FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

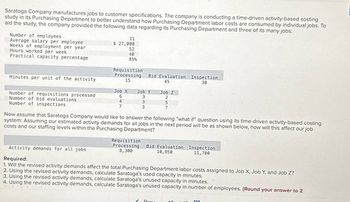

Transcribed Image Text:Saratoga Company manufactures jobs to customer specifications. The company is conducting a time-driven activity-based costing

study in its Purchasing Department to better understand how Purchasing Department labor costs are consumed by individual jobs. To

aid the study, the company provided the following data regarding its Purchasing Department and three of its many jobs:

Number of employees

Average salary per employee

11

$ 27,000

Weeks of employment per year

Hours worked per week

52

40

Practical capacity percentage

85%

Requisition

Minutes per unit of the activity

Processing

15

Bid Evaluation Inspection

45

30

Job X

Job Y

Job Z

Number of requisitions processed

Number of bid evaluations

6

3

2

4

3

5

Number of inspections

7

3

7

Now assume that Saratoga Company would like to answer the following "what if" question using its time-driven activity-based costing

system: Assuming our estimated activity demands for all jobs in the next period will be as shown below, how will this affect our job

costs and our staffing levels within the Purchasing Department?

Activity demands for all jobs

Required:

Requisition

Processing

8,300

Bid Evaluation Inspection

10,950

11,700

1. Will the revised activity demands affect the total Purchasing Department labor costs assigned to Job X, Job Y, and Job Z?

2. Using the revised activity demands, calculate Saratoga's used capacity in minutes.

3. Using the revised activity demands, calculate Saratoga's unused capacity in minutes.

4. Using the revised activity demands, calculate Saratoga's unused capacity in number of employees. (Round your answer to 2

Prov

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Milligan Freelancing provides different services to its clients. The company uses an activity-based costing system for its overhead costs. The company has provided the following data from its activity-based costing system. Activity Cost Pool Total Cost Total Activity Consulting 368,364 36,250 hours Bookkeeping 142,500 8,100 jobs Client support 37,620 680 clients Other 220,000 Not Applicable The “Other” activity cost pool consists of the costs of idle capacity and organization-sustaining costs. One particular client, Adams Corporation requested 24 jobs during the year that required a total of 31 hours of service. For this service, the client was charged P1,750. Compute the increase/(decrease) in margin assuming Milligan Freelancing decides to use traditional costing system in which all costs are allocated…arrow_forwardBrannon Company manufactures ceiling fans and uses an activity-based costing system. Each ceiling fan consists of 20 separate parts totaling $95 in direct materials, and requires 2.5 hours of machine time to produce. Additional information follows: Cost Pool Allocation Base Overhead Rate Materials handling Number of parts $.08 Machining Machine hours $7.20 Assembling Number of parts $.35 Packaging Number of finished units $2.70 What is the cost of machining per ceiling fan? Brannon Company manufactures ceiling fans and uses an activity-based costing system. Each ceiling fan consists of 20 separate parts totaling $95 in direct materials, and requires 2.5 hours of machine time to produce. Additional information follows: Cost Pool Allocation Base Overhead Rate Materials handling Number of parts $.08 Machining Machine hours $7.20 Assembling Number of parts $.35 Packaging Number of finished units $2.70 What is the cost of machining per ceiling fan? $144.00 $18.00 $180.00 $30.00arrow_forwardMultiple Choice $6.49 $5.63 $3.92 $5.20arrow_forward

- Helm Corporation uses an activity-based costing system with three activity cost pools. The company has provided the following data concerning its costs and its activity-based costing system: Costs: Manufacturing overhead Selling and administrative expenses Total Distribution of resource consumption: Manufacturing overhe Selling and administrative expenses Activity Cost Pools Customer Support 85% 20% Order Size 5% 60% S O $348,000 O $188,500 $29,000 O $84,000 S Other 10% 20% The "Other" activity cost pool consists of the costs of idle capacity and organization-sustaining costs. 480,000 100,000 580,000 You have been asked to complete the first-stage allocation of costs to the activity cost pools. Total 100% 100% How much cost, in total, would be allocated in the first-stage allocation to the Order Size activity cost pool? Next ▸arrow_forwardHardevarrow_forwardXYZ Co. currently uses traditional costing procedures, applying $800,000 of overhead to products Beta and Zeta on the basis of direct labor hours. The company is considering a shift to activity-based costing and the creation of individual cost pools that will use direct labor hours (DLH), production setups (SU), and number of parts components (PC) as cost drivers. Data on the cost pools and respective driver volumes follow. Product Pool No.1 (Driver: Pool No. 2 (Driver: SU) Pool No. 3 (Driver: PC) DLH) Zeta 1,200 55 2,250 Beta 2,800 45 750 Pool Cost $160,000 $280,000 $360,000 The overhead cost allocated to Zeta by using activity-based costing procedures would be: O a. $356,000. O b. $472,000. O c. None of the given answers. O d. $328,00. O e. $444,00.arrow_forward

