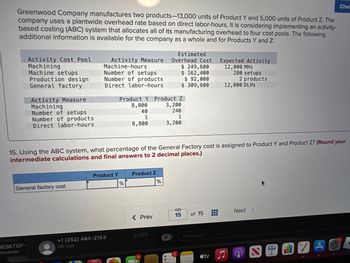

Transcribed Image Text:Greenwood Company manufactures two products-13,000 units of Product Y and 5,000 units of Product Z. The

company uses a plantwide overhead rate based on direct labor-hours. It is considering implementing an activity-

based costing (ABC) system that allocates all of its manufacturing overhead to four cost pools. The following

additional information is available for the company as a whole and for Products Y and Z:

Activity Cost Pool

Machining

Machine setups

Production design

General factory

Activity Measure

Machining

DESKTOP-

Windows

Number of setups

Number of products

Direct labor-hours

General factory cost

Activity Measure

Machine-hours

Number of setups

Number of products

Direct labor-hours

Product Y

+1 (252) 484-2153

Oh nun

Product Y Product Z

8,800

3,200

40

240

1

1

8,800

3,200

%

15. Using the ABC system, what percentage of the General Factory cost is assigned to Product Y and Product Z? (Round your

intermediate calculations and final answers to 2 decimal places.)

Product Z

< Prev

2/7/23

11

Estimated

Overhead Cost

$ 249,600

$ 162,400

$ 92,000

$ 309,600

%

A

L

S

15

of 15

iMessage

tv

Expected Activity

12,000 MHS

H

280 setups

2 products

12,000 DLHS

Next >

(@

2

0

Chec

Å

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Greenwood Company manufactures two products—14,000 units of Product Y and 6,000 units of Product Z. The company uses a plantwide overhead rate based on direct labor-hours. It is considering implementing an activity-based costing (ABC) system that allocates all of its manufacturing overhead to four cost pools. The following additional information is available for the company as a whole and for Products Y and Z: Activity Cost Pool Activity Measure Estimated Overhead Cost Expected Activity Machining Machine-hours $ 192,000 10,000 MHs Machine setups Number of setups $ 50,400 120 setups Production design Number of products $ 76,000 2 products General factory Direct labor-hours $ 387,200 16,000 DLHs Activity Measure Product Y Product Z Machining 7,200 2,800 Number of setups 50 70 Number of products 1 1 Direct labor-hours 7,200 8,800 What is the activity rate for the Product Design activity cost pool? What is the activity rate for the General Factory…arrow_forwardTime Clock Shop manufactures clocks on an automated assembly line. It utilizes two cost categories: direct materials and conversion costs. Each product must pass through the Assembly Department and the Testing Department. Direct materials are added at the beginning of production, while conversion costs are allocated evenly throughout production. The company uses weighted-average costing. Data for the Assembly Department are given in the table. (Click the icon to view the table.) What is the total amount debited to the work-in-process account during the month of June at Time Clock Shop? A. $450,000 B. $2,270,000 C. $3,250,000 D. $2,000,000 E. $2,450,000 Table Work in process, beginning inventory Direct materials (100% complete) Conversion costs (50% complete) Units started during June Work in process, ending inventory Direct materials (100% complete) Conversion costs (75% complete) Work in process, beginning inventory Direct materials Conversion costs Direct materials costs added during…arrow_forwardLens Care Inc. (LCI) manufactures specialized equipment for polishing optical lenses. There are two models - one mainly used for fine eyewear (F-32) and another for lenses used in binoculars, cameras, and similar equipment (B-13).The manufacturing cost of each unit is calculated using activity-based costing, using the following manufacturing cost pools: Cost Pools Allocation Base Costing Rate Materials handling Number of parts $ 3.00 per part Manufacturing supervision Hours of machine time $ 14.86 per hour Assembly Number of parts $ 3.60 per part Machine setup Each setup $ 56.80 per setup Inspection and testing Logged hours $ 45.80 per hour Packaging Logged hours $ 19.80 per hour LCI currently sells the B-13 model for $3,125 and the F-32 model for $2,900. Manufacturing costs and activity usage for the two products are as follows: B-13 F-32 Direct materials $ 164.80 $ 75.84 Number of parts 166 126 Machine hours 8.20 4.26…arrow_forward