- Foam Products, Incorporated, makes foam seat cushions for the automotive and aerospace industries. The company's activity-based costing system has four activity cost pools, which are listed below, along with their activity measures and activity rates: Activity Cost Pool Supporting direct labor. Batch processing Order processing Customer service Activity Measure Number of direct labor-hours Number of batches Number of orders Number of customers Activity Rate $10 per direct labor-hour $90 per batch $286 per order $ 2,602 per customer The company just completed a single order from Interstate Trucking for 2,800 custom seat cushions. The order was produced in four batches. Each seat cushion required 0.3 direct labor-hours. The selling price was $141.10 per unit, the direct materials cost was $102 per unit, and the direct labor cost was $14.20 per unit. This was Interstate Trucking's only order during the year. Required: Calculate the customer margin on sales to Interstate Trucking for the…arrow_forwardSaratoga Company manufactures jobs to customer specifications. The company is conducting a time-driven activity-based costing study in Its Purchasing Department to better understand how Purchasing Department labor costs are consumed by Individual jobs. To ald the study, the company provided the following data regarding its Purchasing Department and three of its many jobs: Number of employees Average salary per employee Weeks of employment per year Hours worked per week Practical capacity percentage $ 30,000 52 40 85% Requisition Processing 15 Bid Evaluation Inspection 45 30 Minutes per unit of the activity Job X Job Y Job Z Number of requisitions processed Number of bid evaluations 6 3 2 2 1 3 Number of inspections 5 1 5 Now assume that Saratoga Company would like to answer the following "what if" question using its time-driven activity-based costing system: Assuming our estimated activity demands for all jobs in the next period will be as shown below, how will this affect our job…arrow_forwardXYZ Co.currently uses traditional costing procedures, applying $800,000 of overhead to products Beta and Zeta on the basis of direct labor hours. The company is considering a shift to activity-based costing and the creation of individual cost pools that will use direct labor hours (DLH), production setups (SU), and number of parts components .(PC) as cost drivers. Data on the cost pools and respective driver volumes follow Pool No.1 (Driver: DLH) Pool No. 3 (Driver: PC) Pool No. 2 (Driver: SU) Product 2,250 55 1,200 Zeta 750 45 2,800 Beta $360,000 $280,000 $160,000 Pool Cost :The overhead cost allocated to Beta by using activity-based costing procedures would be $356,000 a O $328,000 .b O .None of the given answers .c O $444,000 .d O $472,000 .e Oarrow_forward

- Maxey & Sons manufactures two types of storage cabinets—Type A and Type B—and applies manufacturing overhead to all units at the rate of $120 per machine hour. Production information follows. Type A Type BAnticipated volume (units) 24,000 45,000 Direct-material cost per unit $ 28 $ 42 Direct-labor cost per unit 33 33 The controller, who is studying the use of activity-based costing, has determined that the firm’s overhead can be identified with three activities: manufacturing setups, machine processing, and product shipping. Data on the number of setups, machine hours, and outgoing shipments, which are the activities’ three respective cost drivers, follow. Type A Type B TotalSetups 140 100 240 Machine hours 48,000 67,500 115,500 Outgoing shipments 200 150 350 The firm’s total…arrow_forwardHelm Corporation uses an activity-based costing system with three activity cost pools. The company has provided the following data concerning its costs and its activity based costing system: Costs: Manufacturing overhead Selling and administrative expenses Total Distribution of resource consumption: Manufacturing overhead Selling and administrative expenses $304,500 $493,000 Activity Cost Pools Customer Support 85% 20% O $116,000 O $428,000 Order Size 5% 60% S S Other 10% 20% The "Other" activity cost pool consists of the costs of idle capacity and organization-sustaining costs. You have been asked to complete the first-stage allocation of costs to the activity cost pools. How much cost, in total, would be allocated in the first-stage allocation to the Customer Support activity cost 480,000 100,000 580,000 Total 100% 100%arrow_forwardLakeside Inc. manufactures four lines of remote control boats and uses activity-based costing to calculate product cost. Activity Cost Pools EstimatedTotal Cost Estimated Cost Driver Machining $ 334,000 13,600 machine hours Setup 76,000 420 batches Quality control 103,000 830 inspections Compute the activity rates for each of the following activity cost pools: How do you find the activitiy costs???arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education