- Maxey & Sons manufactures two types of storage cabinets-Type A and Type B—and applies manufacturing overhead to all units at the rate of $140 per machine hour. Production information follows. Descriptions Anticipated volume (units) Direct-material cost per unit Direct-labor cost per unit Descriptions The controller, who is studying the use of activity-based costing, has determined that the firm's overhead can be identified with three activities: manufacturing setups, machine processing, and product shipping. Data on the number of setups, machine hours, and outgoing shipments, which are the activities' three respective cost drivers, follow. Setups Machine hours Outgoing shipments Туре А 160 56,000 200 Туре А 28,000 $38 43 Required 1 Required 2 Required 3 Туре В Unit manufacturing costs 120 78,750 150 The firm's total overhead of $18,865,000 is subdivided as follows: manufacturing setups, $4,116,000; machine processing, $11,319,000 and product shipping, $3,430,000. Required: 1. Compute…arrow_forwardFoam Products, Inc., makes foam seat cushions for the automotive and aerospace industries. The company’s activity-based costing system has four activity cost pools, which are listed below along with their activity measures and activity rates: Activity Cost Pool Activity Measure Activity Rate Supporting direct labor Number of direct labor-hours $ 12 per direct labor-hour Batch processing Number of batches $ 94 per batch Order processing Number of orders $ 278 per order Customer service Number of customers $ 2,633 per customer The company just completed a single order from Interstate Trucking for 2,300 custom seat cushions. The order was produced in two batches. Each seat cushion required 0.7 direct labor-hours. The selling price was $141.10 per unit, the direct materials cost was $108 per unit, and the direct labor cost was $14.00 per unit. This was Interstate Trucking’s only order during the year. Required: Prepare a report showing the customer margin…arrow_forwardKlumper Corporation Is a diversified manufacturer of Industrial goods. The company's activity-based costing system contalns the following stx activity cost pools and activity rates: Activity Cost Pool Supporting direct labor Machine processing Machine setups Production orders Activity Rates $8 per direct labor-hour $ 3 per machine-hour $ 35 per setup $ 160 per order $ 120 per shipment $ 875 per product Shipments Product sustaining Activity data have been supplied for the following two products: Total Expected Activity K425 M67 Number of units produced per year 2,000 50 200 Direct labor-hours 1,825 3,480 13 Machine-hours 40 Machine setups Production orders Shipments Product sustaining 2 13 2 26 2 Requlred: How much total overhead cost would be assigned to K425 and M67 using the activity-based costing system? Activity Cost Pool K425 M67 Supporting direct labor Machine processing Machine setups Production orders Shipments Product sustaining Total overhead cost 이 $arrow_forward

- Lens Care Inc. (LCI) manufactures specialized equipment for polishing optical lenses. There are two models - one mainly used for fine eyewear (F-32) and another for lenses used in binoculars, cameras, and similar equipment (B-13). The manufacturing cost of each unit is calculated using activity-based costing, using the following manufacturing cost pools: Cost Pools Allocation Base Costing Rate Materials handling Number of parts $ 3.60 per part Manufacturing supervision Hours of machine time $ 14.92 per hour Assembly Number of parts $ 3.90 per part Machine setup Each setup $ 57.10 per setup Inspection and testing Logged hours $ 46.10 per hour Packaging Logged hours $ 20.10 per hour LCI currently sells the B-13 model for $4,475 and the F-32 model for $4,580. Manufacturing costs and activity usage for the two products are as follows: B-13 F-32 Direct materials $ 165.10 $ 76.08 Number of parts 172 132 Machine hours 8.50…arrow_forwardCarlise has identified the following information about its overhead activity pools and the two product lines: Activity Pools Materials handling Quality control Machine maintenance Cost Driver Number of moves Number of inspections Number of machine hours Cost Assigned to Pool Indoor Model $ 20,910 $ 85,120 $ 34,790 Materials Handling Quality Control Machine Maintenance Total Overhead Assigned Quantity or Amount Consumed by Quantity or Amount Consumed by Indoor Line Outdoor Line Required: 1. Suppose Carlise used a traditional costing system with machine hours as the cost driver. Determine the amount of overhead assigned to each product line. Complete this question by entering your answers in the tabs below. 2. Calculate the activity proportions for each activity pool in Carlise's ABC system. 3. Calculate the amount of overhead that Carlise will assign to the Indoor line if it uses an ABC system. 4. Determine the amount of overhead Carlise will assign to the Outdoor line if it uses an ABC…arrow_forwardSaratoga Company manufactures jobs to customer specifications. The company is conducting a time-driven activity-based costing study in its Purchasing Department to better understand how Purchasing Department labor costs are consumed by individual jobs. To aid the study, the company provided the following data regarding its Purchasing Department and three of its many jobs: Number of employees Average salary per employee Weeks of employment per year Hours worked per week Practical capacity percentage 9 $ 28,000 52 40 85% Minutes per unit of the activity Requisition Processing 15 Bid Evaluation 45 Inspection 30 Job X Job Y Job Z Number of requisitions processed Number of bid evaluations 10 7 6 2 1 3 Number of inspections 5 1 5 Now assume that Saratoga Company would like to answer the following "what if" question using its time-driven activity-based costing system: Assuming our estimated activity demands for all jobs in the next period will be as shown below, how will this affect our job…arrow_forward

- Please do not give image formatarrow_forwardVishnuarrow_forwardMaxx Inc. has provided the following data from its activity-based costing system:Activity Cost Pools Total Cost Total ActivityDesigning products $383,900 6,580 product design hoursSetting up batches $52,678 7366 batch set-upsAssembling products $25,122 4,018 assembly hoursThe activity rate for the “designing products” activity cost pool is:arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education